The Capital Gearing Trust and the Ruffer Investment Company

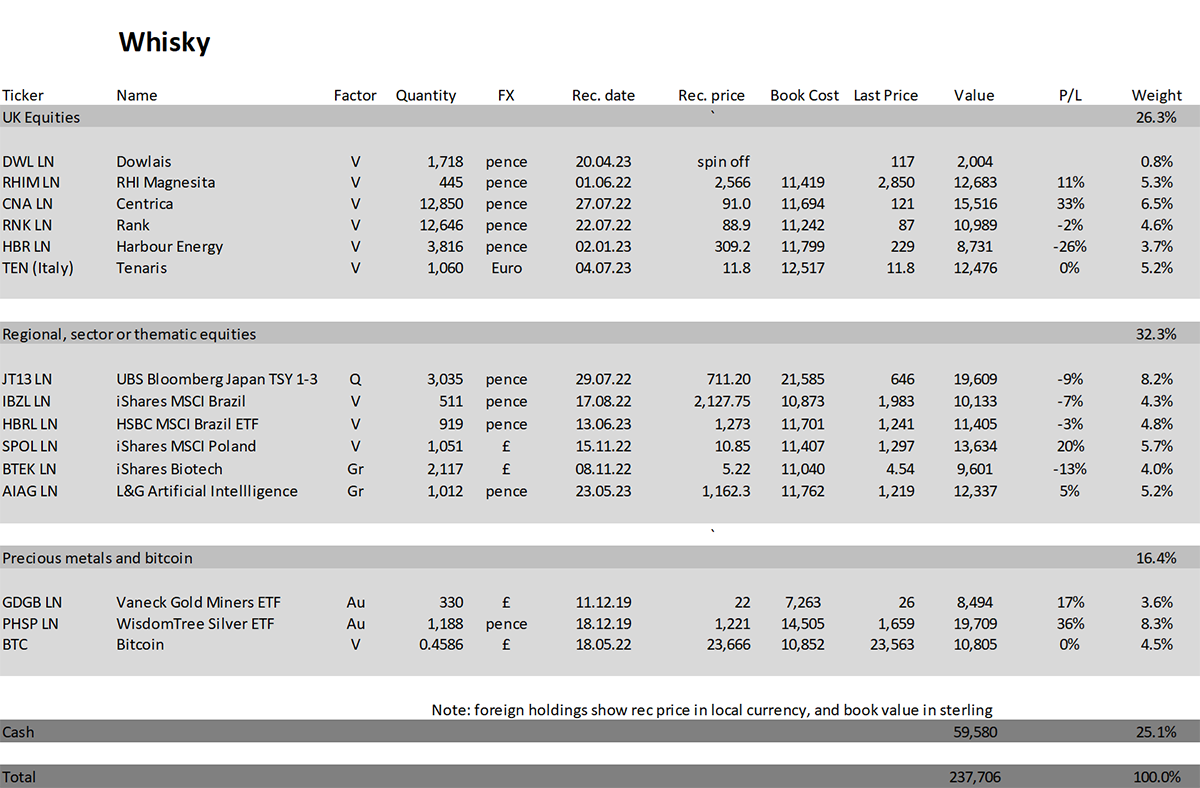

Trade in Whisky;

There is disquiet as our two long-standing, multi-asset investment trusts have come under pressure. The Capital Gearing Trust (CGT) and the Ruffer Investment Company (RICA) have excellent long-term track records and would both be considered diversified and defensive. Yet things have gone wrong for these strategies in 2023, mainly because the pound has gone up, index-linked bonds have not recognized the inflation around us, UK interest rate expectations have ballooned, and discounts on investment trusts have widened. It’s a perfect storm.

You can be sure that sooner or later, the pound will ease, the bond market will settle down and correctly price inflation, while the discounts on investment trusts will narrow. When that happens, CGT and RICA will spring back to life. Although it may not appear that way, these funds are defensively positioned, and the pressures around them are unparalleled. They are prepared for a bigger battle, which is a major recession brought about by excessively tight monetary policy and longer-term - and volatile - inflation. It seems their defensive positioning, to fight the bigger fight, has caused the problem.

This week, I will have a look at CGT and hopefully cover RICA next week as they announce their results next Tuesday, assuming there is time. In any event, these trusts will be at the forefront of our discussion until all of your questions are answered. But be sure, I have not lost confidence in these managers. On the contrary, the market has presented us with highly unusual circumstances, which will sooner or later pass.

Capital Gearing Trust

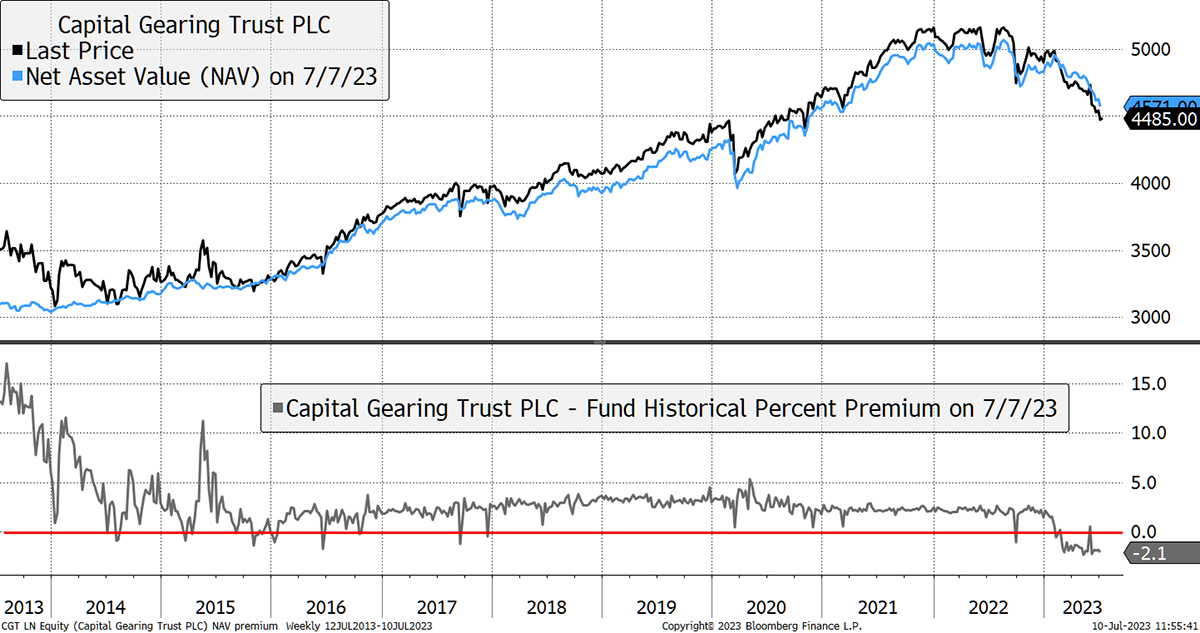

CGT’s net asset value (NAV) has fallen 6% this year, and their share price 10%, as the shares have swung from a 2% premium to a 2% discount. It is important that we focus on the 6% loss of NAV and deem the discount as a temporary irritant that is irrelevant to long-term holders. Over the years, CGT has tended to trade at a premium because its shares have been in high demand.

CGT Discount

This premium-to-discount shift is something that has been felt across the investment trust sector as market liquidity has come under pressure. There have also been mergers in the wealth management sector which has led to concentrated ownership. The large wealth managers are backing away from owning investment trusts, with the shares being snapped up by private investors. On their clients’ behalf, Hargreaves Lansdown, Interactive Investor and AJ Bell are the three largest shareholders. I expect that trend to continue. That said, CGT are buying back shares in the market on a daily basis, which means the discount should not widen any further.

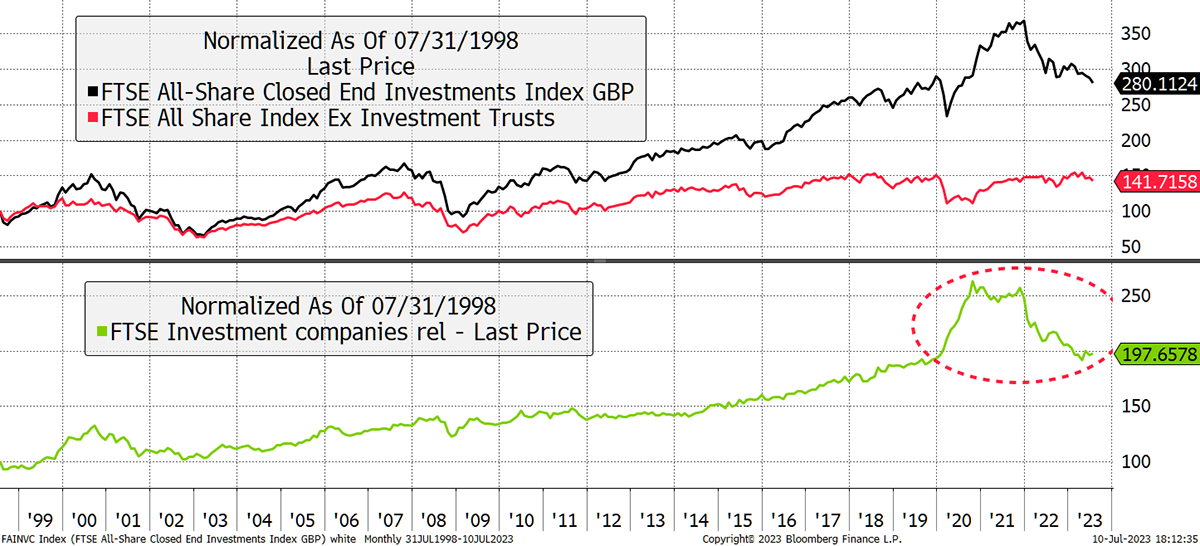

Over two decades, investment trusts have very clearly beaten the stockmarket, mainly because they have good managers, better governance, a little gearing and make longer-term investment decisions. That said, they have hit a bad patch and have been collectively underperforming the stockmarket for nearly two years. Much of that will be because many are income vehicles invested in property, infrastructure, renewables and even music rights. All have been impacted by rising interest rates.

Investment Trusts Normally Beat the Market

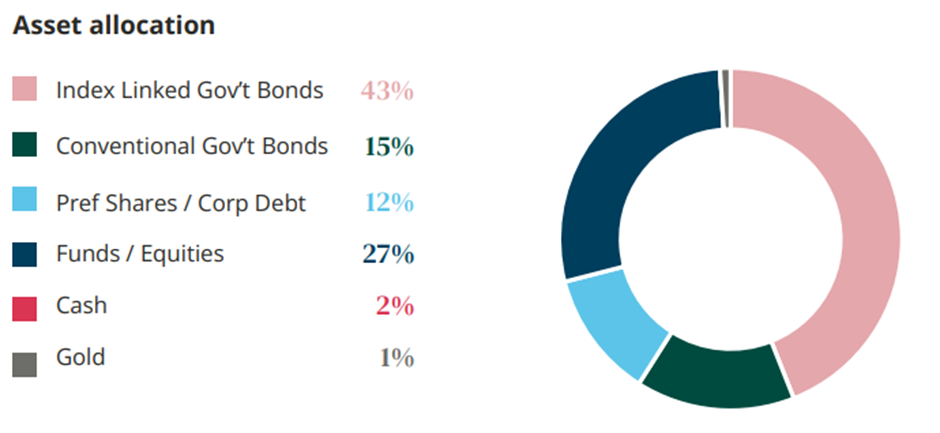

This is relevant to CGT because it is an investment trust that has suffered a swing from premium to discount and also because it owns other investment trusts within the funds/equities part of the asset allocation.

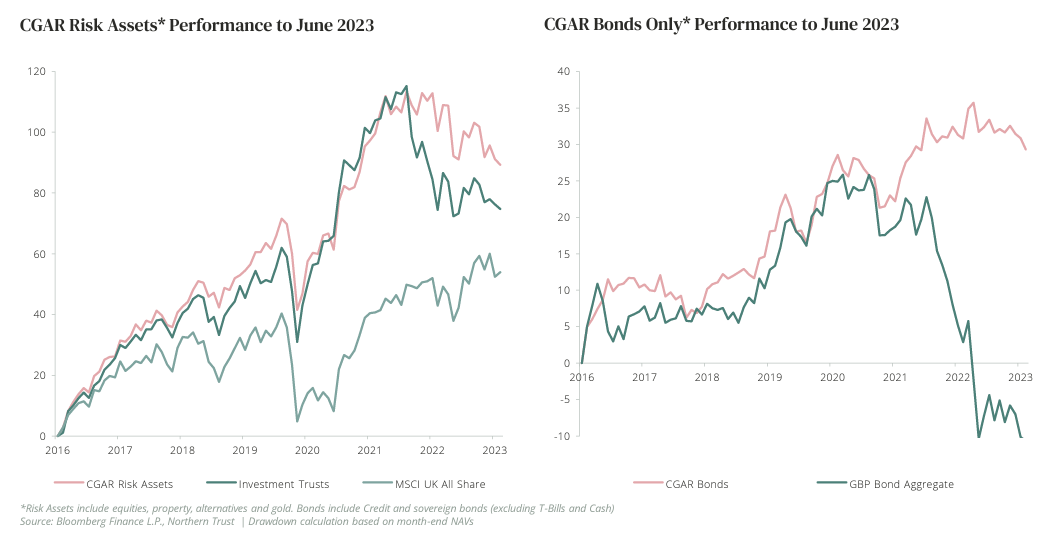

The chart below on the left shows CGT’s equities, funds, and gold. This part of the portfolio has also fallen, but less than the investment trust sector, which is where most of its investments are. To its detriment, its equities and funds have fallen when the stockmarket has been rising. This is attributable to the investment trust exposure mentioned, where discounts have widened, and a bias towards income-generating assets. These discounts will narrow when the market recovers.

The elephant in the room is 58% investment in government bonds, mainly index-linked (inflation) and another 12% in corporate bonds and preference shares. The fund is heavily skewed towards bonds, as it normally is. However, their portfolio duration is low, meaning it is much less risky than the bond market in general terms. That is demonstrated in the chart on the right, which shows that their bonds have fallen, but by much less than the market.

CGT has been right to own short-dated bonds, but being cautious hasn’t been enough. Furthermore, 41% of their portfolio is international. The pound has been rising sharply this year, and this has been a major headwind for the portfolio.

CGT has not hedged its overseas bonds, which is the managers’ default choice, because it is the right thing to do most of the time. A major benefit of international investing is the additional diversification because if the pound falls, you’ll be better off having international assets. But if the pound rises, which occasionally happens, and never lasts, that goes against you.

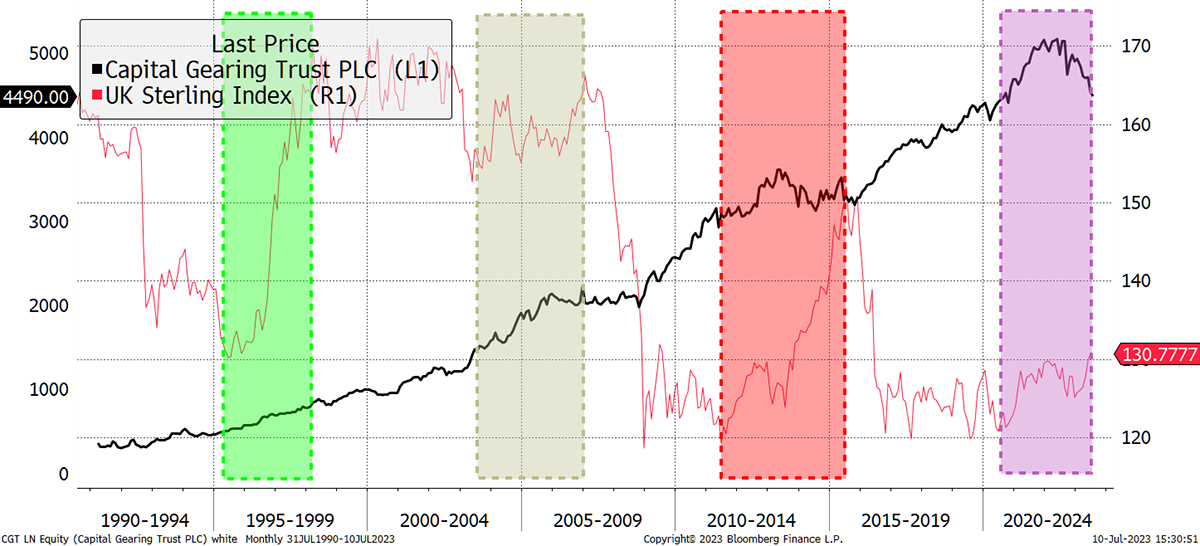

The boxes show the times when the sterling index (vs global FX basket) has been rising, with just four notable occurrences in 33 years. The black line shows CGT performance. The first two times made little difference, but they did stall in the 2011/14 era, which was followed by a jump in performance. This time the strong pound has added to their problems.

The Impact of a Strong Pound

I also showed some charts last Friday, highlighting how we just haven’t seen years like this in a very long time. The problem is the bond bear market, which they did well to avoid in 2022, but still, any exposure at all in 2023 has been a drag. Furthermore, inflation-linked bonds have not been rewarded by the market. For whatever reason, and despite real-life experiences such as labour shortages and food prices, index-linked bonds have not been differentiated from conventional bonds. This must change and will be a key discussion point in the webinars.

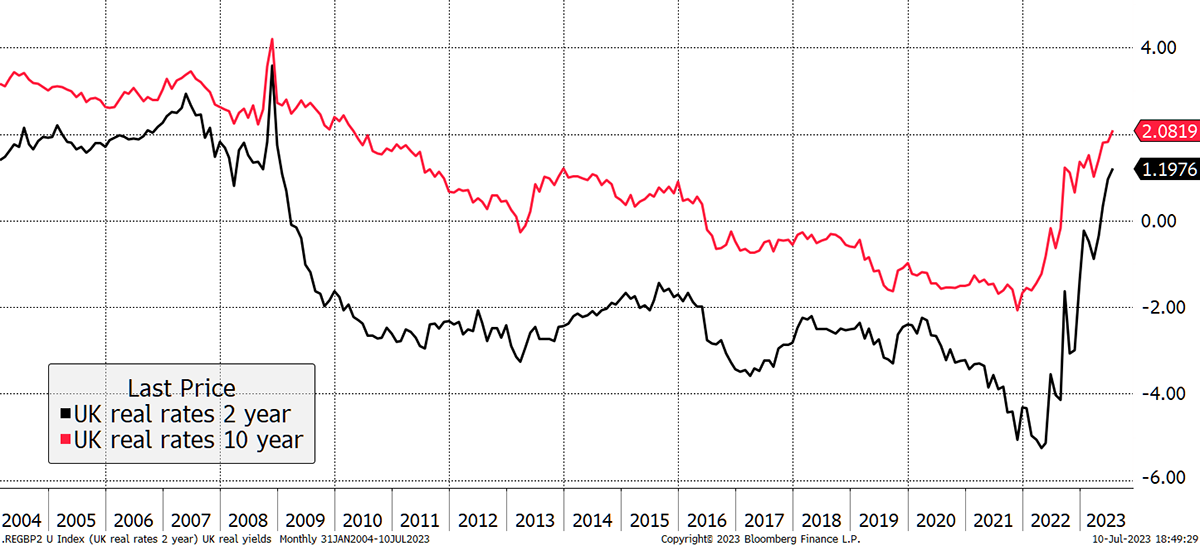

The real yield, or the yield after inflation, trades at extremely attractive levels, and it seems unlikely they will stay this high as they will harm the economy. The last time real yields spiked was in 2008. Over the next decade, they returned 9.2% p.a. or 150% in total. There are very good reasons to be holding index-linked bonds at these prices.

UK Real Yields

In my opinion, rates, inflation and sterling are all linked and will flip around very quickly when the central bankers back off. That can’t be far off. The discounts will take a little longer, but the main point is that all of these problems are temporary and will reverse. The one thing not to do is panic and sell. If anything, do the opposite.

I’ll leave it there; suffice to say, I look forward to the webinars. CGT’s website has plenty of information, including their recent Q2 webinar, which enthusiasts should visit. Have your questions ready, and if you can’t attend live, just send them to me. The webinar will be available on playback.

Buy 5% Schlumberger (SLB) in Whisky

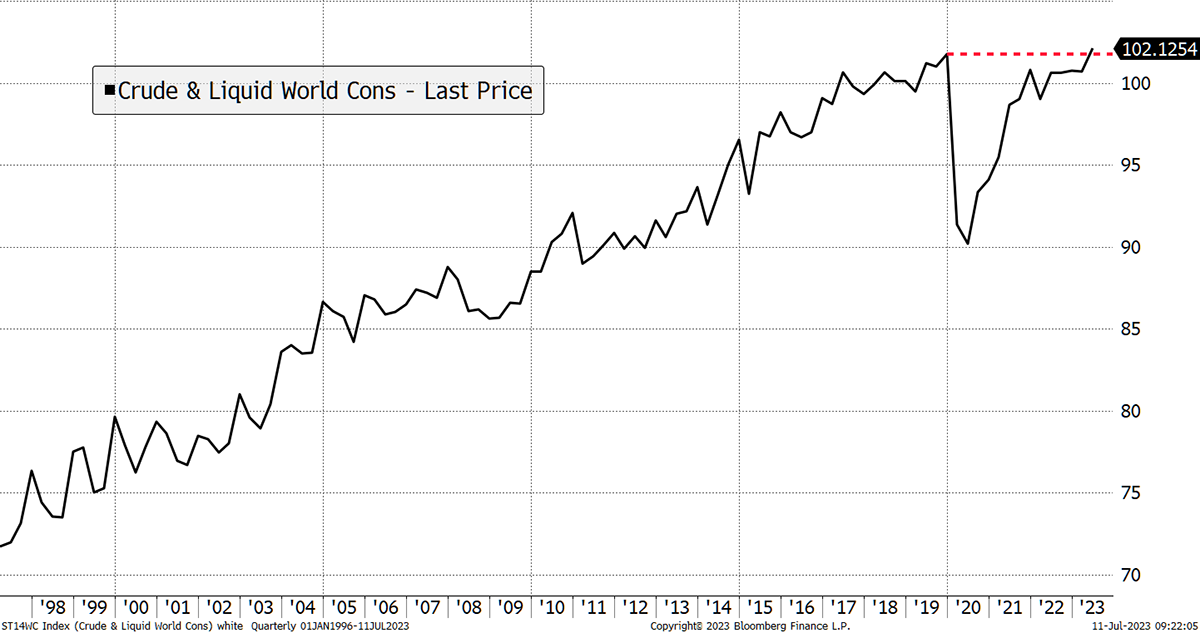

As I keep on saying, the demand for oil is relentless and grows year on year, and we have just hit a new post-pandemic all-time high. Demand is now 102 million barrels per day, and the International Energy Agency still sees that growing year on year.

World Energy Consumption

The key suppliers are Russia, Saudi Arabia, and the USA, with the latter still producing less than their 2019 peak. The bottom line is that we need more oil and will do so for many more years to come. There is plenty of oil out there, but it is getting harder to access, and this is where the balance of power shifts from the oil producers to the oil services companies. Following on from Tenaris, I am recommending the US giant SLB.

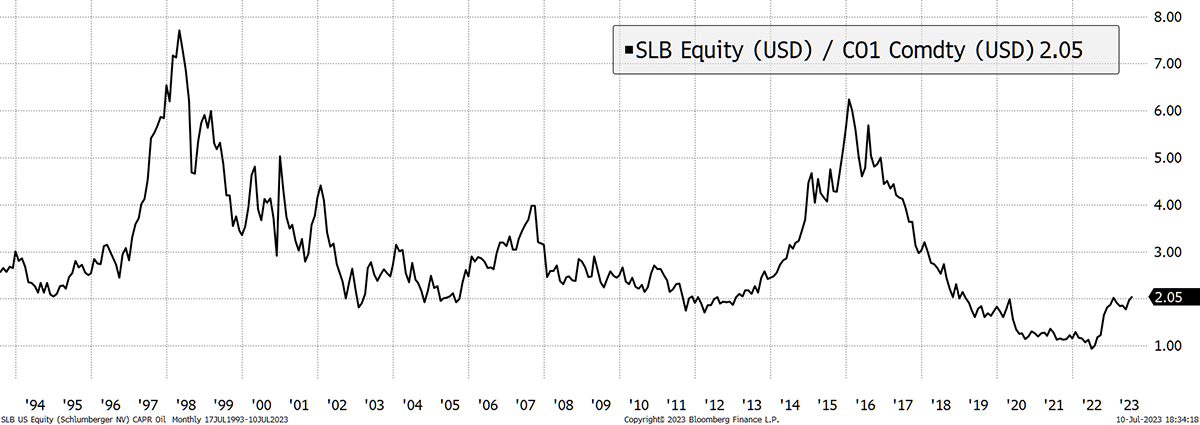

Last year SLB saw sales of $28 bn, forecast to rise to $36 bn next year. The company sits at the heart of the oil business and operates all over the world, with 78% of operations outside the USA. The stock is reasonable value on conventional metrics but is compelling in comparison to the current soft oil price. I believe that SLB will be revalued when the oil price strength resumes, just as it has in the past.

Schlumberger Offer Value Versus Oil

I am sensing strength in this sector, not just in the share prices but in the forward-looking statements. The offshore oil market is strong, and I feel it is time to rebuild exposure. It may well be that there is a recession, but I sense the oil market has already corrected. Moreover, the disappointing Chinese reopening this year demonstrates that global cycles are becoming increasingly mixed. Finally, if the oil price is soft, OPEC will cut their way out of it.

SLB trades in many markets, but I suggest you buy the US shares with the ticker SLB. If you are new to US shares, you will need to fill out a W-8Ben form with your broker.

Risk

SLB is the world’s largest energy services company, established many years ago, worth $76 bn. The shares are highly liquid, and the company has a strong balance sheet. The main risk is the oil price. I believe it will prove resilient, but the oil price could fall. I deem SLB to be medium to high risk.

Action:

Buy 5% Schlumberger (SLB) in Whisky

Postbox

There have been questions surrounding CGT and RICA, and I hope they have been answered or will be shortly.

Portfolios

New readers, please find a note at the end after the summary.

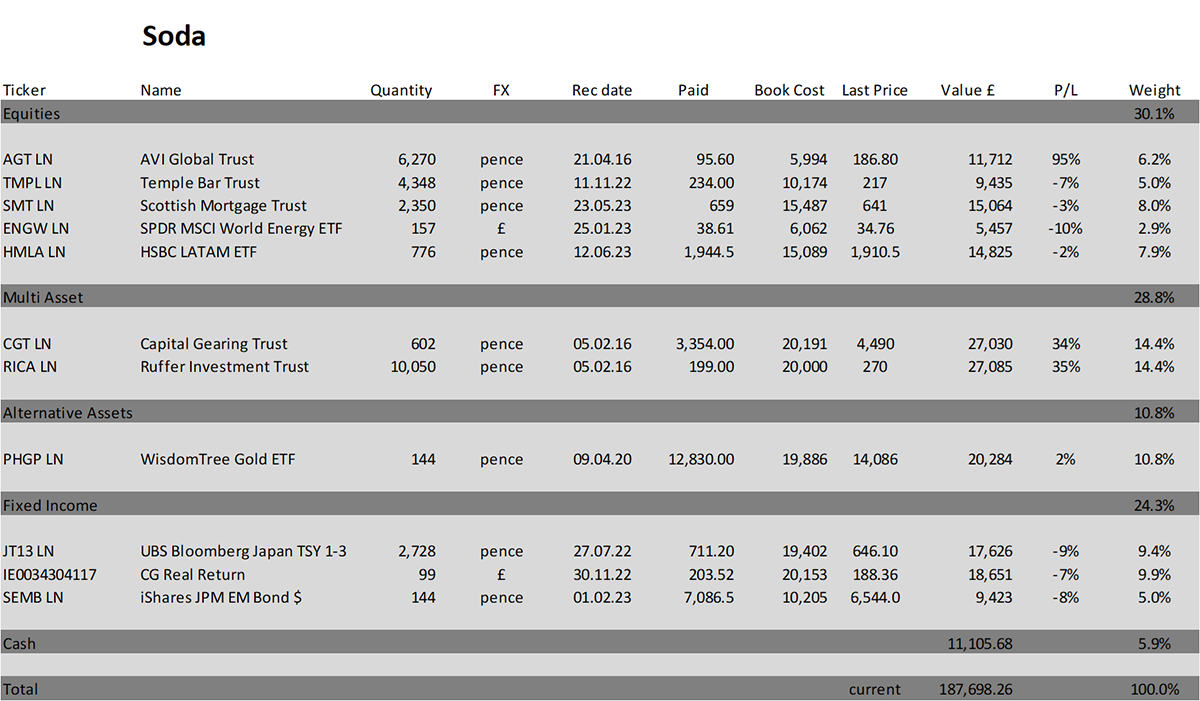

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts. The Soda portfolio is down 6.2% this year and is up 87.7% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.4% this year and up 137.7% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

One thing that stands out is how we are seeing the pound rise when discounts are widening when normally it is the other way around. But it’s the summer, which are the months that are notorious for strange price moves.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()