The Technology Bear Market

ByteFolio Issue 195;

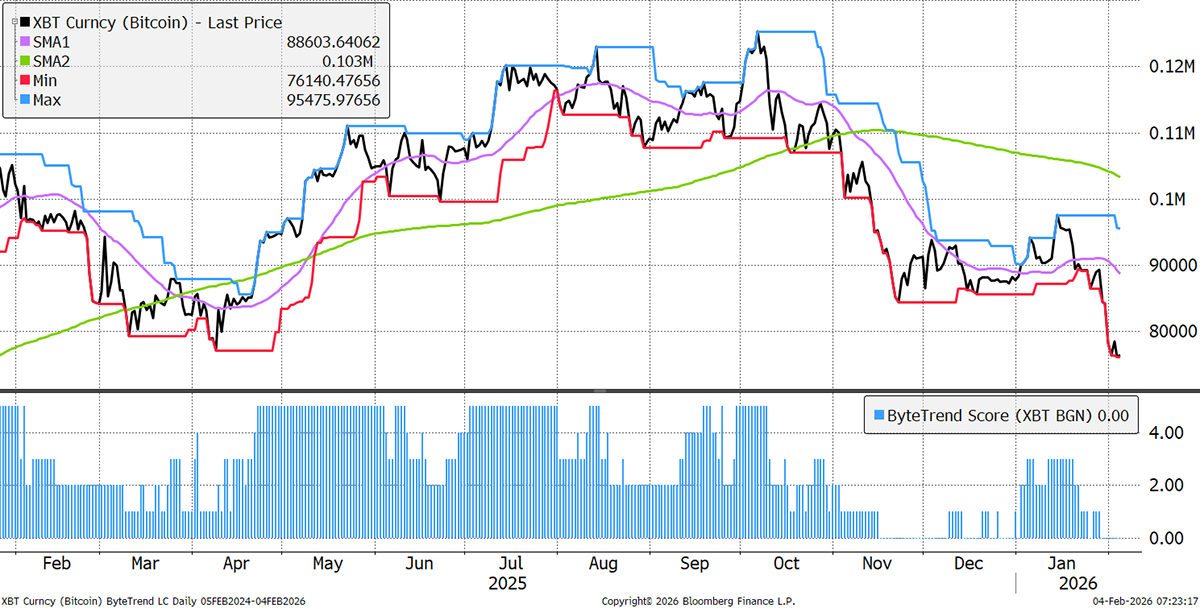

Bitcoin’s ByteTrend Score drops back to zero, as the price now challenges the April 2026 low.

Bitcoin

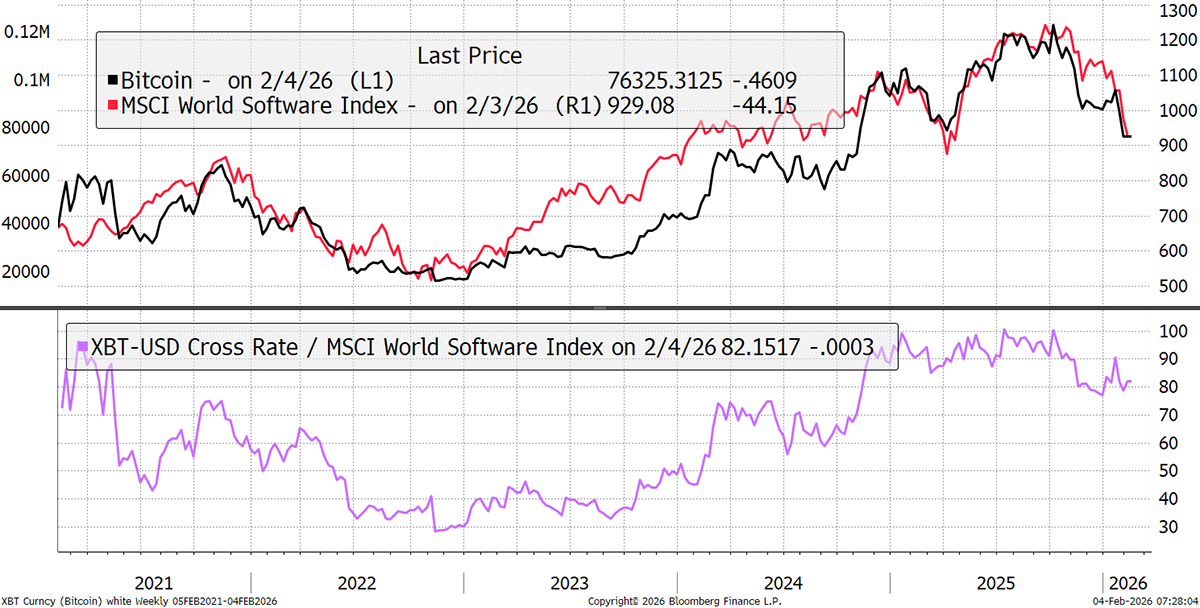

There can be no doubt that Bitcoin has been caught up in the technology selloff. At its heart, Bitcoin is an internet stock. Software stocks have been the most recent casualty, and the price of Bitcoin has shown similar performance over the past five years, with high correlation.

Bitcoin versus Software

Macroeconomic factors that are relevant to gold, a real-world asset, are not currently relevant to Bitcoin, a digital asset. Gold demand has been driven by the non-OECD central banks, as they seek to diversify their reserves. Bitcoin is not on their list, and as a result, does not enjoy their structural bid.

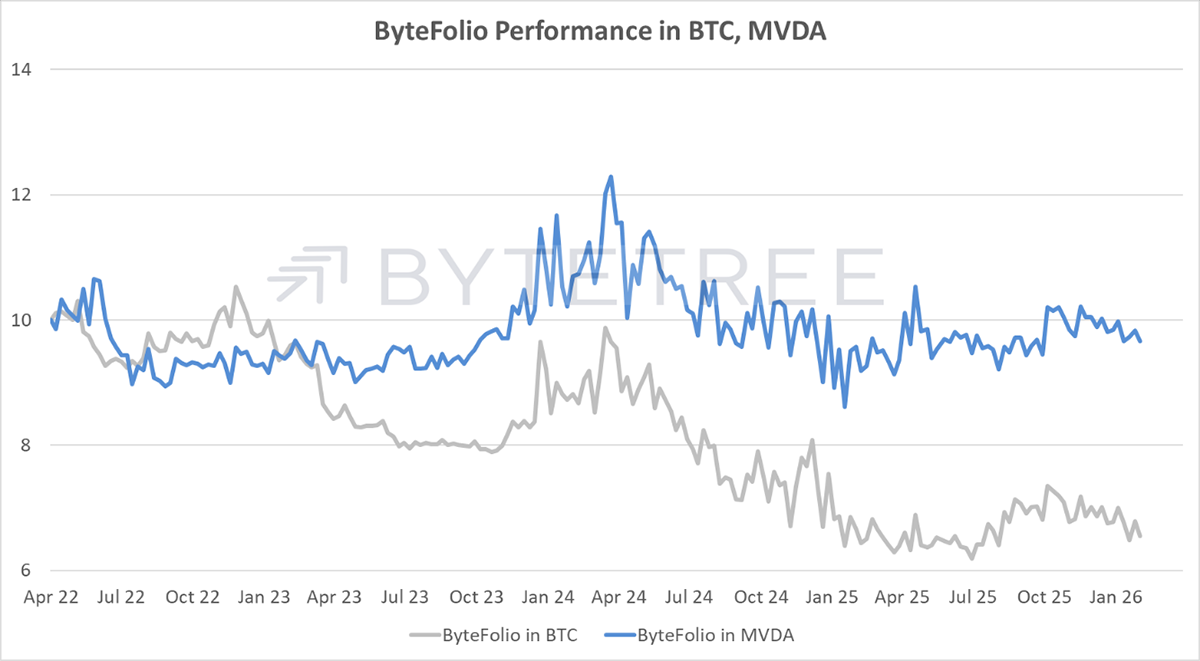

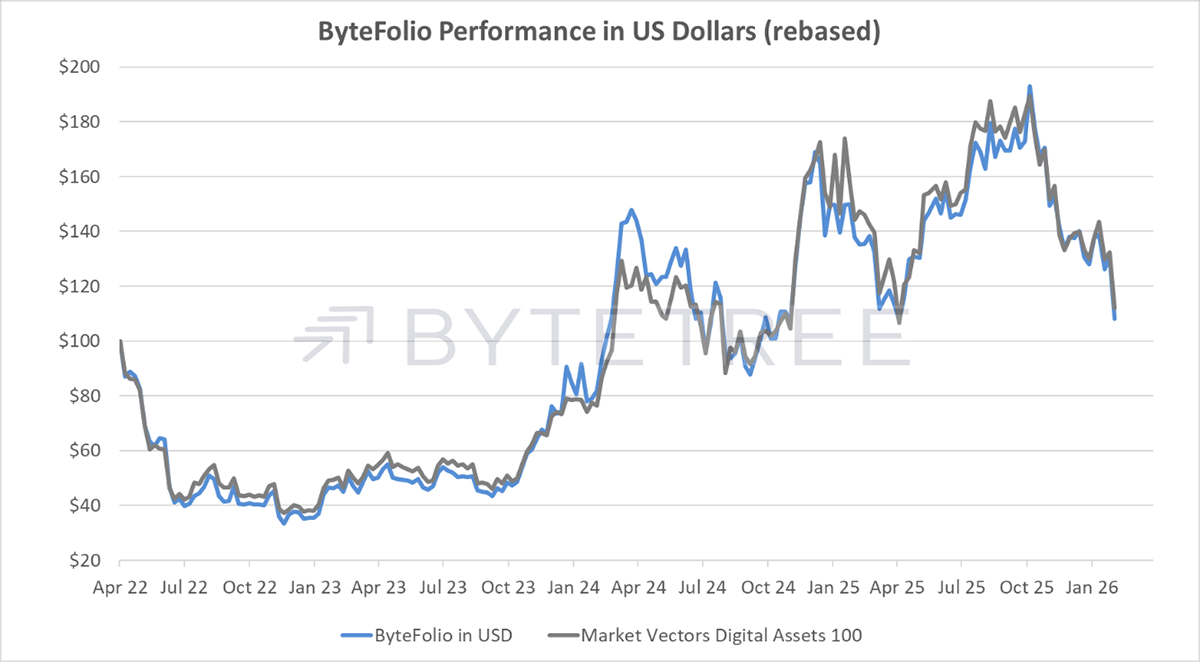

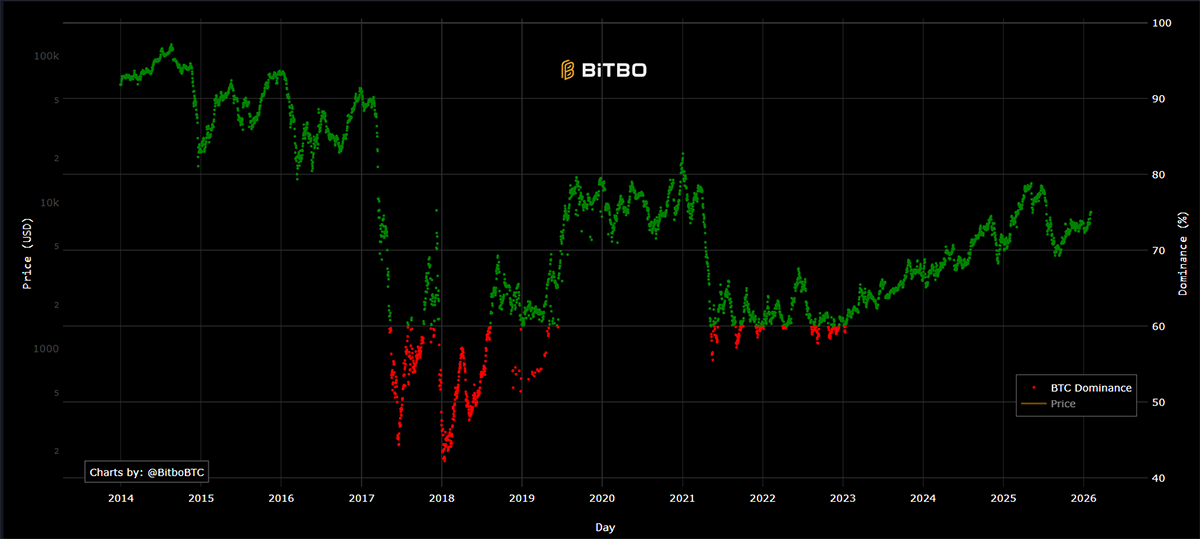

Bitcoin dominance, i.e., its share of the crypto market cap excluding stablecoins, is a key measure of Bitcoin’s relevance. In the early days, as the only coin, it had a 100% share. As altcoins were created, this fell, hitting a low of 40% during the 2017 altcoin boom. Nine years later, and dominance is at 75%. Despite the weakness in crypto, Bitcoin stands tall as the dominant and most relevant digital asset.

Bitcoin Dominance

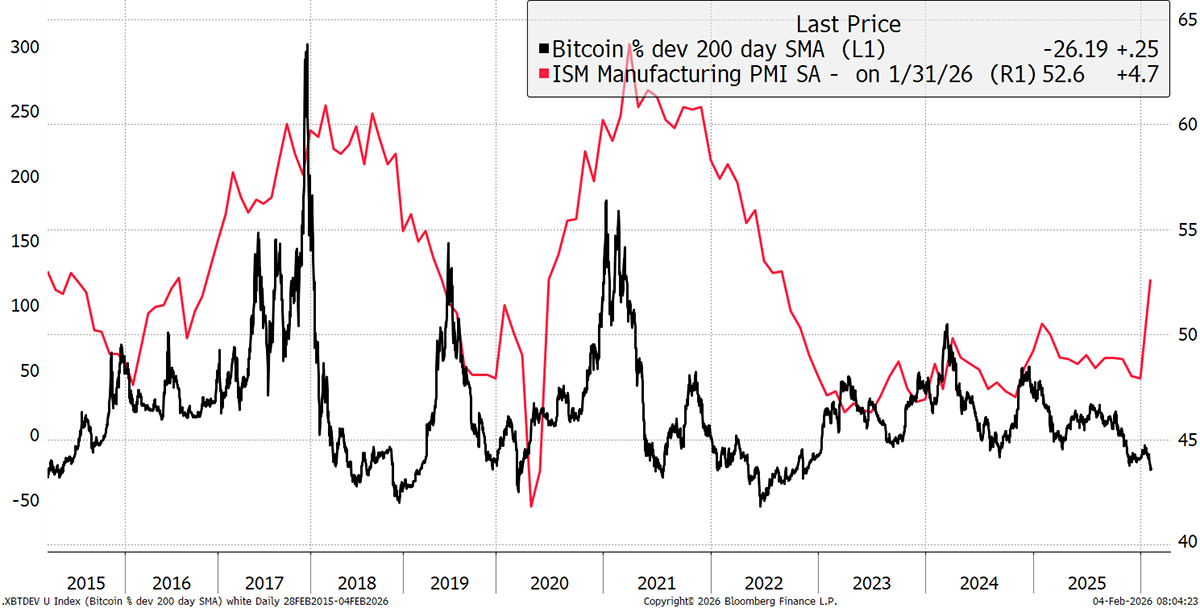

How long will the technology bear last? ByteTree’s Robin Griffiths always said the average duration of a bear market is 14 months. Some are much shorter, others longer, of course, but that is the norm. Given this weakness began in early October, the likelihood is that it will remain ongoing for 2026. Lots of things could change that, such as a super-strong economy. The US ISM just spiked, and as many have pointed out, that has historically been bullish for Bitcoin.

Bitcoin Trend deviation and the ISM

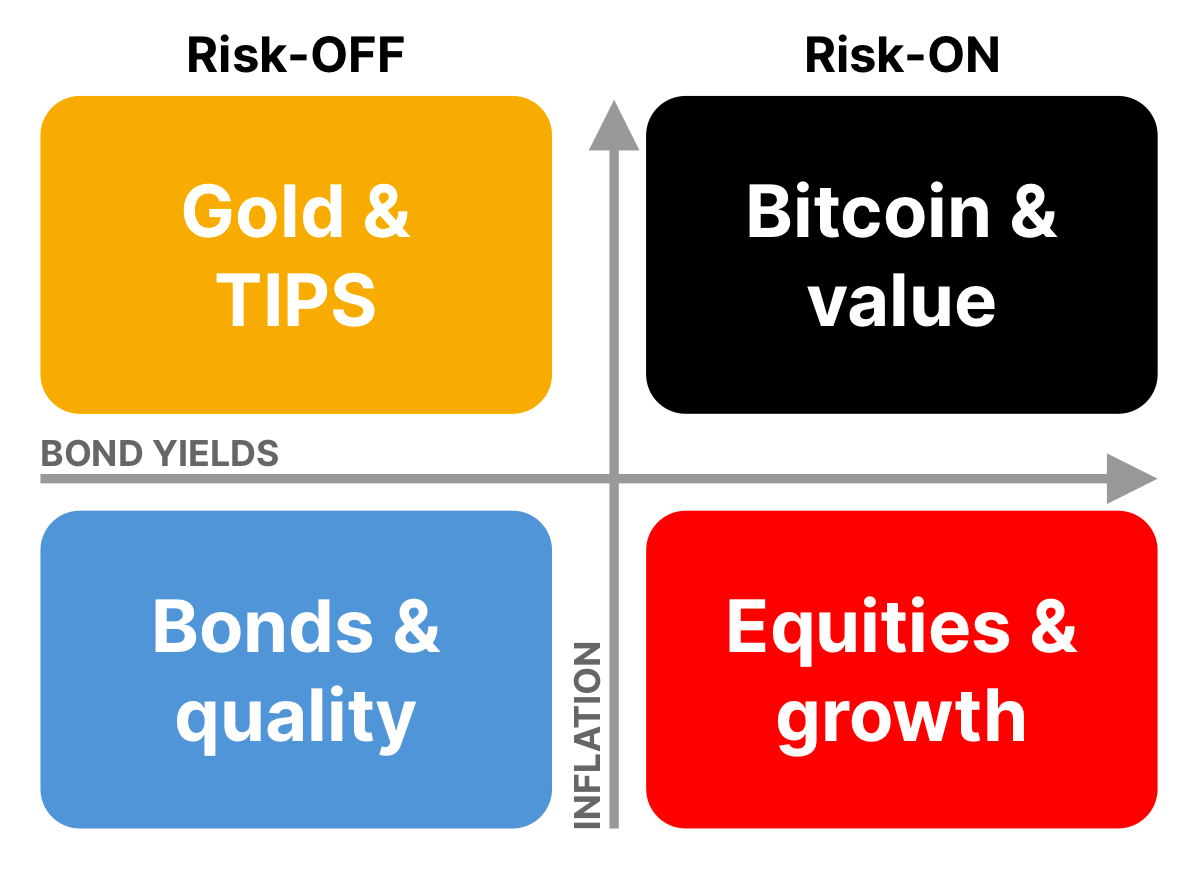

The ISM is another way to show what ByteTree has been saying for years, which is that Bitcoin likes a strong economy. This can be visualised in our Money Map. When the ISM is strong, bond yields and inflation expectations are expected to rise. The ISM suggests that it is likely, as the White House wants a strong economy. According to Barron’s, the Trump administration projects 4% to 5% inflation-adjusted GDP growth for 2026, with Treasury Secretary Scott Bessent citing potential $1,000 tax refunds.

The Money Map

Bitcoin remains the strongest major asset of the post-2022 cycle. The price is under pressure, but the best days lie ahead.