Oil and the Crisis Season

Trade in Whisky;

Back in 2006, I attended a lunch presentation with Arjun Murti, the Goldman Sachs oil analyst who coined the phrase “super spike”. I followed him closely, and needed to, because our oil guy at HSBC Asset Management was still forecasting $25 per barrel on the basis that Chinese growth would slow, supply was forever plentiful, and oil would be replaced by renewables. That was in 2006! How some things don’t change.

In the run-up to 2008, Murti correctly predicted the move to $148 per barrel. Soon after that, we lost him to private equity, where he presumably made his fortune. He’s reappeared and recently wrote:

“The divergence in expected 2028-2030 oil demand between the International Energy Agency's (IEA) recently published Oil 2023 report and its May 2021 Net Zero by 2050 report is staggering. A mere two years ago, the IEA laid out a scenario where oil demand had peaked in 2019 at 100 million barrels per day (mbpd) and would decline to around 75 mbpd in 2030. It now projects a remarkable 105 mbpd of oil demand in 2028… For a sector as large and important as the oil industry, these numbers are not close.”

He reminds us that oil consumption is rising, even while the global economy is slowing. There are 7 billion people consuming 3 barrels each per year, with the other lucky billion people (living in the developed world) consuming 14.

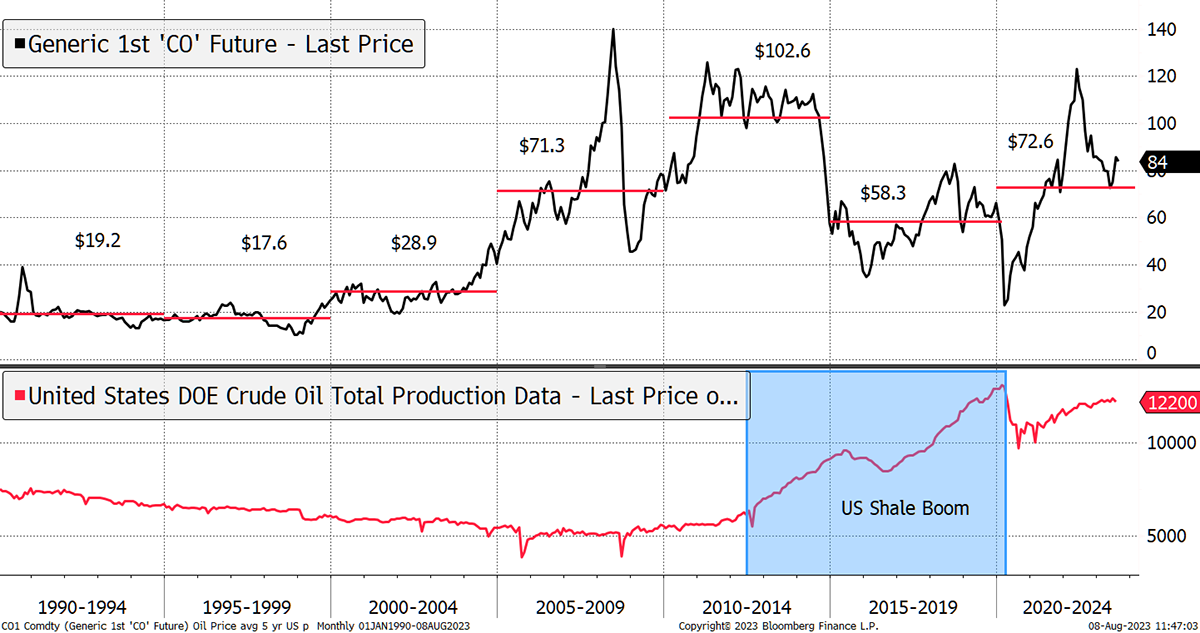

Going back to the early 1990’s, there was a brief spike associated with the first Gulf War, which elevated the five-year average oil price to $19.2. It fell in the late 90s, held back by the Asia Crisis, only to advance as the emerging markets grew in the noughties, which increased their oil consumption. What’s remarkable is how the 2010 to 2015 era saw a $102.6 average price following the credit crisis, which caused Murti’s super spike to briefly collapse back to $37. That devastating global economic crisis did nothing to crush oil’s longer-term growth in demand.

A Brief History of the Oil Price

With demand unstoppable, supply came to the rescue in the form of US shale. The oil price collapsed in the autumn of 2014 as US production took off. US production surged from around 5.5 mbpd to 13 mbpd just before lockdowns. What we have seen so far in this half-decade is an average price of $72.6. That is unremarkable compared to the 2010/15 period, but the pandemic successfully crushed demand. With cheap financing behind us, US shale production appears to have peaked.

Oil demand is not going away, whatever net zero commitments Western governments make. With the freeing up of new licenses in the North Sea, even the UK government is finally acknowledging this harsh reality. Just after my last issue, Tony Blair came out as an energy realist, saying:

“Don’t ask us to do a huge amount when frankly whatever we do in Britain is not really going to impact climate change. The number one issue today – and this is where Britain could play a part – is how do you finance the energy transition? Because, basically, the developed world’s emissions are going down, but the developing world’s are going up. These countries have got to grow, so how do you finance the transition? Secondly, how do you accelerate the technology?”

This outbreak of common sense is a breakthrough. Now that Blair has said what the majority were already thinking, a more sensible discussion can begin.

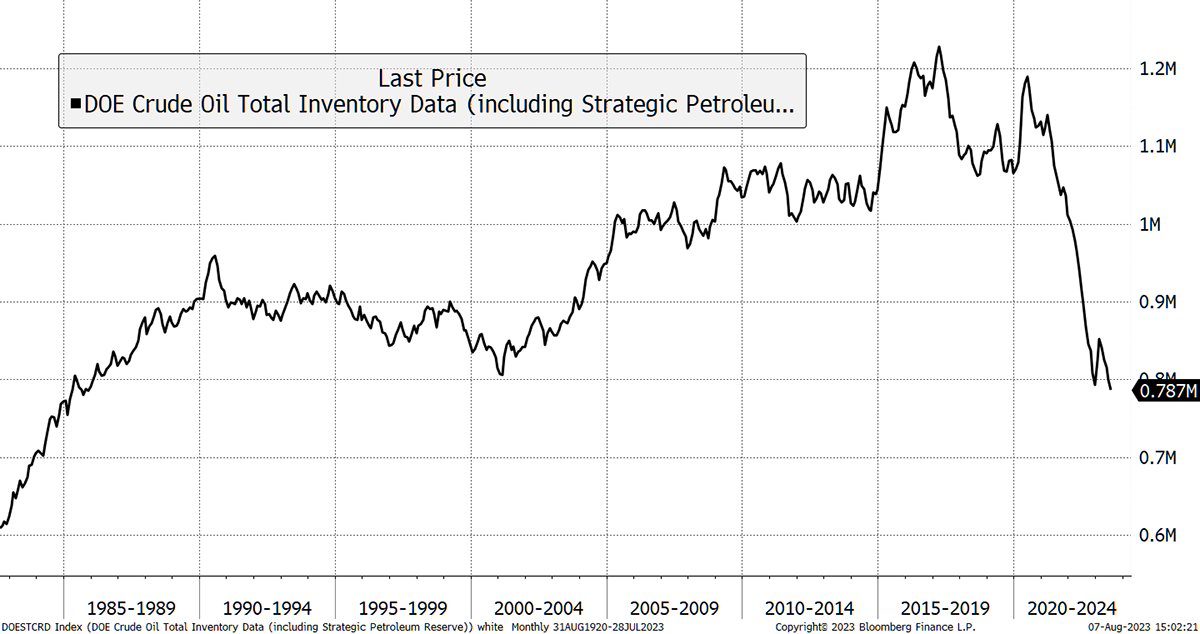

We know that demand will rise until there is a lasting and credible alternative source. Wind and solar are helpful, but they can’t do it alone, and in the interim, we need fossil fuels. We also know that the ESG conversation has starved the oil exploration industry of capital, meaning future supply will become less abundant. Furthermore, one of the main reasons for the recent soft patch in oil prices has been the reduction in US strategic reserves, which have collapsed from 1.2 billion barrels to 790 million barrels.

Oil Reserves Have Collapsed

To put it another way, oil reserves have fallen from 12 days’ global demand to 7.9 days. That reduction, by presidential order, put a lid on a potential surge in the oil price following the war in Ukraine. But presumably, there is a need to rebuild these stocks, and this is yet another good reason that illustrates how the energy markets are well underpinned. And incidentally, it is where we continue to find good value in the stockmarket.

I am well aware that a slowing economy could dampen demand, but a recession is nothing like a lockdown or a global financial crisis, and I believe the positive forces will start to outweigh the negative. In addition, and as mentioned, oil demand will be underpinned by the rebuilding of strategic reserves. That said, a short-term fall in the oil price remains entirely possible, but I think that is something we should tolerate. The danger is to be overly defensive when the energy sector has a very high probability of a highly profitable outcome.

I remind you of this because whatever happens in the short term, we should not be shaken out of this trade. It is a secular theme.

The Crisis Season

I hate to disappoint you, but this is not mid-summer in the Northern Hemisphere, but late summer. In a few weeks’ time, it’ll be autumn, which marks the crisis season in markets. Sometimes it passes without incident, but this year I feel we should be prepared as things are coming to a head.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd