Southern Asian Growth Outshines

Trade in Whisky;

Bond yields have been pushed higher again, but there was a relief yesterday when a Fed official said that this was helping with their tightening efforts. The higher yields would reduce the pressure to keep raising rates, which the markets took well. The trouble is that yields fell sharply on the news, which presumably means they’ll have to keep hiking rates. Be careful what you wish for, but this must all come to a head soon.

A softer monetary environment would support the economy, but the risk is it comes too late, as the damage is already done. But the global economy will keep on growing regardless because it’s not all about the developed world. The emerging markets dominate the world’s population, resources, and land mass. They have a long way to go to catch up with Western living standards, and while the Fed can slow them, they can’t stop them. The end of this rate cycle will be very well received by the emerging markets. High time too.

Stronger Growth in Southern Asia

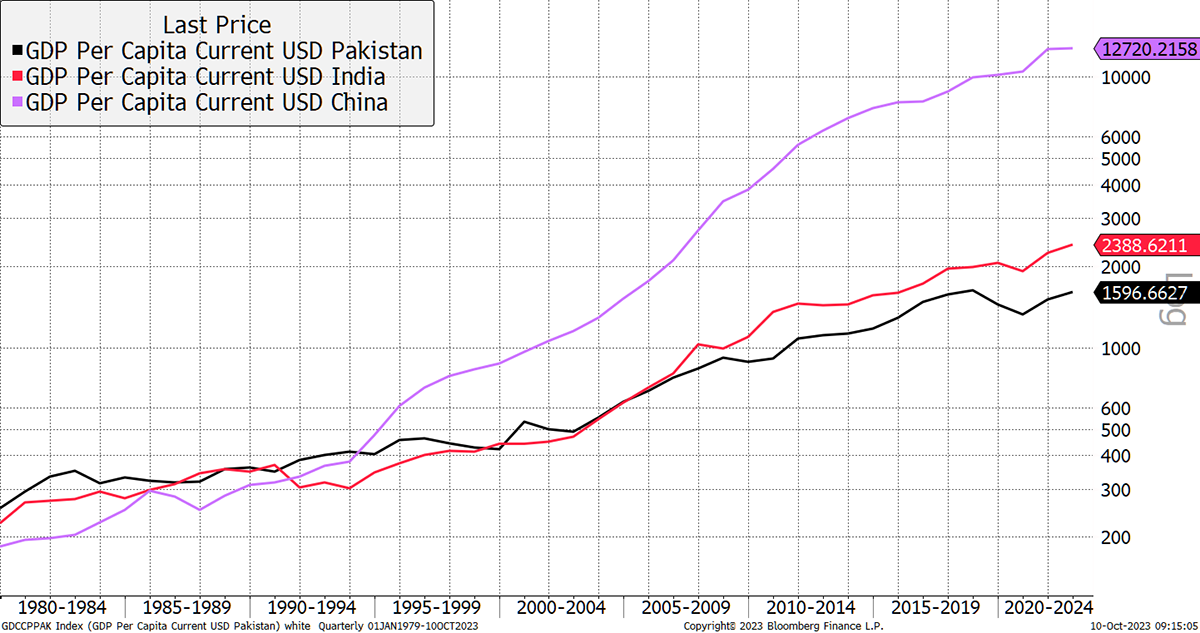

While the West is on the cusp of recession, the World Bank upgraded growth forecasts in South Asia from 5.6% to 5.8%. The region is dominated by India with its $2,256 GDP per capita, which contrasts with China’s $12,556 GDP per capita. Why did India lag by so much? The witty answer is, “it’s a democracy.” Less talked about is Pakistan, probably because it has fewer people. Its GDP per capita lags India at $1,505.

| Pop. (m) | GDP per capita | GDP bn | |

| China | 1,425 | 12,556 | 17,892 |

| India | 1,418 | 2,256 | 3,199 |

| Pakistan | 231 | 1,505 | 348 |

GDP per capita was about the same in the 1980s until China roared away. India and Pakistan have been surprisingly close, but India has pulled away over the past decade. Yet India is a well-known growth story, whereas Pakistan isn’t. I want to investigate this.

Comparing GDP per Capita

In recent years, Pakistan has had its problems, but some things appear to be improving. For example, after a painful pandemic, the current account has returned to surplus, and the trade deficit has shrunk. But it’s not a pretty picture. Inflation is 31%, down from 38% in May. Unsurprisingly, and with inflation so high, interest rates are 21%.

Foreign reserves are low, and in July, they received an IMF bailout for $3 billion. The government has 89% debt to GDP, which is high for a developed market and frightening in an emerging market. According to the sovereign default spreads, Pakistan has a 40% chance of defaulting. But last year, it had a 200% chance of defaulting and didn’t (how that is possible?). Finally, it ranks 140 out of 180 on Transparency International’s Corruption Perceptions Index, which only seems to get worse.

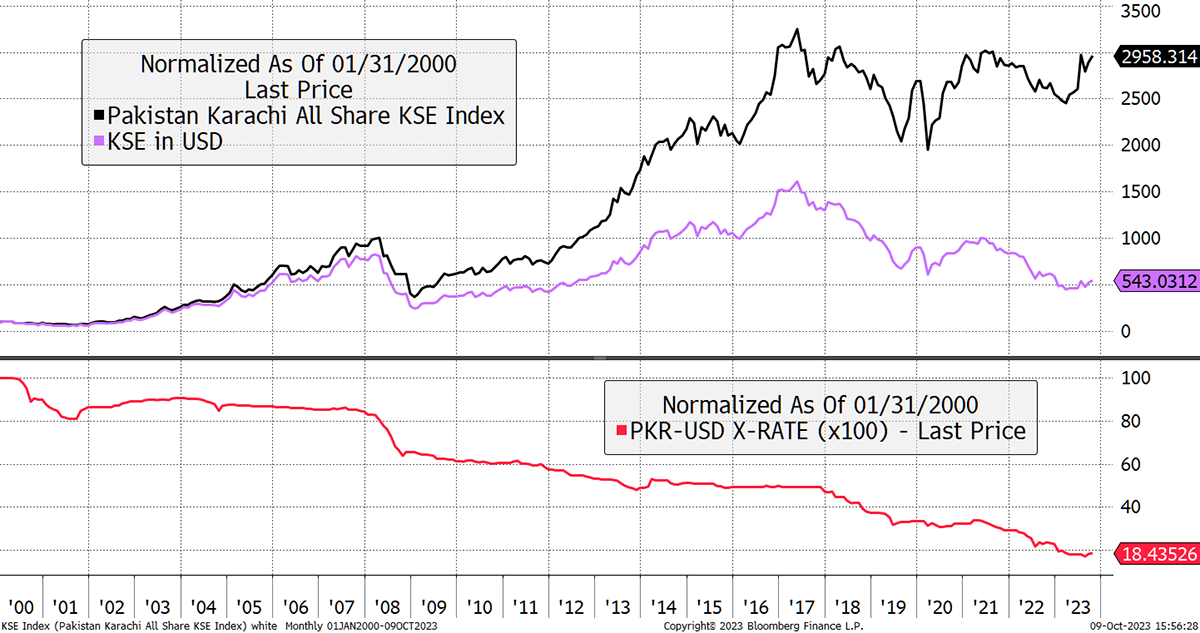

The government is troubled, but the Karachi Stock Exchange (KSE) reflects the fortunes of the private sector. It digests this underwhelming news and responds with lower prices for either the stockmarket, the currency, or both.

The black line is the KSE All Share, and the purple line shows the KSE in USD. The bottom red line is the Pakistan Rupee vs the USD. The charts are rebased to 100 for comparison. The KSE has gone sideways since 2016, but in USD terms, it has been falling. But still, it’s up 5x this century before dividends (100 to 543).

Karachi Stock Exchange and the Rupee

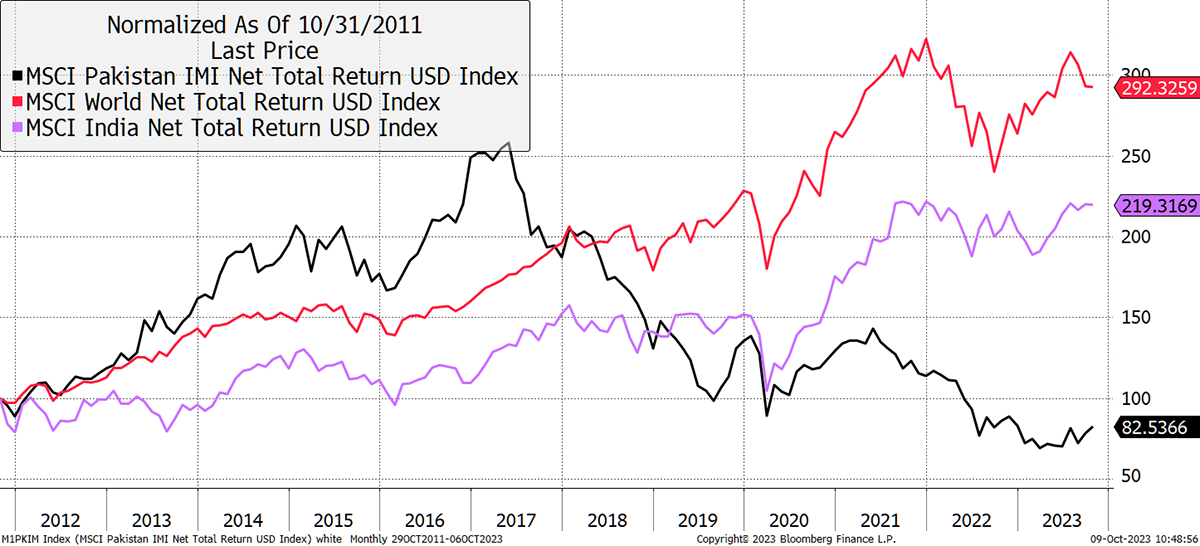

The MSCI Pakistan Index (USD inc. dividends) is more liquid and investable for foreigners. It was riding high in 2017, even ahead of India and the rest of the world, before things changed. I don’t pretend to understand Pakistan’s politics, but I gather the bull years followed the 2013 election, which awarded a “super majority” to Nawaz Sharif. He had been prime minister twice before but not for 14 years. Then, in 2017, he was disqualified following corruption charges.

Pakistan vs India and the World

Imran Khan followed in 2018 with an anti-corruption agenda. So far as I understand, the US wanted him removed from office in 2022 because he was neutral in the war between Ukraine and Russia. They clearly don’t appreciate cricket, and Khan was then arrested in May this year, which was deemed to be illegal. It goes on.

Going back to the stockmarket, it can be a blessing to come across countries that behave differently. They may be packed with risk, but a different kind of risk to what we see elsewhere. In a diversified portfolio, the collection of different risks leads to better outcomes, other factors considered.

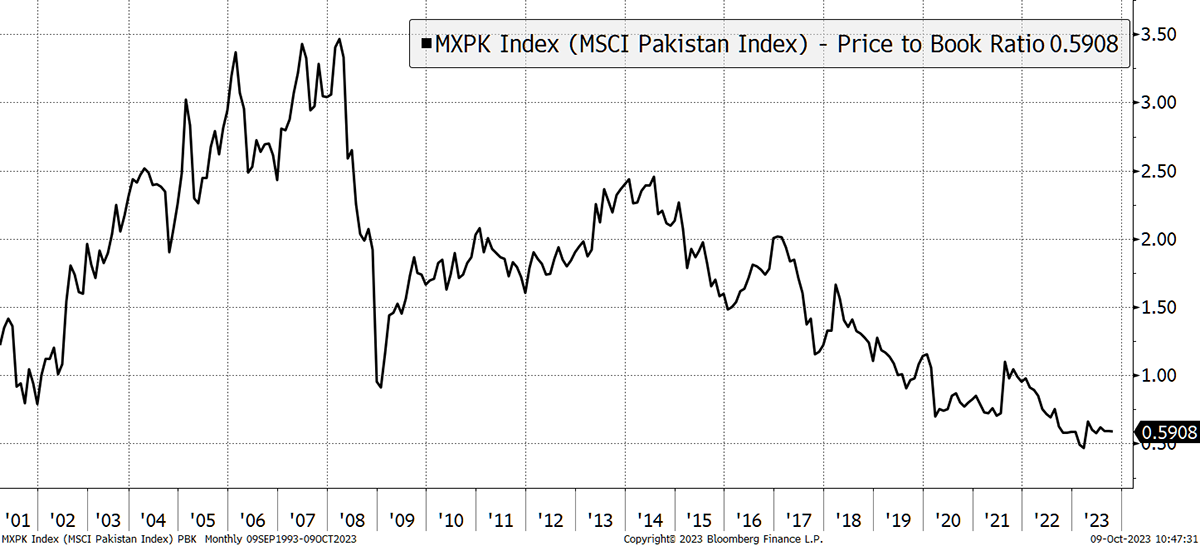

In this case, the KSE is dirt cheap. This diversified Index has a PE Ratio of 3.5x and a dividend yield of 12.3%. I show the price-to-book ratio, which has fallen over the years to well below replacement cost. This is half the valuation seen during the credit crisis, and the turn of the century, when no one was interested in emerging markets.

The Pakistan Stockmarket Has a Compelling Valuation

The KSE is well positioned for easing US rates, and it could race away very quickly. I think it’s a compelling situation. A modest position in Pakistan equities will have a similar impact to a large position in the wider region. Besides, the Indian market is expensive, while the KSE is dirt cheap.

Trade in Whisky

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd