Coppock Buy Signals

Trade in Soda

On 11th October, just before The Multi-Asset Investor first appeared on ByteTree, I wrote what I thought would be my last issue of the Fleet Street Letter. The title was; “What are the signs that the bear market for stocks is ending?”. It was controversial because markets were in panic mode, but I could see some light.

Believing my departure would be announced the following week, it was a discreet parting gift. I covered the Coppock Indicator, which has generally been a reliable long-term way to call time on bear markets. As it happens, my departure was delayed for several weeks for reasons beyond my control. I raise this now because Coppock has spoken, and I am back to tell the tale.

To remind you about the Coppock Indicator, Edwin Coppock was asked by the Episcopal Church to identify low-risk buying opportunities for long-term investors. The story goes that he built his indicator around the time it takes to overcome bereavement, which is thought to be approximately 14 months. The church, after all, is an expert in such matters.

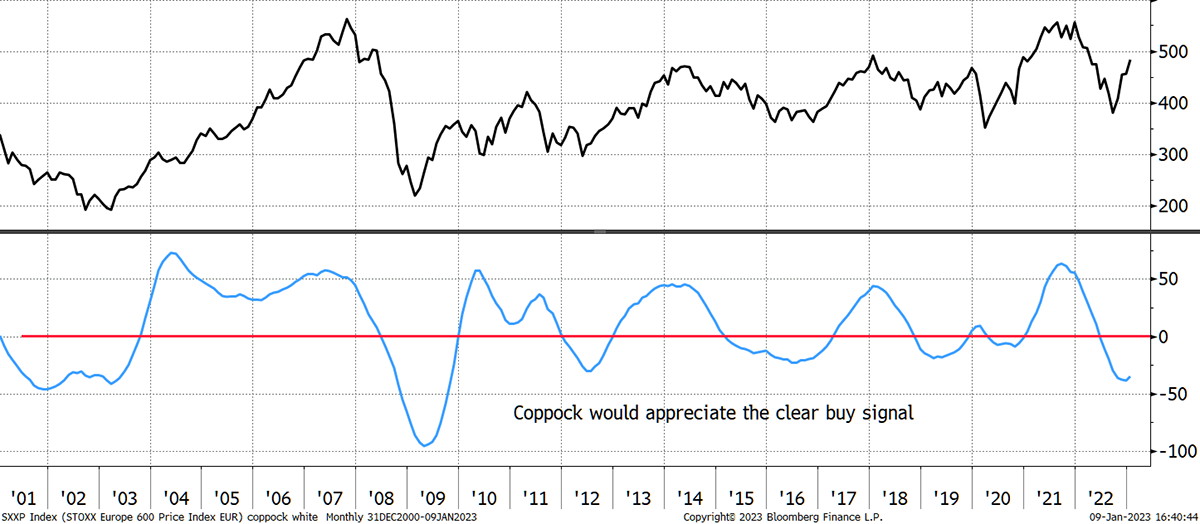

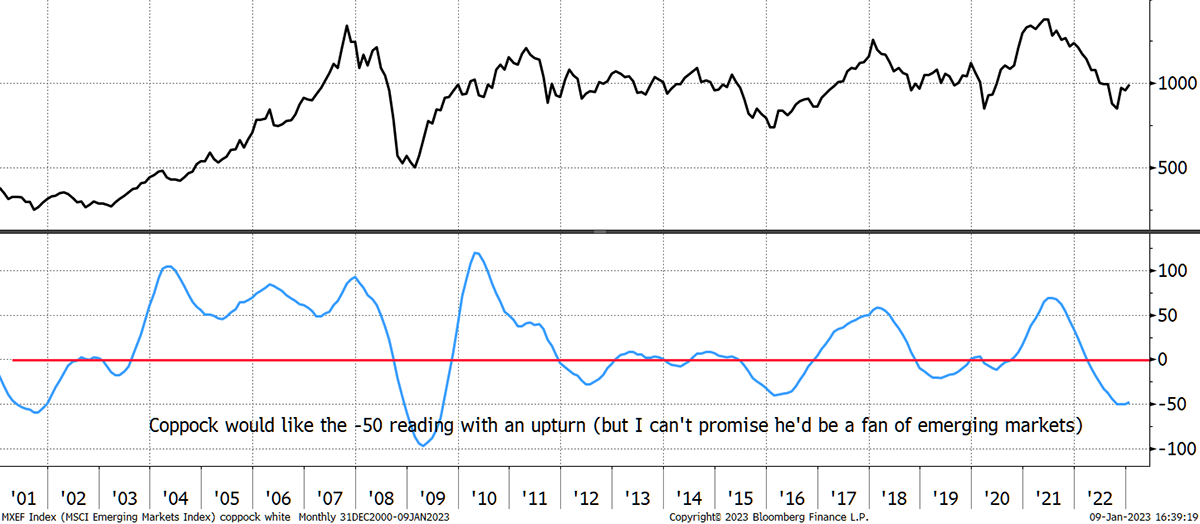

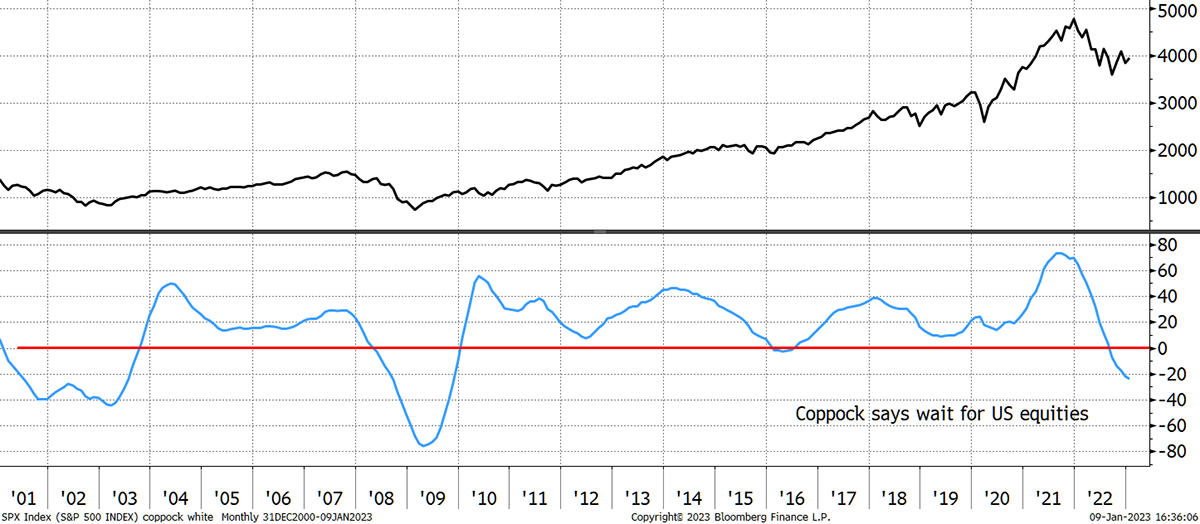

The Coppock indicator aims to call the end of bear markets, or more specifically, to identify “low-risk entry points”. Looking at the blue line below, first, it must move below zero, which identifies a bear market and then turn up. I show Europe, Emerging markets, Japan, and the USA.

I’m adding European dividends to Soda - and I’ll explain why.

Europe - Coppock Buy

Source: Bloomberg

Most major markets have the same shape, where they did well into 2007, and have spent 15 years consolidating since. As I said, a buy signal needs the blue line to fall below zero and then turn up. The lower readings can lead to stronger rallies, but that isn’t always the case. In Continental Europe, this looks like a good setup (the UK is also a Coppock buy).

Coppock also sees a buy signal on emerging markets, which sold down to -50 and have also turned up. That is the green light we have been waiting for.

Emerging Markets - Coppock Buy

Source: Bloomberg

The surprise is that although many markets have given a Coppock buy signal, US equities still haven’t. Notice how infrequently the US Coppock line traded below the red line in recent years, which is another way of showing their former strength.

US Equities yet to Give Coppock Buy Signal

Source: Bloomberg

It could be that US equities give a Coppock buy soon, but they could keep us waiting. Either way, I believe the dollar has peaked, and so even if US equities turn up from here, you’ll lose on the currency. I understand that the US is God’s gift to capitalism on so many levels, but not this cycle. It has had it too good for too long.

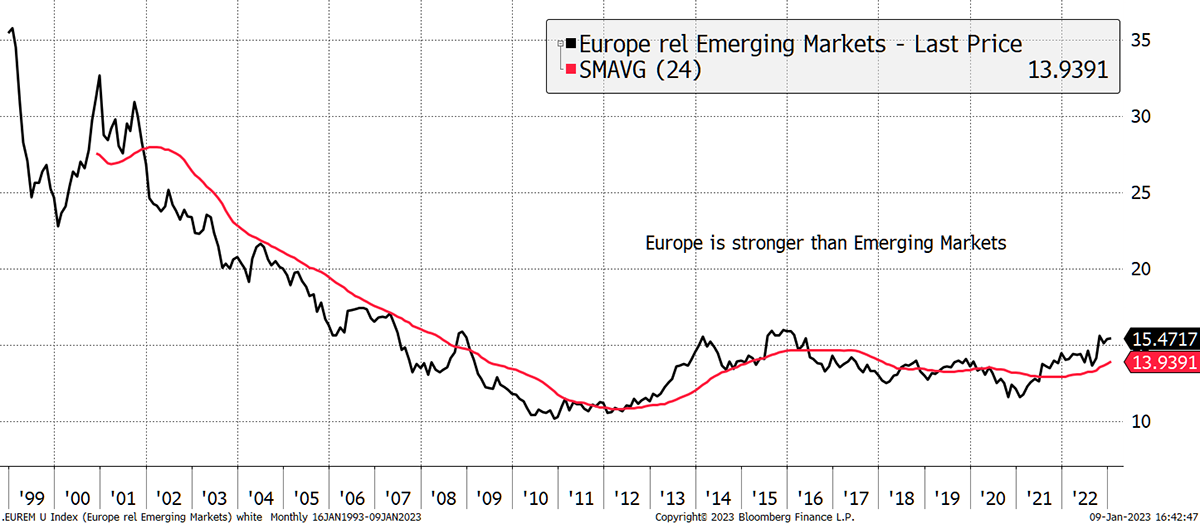

Having seen that both Europe and the EMs are Coppock buys, which one is stronger? We already know that emerging market value stands out on the GMO valuation (expected returns) data, but recently, Europe has shown considerable strength. Perhaps that is down to the collapse in European energy prices or diminishing fears that the war in the north will spread. The important point for investors is that while adding to emerging markets makes sense, don’t forget Europe. We already have some UK exposure, and I am keen to add exposure to the Continent in the interest of balance, opportunity and diversification.

Europe Outperforms Emerging Markets in the Recovery

Source: Bloomberg

Buying iShares Euro Dividend ETF (IDVY)

I am pleased that the Soda Portfolio has higher equity exposure than it did last October. It is becoming increasingly clear that markets are looking more constructive in 2023. I am also mindful that the FTSE Private Balanced Index holds 60% in equities.

Our Soda Portfolio equity exposure is between 35% to 40%, depending on how much you attribute to our multi-asset funds. However, it’s not just the amount of equity but the categories in which they sit. In these funds, they are a long way from being high-risk. It is, therefore, right to keep on adding, so long as we can find credible areas.

Europe appears to be on point. I may do more in the coming weeks, but for now, I will keep it simple. Having explored the options, I took a liking to the iShares Euro Dividend ETF (IDVY), which best meets our objectives. I could also follow up with Pan European Value or even Midcaps. But we’ll start with dividends.

IDVY is invested in Pan-Europe ex UK dividend-paying blue chip stocks. The highest exposures are to France, Germany and the Netherlands, and there is significant exposure to financials, such as ASR Netherland, Axa and Credit Agricole. These will benefit from higher interest rates.

IDVY is invested in 30 companies, pays a dividend yield of around 4.8%, trades in GBP and charges a modest 0.4% annual management charge. I see this as a simple addition to the Soda Portfolio, which takes us a step closer to being invested again. For that to happen, I would like to know that inflation is under control.

Risk

IDVY invests in large cap liquid stocks. The risk is slightly higher than the FTSE 100 Index as it is more concentrated. I was keen to avoid a mainstream index because there was high exposure to defensive stocks, which I believe offer poor value. I deem this to be medium risk.

It’s a heavy postbox today, so I’ll stop there.

Action:

Buy 5% iShares Europe Dividend ETF (IDVY) in Soda

Postbox

Platinum

If you watched my recent video, I stumbled when asked about platinum. It isn’t something I have recently been paying attention to, and I promised an update.

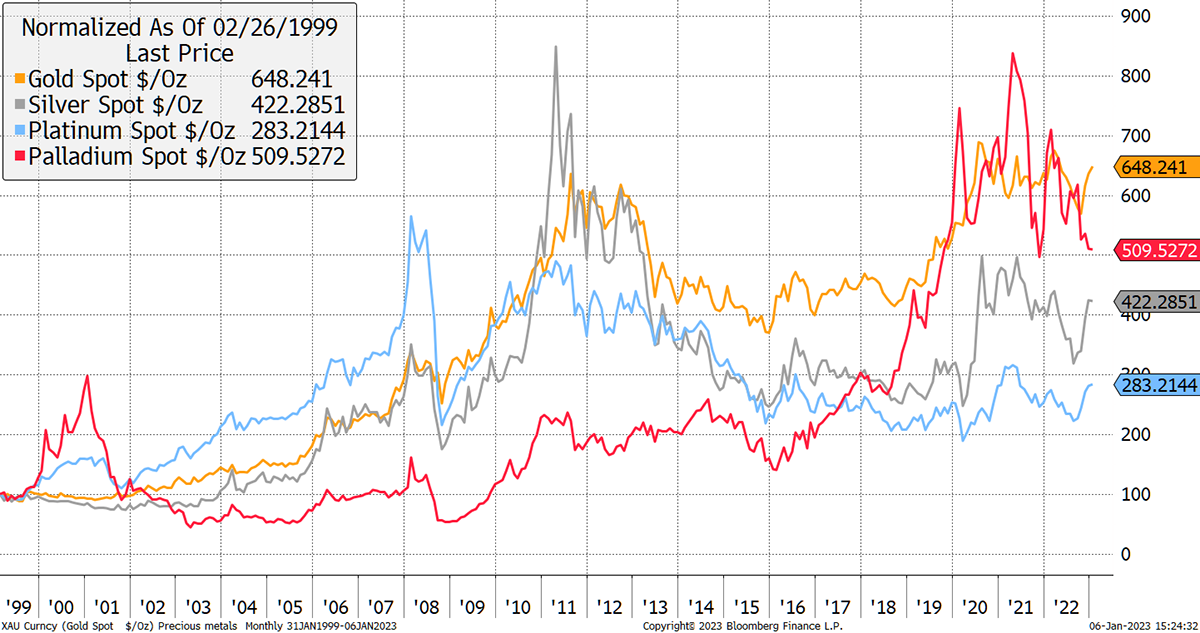

I show the four precious metals since 1999 – gold, silver, and the PGMs: platinum and palladium. Gold, silver and platinum traded in a tight group until 2013. Palladium has generally been the outlier that was more connected with the tech cycle. It boomed in 1999 only to bust in 2002, something that has been repeated since 2016.

Platinum (auto catalysts) suffered from the diesel scandal in 2014, which subsequently reduced demand. Recently it has rallied, but when you put it into a longer-term context, the move looks more like noise.

Precious Metals

Source: Bloomberg

The bull case for platinum is generally that it has a tight supply, can be substituted for palladium or be used in hydrogen fuel cells. The World Platinum Council drives the narrative. Yet none of these convincing arguments seem to have moved the dial.

I recommended platinum in 2017 and finally bit the bullet last April. The forecasts saw a supply shortage, which never materialised. I will keep this on my radar, but I suspect our main activities will be in gold, silver and oil, with the occasional dabble elsewhere.

What’s happening in Brazil? Is it going to recover?

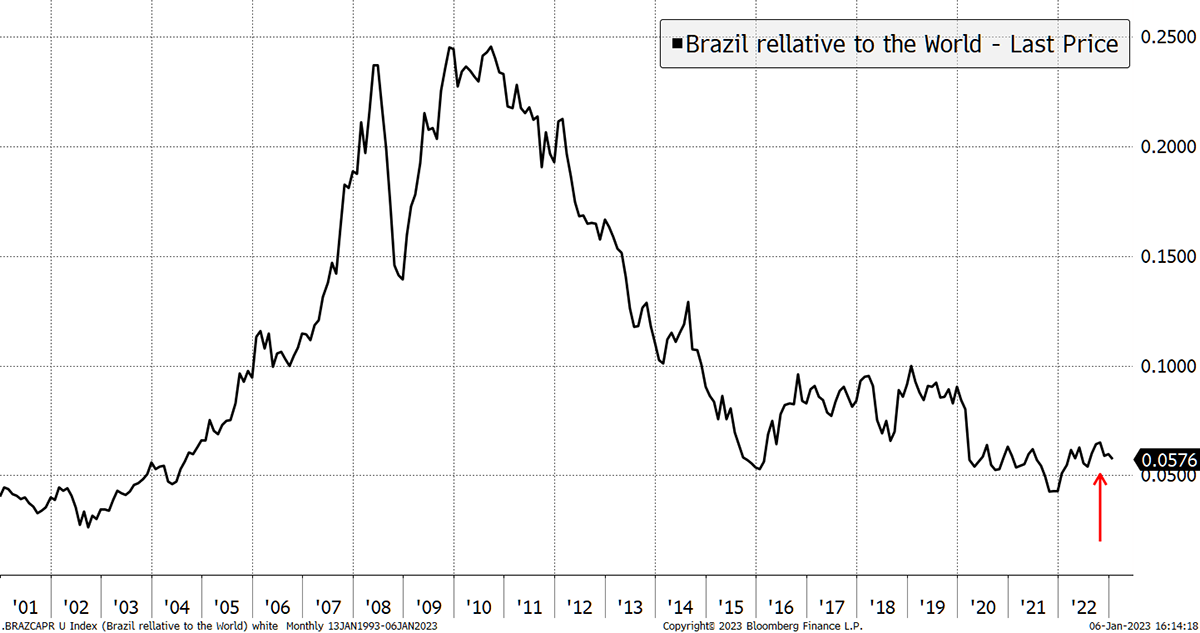

I recommended Brazil in August, and it is 13% lower as I write. The politics have been interesting, and over the weekend, the media has shown crowds storming government buildings. I can see why some see that as a concern. But this trade was never about politics; it was about value and exposure to commodities, which I was seeking at the time of the recommendation.

Brazil relative to the world looks like a long-term buying opportunity. I will never forget the rally post-2003, which took the world by surprise. This market is dirt cheap and pays a whopping 9% + dividend yield.

Opportunity in Brazil

Source: Bloomberg

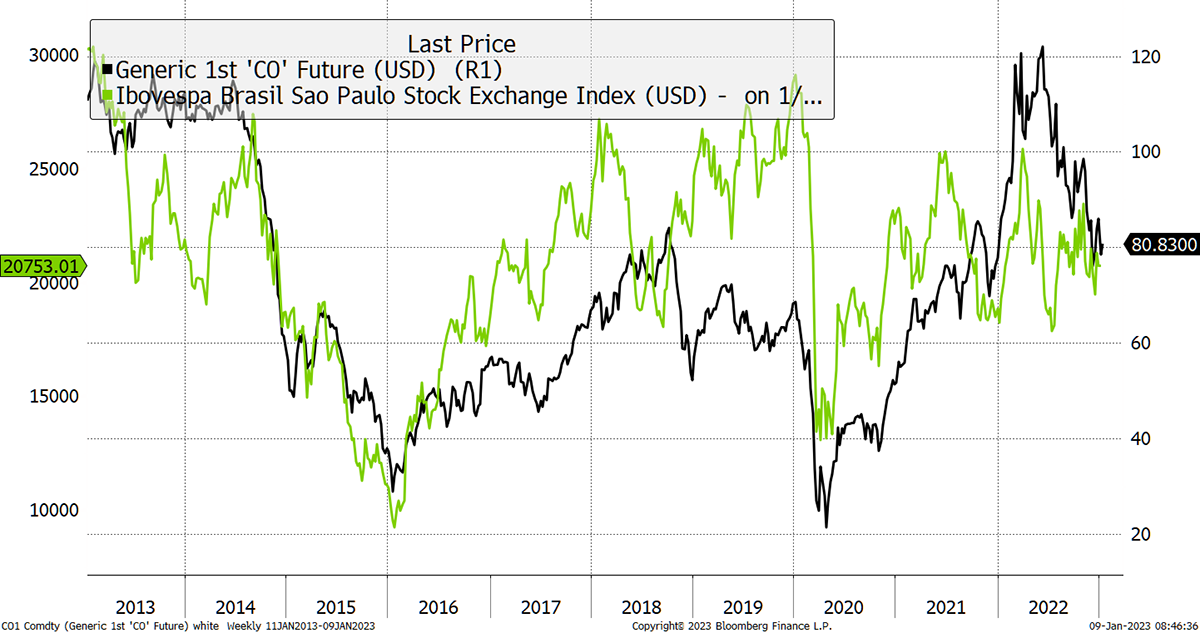

The Brazilian stockmarket has broadly followed the oil price (constant currency). The relationship is quite close over time and shows that commodity prices generally matter more than politics.

Commodity Prices Matter More than Politics

Source: Bloomberg

Brazil isn’t rising when much of the rest of the Whisky Portfolio is. That’s not necessarily a bad thing, as it boosts diversification while the underlying investment case hasn’t changed. I see it as something to look forward to when the portfolio stops rising.

I have reduced commodity exposure but I am in no hurry to sell it all because I cannot be sure which way things are going. We’ve had a great run with commodities, and it is time to find other opportunities. Brazil is a great way to get “paid to wait” because the yield is so high.

I have had many emails on Brazil, so it is clearly a concern. The contrarians among you will know this is the time to be bullish.

My question relates to the price-to-sales ratio prompting the sale of BA Systems (BA). Clearly a welcome and juicy profit over the short period of our involvement. Could a large part of the share price gain be due to an influx of business from HM Gov (and others) to help supply Ukraine with defensive hardware?

I sold BA in late November. The price to sales ratio rose to the 20-year top of the range, and I felt there was a risk BA would be caught up in the momentum crash and at risk of a market rotation. The price to sales ratio was one of many indicators I looked at, but in this case, it made the point very clearly. Demand for defence kit will grow a little faster, but the defence stocks have already been repriced to reflect that.

I have little doubt that BA is in a great place, but, as you may have noticed, in the current environment, my strategy is to buy undervalued shares and let go of them when they recover. If, on occasion, they do so well that they turn into go-go stocks, I’ll be disappointed, but I can live with that.

Defence may be an exception, but we have already had a significant uplift. I am happy to explore new ideas where the risk/rewards are more favourable.

I am keen to hear your talk around the other parts of ByteTree – particularly the extent to which you’d recommend the AAA report as a way to both keep diversified and gain standard returns. Of course, it is hard for you to be impartial but I’d love to get your best attempt at an impartial analysis of a possible asset allocation between different parts of your research.

There is no easy answer to how to allocate across different ByteTree services, and I hope there will be more over time. I have no personal desire for readers to follow the Whisky and Soda Portfolios over others. I just hope readers follow the services that are right for them and get the best from ByteTree.

I wrote up AAA last Friday. It is a great service, but it is important that it isn’t for everyone and, at times, requires a thick skin in order to score all of those long-term goals. I would think the AAA is the sort of thing we should package into an ETF, as it is so much better than the iShares Momentum Funds. Most people will follow it half-heartedly and inevitably miss the big winners when they come along. If you are going to do it, then I suggest you stick with it.

We’ll revisit this periodically.

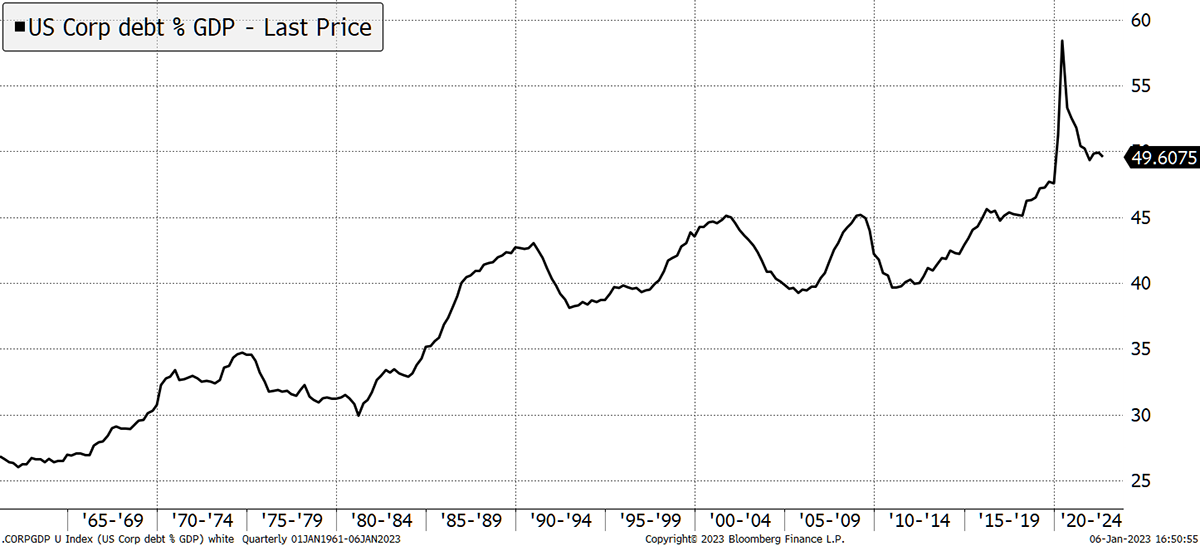

In the USA, there is much being made of the credit cycle rolling over with widespread losses/write-offs in corporate and personal debt. The numbers seem large but how significant are they? To what extent do you see these events having an impact on equities elsewhere, and the MAI portfolios?

The numbers in the US are big, but as they used to say, everything’s big in America. Household debt was a big problem pre-2008 but has been coming down sharply. The amount of debt may have grown, but the economy has outgrown it. Households will face pressures with falling house prices and rising rates, but they aren’t the biggest problem.

US Households in Better Shape than Pre-2008

Source: Bloomberg

I am more concerned about US corporates which have geared up their balance sheets and bought back stock. US companies are more geared than in 2000 or 2008. It really is remarkable. Currently, I do not like US equities, as I keep on saying.

US Corporates Are More Geared

Source: Bloomberg

Our exposure to US equities is low. I don’t believe the leverage has built up elsewhere in anything like the same way (Chinese property excepted). This has been a US-centric cycle, and while there will inevitably be storms, I am hopeful we are well insulated.

In its pre-Covid prime, the total value of Chinese worldwide travel was just over $250 billion. The number of Chinese who made trips outside the mainland in 2019 was 155mn etc. In my view, this can only lead to a boost in demand for goods and services as the Chinese start travelling again - something you seem to agree with regarding your recent purchases in emerging markets. But how do you see this affecting inflation in the west? I believe this could lead to a second resurgence of inflation, forcing the Fed to tighten further and sending markets into a tizzy and the Dollar higher again. What are your thoughts?

Demand is good; inflation is bad. They are not the same thing, and when the system works, you can increase demand without raising prices. The recent inflation was driven by shortages (commodities and finished goods) and excessive easy money. The shortages have taken care of themselves, and the remaining problem is labour, as everyone wants a pay rise.

I hope the Chinese, and other tourists, spend as much of that as they possibly can in Brazil, Poland, Thailand, Europe and here in the UK. More specifically, in Rank’s Casinos. If there’s any leftover, I hope they pop into Marks and Spencer for some Percy Pigs or JD Sports for a Man U top. And while they wait in the airport, I hope they pop into WH Smith for a nice new biro and a puzzle book.

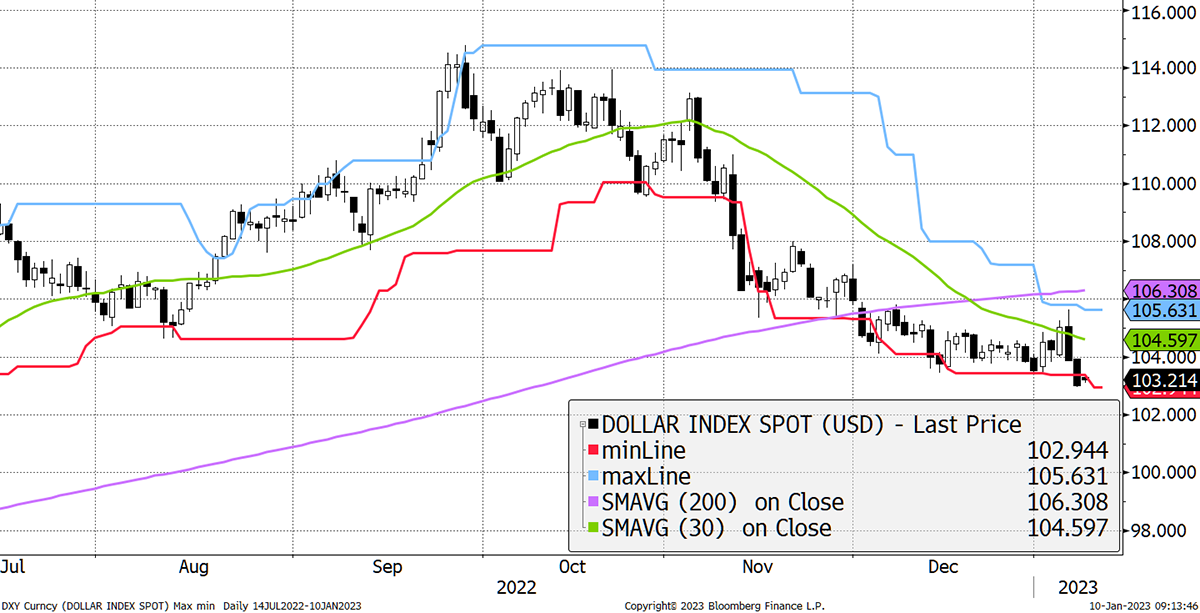

I welcome the demand. But I think the resumption of inflation would be a bigger longer-term concern if the Fed wasn’t serious about fighting it. They say they are, but if they were really serious, the dollar would be rising. It isn’t, it is falling, and in ByteTrend parlance, the trend is a mere 1* (shown by the DXY vs USD below). I’ll explain that in more detail another time, but the price action is terrible, and when the 200-day moving average turns down, which looks likely to be soon, the dollar will be in a confirmed downtrend.

The Dollar Slides

Source: Bloomberg

In my opinion, this soft dollar is providing relief to financial markets, much more so than anything economic. The market thinks the Fed is not serious and will start cutting rates within a year. That is floating all boats.

Be sure, I watch this stuff like a hawk.

I am a keen follower of your work and have followed you from Southbank to Bytetree Premium (as well as Robin and Rashpal). I’ve long been fascinated by bitcoin, and the seriousness with which you and other analysts I respect have approached the asset is reassuring. While its long-term future is uncertain, I can clearly see the use case and investment rationale – digital gold, digital bearer asset, secure and instantly transferable, etc.

With ByteFolio, you recommend non-BTC crypto such as Ethereum, Polygon and Chainlink. I understand that these are based on criteria such as network strength and fund flows, but it still seems to me that you are taking a diametrically opposite approach to Whisky/Soda, where you focus on fundamentals and look for genuine value. Am I missing something?

You are on the money sir.

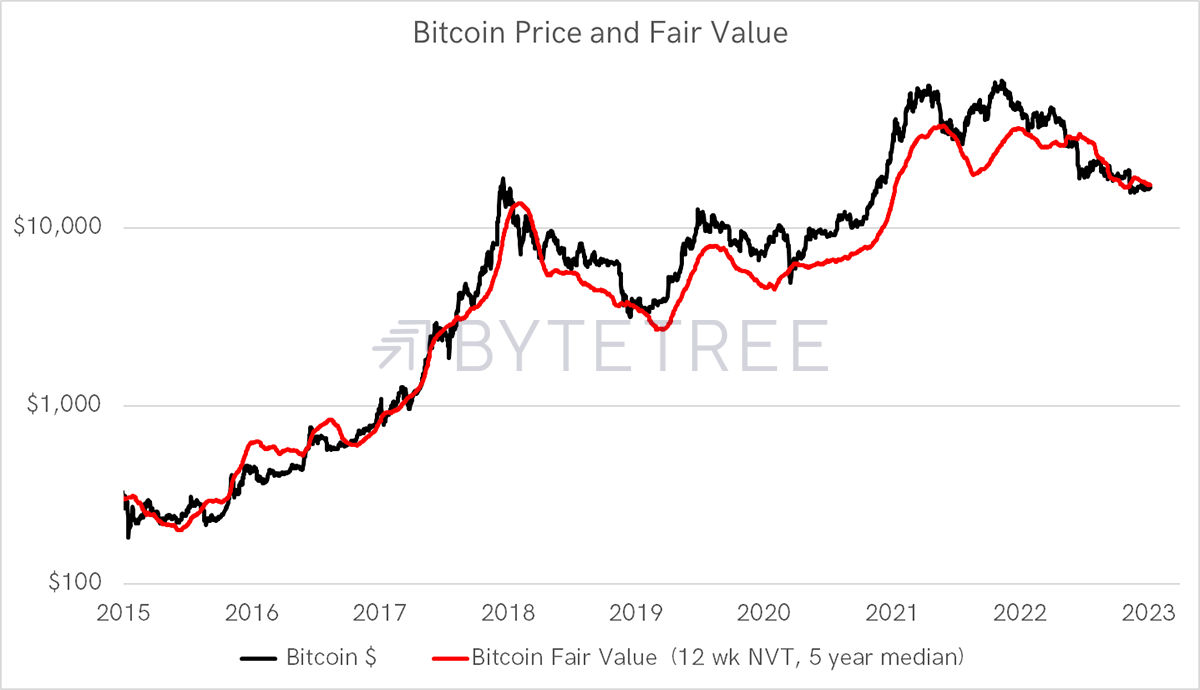

I became intrigued by bitcoin in 2013 and founded ByteTree, with the primary objective of valuing bitcoin. That work began with analysing the blockchain to see what data were available. It soon became clear that the amount of value transferred across the network correlated with price. That is simply communicated by our fair value methodology, which has been effective. The best way to stay informed on Bitcoin is through ATOMIC, written by my colleague Charlie Erith.

Source: ByteTree

The intrinsic value of bitcoin is zero, but the network is extremely valuable, and without the reach of the internet, this sort of extraordinary value creation would not be possible. The crypto naysayers simply do not understand this point and can’t get past the intrinsic value being zero.

In other cryptos, value is hard to ascertain, but there are clues. In the main, it revolves around project adoption and growth, with a necessary leap of faith. In Ethereum, you can look at network fees and such. In other projects, such as Chainlink, you have less information. But just as with the internet 20 years ago, knowing that a project is catching on is powerful information.

When assessing an investment (bond, stock, commodity, currency or crypto), I ask three questions. What is the asset’s quality, value and trend? In most crypto projects, you have no choice but to give the highest weight to trend, some to quality, and value if and when you can. Measuring value in crypto will become obvious in the years ahead, but you have to accept it is currently hard to gauge.

If you applied our ByteFolio investment process to the 1990s dotcom era, or indeed any growth era, you would end up with a superior result to most other strategies I can think of. That is because you are allowing the market to shape your portfolio and kicking the tyres whenever you can. Identifying winners is one thing, but avoiding losers is even more important as it avoids capital destruction.

To put my crypto views into perspective, I believe a 60/40 equity/bond portfolio is enhanced by switching 8% out of bonds and into gold. Since bitcoin came along, I have concluded that 8% gold should be accompanied by 2% bitcoin, using BOLD. We now have 58% in equities, 2% in bitcoin, 32% in bonds and 8% in gold.

If you wanted additional non-bitcoin crypto exposure, it should come out of equities, and that might mean 2% in non-bitcoin crypto. A diversified investor now holds 56% in equities, 2% in bitcoin, 2% in crypto (say), 32% in bonds and 8% in gold. But if bitcoin and/or crypto don’t interest you, it is fine to ignore them. Investments are there to make you more secure, not to keep you awake at night.

This is an academic exercise and does not relate to my current tactical views, which are expressed in the various ByteTree portfolios.

ByteFolio is the best way I know to make sense of building an optimised crypto portfolio in a brave new world where value is hard to measure. You know crypto isn’t going away, and this is our best solution to a difficult problem.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

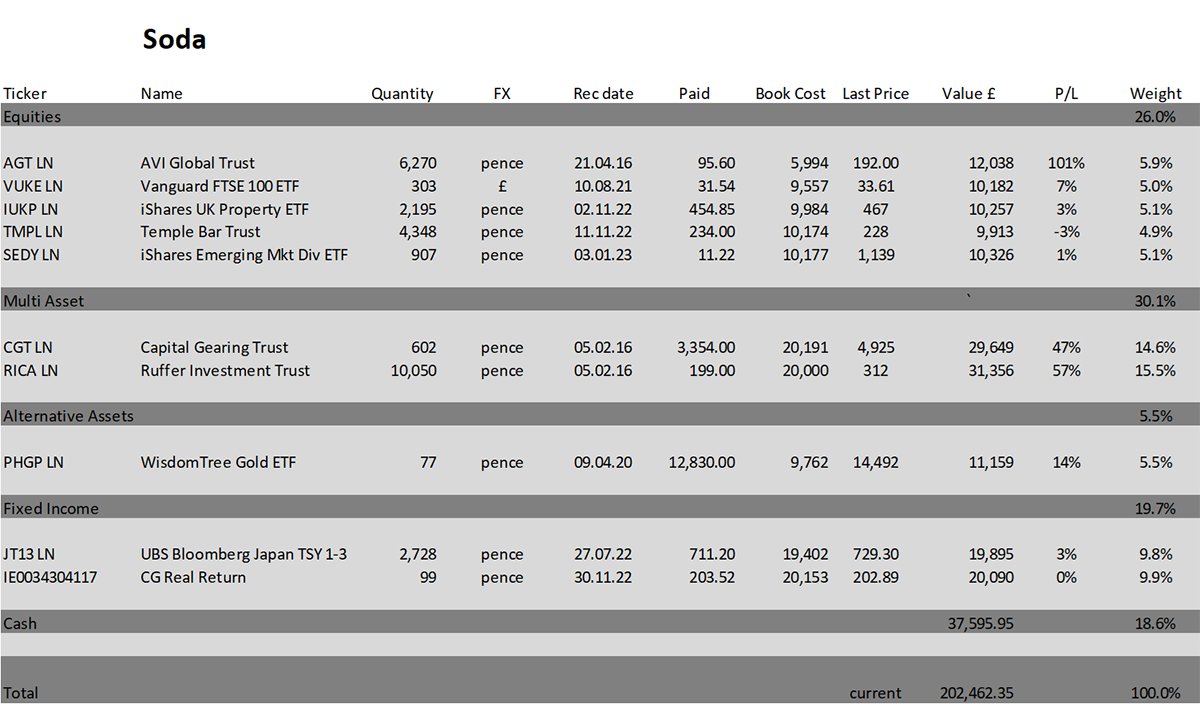

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 1.2% this year and is up 102.5% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

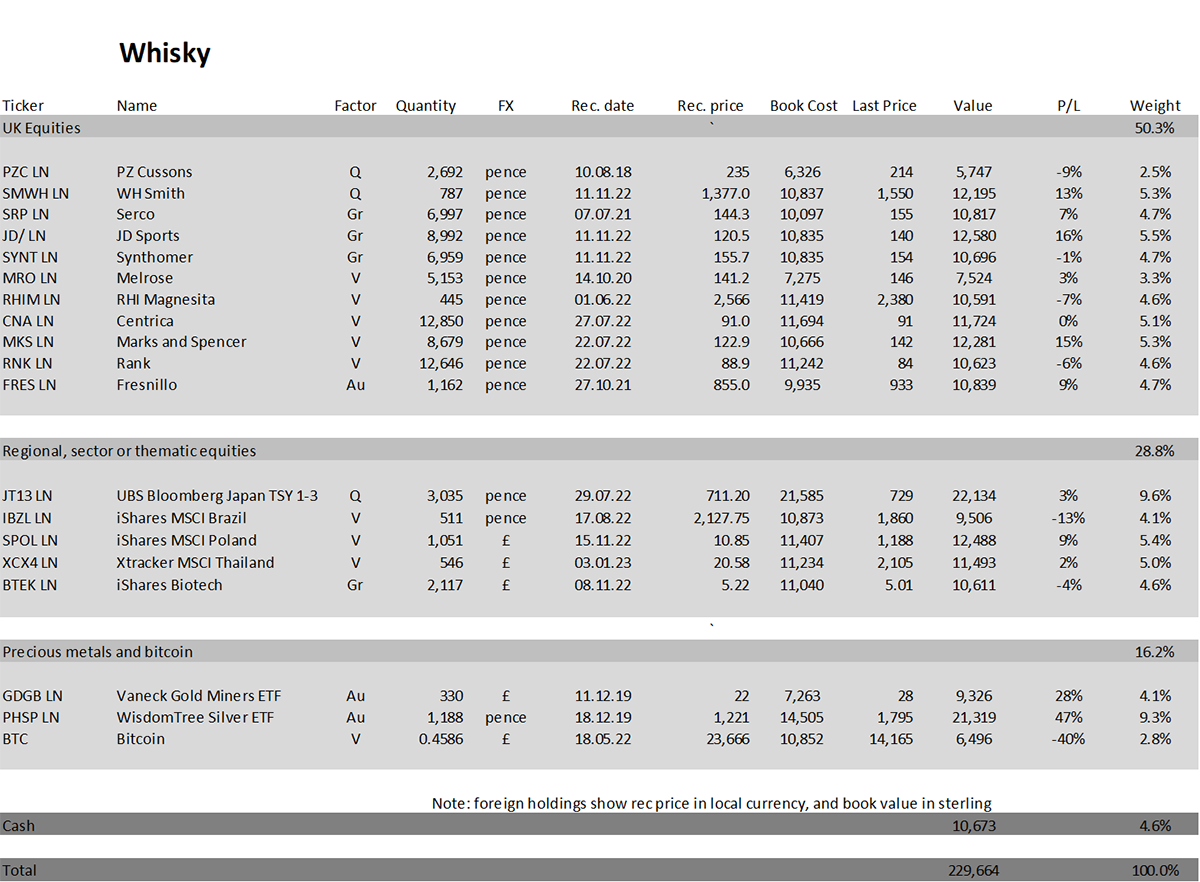

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 2.8% this year and up 129.7% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

Sorry for the bulging post box, but there was some catching up from the holidays.

We proceed with caution and welcome our European friends to Soda.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()