ByteTree Quarterly Investor Letter - Q3 2025

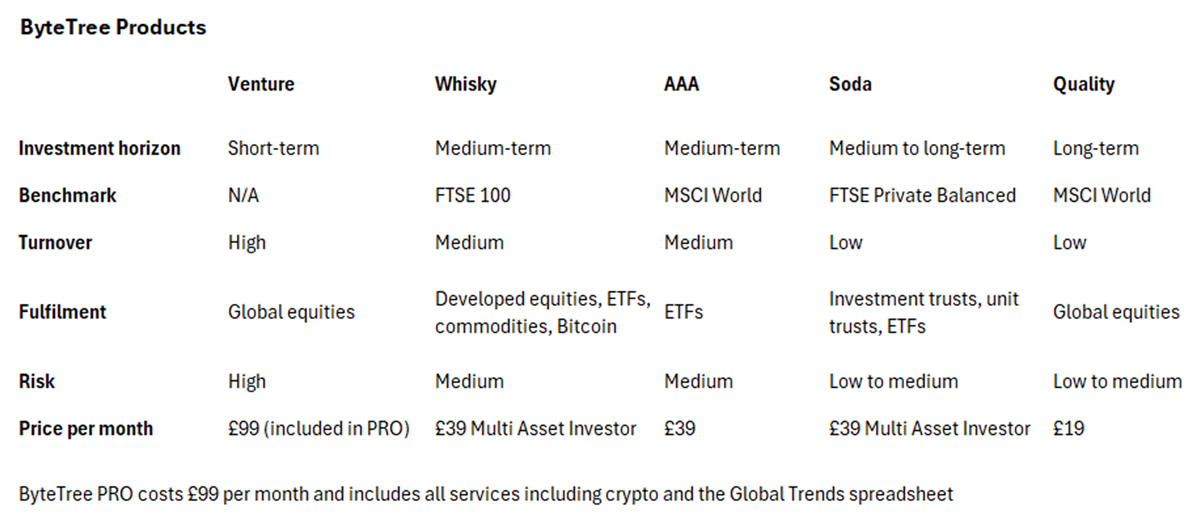

Since 2013, our mission has been to help people invest better. We do this by delivering actionable, high-quality, contemporary investment guidance at an affordable price. With all the information out there, we help investors by distilling our advice into model portfolios, explaining every new investment recommendation in real time.

In this Q3 2025 update, I shall review the model portfolios, named Whisky and Soda, which I have been managing since February 2016. These are covered in The Multi-Asset Investor, which is published on Tuesdays. I shall also touch on our other services.

Letter from Charlie Morris, CEO

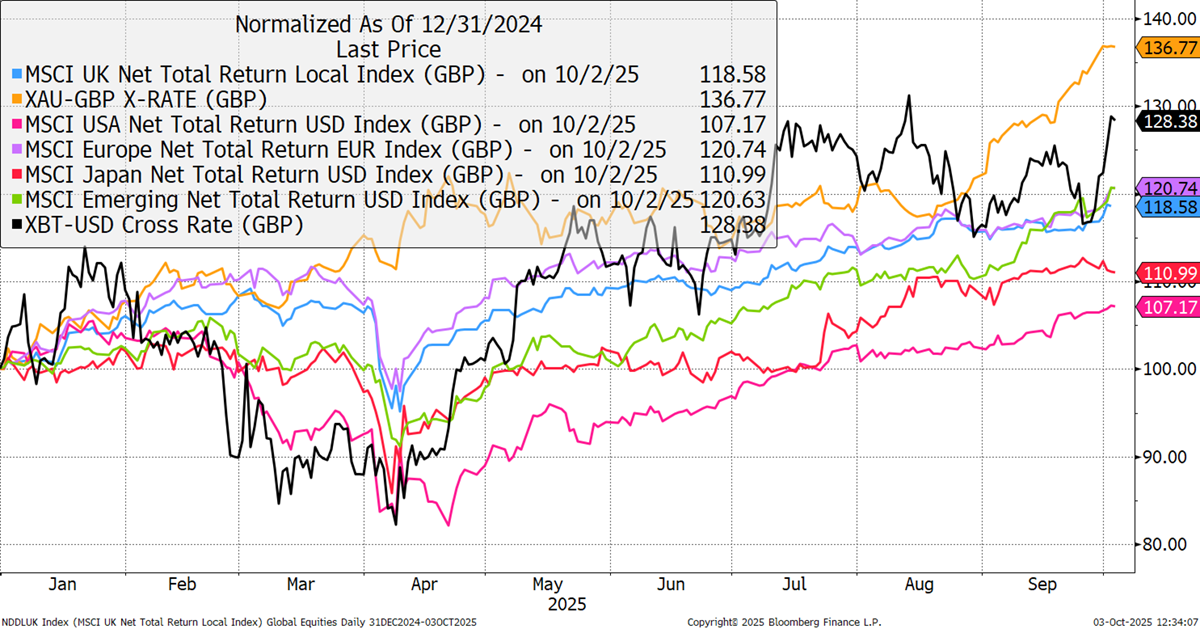

Q3 contrasts with my review of Q2, where I had to cover the market crash over tariffs. These last three months have seen a melt-up with global equities, up 9% in GBP. But that’s nothing compared to the 19.3% rally in gold, 32% in silver, and 51.3% in gold miners. But it wasn’t all fun, as the long-dated gilt fell 6.2% and oil remains fast asleep.

Gold has led the world this year, closely followed by Bitcoin. Emerging markets and Europe have led the stockmarket, followed by Japan. The US has been held back by a weak dollar.

Global Equities in 2025

The US market accounts for two-thirds of the World Index, and that means when it lags the world, it is a gift for portfolio managers in search of outperformance. With most of our exposure outside the US, the ByteTree portfolios are having a good year.

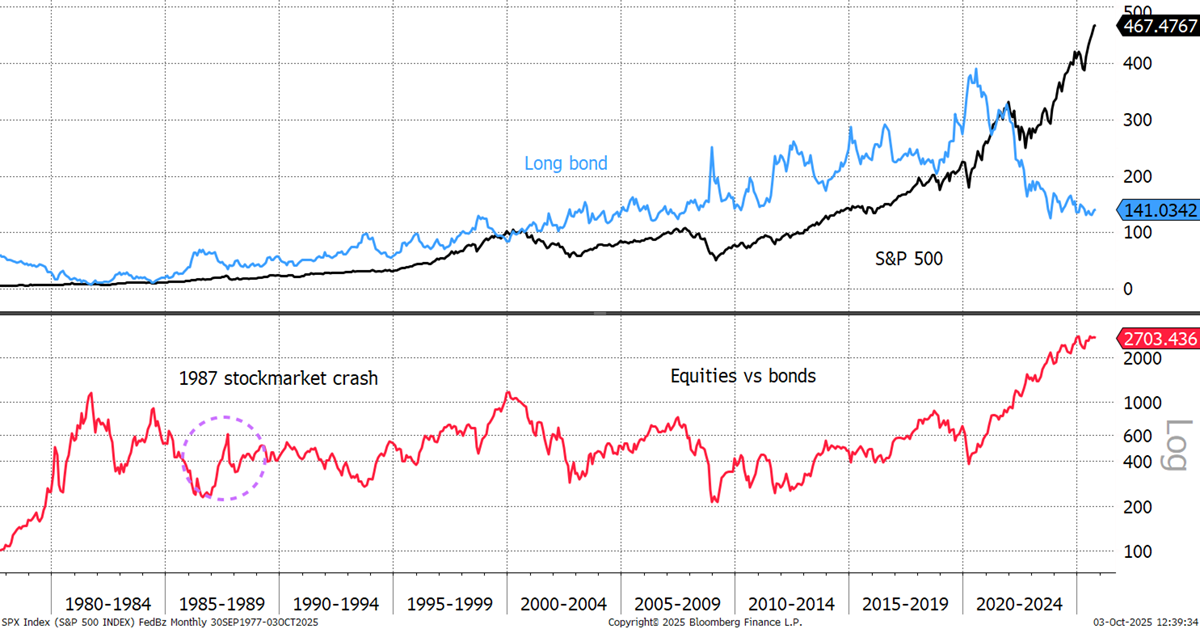

The other thing to avoid has been bonds. They may be showing signs of stabilisation, but you cannot ignore the signal from hard assets, such as Bitcoin and gold, that inflation is likely to return. Indeed, in a recent piece, I highlighted how quantitative easing may return much sooner than expected. The last time we saw such performance of equities over bonds was in the 1970s.

Bonds and Equities

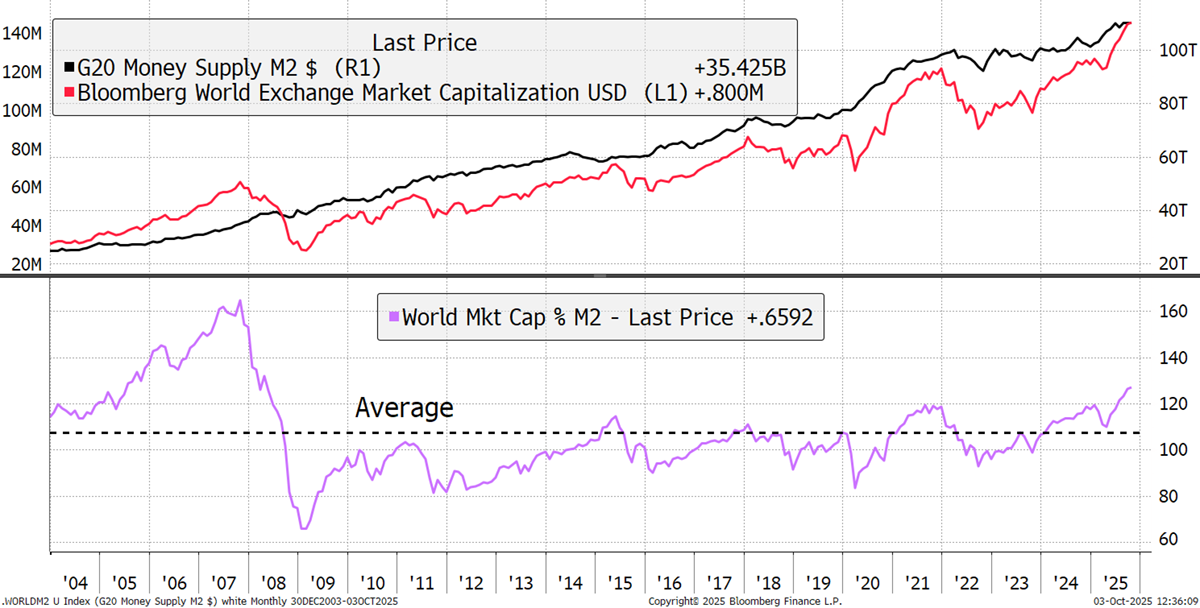

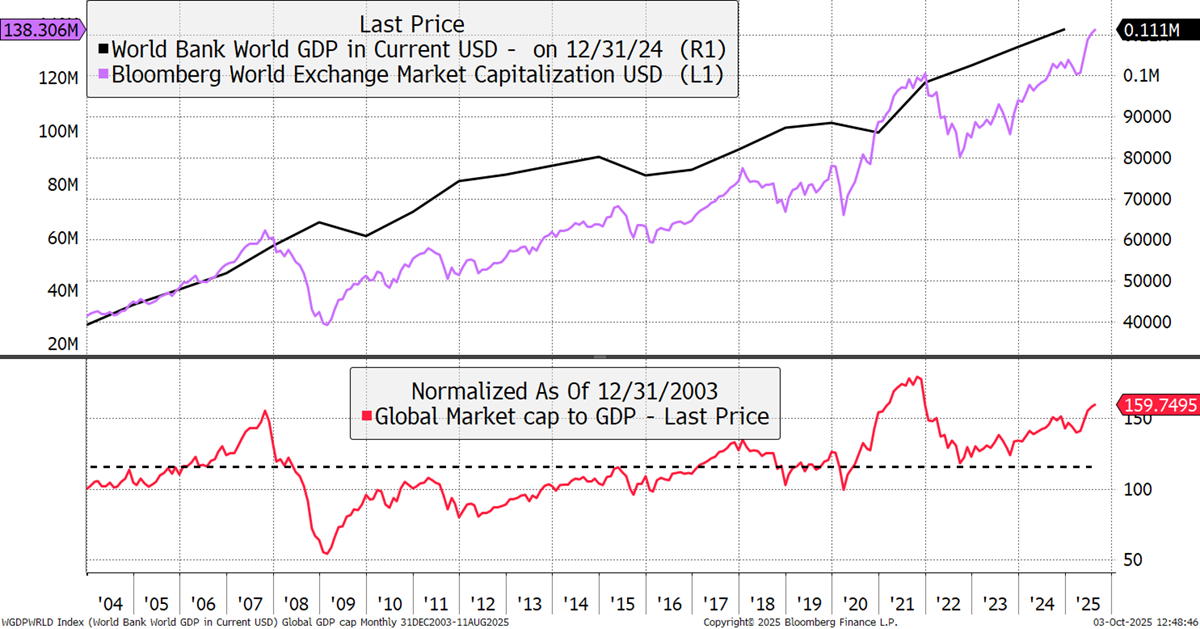

Government deficits are persistent and large. Yet the money supply continues to grow, and this has been driving asset prices ever higher. The global market cap to the global money supply (G20 countries) is now at a 17-year high, and well above average. At least it is still well below the levels seen in 2007, but that isn’t particularly reassuring.

Global Market Capitalisation and the Money Supply

Our friend Warren Buffett prefers this measure: the value of global equities to GDP. My version is global, and in this case, the level has exceeded 2007 and is headed to 2021 levels.

Global Market Capitalisation and GDP

There can be no doubt that markets are lofty. But as a friend reminded me, bear markets are normally triggered by a lack of liquidity rather than valuation. Let’s hope they keep on printing more money.

But hope isn’t a strategy, and that’s why our portfolios at ByteTree focus on sound principles, including diversification, value, quality, opportunity, and above all, patience.

The Multi-Asset Investor

The Whisky Portfolio

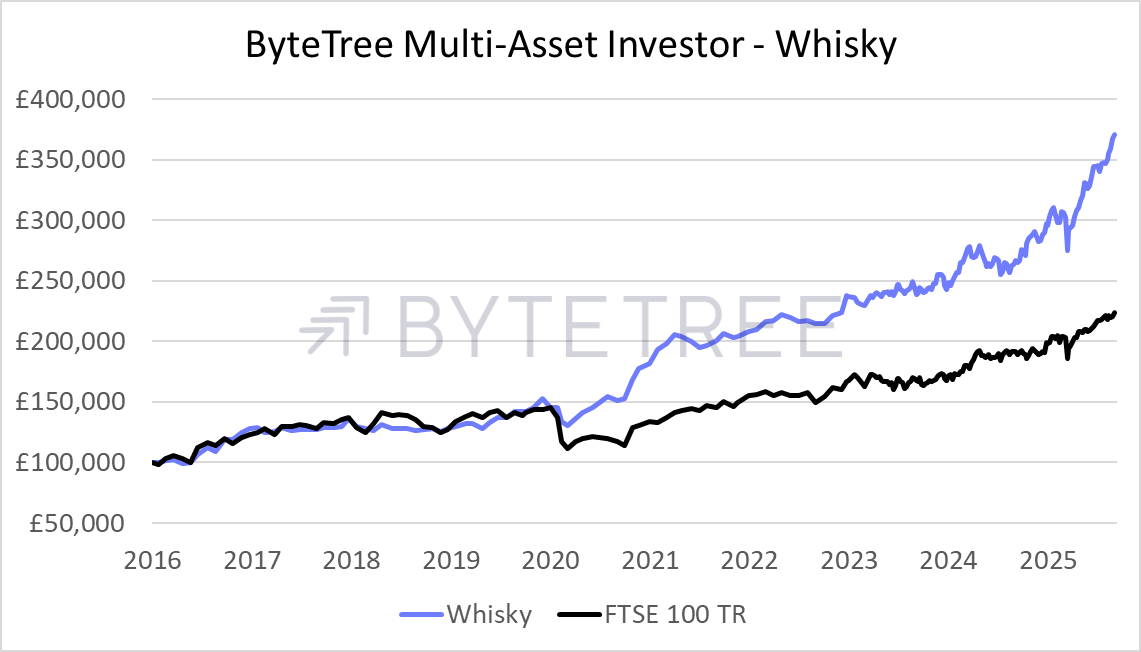

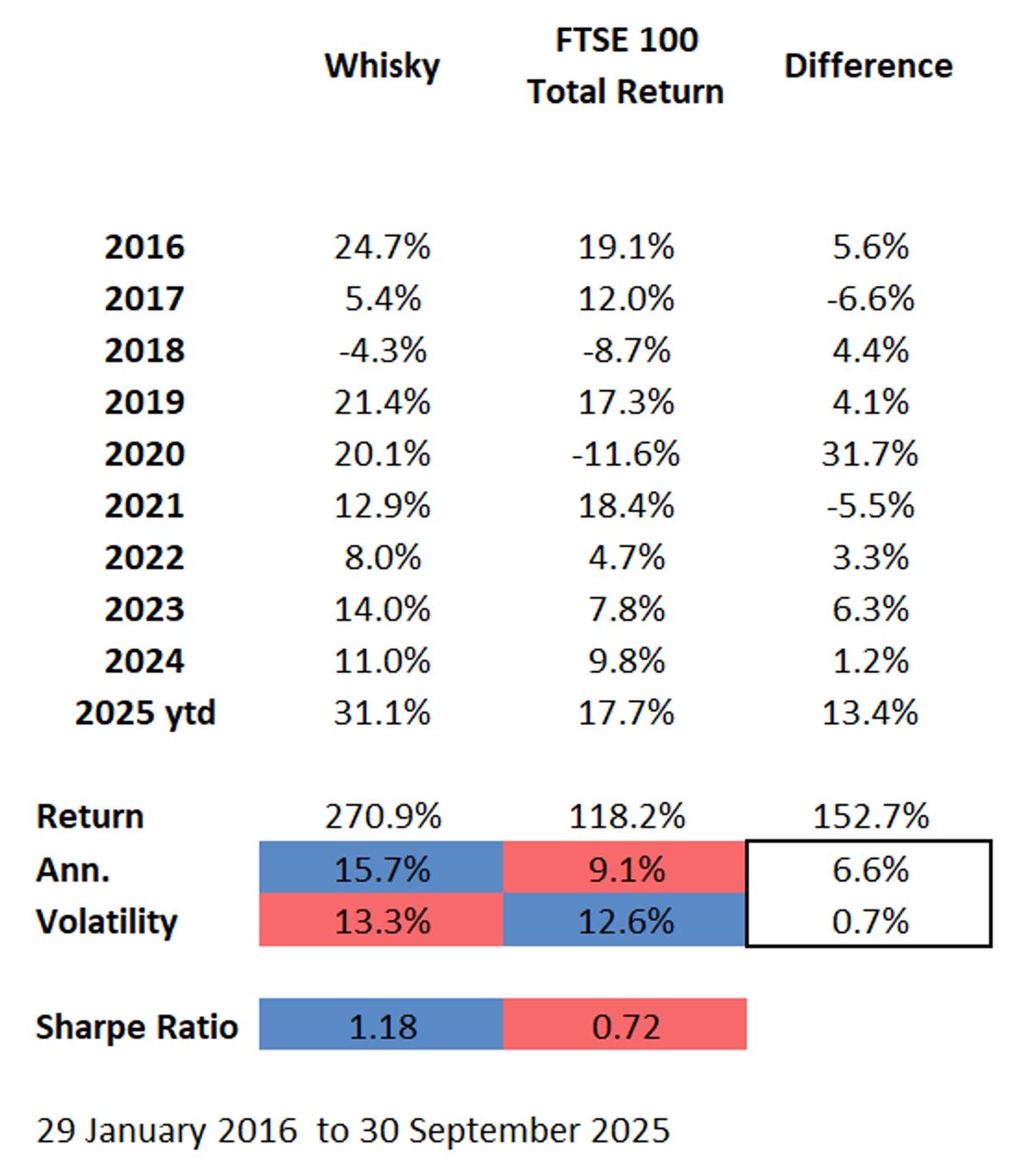

It has been a strong quarter for the Whisky Portfolio, which is up 31.1% in 2025, against the FTSE 100’s respectable 17.7%. The jaws have started to widen with an impressive rebound since the April correction.

Whisky Portfolio Performance

I would like to take full credit, but much of the heavy lifting was done by gold, silver, miners, and Bitcoin. I am conscious that they will not always be this strong and at some point, they will stall. But the difference between a bubble and a bull market is that a bubble pops. The risk to hard assets is balanced government budgets, as they would stop investors from trying to exit the system. I believe hard assets are more likely to slow than reverse. This is covered in more detail in Atlas Pulse.

Yet there was also a strong contribution from equities. Many of our stocks rose between 10% and 15%, with a 30% move from the Hang Seng Tech Index. WH Smith was the disaster, reminding me that you can’t win them all. The bottom line is that even without the hard assets, we still had a good quarter.

The long-term results are starting to shine. Whisky is 13.4% ahead of a strong FTSE this year and has compounded at 15.7% per year against 9.1% for the index. Portfolio volatility is slightly higher over the long term but currently remains surprisingly low. The risk-adjusted return, the Sharpe Ratio, is a healthy 1.18. Move over Warren.

Whisky vs FTSE 100

The Soda Portfolio

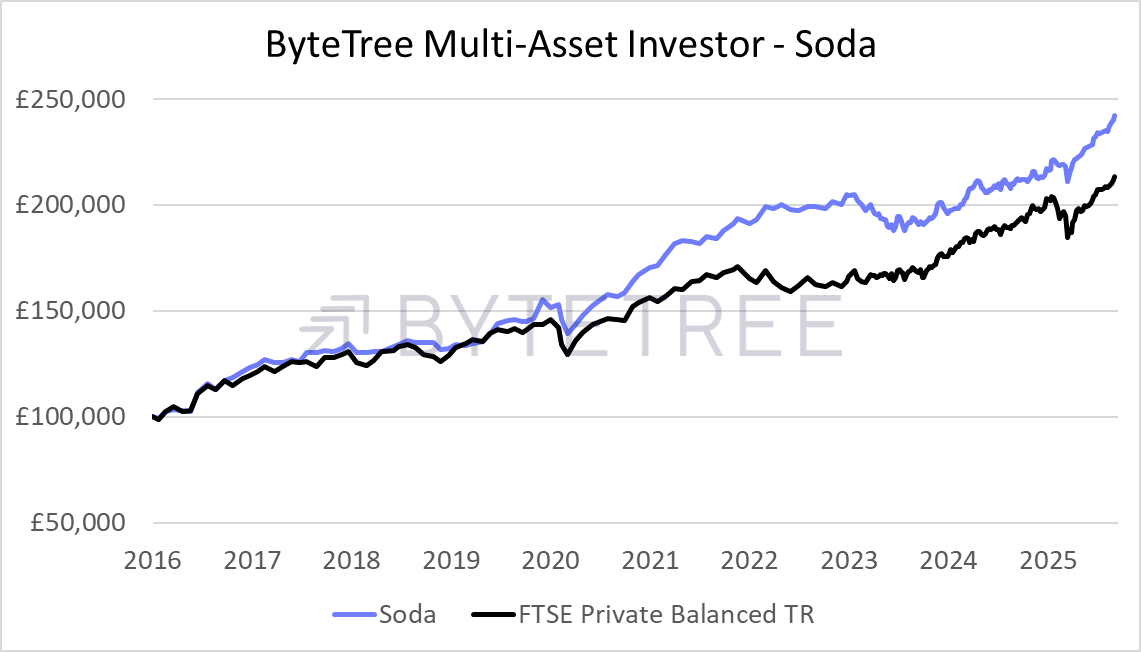

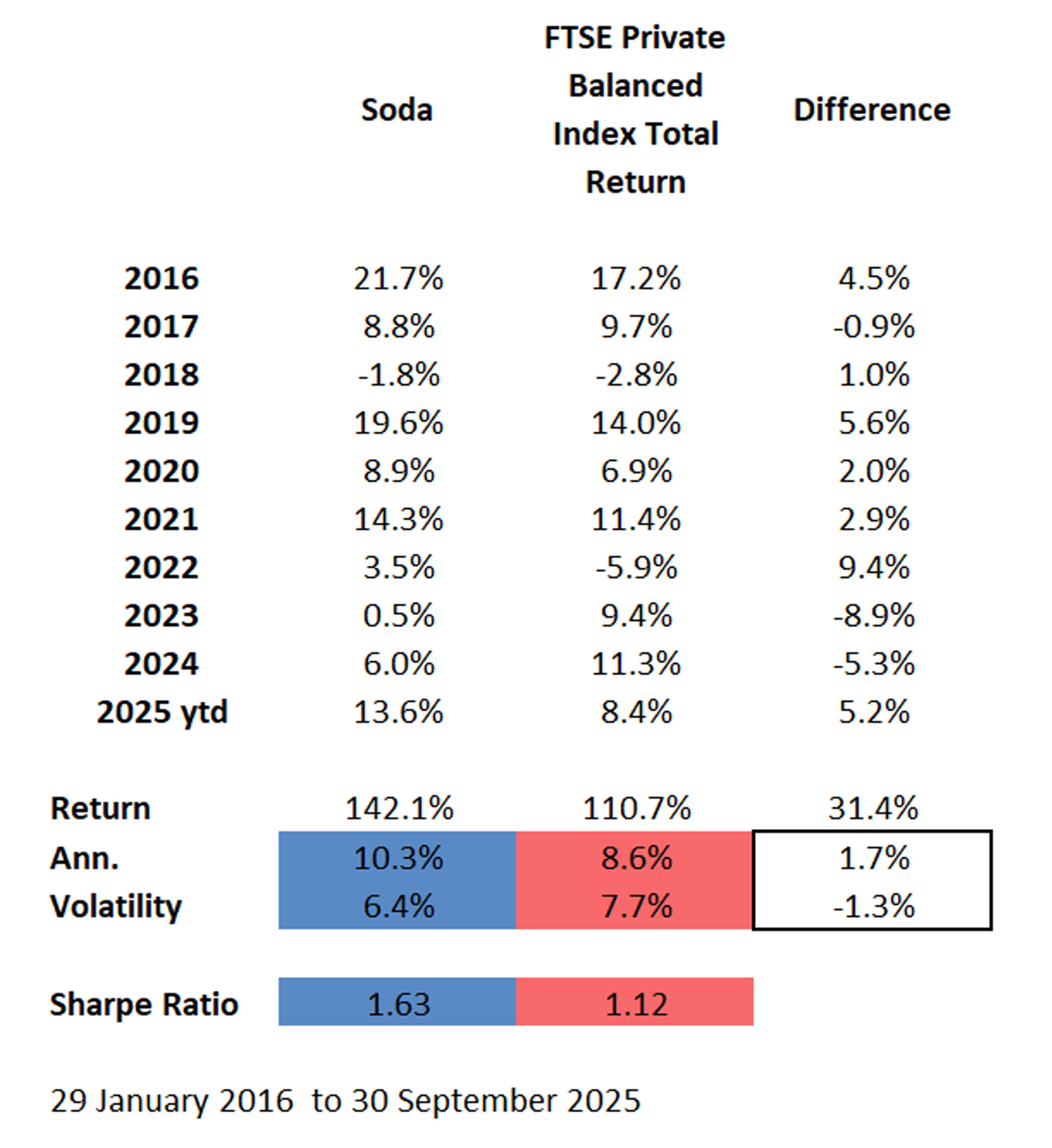

Soda is up 13.6% this year against the FTSE Private Balanced Index, up 8.4%, meaning a 5.2% outperformance. High time, as my 2022 heroic result was reversed in 2023 and 2024. Why? I refused to buy the big tech stocks, which seemed to be the only game in town. I don’t regret that decision because I manage the portfolios with risk management at the front of my mind.

Soda Portfolio Performance

I believe clients should have the majority of their money in Soda, with a tactical position in Whisky, which is more active and responsive to events. Soda is clearly less risky, as it holds less equity and focuses on diversified funds, investment trusts, and alternative assets.

The star assets of the quarter were the BlackRock World Mining Trust, European banks, Asia, and, of course, physical gold. My high hope for Soda is the closing of the discounts in our investment trusts, something to look forward to next quarter. The equity allocation spreads around the world, and currently remains heavily underweight the highly valued US market.

The long-term returns have compounded at 10.3% versus 8.6% for the index, yet with materially lower volatility. That makes our Sharpe Ratio even higher than Whisky’s at 1.63. A hedge fund with these numbers would be managing billions by now, and charging fees associated with mega yachts. Yet at ByteTree, we charge £39 per month. Ah, well, it’s nice being a man of the people.

Soda vs FTSE Private Balanced Index

The Multi-Asset Investor, backed by Charlie’s experience and a nine-year track record, is open to new subscribers.

The ByteTree Quality Portfolio

The ByteTree Quality service, launched in August 2025, has recommended four companies to date. The first note on Diageo was shared publicly and can be read here.

We are launching this product now because quality investing is out of favour. In fact, in America, it has underperformed the index by the largest amount in the last 12 years. We are on track to build the Quality Portfolio over the next year, when we plan to have approximately 24 stocks from around the world. Following the correction in quality stocks in general, we believe this is an opportune time to build a portfolio of long-term winners. Quality is our most affordable product yet, and we are incredibly excited about the investment opportunity over the coming years.

This new service adds to what is becoming a comprehensive research platform. ByteTree has something for everyone, depending on your interests, risk appetite, and time horizon.

Other Q3 Business

We will be hosting a live webinar this Thursday to discuss the quarter.

Charlie featured twice in MoneyWeek and on multiple podcasts, including Money Makers by Jonathan Davis.

- Jonathan Davis podcast.

- MoneyWeek article – where investors can find value now.

- MoneyWeek article - maturing bitcoin.

We also added some general research reports to a new page, where we will occasionally share insights in the form of free reports.

We would also like to highlight our affiliate program, which offers a significant discount to you for introducing new customers.

And as always, you can follow us on Twitter and LinkedIn.

Summary

October will be an exciting month, as this week brings the end of the crypto ban in the UK. Meanwhile, as long as interest rates remain high alongside record valuations, markets will remain fragile. With gold enjoying a record run in Q3, it will be interesting to see what Q4 brings.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd