Brace Yourselves for Emerging Markets

A warm welcome to new readers. I shall soon host a webinar to introduce you to ByteTree and answer questions.

If the valuation models are correct, which no doubt they are, emerging markets are getting ready to lead the world, just as they did before 2008. We currently have a modest allocation to emerging markets, and I plan to increase this for the reasons laid out in this piece. But before we do that, we have to think about China.

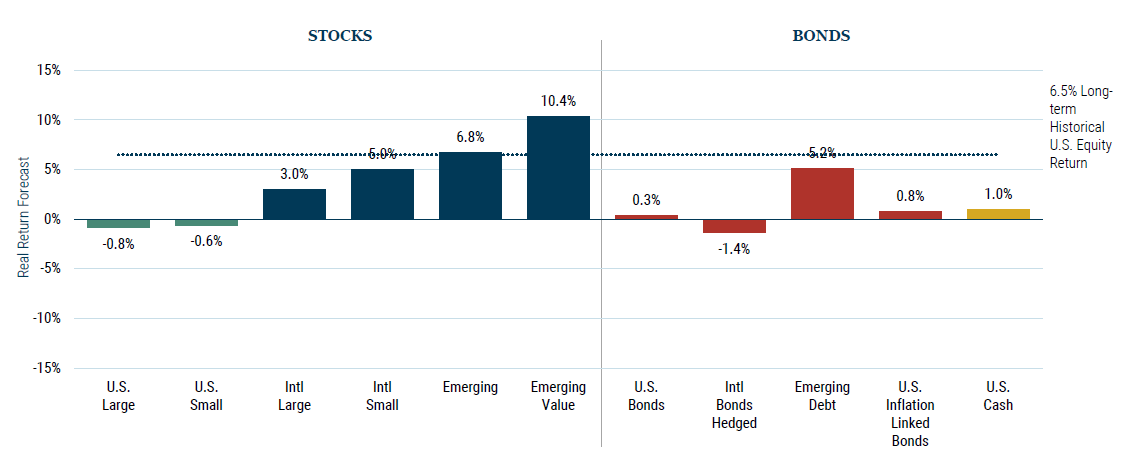

You may be familiar with this chart from GMO, a fund management firm based in Boston. They look at current market valuations, and make a few assumptions, to forecast future returns. They highlight that historically, US equities have delivered real returns of 6.5% per year, which they have averaged over the past century.

Seven-year Asset Class Forecasts

Source: GMO

A real return for US equities = stock market gains + dividends - inflation.

Currently, GMO’s models see valuations too high to sustain a 6.5% real return, and they forecast real returns for US large cap equities of -0.8% per year for the next seven years.

US small caps are also expensive, yet international small caps imply +5% real returns, which is closer to long-term expectations. Emerging market equities stack up well (+6.8%) while emerging value is super cheap (+10.4%).

In bond markets, return forecasts have risen, with most finally back above inflation. Emerging market debt stands out as good value. No one ever expected bonds to deliver 6.5% real returns in the long run. What should they be? It’s hard to say, but definitely above zero.

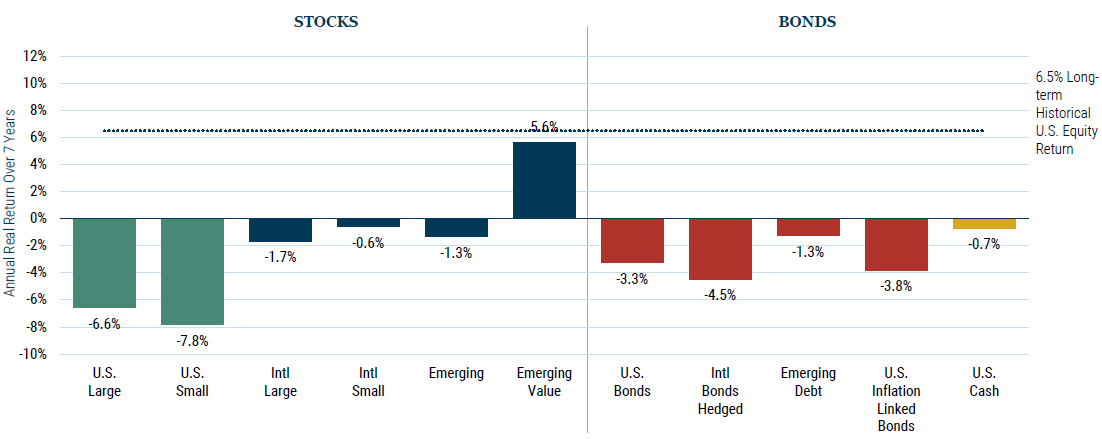

At the end of 2020, it was a very different picture. GMO’s models saw US large cap equities returning -6.6% per annum and US small caps -7.8%. But look at bonds. Their models correctly forecasted losses across the board, and they were right.

Seven-year Asset Class Forecasts - at the End of 2020

Source: GMO

This model isn’t rocket science. But it is a wonderful independent source from a respected firm that applies long-term valuation metrics across markets. Two years ago, it was a really bad idea to invest in bonds, but the Bank of England, and many other pension funds, had no qualms. Not only did they invest, they leveraged up. It really is staggering when you think these people should know better.

Two decades ago, long-term valuation models were banging the drum for emerging markets, just as they are today. Emerging markets became hugely popular from around 2003, and by 2007, they were over-priced and the talk of the town. It’s funny how they have delivered no return in the following 15 years.

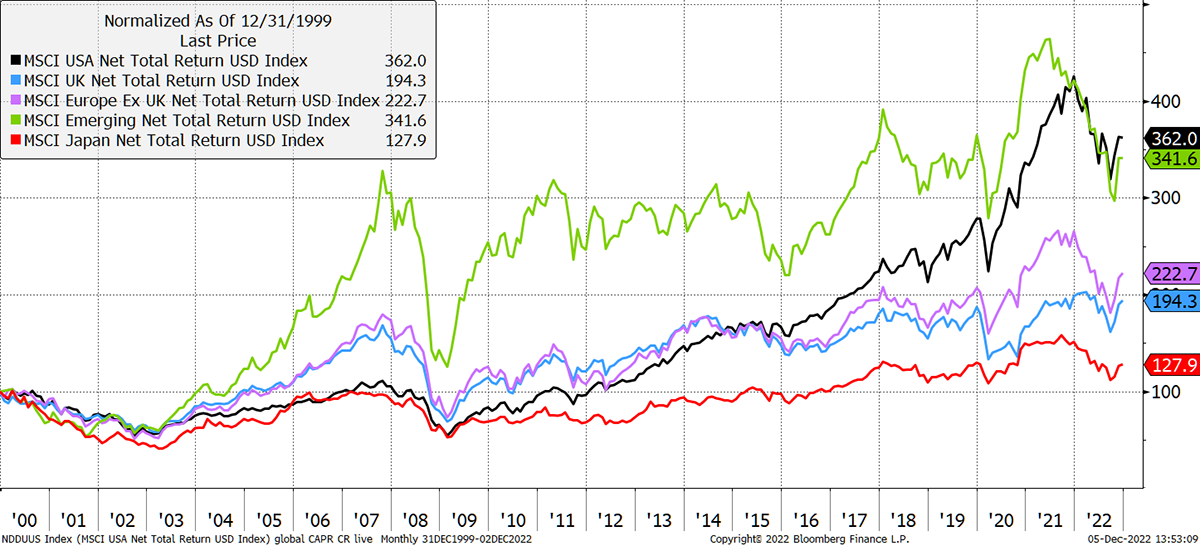

Regional Equities in the 21st century

Source: Bloomberg

Since 2007, emerging markets have stood still while the UK and European stockmarkets doubled as US equities quadrupled. Shame about Japan. Is Japan undervalued? Yes, but that’s a subject for another day.

This contrasts with the post-2000 period, where US equities took 11 years to make a new high following the preceding technology bubble. Emerging markets, UK and European equities were way ahead in the first decade of the century. It was only this last decade that US equities excelled themselves. They finally caught up with emerging markets, and today stand neck and neck.

The bottom line is that at the turn of the century, it didn’t matter whether you chose the US market, propelled by internet stocks, or emerging markets, propelled by rising living standards; 22 years later, they both got you to the same place. Europe and the UK were lacklustre, but the most important decision was avoiding Japan.

It takes time for the excitement to shift between megatrends. Pre-2008 it was all about global growth and China. How the new world was growing faster as they played catch up. Today, it’s technology, but I believe the best of that megatrend is behind us. Naturally, technology will keep evolving, but the stockmarket will view it with a more level head. The next tech bubble won’t be for a while yet.

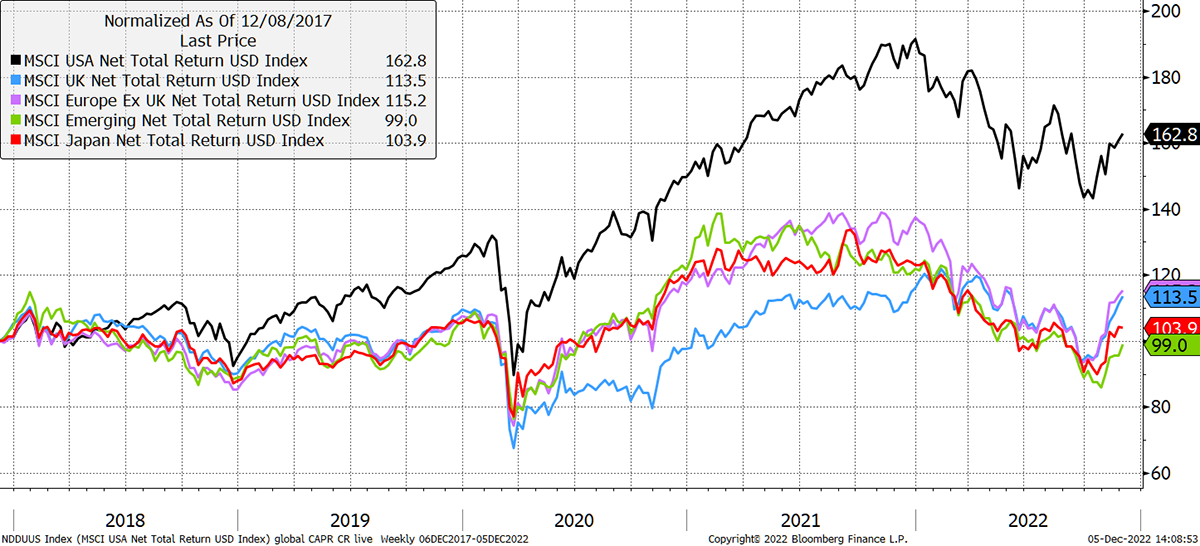

That same chart above over five years is bizarre. US equities gained while the emerging markets, Europe, the UK and Japan all lagged behind in a tight group (shown in USD). I have little doubt that the rest of the world will deliver much higher returns than the US over the next seven years. Better still, the valuation models imply that emerging markets will lead the way.

US and Them

Source: Bloomberg

Weak Dollar Propels Emerging Markets

In addition to the value identified, we now have a trigger. If it’s true that the US dollar has peaked, then it stands to reason emerging markets will take the lead. It strikes me that the dollar has likely peaked because it is overpriced, and upward pressure on interest rates will ease. But that hasn’t fully happened yet. We sense it, but it may require a little more patience.

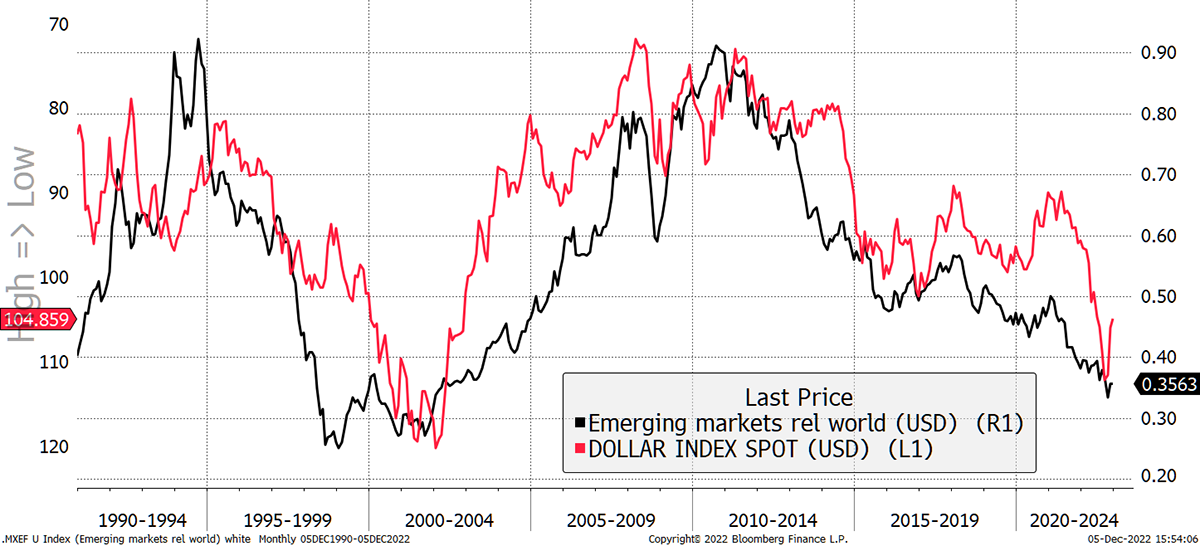

Longer term, it has been clear that when the dollar is falling (black line - chart is inverted, so the black line is rising), emerging markets beat the rest of the world. The logic is simple. A strong dollar equates to tighter policy, while a weaker dollar improves their terms of trade and capital flows. A weak dollar makes their lives easier.

Emerging Markets Thrive on a Weaker Dollar

Source: Bloomberg

Whenever the dollar has been structurally falling, emerging markets have been outperforming global equities and vice versa. We would normally say the same about commodities, which also like a falling dollar.

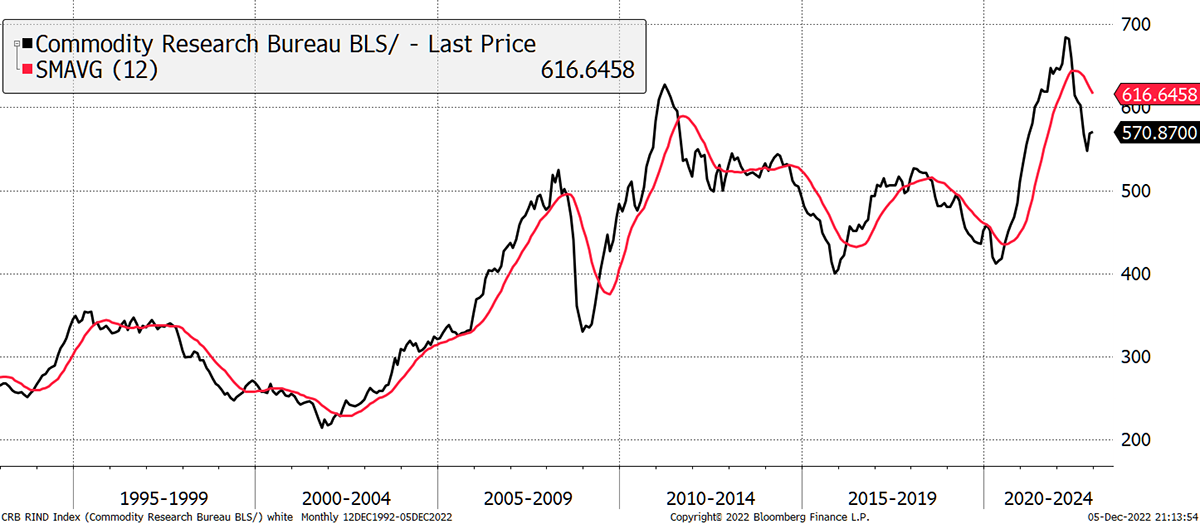

There’s just one problem. Commodities are weakening, and that doesn’t bode well. The message is that global growth is headed south.

In recent weeks, I have reduced exposure to oil, and that feels right. Any talk from OPEC or Russia seems to fall on deaf ears. Just as we couldn’t keep the oil price down a year ago, now we can’t keep it up.

Commodities Prices Are Easing

Source: Bloomberg

The CRB Rind shows you the “behind the scenes” commodity prices. Out go oil and copper, and in come the likes of wax, scrap steel, tarp and wool. They aren’t traded in the futures market and so are not distorted by financial speculation to the same extent. I believe they show what commodity prices are doing in the real world, which is falling.

The message from the market is that it is right to allocate more to emerging markets, but my instinct is that they are unlikely to surge until global growth turns the corner. And for that, we need more buoyancy in commodity prices.

That said, I am prepared to move sooner, but we just need a little more evidence that emerging markets don’t just outperform the US market but make money in real terms.

The other consideration for investing in emerging markets is China.

China

The emerging markets index comprises many countries and around 80% of the world’s population and land mass. China makes up nearly 30% of the index.

The economic troubles in China are well flagged, with a property market in disarray and never-ending lockdowns. The people have spoken, and the authorities have signalled a willingness to ease restrictions as the Omnicron variant was “less pathogenic”.

Some of you may be uncomfortable investing in China. I understand that on ethical grounds, but equally, it is an important part of the global economic system and therefore not (yet) out in the cold. I picked up this piece in the FT in an interview with 76-year-old Howard Marks, founder of Oaktree, one of the world’s most respected bond fund managers.

“Marks says he got comfortable with investing in China after years of high-level discussions with authorities and assurances that the rule of law would prevail.”

Oaktree is a hugely respected firm and very active in China. I side with Marks. In any event, some of you will have views on the matter, and I would like to hear from you. If China had a 10% weight in the index, I wouldn’t be concerned, but it is 30% and growing. Best we flush this one out.

Currently, I plan to embrace China in our investment strategy, although I will proceed with caution. As an investor, I believe we need to embrace emerging nations, and think more of the people living in these countries, than the regimes which we may or not disapprove of.

In any event, we will be going into emerging markets in 2023, and it makes sense to flush out your concerns now. Please share your thoughts.

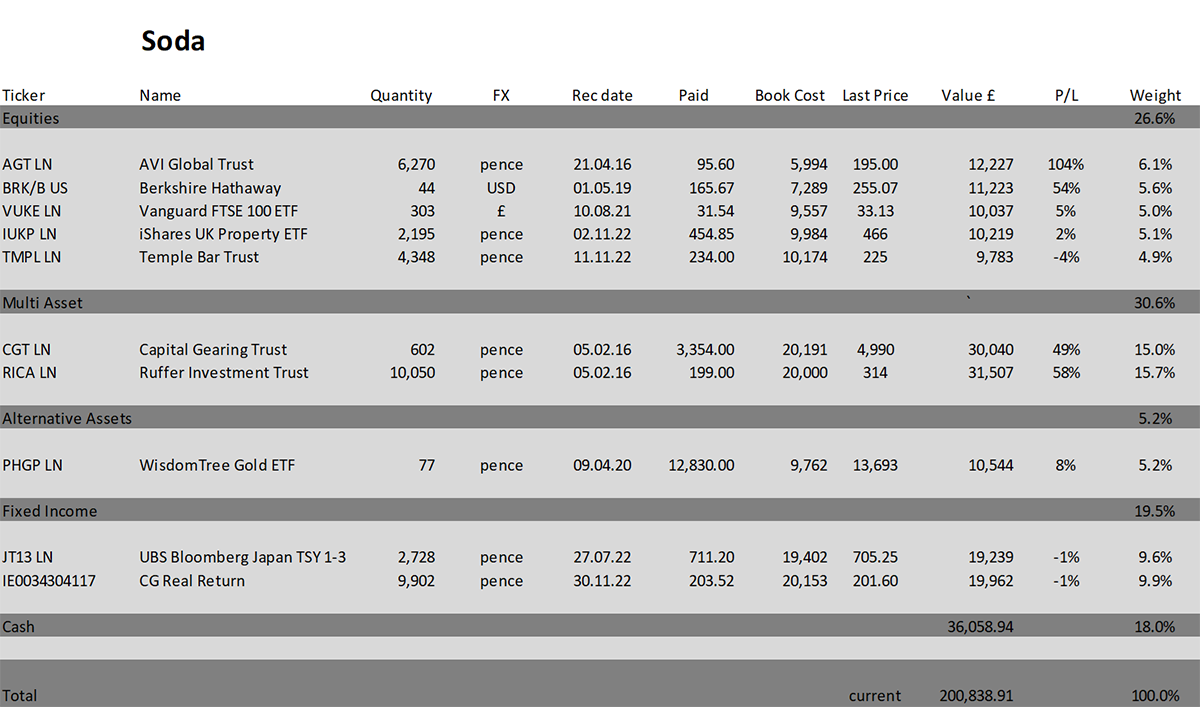

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 3.8% this year and up 100.8% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

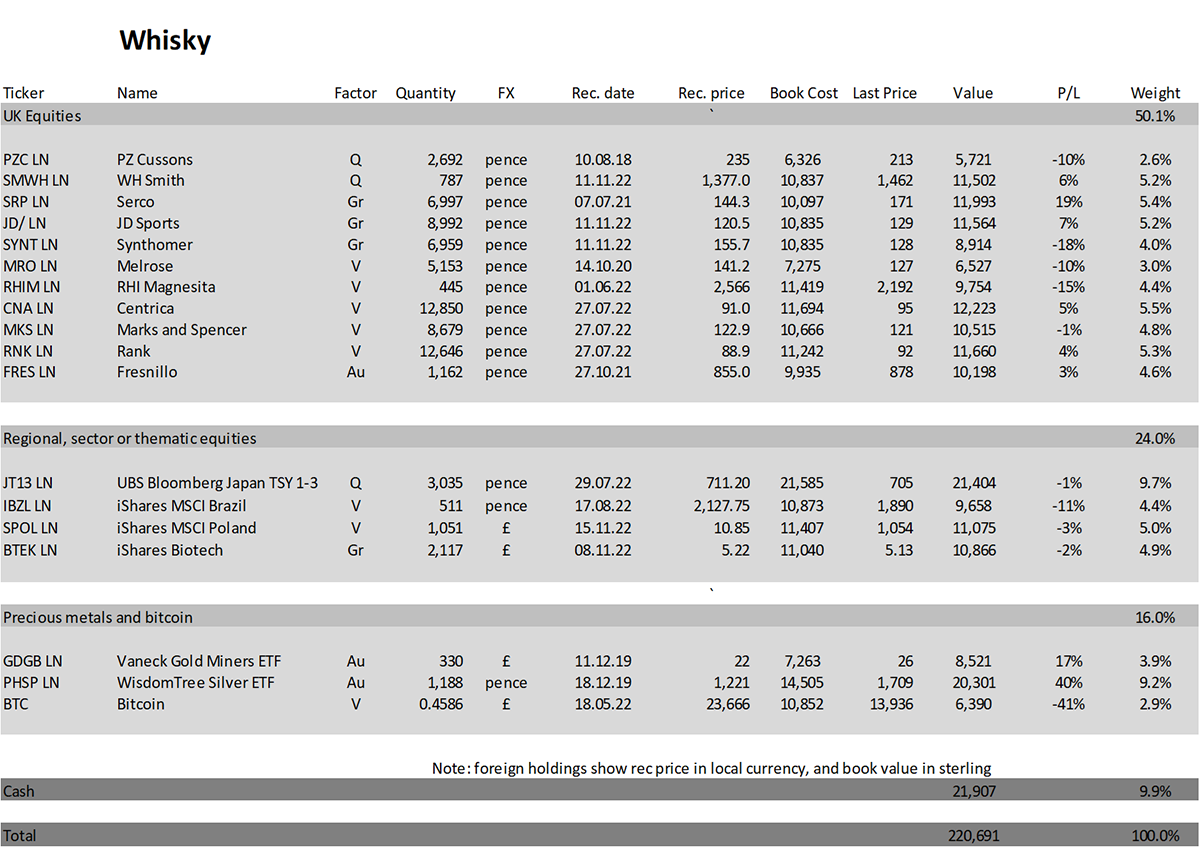

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.7% this year and up 120.7% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Readers have highlighted some incorrect purchase dates in the portfolios (some 2023!), and the bitcoin to sterling conversion was incorrect in Whisky. Thank you for pointing that out.

Summary

From this day, The Multi-Asset Investor lives exclusively on ByteTree, and from next week, we will reinvigorate the Post Box. It has been tricky with a split audience.

Once again, thank you to the new readers who have joined ByteTree. Please have a look around the site. Whether you love or hate crypto, it’s all good fun, with lots of geeky data to play with. I shall arrange a webinar soon.

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()