Going Global

Trade in Whisky;

US equities think it’s a bull market, European equities are scratching their head, while Asian equities see a crisis. In contrast, surging interest rates fight stagflation, commodities see a recession, and the long bond a depression. Gold softness reflects relief in global tensions, while Bitcoin advances with confidence. Markets are giving mixed messages, but BOLD carries on regardless.

I wrote that in my recent rebalancing piece on our BOLD Index and thought I’d say it again in case you missed it. It is a summary of what’s going on and highlights the confusion in markets.

Currently, Soda is remaining cautious while Whisky continues to seek opportunities as and when they crop up. You’ll be pleased to know that this week, I am adding an Italian-listed value stock, Tenaris.

I have said before that great opportunities in UK liquid stocks are harder to find, mainly because there aren’t enough of them. There are cheap stocks, but not enough cheap AND liquid stocks. Last week I pointed out that Apple was now more valuable than the FTSE. It is a sad state of affairs, but it surely means UK stocks are undervalued. Nevertheless, in the search for cheap and liquid stocks, I need to cast a wider net and go global.

If we don’t count Berkshire Hathaway, this will be my first non-UK equity recommendation. Expect more to follow as we broaden the portfolio internationally, focusing on the USA, Canada and Europe for direct equities and ETFs for the rest. There can be no doubt that embracing global stocks will increase the available opportunities.

Buy Tenaris (TEN IM) in Whisky

Tenaris was founded in Argentina in 1948. It grew organically until the 1990s, when it became a global business through a series of strategic investments and acquisitions. Today they are the leading manufacturer of pipes and related services for the world's energy industry and other industrial applications. They manufacture in 16 countries with sales and servicing teams in over 30. Today, their head office is in Luxembourg, and their primary listing is in Italy.

The initial appeal of TEN was the low valuation. It’s a good company with a strong market position, yet the shares trade on a forward price to earnings of 3.7x. Last year it generated $1.7 bn of free cash flow from sales of $13.5 bn. The company is valued at $17 bn, yet by the year-end, they are expected to have $4bn of net cash on the balance sheet and continue to generate circa $3 bn per year after that.

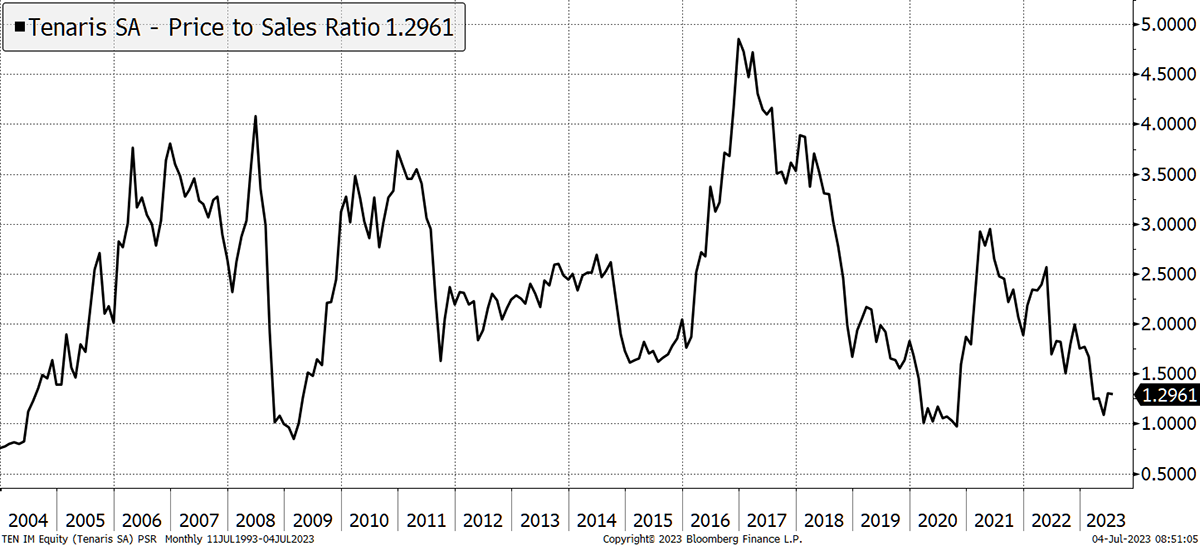

The price-to-sales ratio says it all. As you know, the absolute number of 1.3x is not what I am looking at, but how the relationship between market cap and sales has changed over the years. A high PSR is generally expensive and a low one cheap. The current PSR is commensurate with the ultra-low buying opportunities seen during the 2008 credit crisis, the 2015 US shale boom (which crashed the oil price) and 2020 (when oil really tanked).

Tenaris Trading Dirt Cheap

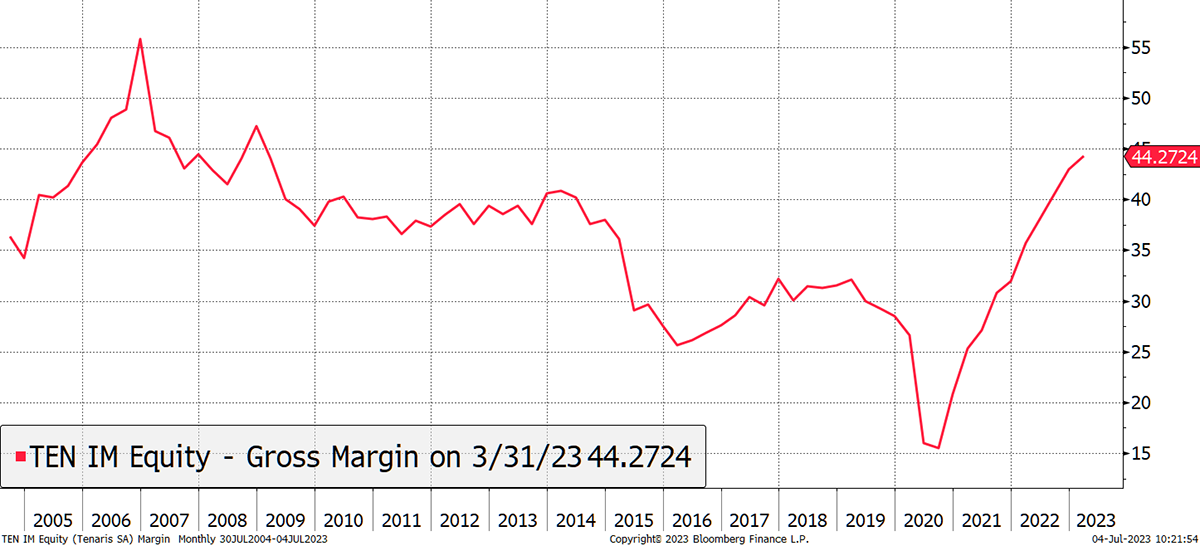

Their core business is to be a leading supplier to the energy industry. They were well placed for the energy surge last year, but that has subsequently cooled off and is unlikely to return anytime soon. But the shares offer good value regardless, and there is a likelihood that higher margins are sustainable. This is in part due to their higher exposure to offshore drilling, which has longer-term contracts, and the offering of “Rig Direct”, which offers deep-routed partnerships with their clients.

High Margins Can Be Sustained

The margins are high, and assuming the oil price can maintain its current level or better, TEN deserves to be rerated by the market. It is not that difficult to see a case where this doubles or more over the next few years.

The company’s largest exposure is in the Americas, with 58% of revenue in the north and 21% in the south. The middle east and Europe both make up around 8%. Here in the UK, their operations are run out of Aberdeen.

TEN is a specialist business that has grown its market position over the years. I think it is a relatively straightforward business case. The harsh reality is that pipes are unglamorous and are not involved in artificial intelligence. Here lies the opportunity. TEN pays an expected dividend yield of 3.5%.

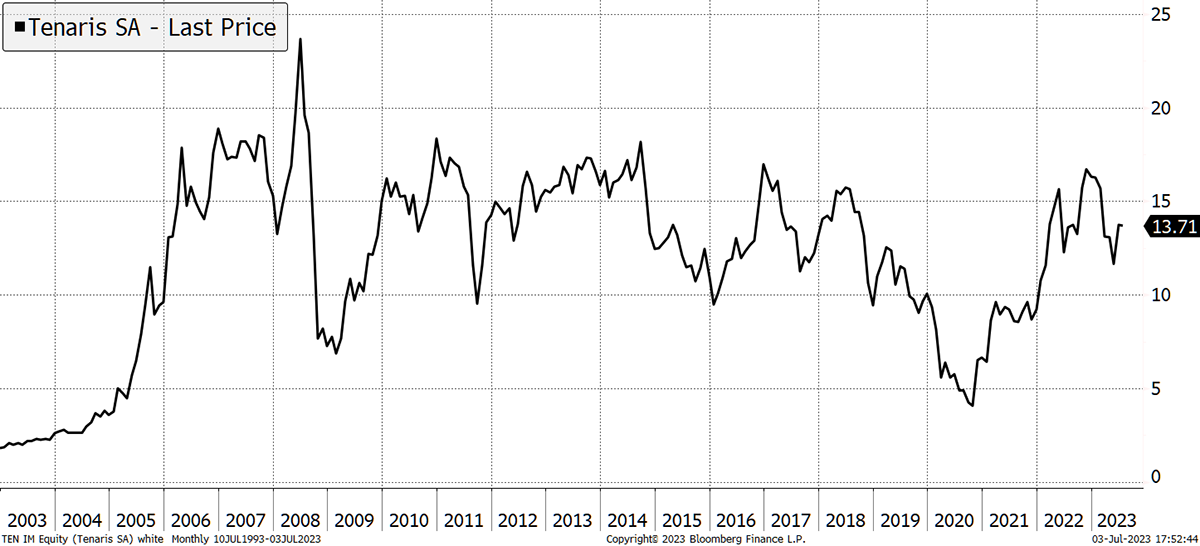

The technical position is interesting as well. TEN resembles the oil price, which is hardly surprising, but with extreme value attached, which is why it is proving resilient. The Saudis and Russia are doggedly determined to keep oil elevated and have cut supply yet again. As you well know, the coming years will need to see huge investments in the oil industry, and TEN is at the heart of that. The share price has been consolidating for nearly two decades. It means when the breakout comes, it’ll likely be big because the price is right.

An 18-year Consolidation

TEN should be widely available on UK investment platforms and trades around EUR 5 million per day. If the price jumps on my recommendation, which I do not expect it to, maybe come back in a few days rather than chase it. It is a value situation, so regardless of booms and busts in financial markets, it should come our way in good time.

Risk

As I said, this is simple, and the company is cheap. The balance sheet is strong, and with geographically diversified manufacturing and clients, there is a negligible chance of business failure. That said, it is exposed to the oil price and correlated to it. If the oil price falls, TEN would fall as well. It is also exposed to Argentina, but much less so than in the past. I deem this to be medium to high risk.

Action:

Buy 5% Tenaris (TEN IM) in Whisky

Postbox

RHIM Magnesita (RHIM)

Several of you have written in about the tender offer on RHIM. On 6 June, I wrote in the postbox:

“Barclays is the lead advisor in this deal, and before they ceased coverage after the announcements, they had a £29.50 price target. The other five analysts, with recently updated forecasts, range between £26 (RBC) and £45 (Peel Hunt). RHIM is cyclical and may struggle in a recession, but I think what it went through last year with high energy prices is as bad as it gets. I will ignore this tender offer and sit tight.”

I would add that this offer undervalues the company but does leave us in a less liquid stock as 29.9% will be held by many shares will be tendered. That said, it’s a good company, and with a 5% yield, we can wait.

What is the reason for, and purpose of, a CBDC? No-one seems to know, with only vacuous statements from governments, and conspiracy theories from others. Can you help us mere mortals?

A central bank digital currency is digital cash. The money on your bank app is a digital deposit that comes with bank deposit risk. A CBDC is managed by the central bank, such as the Bank of England, and is (credit) risk-free when issuing pounds because it can print them. In contrast, a private sector equivalent “stablecoin” would have some credit risk but would presumably be regulated like a fund.

What is the use case?

Think about artificial intelligence, whereby computers talk to computers. Say one has valuable data or information, we will see a world emerge where computers trade with other computers. Imagine trying to get NatWest and HSBC to open bank accounts with AI? No chance, and probably another reason why the banks are dying slowly. Computers will exchange value using CBDCs, stablecoins or even more probable, crypto.

The downside of digital cash over folding cash is that it leaves a data trail which is potentially intrusive. But as a technology, it will change the world, and that is fascinating. Digital cash and crypto are bank killers, and that’s why they are so uncooperative.

In relation to the Japanese short-term government bond investment, there’s a piece by Lynn Alden which suggests that Japan won’t be raising interest rates.

“Japan is the main example of a country that is already through the looking glass, where everything is flipped. Their deficits greatly exceed their loan creation. They’re already at the point where interest rates aren’t an effective inflation-fighting tool, which is likely part of the reason they’ve been doing the heterodox policy of not using interest rates in the face of inflationary pressures. With public debt equal to about 250% of GDP, every 1% higher weighted average interest rate on Japanese debt would increase the fiscal deficit by about 2.5% of GDP. To the extent that Japan sees above-target consumer price inflation in the years ahead, it likely won’t be due to excessive bank lending, but rather will be from high energy or materials import costs, and so that requires more of a fiscal/geopolitical toolset than a monetary one.”

I wonder how you react to this? I appreciate your application in times which seem even more bewildering than usual.

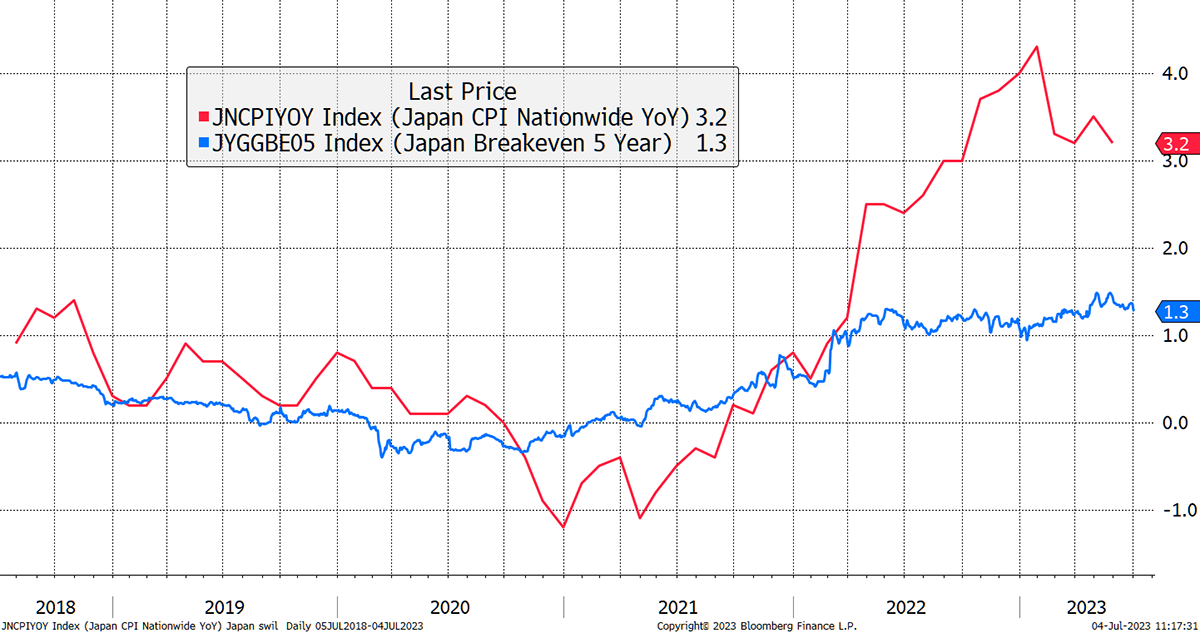

I agree with those points. The Japanese have made it clear they are unconcerned about inflation and think it will pass. It peaked at just 4% and is coming back down. The five-year forecast sees it returning to 1.3%.

Japanese Inflation Cooling

As stated in the quote, it is the import costs that would raise inflation but that would only happen if the yen remained cheap and got even cheaper. This seems unlikely because while they would like to keep exports competitive, that advantage would dissipate if import costs became a burden, as Japan imports raw materials.

A change in policy seems less likely than a year ago, but I still feel holding yen is effective portfolio insurance in an environment where little else is. The long bond might work, but not if inflation returns, and has significant downside if the economy recovered. Inflation-linked bonds seem to be a better bet, but not if deflation returns exported from China. Gold is fabulous but is 40% overvalued, according to my model. For those reasons, I welcome some exposure to the deeply undervalued yen because it might be our saviour.

Portfolios

New readers, please find a note at the end after the summary.

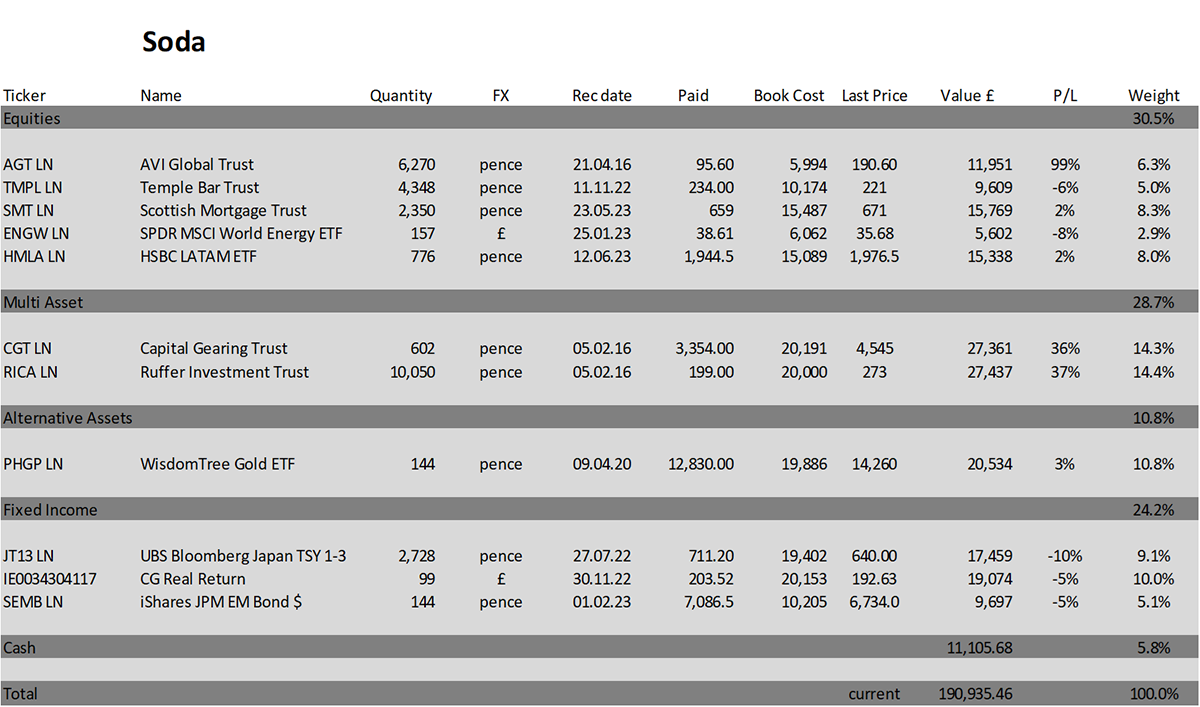

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts. The Soda portfolio is down 4.6% this year and is up 90.9% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

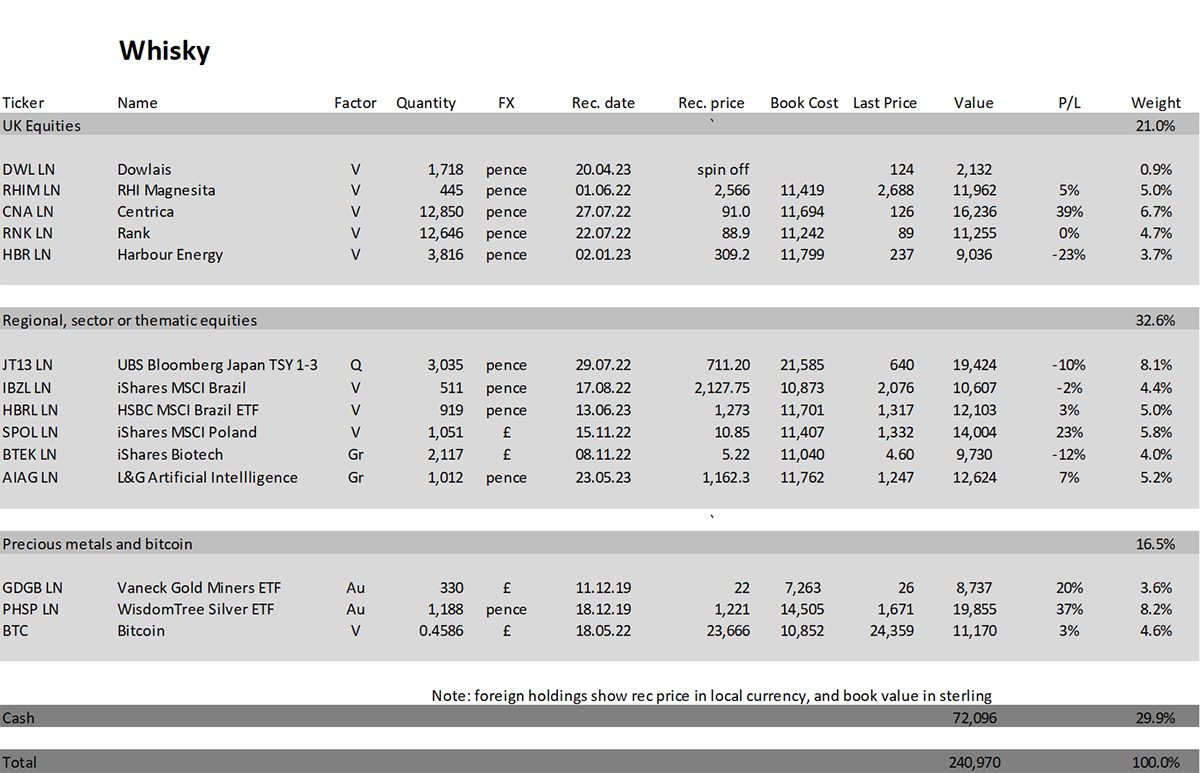

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.9% this year and up 141.0% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

Italy is first up as we go global. We love their food and culture, but it is often overlooked as a serious contender in high-end engineering.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()