China versus the West

Trade in Soda;

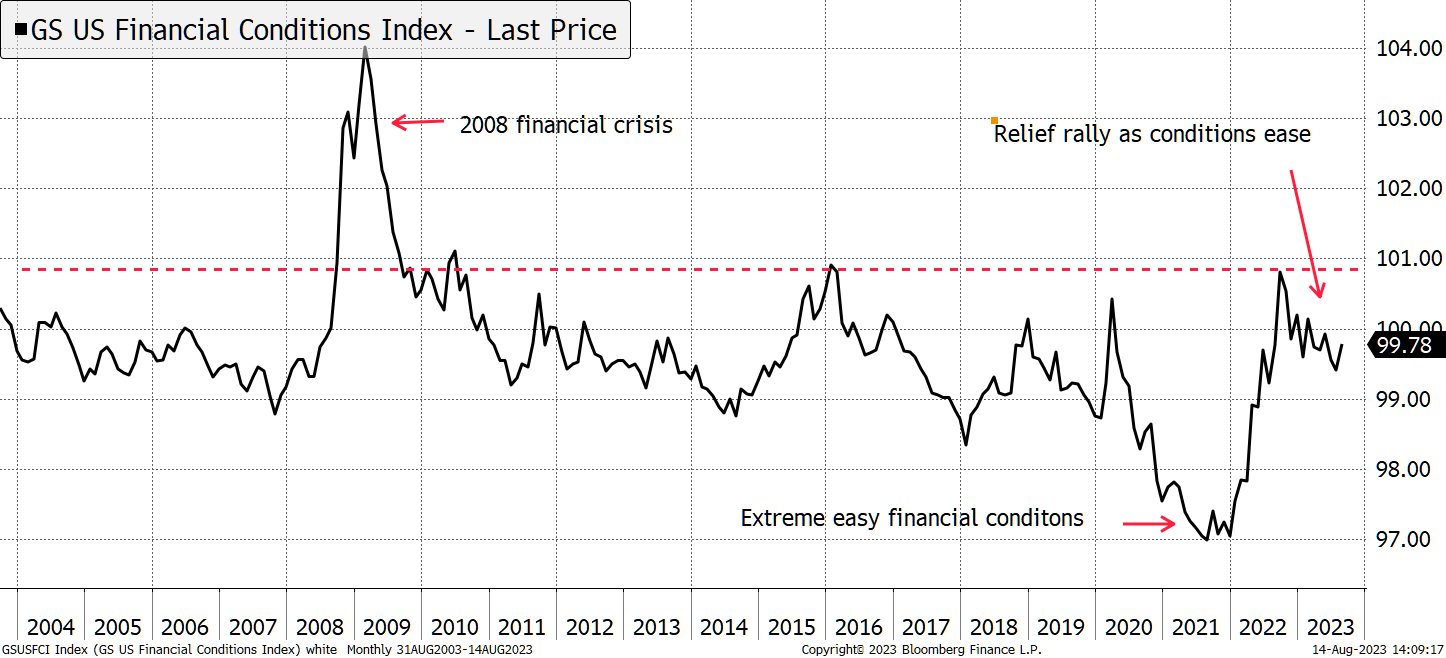

One of the mysteries of 2023 is why it is taking so long for the economy to slow following the aggressive monetary tightening. We have discussed this from various angles, but the Goldman Sachs US Financial Conditions Index caught my attention. It shows how conditions have tightened but have yet to witness stressed territory. Last October, it came close but didn’t stay for long. The bottom line is that despite all the efforts to crush demand, the system has proved resilient, at least in the West.

Financial Conditions are Not as Tight as Expected

That is despite numerous recession indicators suggesting there’s a 100% (not 90% or 80% but 100%) chance of a recession within 12 months… and that was 14 months ago. It must be the case that a recession is still coming but is taking longer because the money people have severely underestimated the scale of removing the vast amounts of excess money that they printed during the pandemic.

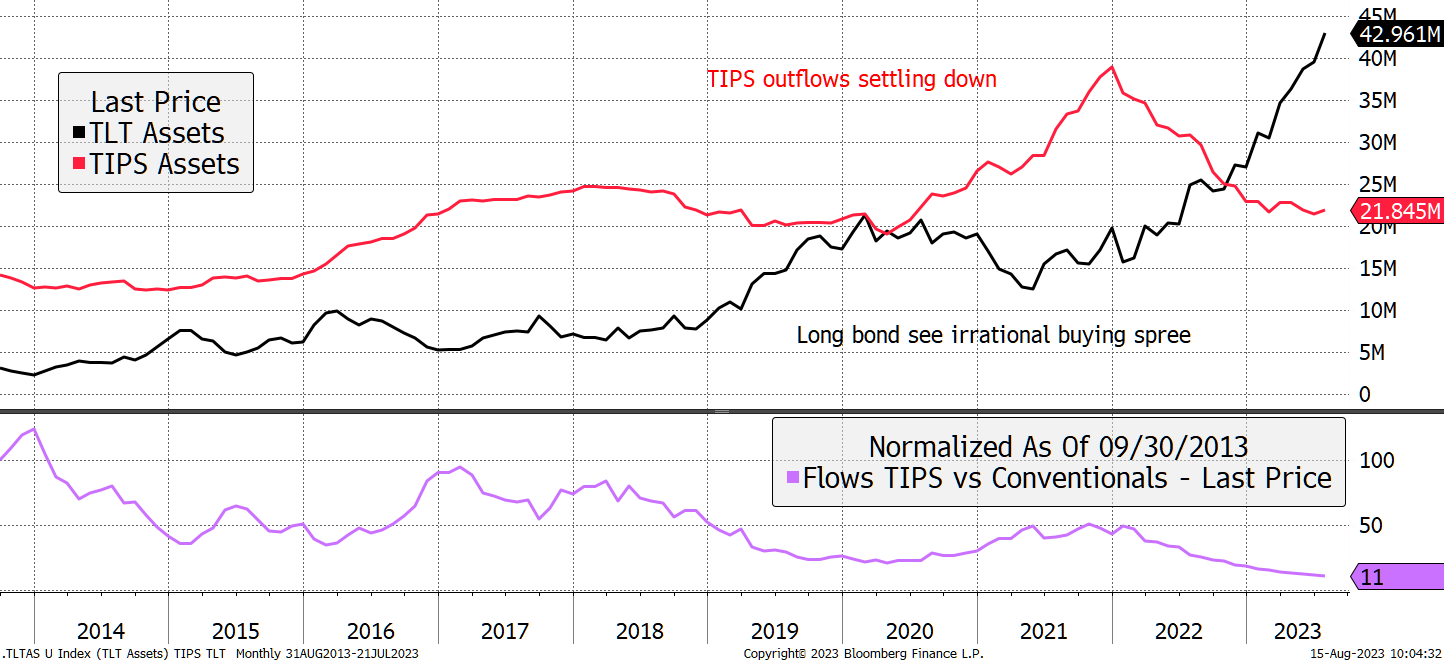

I think one of the worst outcomes that has added to the general confusion has been an excessively high demand for the long bond. A recession was so widely expected investors bought the long bond because they inherently believe we return to the old normal. That is low inflation and low rates. See how investors scrambled to ditch the TIPS ETF (TIPS), which offered inflation protection and switched into the long bond ETF (TLT). I have never seen such extreme moves in the asset base between two ETFs.

Extreme ETF Flows

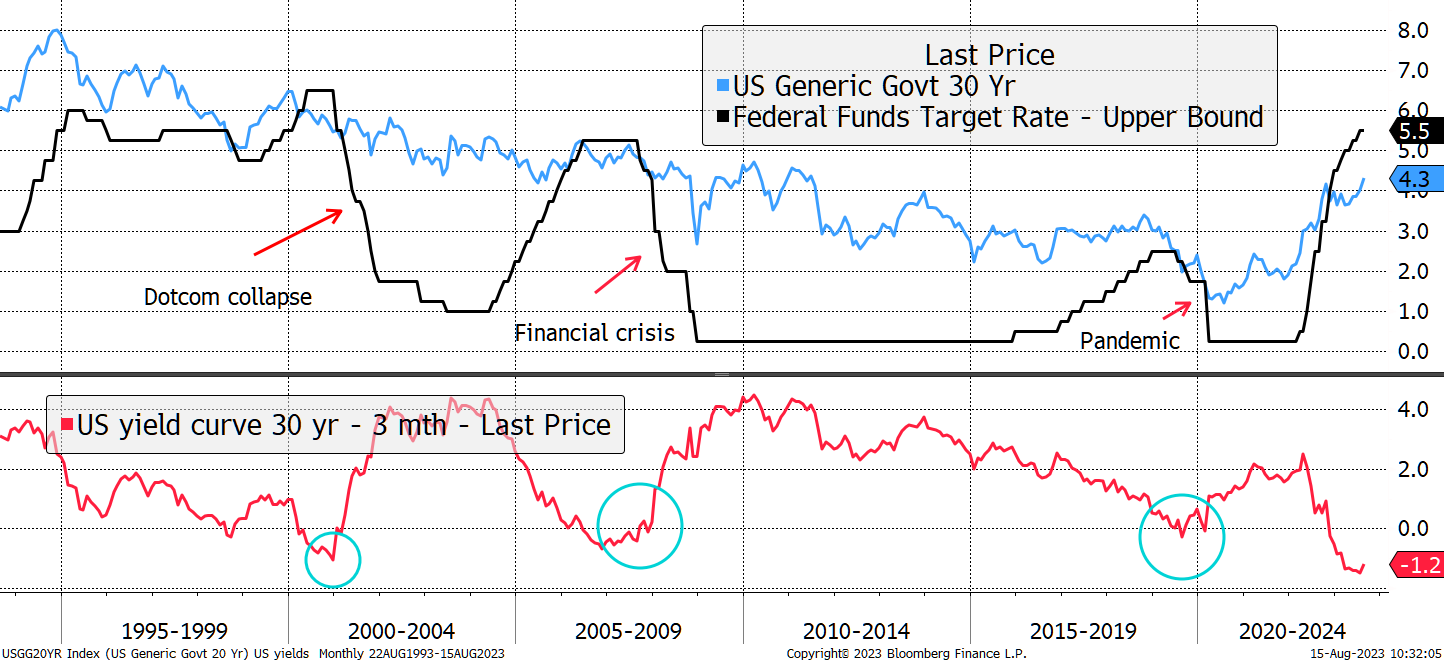

Those investors were wrong because the long bond TLT is down 33% compared to TIPS, and TIP ETF is down 11.5%. Still, they were both down. Below shows how base rates have always jumped around while long-term rates have been a sea of calm in comparison. But one thing has changed. The long-bond has seen a change in trend for the worse, and to assume yields are headed back to 2% or so seems increasingly hopeful.

Fear Rate Cuts When They Come

But I remind you, it is not the inverted curve that has marked the problem in financial markets but the subsequent interest rate cuts that have followed.

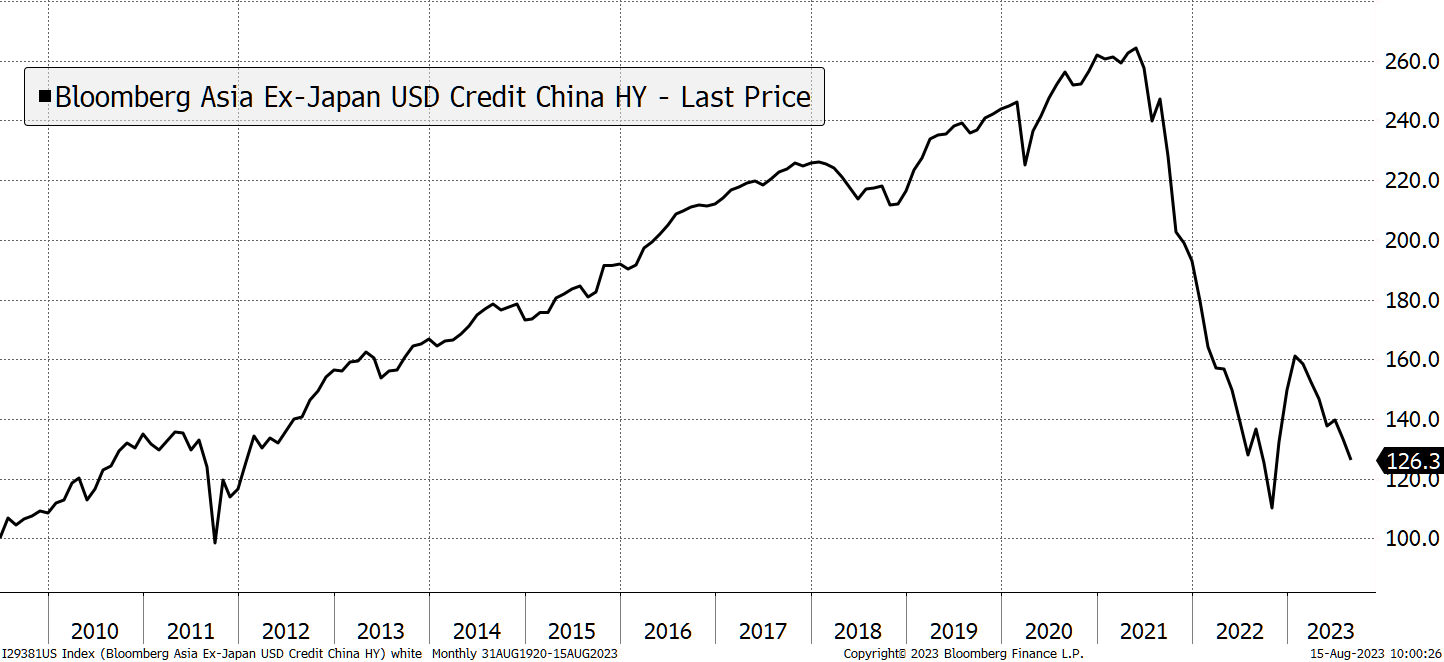

China

I said we shouldn’t assume rates are headed back to zero, but in China, they are. It is easy to assume that China is somewhere over there, and we can’t ignore it. Last night, the Bank of China cut interest rates yet again, sending their currency to the lowest levels for 15 years. As we have discussed before, the Chinese property collapse should not be seen in isolation. Many institutions around the world funded the preceding boom, and the risks cannot be swept under the carpet. Asian credit is falling again, and this is not good news. It stems from a collapsing property market, and the developers are in serious trouble.

Credit Conditions Deteriorate in Asia

I believe we should continue to take decisive action to protect the portfolios during this period of heightened uncertainty. Chinese rates may be falling, but the currency weakness will likely lead to negative sentiment in emerging market bonds.

Selling Emerging Market Bonds in Soda

I added EM dollar bonds to Soda in February at attractive spreads over government bonds (excess yield). Those spreads have fallen, but the trade was overwhelmed by the rise in sterling. This trade was flat in USD but has lost 3.6% in GBP once factoring in the income received. It could have been better.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 Crypto Composite Ltd