Gentlemen Prefer Bonds

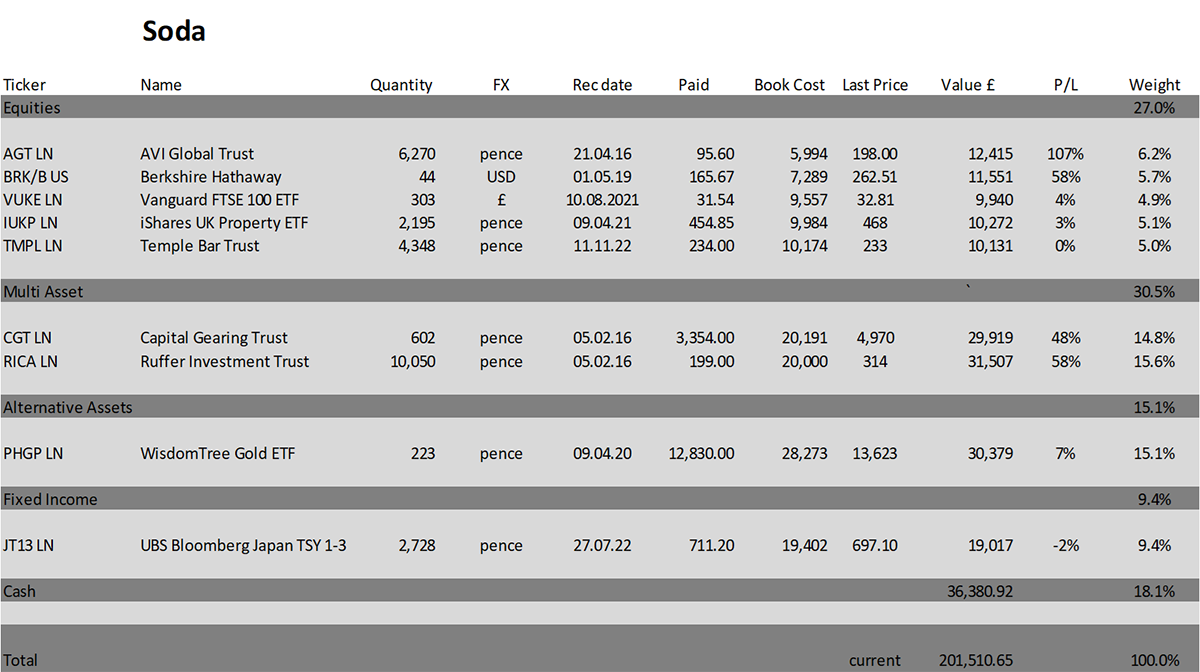

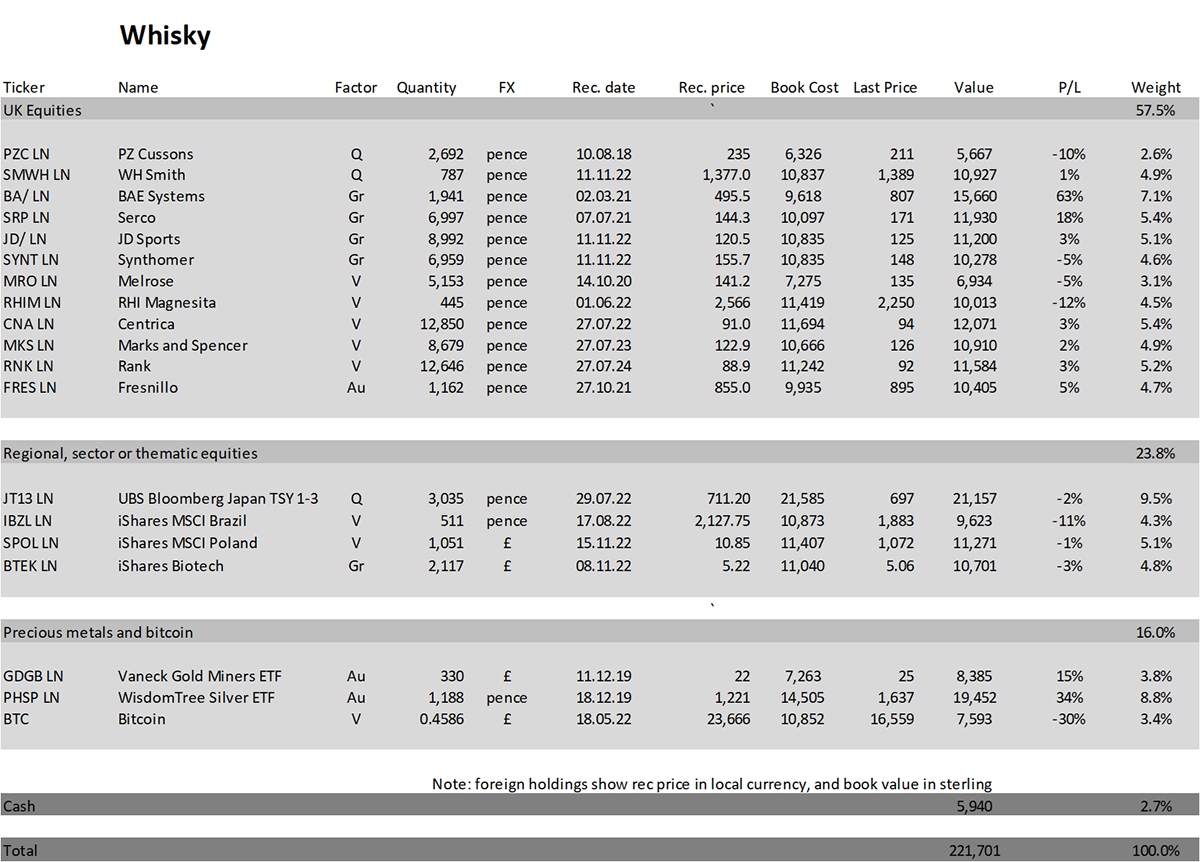

Trades in Soda and Whisky

In recent weeks, the Whisky Portfolio has been repositioned, while Soda’s shift is still underway. While I can find plenty of stocks to buy for Whisky, I am struggling to find diversified equity exposure more suitable for the Soda Portfolio. I am currently underwhelmed by the major indices, such as the S&P 500. That is probably because the value is in bonds, where I am doing more research.

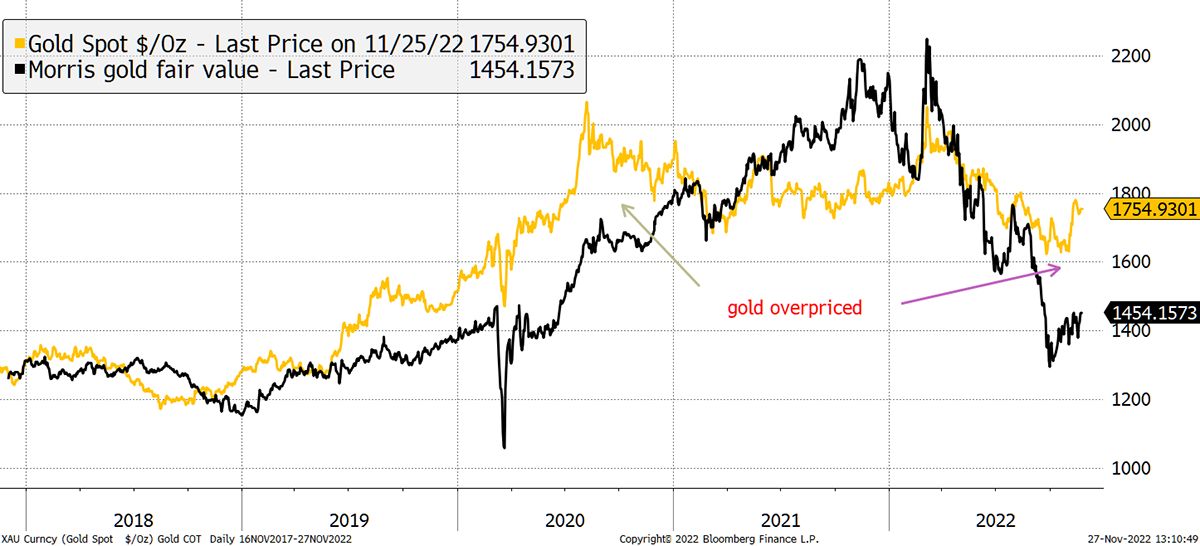

In my recent issue of Atlas Pulse, where I cover the gold market, I highlighted the current gold price premium. That is, gold is currently 20% overvalued according to my model that is based upon US inflation-linked bonds.

Gold Is Holding up Well

Source: Bloomberg

This contrasts with late last year when gold was undervalued. Essentially, the bond market has fallen a long way, and bonds are now much cheaper than they were. Both gold and inflation-linked bonds offer inflation protection, but bonds currently do so at a lower price.

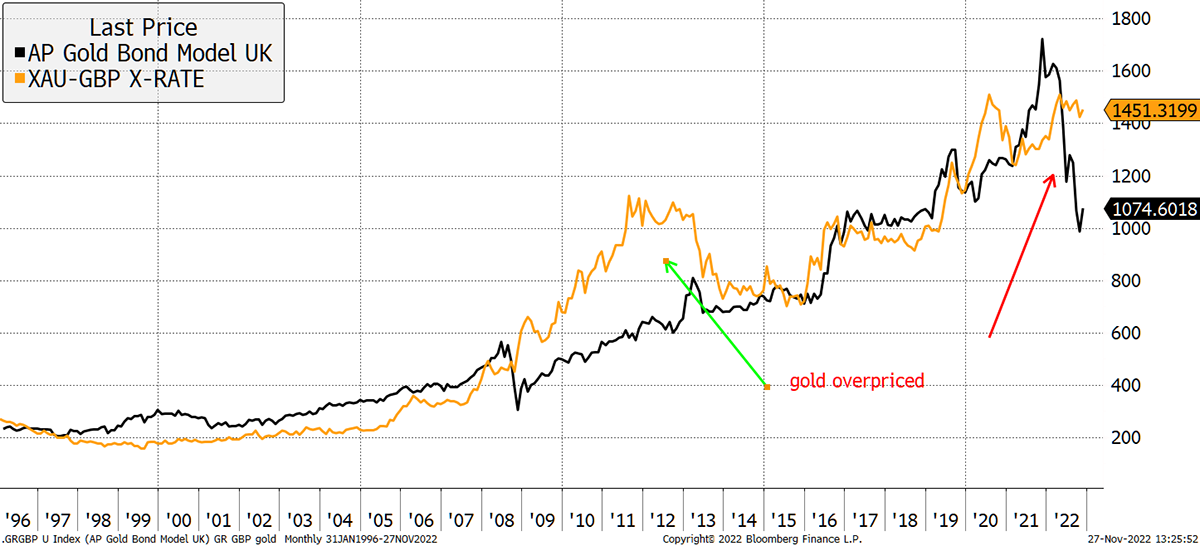

Using the same method in the UK, the premium jumps to 35%. Had you invested in 2011, it took 7 years to get your money back. Premiums can be painful.

Gold in Sterling Has Likely Peaked

Source: Bloomberg

For the US model, I use 20-year US TIPS, and for the UK, 20-year index-linked gilts.

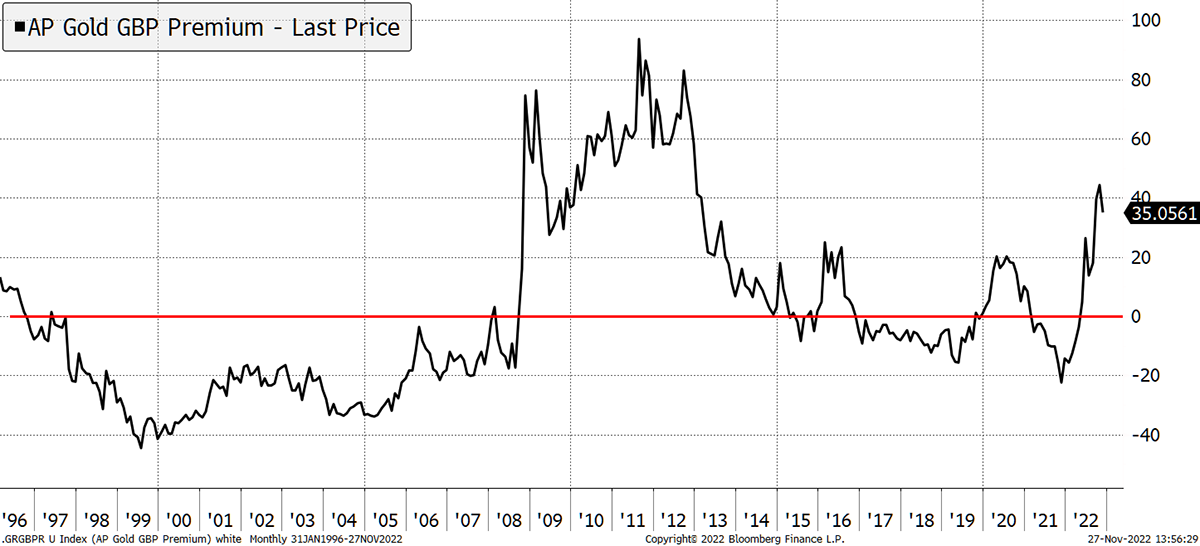

Looking at the GBP premium since 1996, gold was significantly overpriced in the aftermath of the credit crisis in 2008, peaking in 2011. The trigger for the selloff was the “taper tantrum” in 2013 when bond yields started to rise. In 2022, bond yields, and more importantly, real yields, have risen significantly, but gold has held up remarkably well.

The Gold Premium Is High Compared to Index-linked Gilts

Source: Bloomberg

The logical thing to do is sell gold and buy inflation-linked bonds because they are cheaper. More importantly, and at current prices, there is a greater risk of capital loss in gold than in inflation-linked bonds, which have already collapsed. The risk is we do nothing, and gold breaks. I am keen to avoid that.

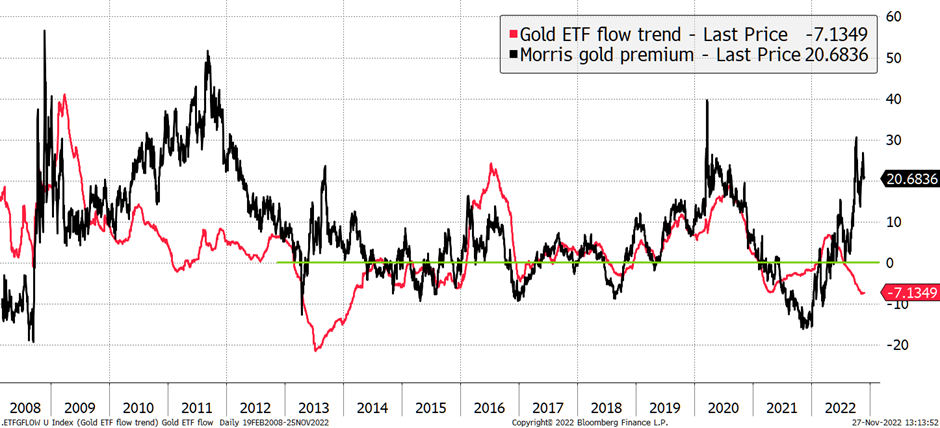

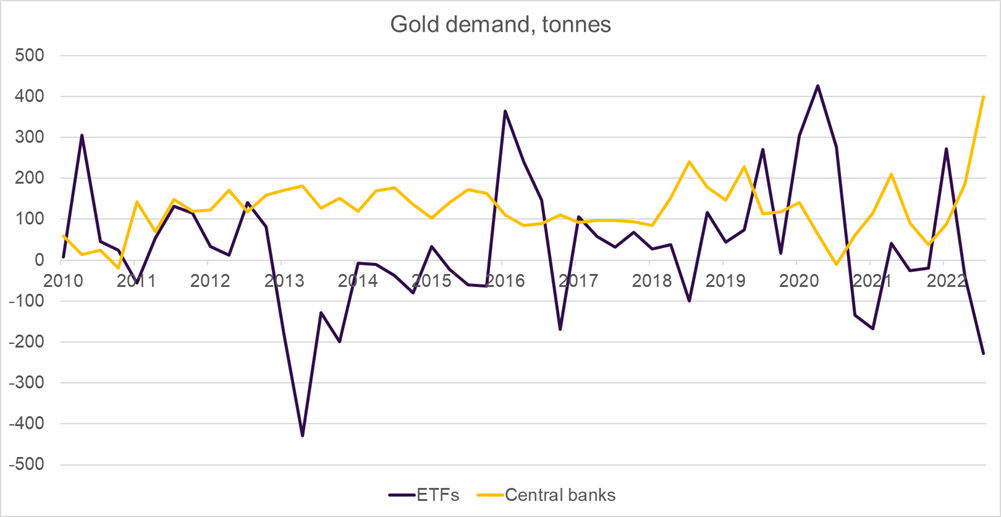

As gold has risen to a premium in 2022, investors have been selling gold. The flows into the ETFs (red) have turned negative as the premium has risen (black).

Investors Are Selling Gold

Source: Bloomberg

One reason I believe the gold price has held up so well is because the central banks bought a record 399 tonnes in the third quarter. This has overwhelmed the selling by the gold ETFs. The main buyers came from Turkey, Uzbekistan and Qatar.

Source: World Gold Council

Perhaps they know something we don’t, but I am concerned that gold may be on the wrong side of the momentum crash, whereby 2022’s winners go into reverse. We have already sold Shell, and I am selling BAE Systems (BA) as well and will cover that later.

The real yields on offer in bonds are much more attractive than they have been for some time. This is especially true in the USA, where you can once again lock in returns above inflation.

Real Yields Are Back to Where They Should Be

Source: Bloomberg

The UK 10-year real yield is actually better than it looks. That is because it is linked to Retail Price Inflation, (RPI) as opposed to Consumer Price Inflation (CPI) used in other countries. This is a historical anomaly, and while it would be welcome to switch to global CPI standards, it would be the bond market equivalent of us deciding to drive on the left. Not worth the hassle.

Over the past five years, RPI has been 1.4% higher than CPI, and so you can add that onto the -0.6% which comes to 0.8%. It’s not huge, but it’s positive, and a low-risk way of beating inflation.

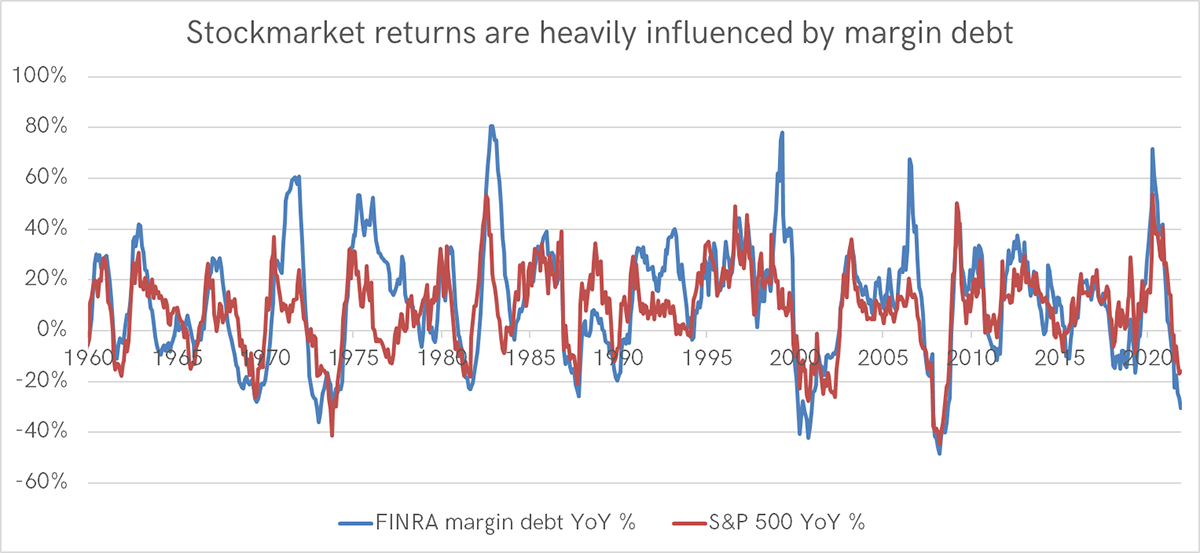

Not only are bonds much more attractive than they were, but equity deleveraging has come a long way. This data on broker’s clients’ margin debts was a cause for concern last year, yet today it is back to 1974, 2002 or 2008 territory - all major market lows. It doesn’t guarantee we’ve hit the bottom, but it’s encouraging to know that much of the leverage has left the stockmarket, although not necessarily the economy.

Source: FINRA

The risk of investing in bonds and equities is much lower than a year ago, but be in no doubt, there’s still plenty of risk out there. And that’s why we tread carefully, exploiting value where we can find it.

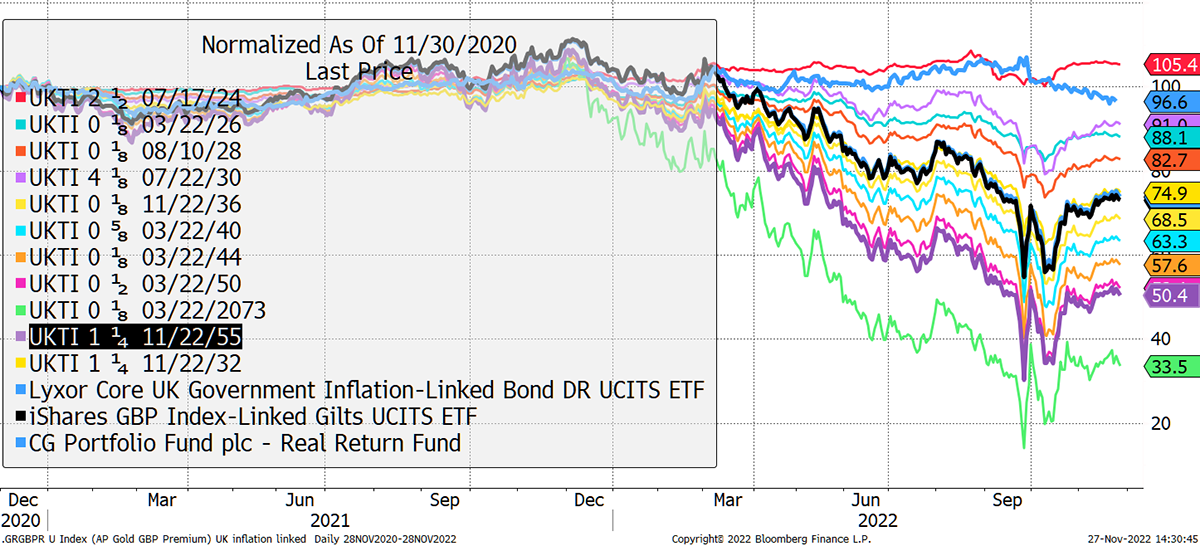

To demonstrate how far we have come, I show how £100 invested in inflation-linked bonds turned out over the past two years. The 2073 inflation-linked gilt, which redeems in 51 years, has seen £100 fall to £33. In the chart, only the 2024 bond made money as it had a relatively high coupon of 2.5% and, with just two years to run, was much less sensitive to rate hikes. Furthermore, it gained from a pickup in Retail Price Inflation (RPI) which is paid to bond holders.

Inflation-linked Bonds Have Collapsed

Source: Bloomberg

I highlight the two UK index-linked ETFs, which saw £100 fall to around £75. The actively managed CG Real Return Fund is shown in blue, which lost £3.40 (or £1.90 if you include income) over the past two years.

Buying 10% CG Real Return Fund, Selling 10% WisdomTree Gold ETF (PHGP) in Soda

I may be highly knowledgeable about gold, but I am not a gold bug. Gold is being reduced because I see a risk of capital loss over the medium term. If the situation changes, I will not hesitate to buy it back.

Gold is a highly liquid alternative asset and works within a rational framework. I have adjusted the exposure to gold several times, and last got excited in 2018. I feel the best of that has played out, and it is time to embrace inflation-linked bonds.

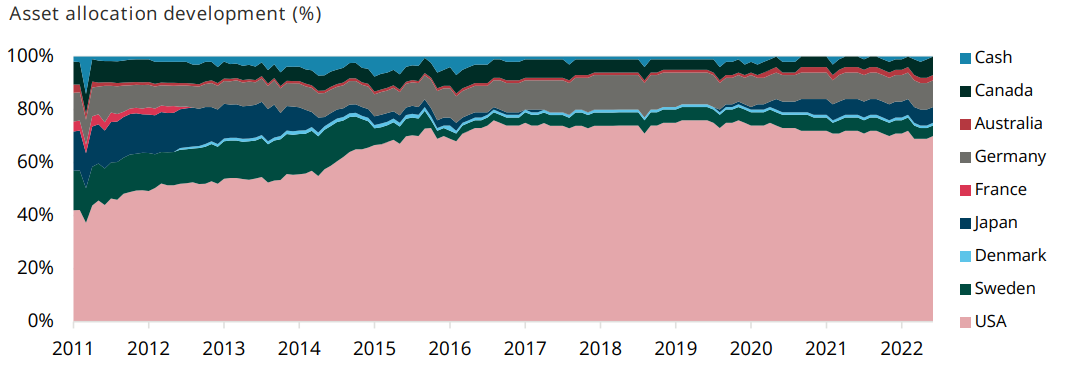

The CG Real Return Fund is managed by Capital Gearing, who also manages our Capital Gearing Trust (CGT) – a long-term holding in Soda. They are experts in inflation-linked bonds and this fund is a spinoff which invests solely in AAA-rated global inflation-linked bonds ex UK. Currently, they have 68% invested in US TIPS and have been increasing exposure to Japan.

Source: CG Asset Management

I could have increased exposure to CGT, but I deem that to be a long-term hold, whereas this is a switch from gold. One day, we will no doubt switch back, when gold is cheap, and the outlook improves.

We have some exposure to UK index-linked bonds via CGT and Ruffer (RICA), so I see no need to add to that, but I will be keeping an eye on the iShares UK Index-Linked Gilt ETF (INXG). The ETF is much riskier than the CG Real Return Fund, and I think an active manager is worth their weight in gold during times like this. I am unaware of any inflation-linked bond team that knows more.

Please have a look at their factsheet.

Fund details:

ISIN code IE0034304117

SEDOL code 3430411 IE

The management fee is 0.3% per annum.

Risk

This switch from gold to index-linked bonds is driven by relative value. Both could go still go up or down, but in my opinion, the bonds will outperform gold.

The inflation-linked bonds are AAA-rated, which, in theory, means they are risk-free. They are in the sense that they will deliver exactly what you expect them to do, and are backed by governments, but that can involve significant price volatility, as we have seen this year. Now that real yields are back in positive territory in some countries, this is a good long-term entry point.

The CG Real Return Fund is more cautious than the market in general. Their fund has materially lower volatility than the available ETFs.

Their job is to identify the cheap bonds that offer the highest real yield, and, given things are changing, I believe it is better to allocate to a competent active manager.

I have recommended the unhedged share class, and do not advise you to buy the hedged share class. For that, you’d need to be a sterling bull, which is not a bad idea in the short-term, but longer-term, the hedge shares lose their “risk-off” credentials. Whenever the pound collapses, which happens from time to time, owning overseas bonds or gold is a saviour. If you hedge, you go down with the pound.

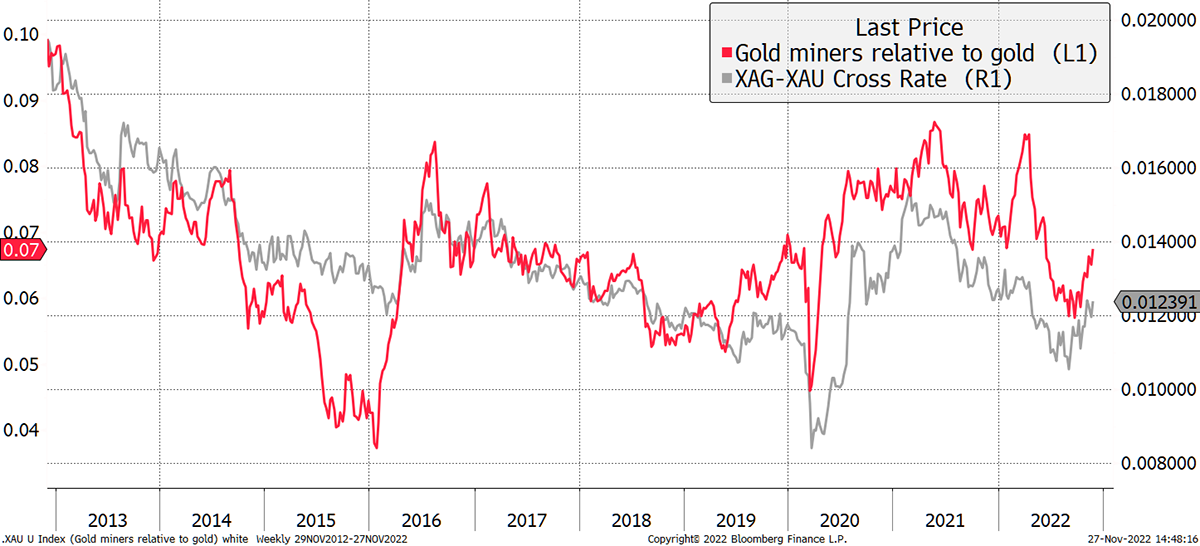

Gold Mining Shares and Silver

The friends of gold are better positioned for the time being because they enjoy risk-on market conditions. All are currently outperforming gold. Whisky has 17% exposure to silver, a gold mining ETF (GDGB) and Fresnillo (FRES).

Friends of Gold Outperform

Source: Bloomberg

I am unlikely to add to this area until the outlook for gold improves and may decide to take profits in due course. I am still enjoying their diversification benefits, and all holdings are in profit, despite sterling’s recent rally.

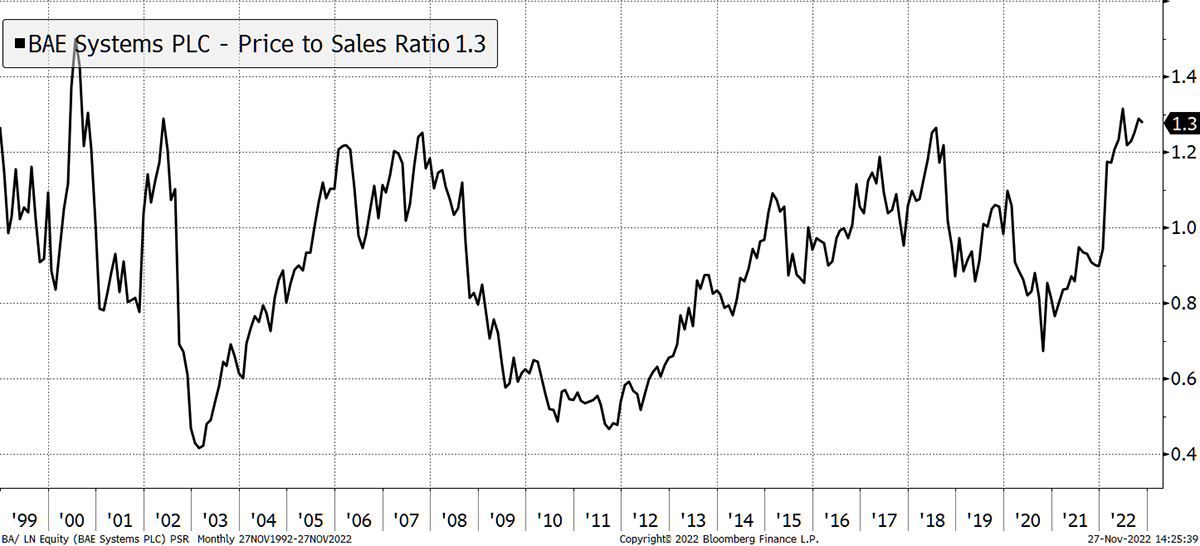

Selling BAE Systems in Whisky (BA)

I recommended BA in March last year, and it is up 63% since. It’s a great company that was unloved at the peak of the ESG craze. Defence stocks were persona non grata, which changed in a heartbeat when Russia invaded Ukraine.

BA Fully Valued

Source: Bloomberg

There is nothing wrong with BA, but the shares trade at the top of their 20-year range on a price to sales basis. I believe we should take profits as they are on the wrong side of the momentum crash.

Action

Sell 10% gold in Soda (PHGP)

Buy 10% CG Real Return Fund (see details above) in Soda

Sell BAE Systems (BA) in Whisky

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 4.2% this year and up 101.5% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.1% this year and up 121.7% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

In recent weeks, the Whisky Portfolio has been repositioned, while Soda’s shift is still underway. While I can find plenty of stocks to buy for Whisky, I am struggling to find diversified equity exposure more suitable for the Soda Portfolio. I am currently underwhelmed by the major indices, such as the S&P 500. That is probably because the value is in bonds, where I am doing more research. Adding inflation-linked bonds is a good start.

I have retained 5% gold for the time being. I hope not much happens, and we simply wait for conditions to improve before adding to gold again. I am conscious that the gold price may stay at a premium because the world has changed. But right now, I see the risk of loss to be greater than the opportunity.

Please be aware that due to travel, the portfolio prices are as of Friday’s close, so prices may have shifted.

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd