Peak Rates and the Yen

Trade in Soda;

Last week, the central banks signalled that the interest rates have peaked. That doesn’t mean we are off to the races, but it removes an obstacle, especially for bonds. We have also made it through to November, which means the crisis season is potentially behind us. The dollar sank on the news, which is normally well received by non-US assets.

Although there are reasons to be upbeat, the peak in the rate cycle isn’t necessarily a good thing. As I wrote in June, the rate cuts can be a warning of trouble ahead. In both 2000 and 2008, rate cuts marked the start of the equity bear market. Rate cuts are better for bonds and homeowners, but as I keep saying, value has already derated and is well positioned to perform. This week, I will add a small position in a European investment company to Soda.

But first, the yen weakness continues, and this trade has become a headache. The idea is simple: the yen is massively undervalued and is overwhelmed by short sellers, motivated by the low carry cost. That is the difference between the interest rates they pay to borrow yen, and go short, and what they receive when they deposit the proceeds into dollars, pounds or euros.

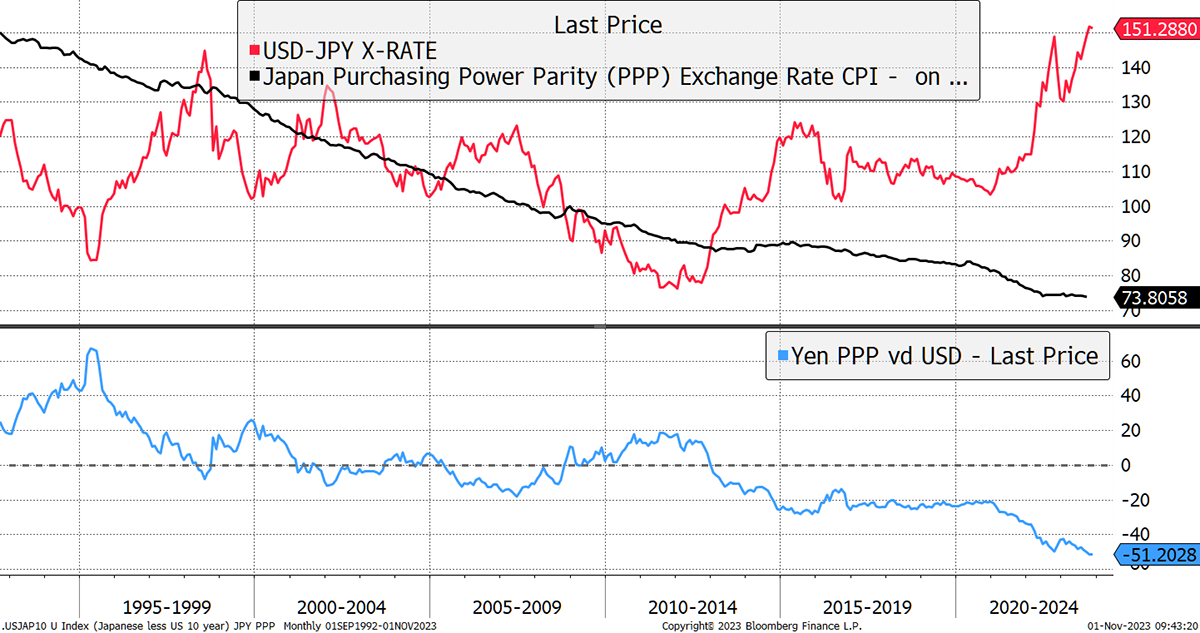

Unlike assets, currencies do not pay a higher yield when prices fall. If a stock or bond halves, the yield doubles, but with FX, it stays the same. That means traditional value doesn’t kick in and supports the price as well as it does in assets. The way to identify cheapness is with purchasing power, whereby you can buy more goods and services in Japan than in the USA for the same amount of money. In this case, twice as much.

The Yen is Dirt Cheap

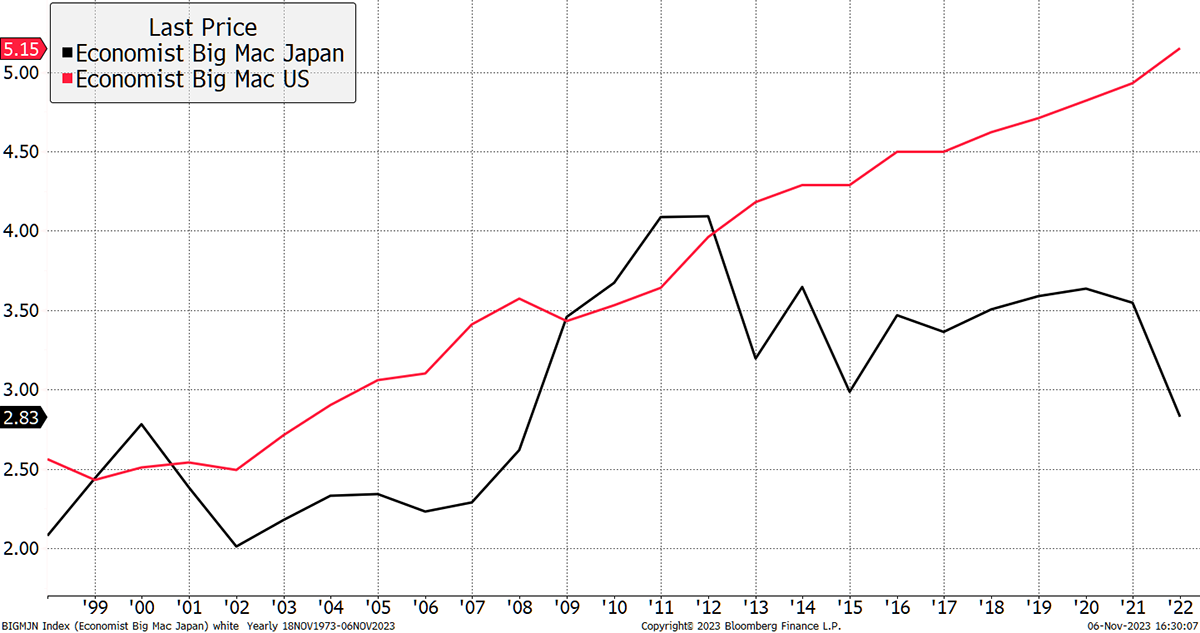

Bringing that home, the Economist’s Big Mac Index confirms it. Big Macs were the same price in both countries in 2010 but are now nearly twice as much in the US than in Japan.

Cheap Big Macs in Japan

The cheapness is remarkable, never previously seen and keeps widening. The main driver has been the rates differential. The chart shows the difference between US and Japanese 10-year bond yields plotted against the yen. The dollar has gained nearly 50% against the yen since 2020, matching rates along the way.

Rate Differentials Drive the Yen

US bond yields have surged, while Japanese Bonds (JGBs) have seen rates capped at 1%. If they were allowed to rise, or US rates fell, the yen would strengthen significantly. This scenario would unfold in a crisis, or on a major policy shift, and my thesis has been that if and when the financial system comes under stress, the yen will strengthen sharply. Therefore, this trade provides important portfolio protection.

But I will readily admit I didn’t see the yen falling 11% against the pound. The situation seems to be unparalleled. What disappoints me is that when the stockmarket has fallen, the yen had appreciated, which is great. But during the recoveries, it gives back more than it gave. It would be better the other way around. The chart above shows us that the yield spread has fallen, and the yen ought to respond to that positively. If it doesn’t do that soon, I may have to capitulate on this trade. It will be uncomfortable but could be a signal that something else is going wrong behind the scenes that is much bigger.

The Bank of Japan seem to consistently do the wrong thing, and you suspect they want a weak yen to compete with China. No action right now, but I am losing enthusiasm for this trade despite the cheapness. It is at the front of my mind. That said, the stockmarket hasn’t crashed, so what can we expect?

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd