Farewell 2023

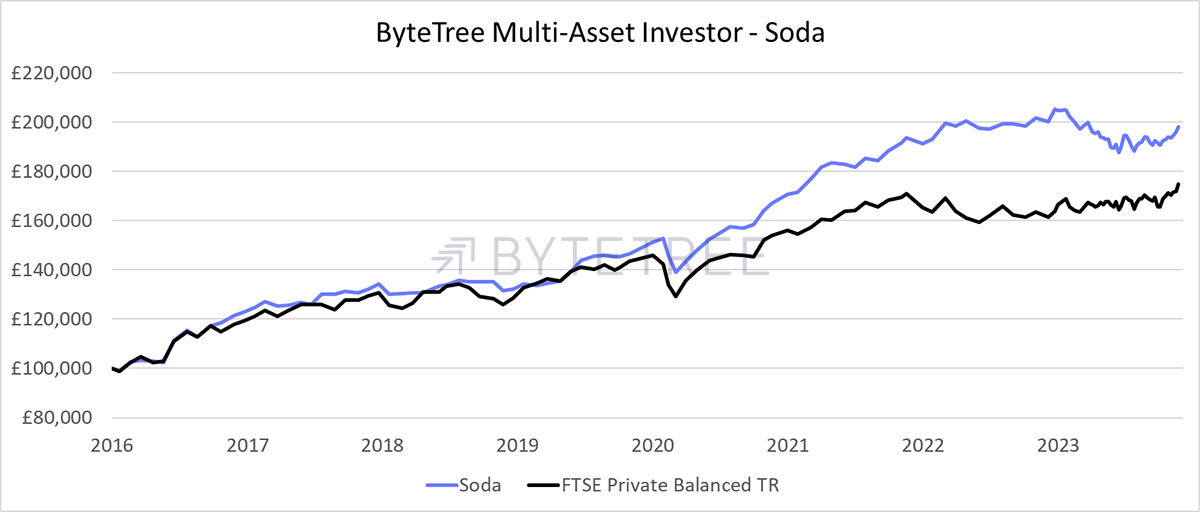

As the year draws to a close, Whisky has gained around 12.9% while Soda has lost 1%. Naturally, I will publish the final score after New Year’s Eve, but we can conclude that Whisky did well while Soda did not. In Soda, I have been too cautious compared to the FTSE Private Balanced Index, where much of the gain came from holding the Magnificent 7 mega tech stocks, which we didn’t. They make up 10% of the balanced index, and as a group, they doubled. In 2023, investors either owned the Mag 7 or they didn’t. We didn’t.

The FTSE Private Balanced Index, a 60/40, rose by 8.2%, meaning the 9% outperformance we had last year has been given back. It’s a brutal comparison, but in the longer term, we are still comfortably ahead, and pulling ahead once again. What you don’t see in the performance data is how Soda has consistently taken less risk than the market, making it less volatile and more resilient to market shocks, something I believe is essential. Yet, in 2023, the shocks were short-lived.

Year to Date Performance in GBP Total Return

(31st Dec 2022 to 18th Dec 2023)

| FTSE 100 TR | 5.4% |

| FTSE Private Balanced TR | 8.2% |

| Mag 7 TR | 94.4% |

| S&P 500 TR | 19.8% |

| S&P Equal Weight TR | 7.0% |

| MSCI Europe TR | 12.4% |

| Japan Nikkei TR | 12.1% |

| MSCI Emerg TR | 2.4% |

| Hang Seng TR | -16.5% |

| Gilts TR | 3.1% |

| Gold | 4.2% |

| Brent Crude Oil | -7.8% |

| Bitcoin | 142.2% |

Source: Bloomberg

Soda Detractors

The Mag 7 nearly doubled, which is exceptional. That drove the S&P 500, which has 30% exposure to the Mag 7, up by 19.8%. In contrast to the S&P equally weighted index, where they make up just 1.4%, rose a more pedestrian 7%, which is closer to the FTSE 100 (+5.4%).

The three main detractors of Soda’s performance were the defensive assets:

- Capital Gearing Trust’s (CGT) net asset value (NAV) plus income is flat this year, while the shares have fallen 6%. Exposure was 14.7% of Soda on 3 January 2023, detracting 0.9%.

- Ruffer Investment Company’s (RICA) NAV plus income was down 8% this year, while the shares have fallen 12.1%. Exposure was 15.6% of Soda on 3 January 2023, detracting 1.9%.

- The Japanese short-dated bond fund (JT13) fell 12.3%. %. Exposure was 10.1% of Soda on 3 January 2023, detracting 1.2%.

Those three positions, which made up 40% of Soda, cost 3.9% of performance. The yen was held as portfolio protection, which turned out not to be required.

CGT ended with a flat year, which is no crime for a defensive fund, but the shares now trade at a discount, which will close sooner or later. Their portfolio is packed full of value, and I suspect it will get back on track next year. CGT has an outstanding long-term record.

RICA performed very poorly, and as a firm, they must be seething. Last year, they declared their lowest-ever equity exposure while embracing costly portfolio protection. The crash never came, and as a result, the portfolio bled slowly. I would say markets are not without risk, and having true diversification never feels right when you don’t need it, but it remains the right thing to do.

There was also a disappointing Chinese reopening and a soon-forgotten banking crisis that was backstopped by the Federal Reserve. They prevented the systemic collapse by guaranteeing all bank deposits, which was surprising. That prevented a stockmarket fall, and once again, remaining cautious was not rewarded.

Soda Beneficiaries

On the positive side, I believe the most important thing we have done is prepare for next year. The equity book is now in good shape. We have diversified value through the family office stocks and exposure to energy and Latin America.

The family office stocks, and diversified investment companies and trusts, all trade at significant discounts, and good things will happen here. A 50% discount to NAV means doubling when the discount is closed. If the NAV rises in the meantime, powerful gains can be made in these situations. I have embraced them because I find the popular investment themes do not stack up on valuation grounds. These funds do.

Long-term holding AVI Global (AGT) did well, gaining 16.8%, and Temple Bar (TMPL) gained 15.2%. The other holdings were added after the 2022 bear market. Energy may not seem relevant in the short term, but these are cheap stocks paying high yields. They can bide their time. Latin America is mentioned in the postbox, where I am bullish.

I am not thrilled with Soda’s result, but I don’t think I would have done anything differently. Perhaps the Chinese reopening message was contrived, and I could have ignored it, but it seemed plausible at the time. It is strange that China, the engine of global growth for two decades, has stalled, and that is being ignored by today’s stockmarkets.

It seems to be all about liquidity rather than reality, and despite record interest rate hikes, quantitative tightening and a falling US money supply, markets have managed to shrug off the negatives. How long can this last?

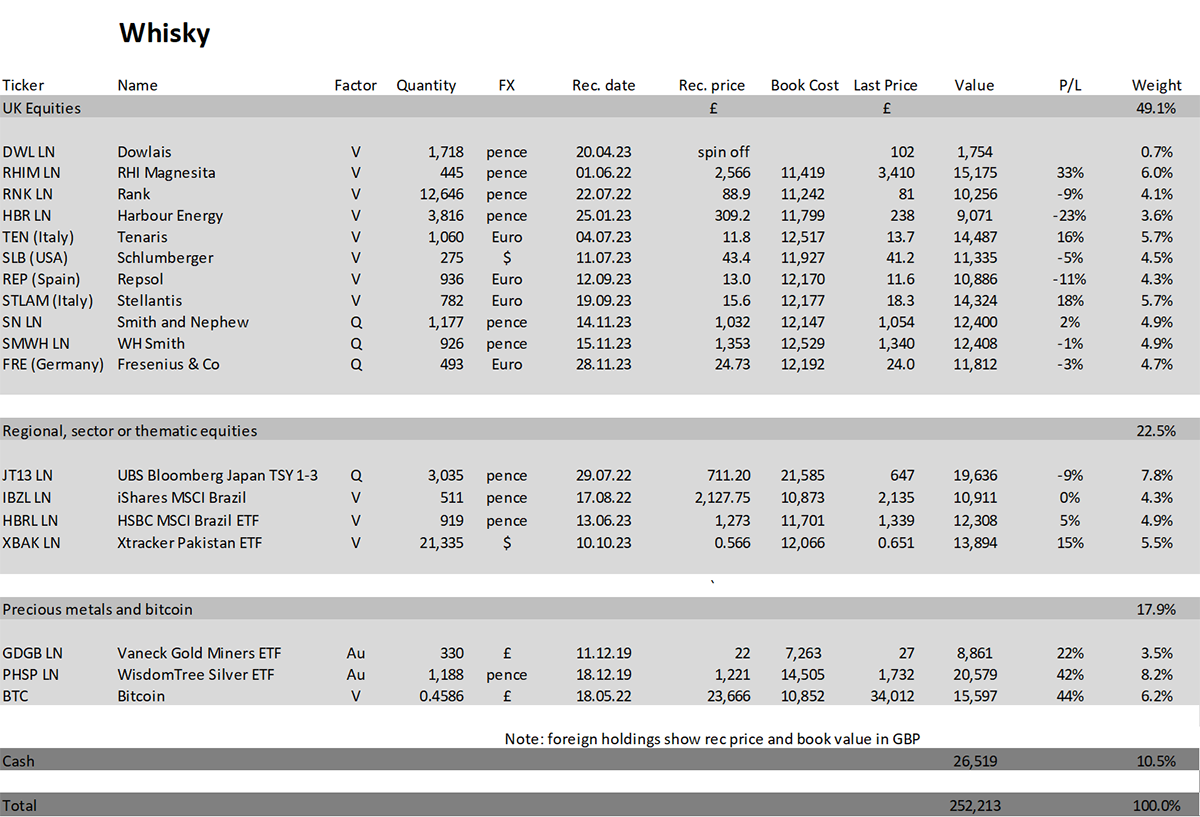

A Good Year for Whisky

A much better time was had in the Whisky Portfolio, where I do what I always do, which is to select undervalued, good companies. This year, I made an important change and decided to embrace more international stocks. The UK had a slow year as international investors and domestic pension funds stayed away. Liquidity was poor on these shores, and despite our home market being cheap, there was no cause for a rerating. Embracing overseas stocks allowed us to cast a wider net.

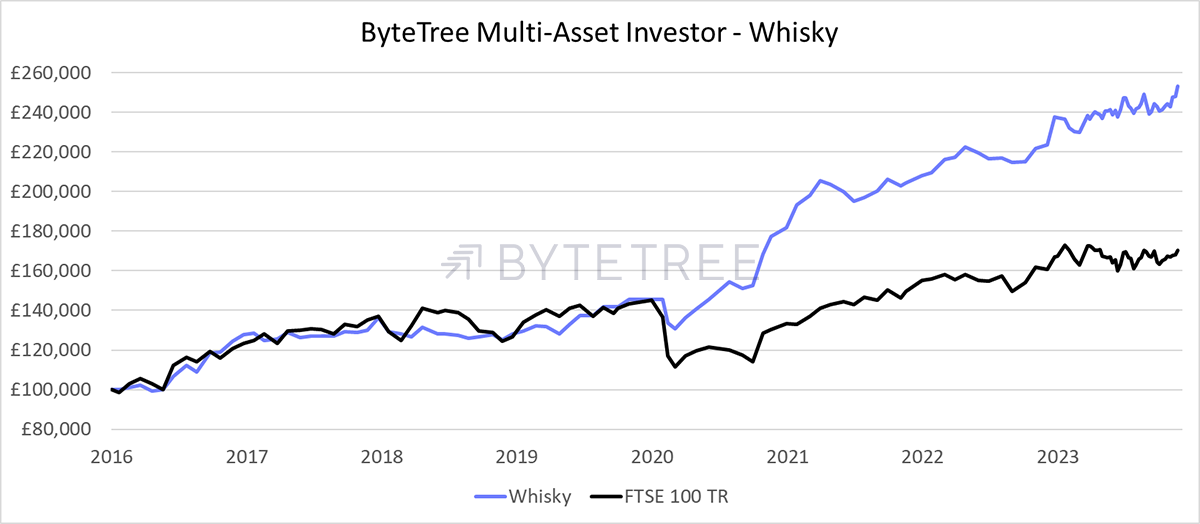

Whisky’s +12.9% is a good result, and if you strip out the comparison with Mag 7, it’s a great result. Moreover, the gap with the market keeps widening in our favour. Whisky has made 152.2% since inception in 2016, which is more than twice the stockmarket (+70.2%).

We had some great success. Melrose (MRO), Marks & Spencer (MKS), and Centrica (CNA) were all members of the FTSE’s top 10 performers this year. We also did well in the FTSE 250 RHI Magnesita (RHIM) and JD Sports (JD). The Poland ETF (SPOL) also stood out. Biotech and AI didn’t work out for us. Precious metals were a drag, but Bitcoin recovered.

In emerging markets, we have Brazil and Pakistan, which is, yet again, very different from the pack. In single stocks, a gang of interesting companies trading at bargain prices. Perhaps there is a bit too much leaning towards energy, but I believe that will work in time. More recently, I have added WH Smith (again) and healthcare stocks that have significantly derated.

It’s all in a good position to carry on next year, where I shall carry on finding undervalued good companies.

Year in Review

This Thursday, 21 December, at 4 PM GMT, I will be hosting a webinar for The Multi-Asset Investor. I will review the year and the outlook for next year. Please ask me anything, and feel free to send in early questions so I can prepare slides to answer them. A replay will be available afterwards.

Last week, I covered Bitcoin, Gold and BOLD. You can watch it here.

Action

No action.

Postbox

What are our thoughts on Lloyds Bank (LLOY)?

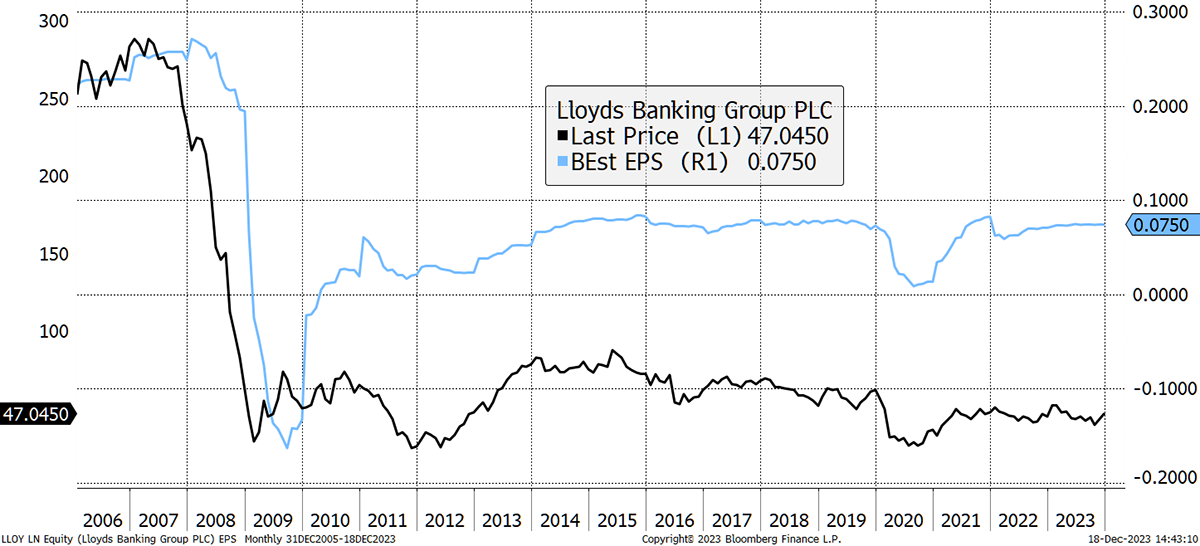

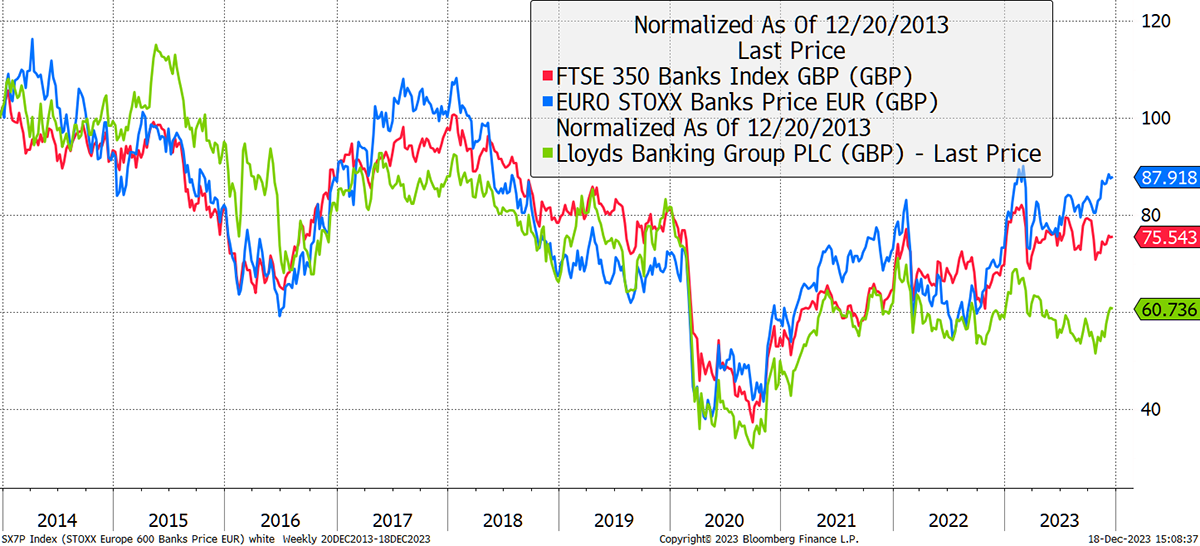

Banks, in general, haven’t done us well in recent years. They slumped in the pandemic when rates collapsed and then haven’t done as well as expected in the hikes that followed. I can see that LLOY is very cheap, but the yield curve is still inverted, and that isn’t the best time for banks.

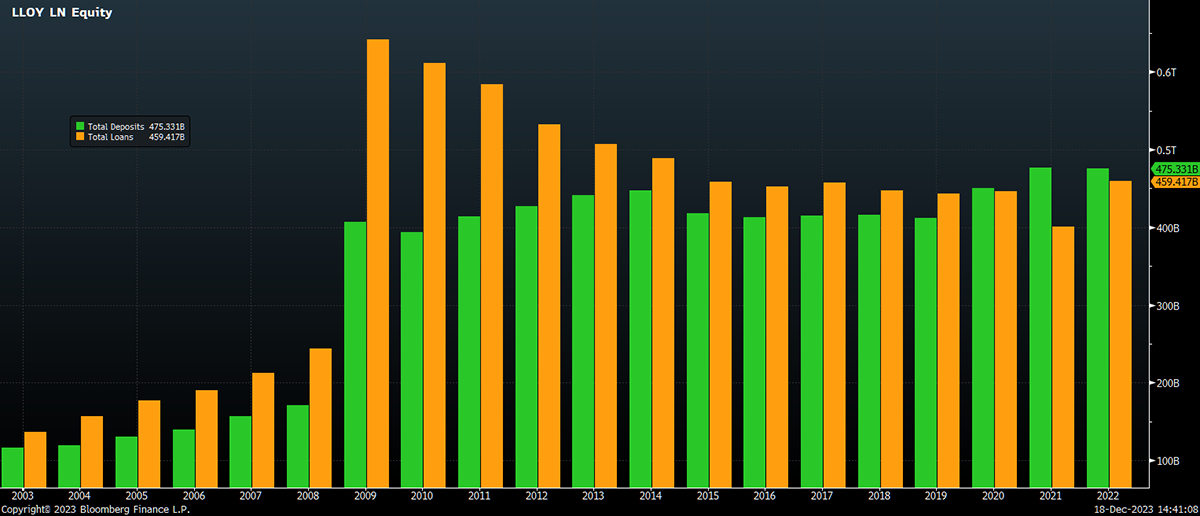

Looking at LLOY’s loans and deposits, you could argue that loans are growing again, which is positive, but deposits remain pedestrian.

Looking at earnings, there’s no growth to look forward to and, of course, it has high exposure to UK housing. That’s fine… or is it?

Lloyds Lacks Growth

I often wonder about the banks. I think one problem is that their costs have snowballed, particularly in areas such as compliance. You wonder if it will ever stop. The NatWest Farage debacle demonstrated how many people are employed doing not very much. Then, on the other hand, the banks are closing branches at pace, which must be doing wonders in slashing costs.

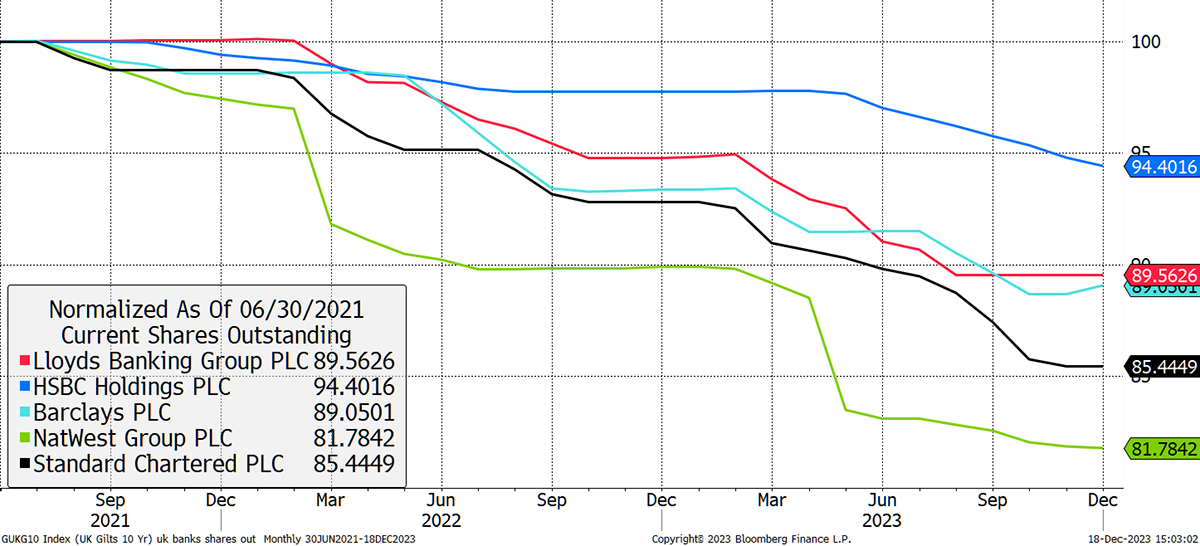

Lloyds is also buying back shares, along with many undervalued companies these days. It’s happening quickly, and in just 7 quarters, they have reduced their share count from 71 million to 63.5 million or 10%. But so are the others, with NatWest (NWG) leading the way.

UK Banks Are Buying Back Shares

Going back to the pre-pandemic era, LLOY has been the laggard, with HSBC in front, and they trade as a tight group, not just in Europe but across Europe. Maybe LLOY, which has slipped behind, has a catch-up opportunity, but I think the banks are more of a macro decision. That said, they are dirt cheap so we should buy them at some point.

UK, European Banks and Lloyds

Something to consider for next year.

With the softening prices on both oil and commodities, are our Latin American investments (particularly Brazil) still as attractive? I suppose the weakening dollar will help immensely and is possibly enough to offset any negative with regards oil and the primary industries that are so prevalent in SA. I like Mexico very much, especially in light of a weaker dollar. Assuming we get one.

I believe Brazil and Mexico are more sensitive to falling interest rates than commodity prices, but they certainly help. They are currently 7.9% and 5.4% respectively, which is very high indeed.

Latin American Real Rates Are High

As inflation cools, which it seems to be doing, that paves the way for rate cuts, and that should fuel the stockmarket. I am very bullish on LATAM, especially Brazil. When things go its way, it can surge. Both markets also have attractive valuations. It may take more time, but I believe we are in the right place.

I read your thoughts on MicroStrategy (MSTR) in Atomic with interest. As someone who holds (but clearly perhaps should sell) MSTR as a proxy for Bitcoin in the Multi-Asset Investor portfolio what is one to do?

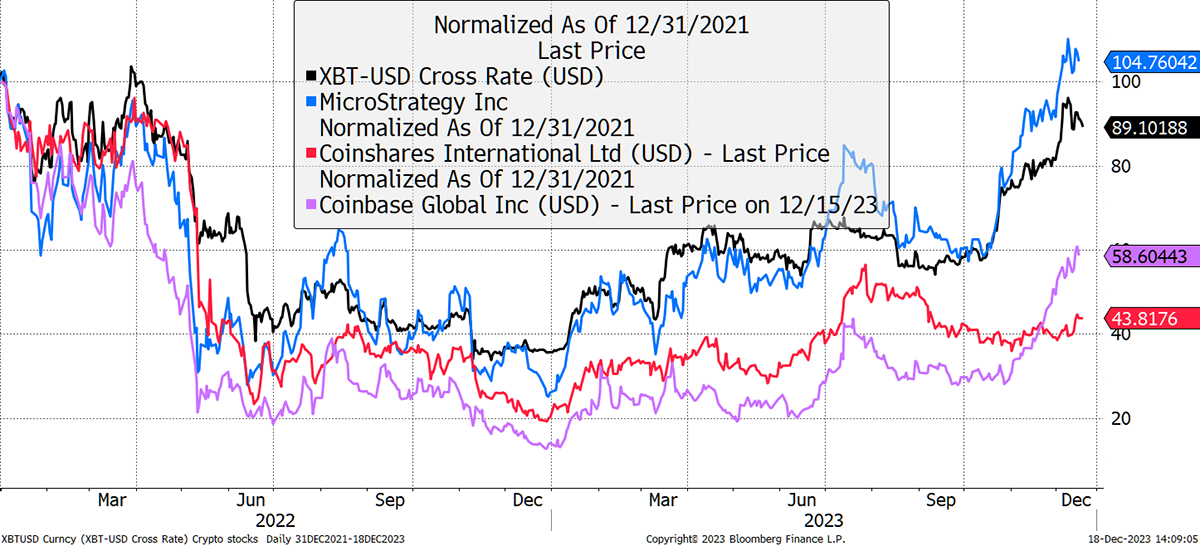

It’s a tricky situation because MSTR is at risk if the bitcoin ETFs are approved as it would serve no purpose and trades at a significant premium to net asset value. I don’t like 55% premiums, and we have already seen what happened to Grayscale (GBTC) in 2021/2. I believe MSTR may repeat that trick.

Bitcoin equities are generally terrible, especially the miners, but the asset managers are not a bad choice. They are highly correlated with bitcoin because they generate fees from holding and trading bitcoin and crypto. I show Coinbase (COIN USA) and CoinShares (CS Sweden). I am confident that CS is undervalued, but a mix of the two would be a good bitcoin proxy.

Bitcoin Alternatives

Can you please tell me if there has been any progress on us UK residents being permitted to buy into BOLD?

There are rumours that the ban on crypto ETFs will be lifted next year, but no more than that. The expectation is that if the SEC approve bitcoin ETFs in the USA, then the FCA will lift the ban here.

BOLD can currently be purchased by investors who self-certify they are elective professionals and use traditional brokers rather than online. Some readers have done this. If you would like to learn more, then please get in touch at bold@bytetree.com.

Portfolios

New readers, please find a note at the end after the summary.

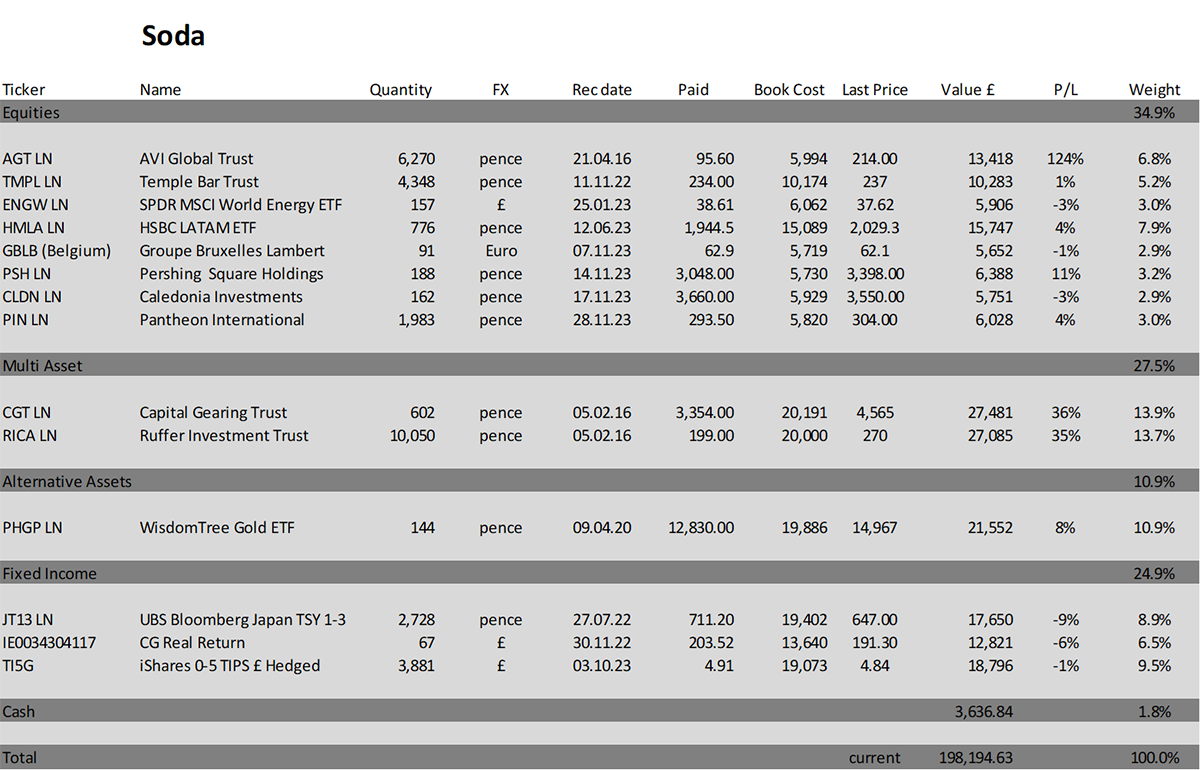

Soda - a long-term, low turnover portfolio investing in diversified large cap stocks, funds, exchange-traded funds (ETFs) and investment trusts. The Soda portfolio is down 1.0% this year and is up 98.2% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in mid to large cap stocks in developed markets, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 12.9% this year and up 152.2% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

Thank you all for sticking with me during this tricky year, and I hope you join the webinar on Thursday. I wish you all a very Merry Christmas and a Happy New Year.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Recent Trades in Soda

| 28/11/2023 | Buy | Pantheon International Plc | PIN | Link to Article |

| 15/11/2023 | Buy | Caledonia Trust | CLDN | Link to Article |

| 14/11/2023 | Buy | Pershing Square | PSH | Link to Article |

| 07/11/2023 | Buy | Groupe Bruxelles Lambert | GBLB Belgium | Link to Article |

| 03/10/2023 | Buy | TIPS ETF | TI5G | Link to Article |

| 15/08/2023 | Sell | iShares EM Debt ETF | SEMB | Link to Article |

| 11/08/2023 | Sell | Scottish Mortgage Plc | SMT | Link to Article |

Recent Trades in Whisky

| 12/12/2023 | Sell | Centrica | CNA | Link to Article |

| 28/11/2023 | Buy | Fresenius | FRE Germany | Link to Article |

| 15/11/2023 | Buy | WH Smith | SMWH | Link to Article |

| 14/11/2023 | Buy | Smith and Nephew | SN | Link to Article |

| 10/10/2023 | Buy | Pakistan ETF | XBAK | Link to Article |

| 26/09/2023 | Sell | Drax | DRX | Link to Article |

| 19/09/2023 | Buy | Stellantis | STLAM IM | Link to Article |

| 12/09/2023 | Buy | Repsol | REP SM | Link to Article |

| 22/08/2023 | Sell | iShares Poland ETF | SPOL | Link to Article |

| 11/08/2023 | Sell | AI ETF | AIAG | Link to Article |

| 08/08/2023 | Sell | Biotech ETF | BTEK | Link to Article |

| 25/07/2023 | Buy | Drax | DRX | Link to Article |

| 11/07/2023 | Buy | Schlumberger | SLB US | Link to Article |

| 04/07/2023 | Buy | Tenaris | TEN IM | Link to Article |

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd