Index-Linked Bonds and Oil

Trade in Whisky;

It is time to re-examine index-linked bonds because once we are sure that prices have settled, there is no better risk-free investment out there. Investors receive a return that is backed by the government, compensates for inflation and more. Nothing else does that for certain. I will also be recommending an oil company, but we’ll get to that later.

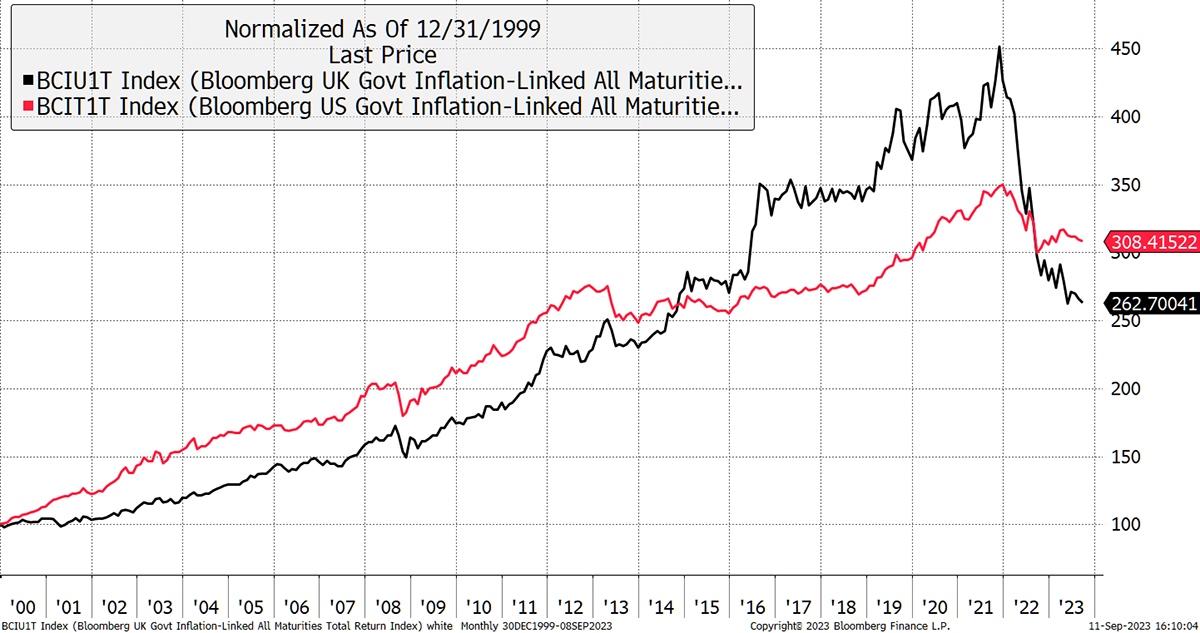

While our post-2022 view of “linkers” is a horror story, the previous two decades were spectacular as they caught the collapse in interest rates and, more importantly, the continued collapse in real rates. UK linkers are shown in black, and US TIPS in red.

Index-Linked Bonds in the USA “TIPS” and in the UK “Linkers”

Inflation never took off until the pandemic, but TIPS and linkers have delivered extraordinary long-term performance until 2022. In the year 2000, they offered excellent value with real yields of 4% in the US. Then, after the credit crisis, these real rates kept on falling into deep negative territory. In the case of linkers, that saw the 10-year gilt yield held below 1%, while inflation expectations were 4%. If you asked an economist or strategist if that was possible five years ago, they would very likely say that it wasn’t. But it happened.

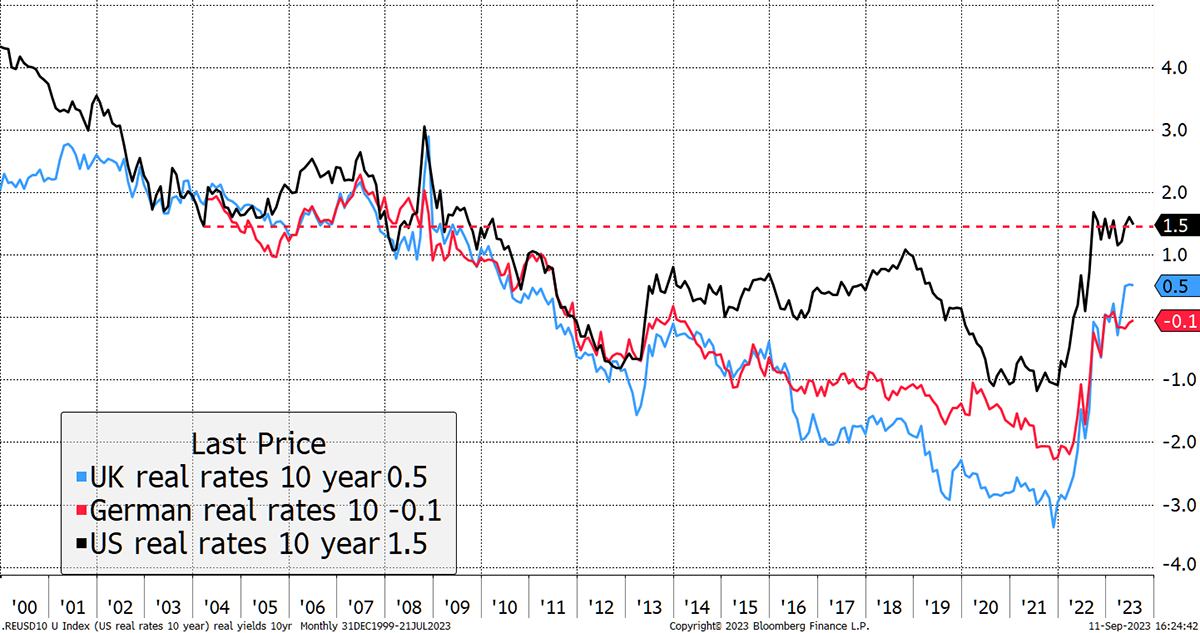

Real Yields

Note: Linkers pay RPI, which is historically around 0.9% more than CPI. It is therefore fair to add 0.9% to the UK real yield to compare them to US or EU real yields. On that basis, UK and US real yields are about the same. The chart below shows this with 0.9% discounted from the UK data, making it more like for like.

The 2022 crash in linkers should not have happened, but it did because the bond market needed to normalise from absurd levels. The pain was felt worst in the UK as real yields had fallen below -3% (or 2.1% adjusted). In the US, they only managed -1%. The Truss/Kwarteng budget took place late in that adjustment process, and the price of linkers has carried on falling (real yields rising) since, albeit at a much slower pace. TIPS, on the other hand, have been more stable over the past year.

For index-linked bond prices to rise, we need lower bond yields or higher expected inflation. Preferably both. Yet we have not seen either, but I wonder if that’s changing. It was remarkable how 10-year inflation expectations stayed so low when actual inflation was in double digits last year. That might finally be changing as these lines in the UK, US and Europe look like they are going up.

Could Long-Term Inflation Expectations Be Rising?

A key inflation driver is the rising oil price, which has met supply constraints. The lack of investment is a longer-term issue, but in the short-term, we have production cuts from OPEC+, which includes its new alliances. There’s a supply squeeze which could be sustained, but I doubt it’s enough to see inflation surge, but it is certainly enough to prevent it from falling.

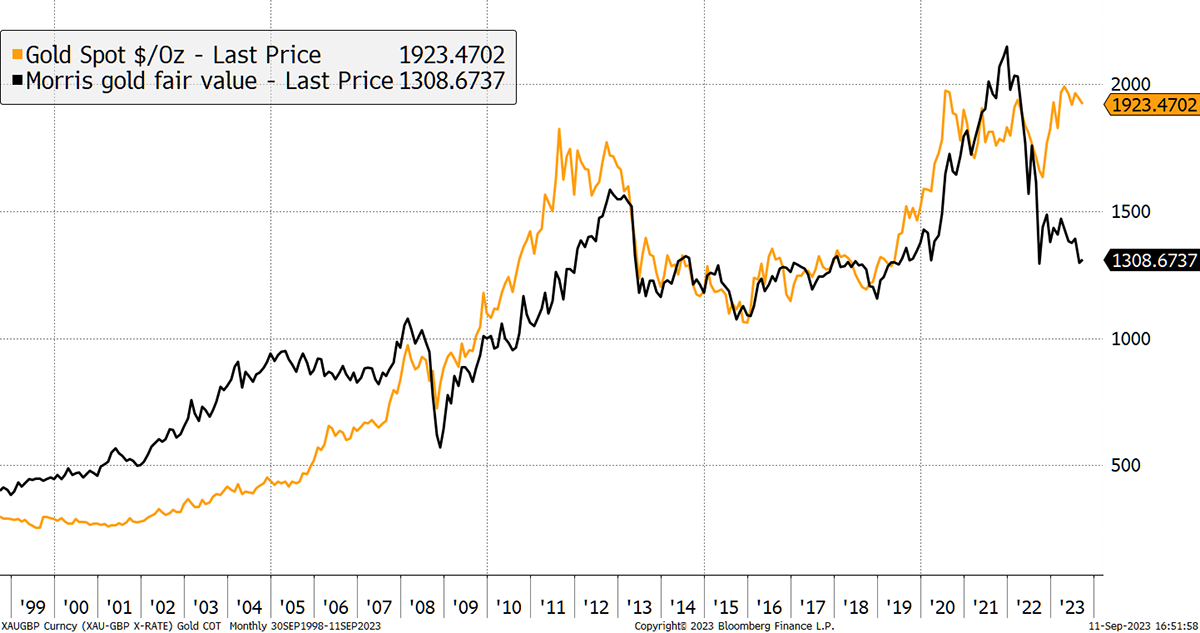

In late November last year, I reduced gold in Soda from 20% to 10% because the price had ignored the rise in real yields, something it had always previously responded to. I watched gold slide by 40% between 2011 and 2015, a move wholly attributable to a rise in real rates. This time, it hasn’t happened, and there are many explanations which I have covered in Atlas Pulse. But the bottom line is that TIPS have 50% upside in comparison to gold, assuming this relationship persists. Double down.

Gold and Fair Value Using the TIPS Model

In practice, the CG real return fund has slipped 6% (flat in US$) since my recommendation when gold rose by 5%. Sometimes, these things happen in finance, even when logic and reason are on your side. The CG Real Return Fund holds non-UK inflation-linked bonds, mainly TIPS (70%), because they offer the best value. The average duration is 8.7 years, which is less than half the volatility of the black line above (20-year duration). The CG Real Return Fund is therefore much less risky.

With UK real yields now so close to US levels, it is time to start buying linkers. The Bank of England’s Andrew Bailey has already said rates have peaked, but the committee doesn’t all agree. But he wouldn’t say that if they weren’t close, and if inflation perks up, linkers will fly.

There’s one more thing, and that’s the UK long bond yield at 4.75% is higher than in the US at 4.35% and Europe at 2.75%, which makes it the least risky in the developed world. This means linkers are getting interesting, and I may well act soon. But given it didn’t work last November, I shall wait for a little evidence of market strength before adding linkers to Soda.

In Whisky, we have lots of inflation-sensitive stocks, some related to the oil industry. To complement that, I want to add a dirt-cheap large oil company.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd