2024: Better for the Economy than Markets

Trade in Whisky;

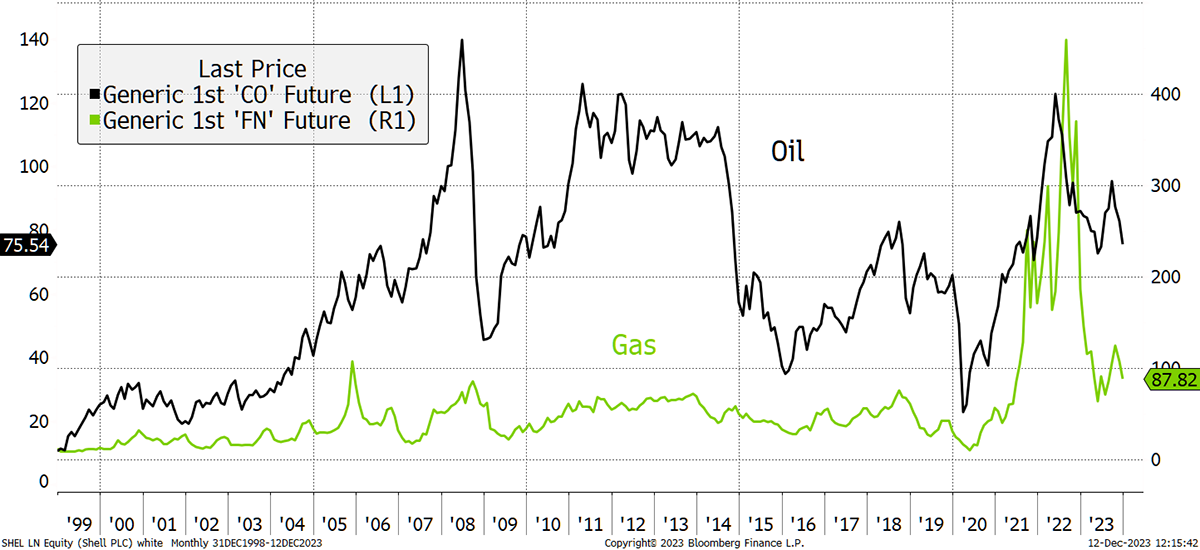

The price of oil has been falling, but not by alarming amounts. I recently highlighted the gold-to-oil relationship at an ebullient time for gold. It suggested that oil currently offered better value, and funnily enough, gold’s all-time high proved to be a damp squib. Better luck next time, but given how gold has been making all-time highs for 5,000 years, we shouldn’t panic.

A falling oil price, or more importantly, energy prices, can be seen as either good or bad news depending on how it comes about. If it reflects weak demand, that’s bad, but if it signals ample supply, that’s good as the economy effectively gets a quasi-tax cut. Energy prices have certainly seen the supply constraints ease, but you can only assume that demand growth has been disappointing, especially in China.

Oil and Gas Prices Ease

Although we only read about tax hikes, there have been a few tax cut equivalents of late. The Fed has signalled the end of rate rises, the dollar has softened, and energy prices have cooled. If you consider these were our major concerns a couple of years ago, they have become reasons to be cheerful. The financial side has certainly boosted markets, but lower energy prices will have done wonders for the real economy.

Yet many experienced market watchers expect a recession, while others believe it will be delayed, but there’s always a crowd that thinks it will be nice and soft and cuddly. Best not to take them too seriously.

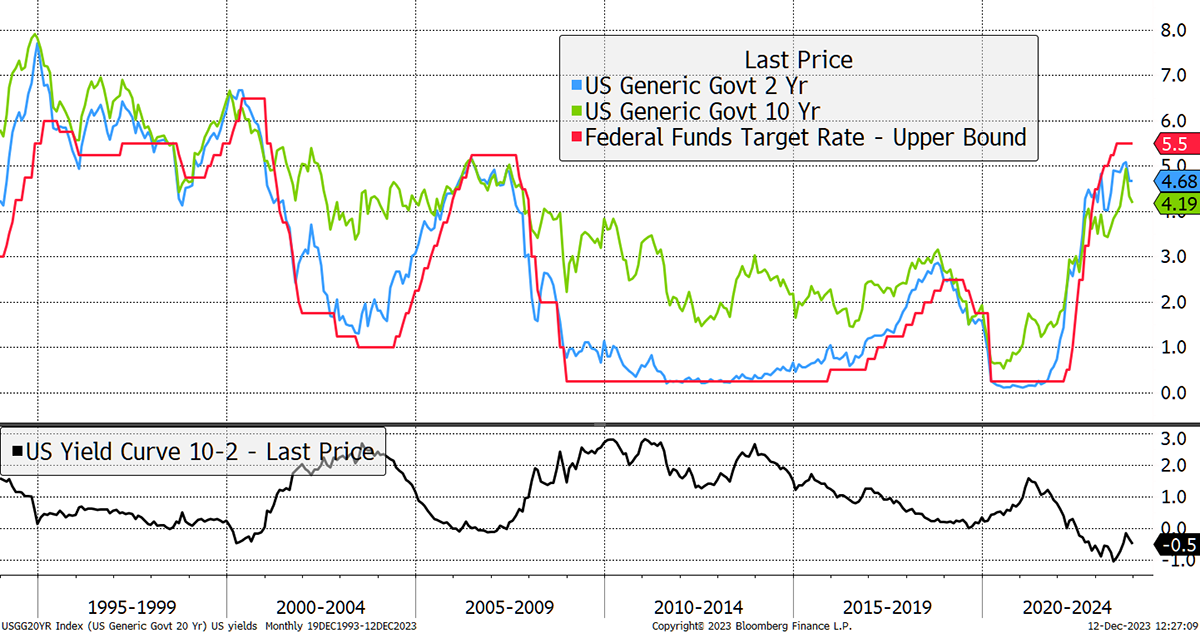

Then there’s the bond market, which has stubbornly refused to signal an economic recovery despite the stockmarket’s best efforts to excite. Rates (red) have surged, and bond yields (green and blue) have followed. The bad news from the bond market is that the 10-year still yields less than the 2-year, meaning the yield curve remains inverted, and that means a recession is coming. They say the bond market has never been wrong on this, but we don’t know how bad it will be.

The Yield Curve Remains Inverted

In recent weeks, yields have started to fall, but nothing like we saw back in 2001 or 2007. The Fed is still worried about inflation. They are probably right to be because while energy prices are no longer the problem, core inflation, which strips out volatile food and energy, remains stubborn.

Core US CPI was reported today at 4%, far above CPI of 3.1%. That means wages are still rising, and the Fed isn’t yet done. It means that with cheaper energy and higher wages, the economy has the upper hand, but before you celebrate, the Fed’s job is to crush it. 2024 is going to be full of surprises.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd