Ethereum Is Scaling Fast

ByteFolio Issue 197;

Ethereum has long faced scalability constraints, particularly during periods of heightened activity such as the launch of CryptoKitties in 2017 and the later NFT and memecoin booms. Each wave of demand exposed the limits of block space and drove transaction fees sharply higher.

Recognising this structural bottleneck, Ethereum embarked on a multi-year upgrade roadmap, initially branded as Ethereum 2.0, beginning with its transition from Proof-of-Work to Proof-of-Stake in 2022. That shift laid the foundation for a more scalable and energy-efficient network.

Major Ethereum Upgrades in 2025

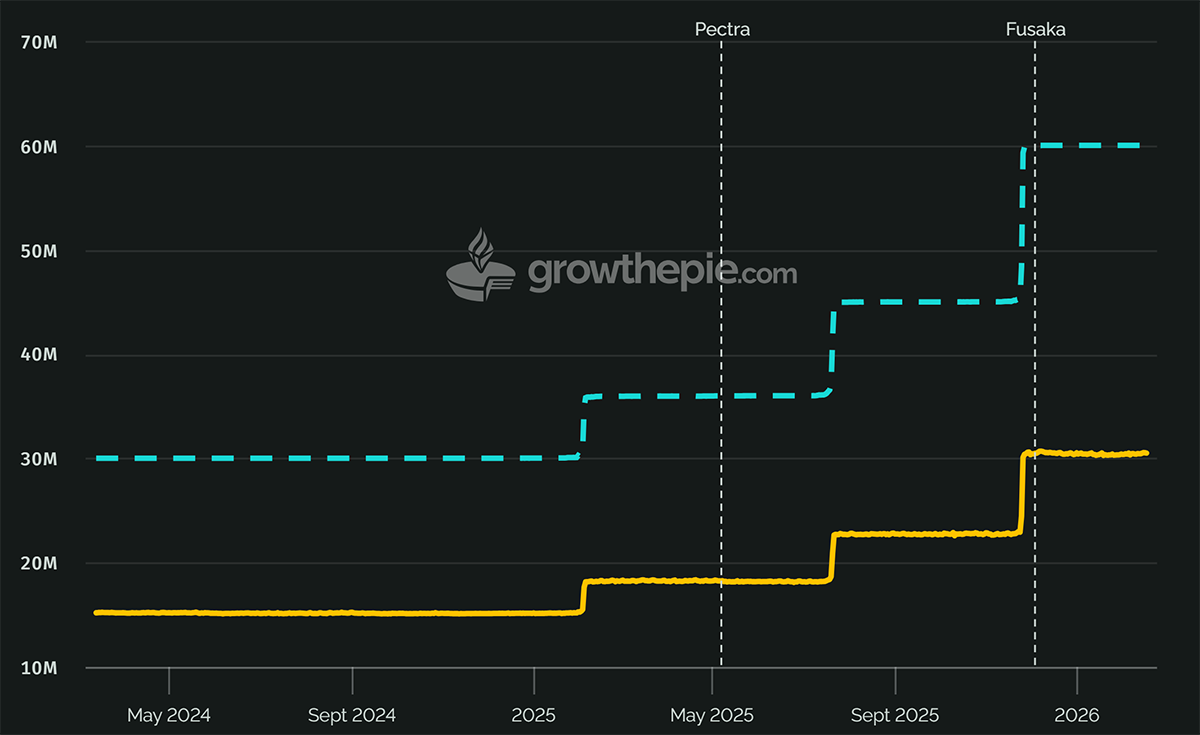

Continuing with the roadmap, Ethereum successfully activated two major upgrades in 2025. The first, Pectra, went live in May and significantly increased the maximum stake per validator from 32 ETH to 2,048 ETH. This change improved validator efficiency and operational flexibility, while also expanding Layer-2 (L2) blob throughput, increasing the amount of transaction data Ethereum can handle.

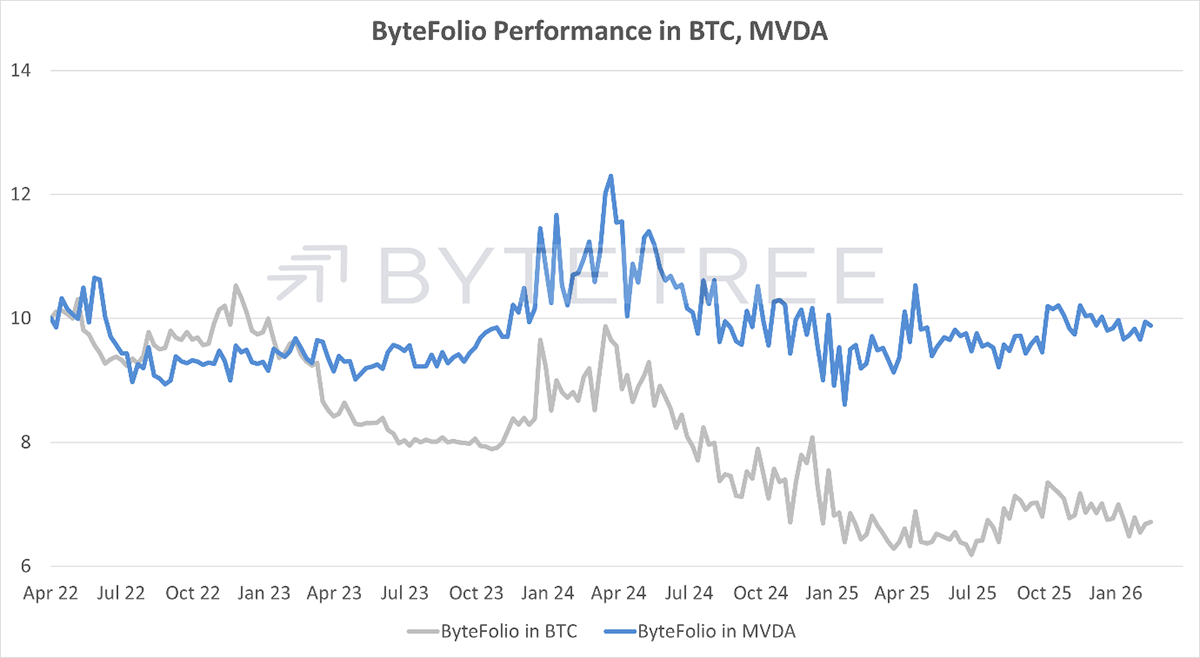

The second upgrade was Fusaka, which Ethereum activated in December. Fusaka introduced a more efficient way for nodes to verify blob data, allowing them to validate random portions instead of downloading the full dataset, reducing bandwidth strain. The upgrade also raised the default block gas limit to nearly 60 million, as shown in the chart below.

Ethereum Gas Limit

Doubling the gas limit from 30 million to 60 million effectively allows each block to process roughly twice as much computational work. In practice, this means more transactions and more complex smart contract interactions can be included per block, increasing throughput. The result is lower congestion during peak demand and more stable transaction fees, as users compete for a larger pool of available block space.

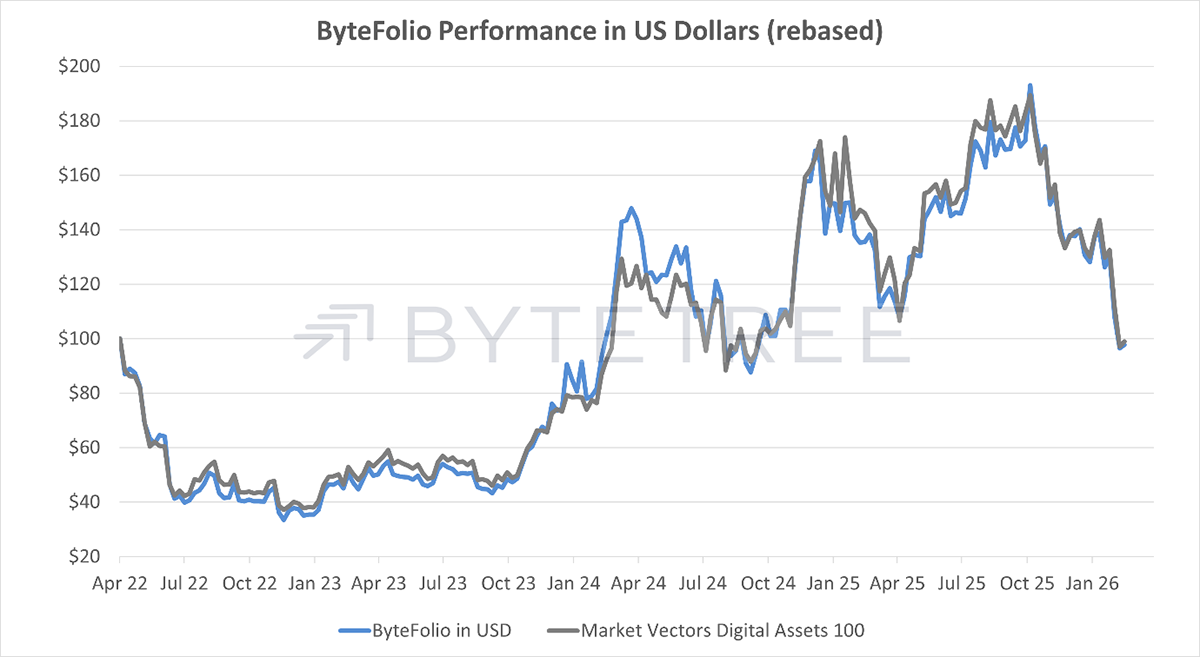

Notably, daily transactions on Ethereum have recently reached new all-time highs. This suggests that recent scalability improvements are working as they should.

Daily Transactions on Ethereum

With gas costs reduced, there has also been a rise in dust transactions, which are very small-value transfers sent primarily because transaction fees are cheap. While this kind of activity does not necessarily reflect meaningful economic usage, it was an expected by-product of lower fees and increased block capacity.

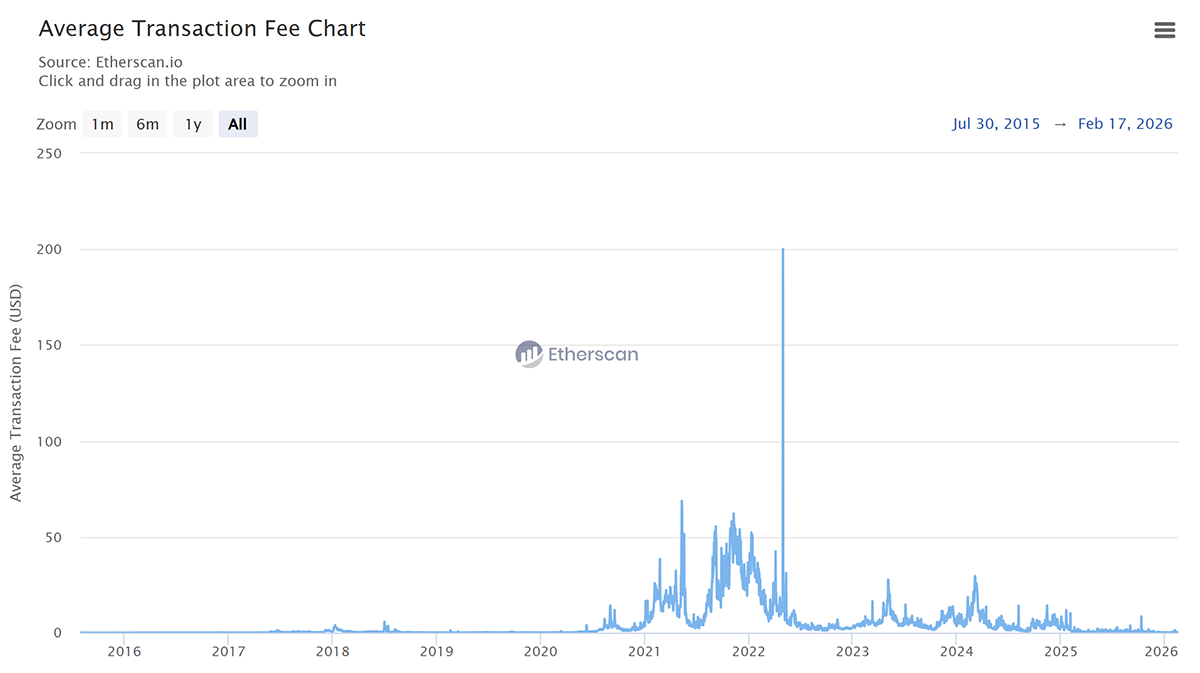

Despite new records in daily transaction volumes, average transaction fees have remained relatively contained.

Average Transaction Fee on Ethereum

This is a notable shift from previous cycles, where comparable levels of activity would have resulted in sharp fee spikes. The combination of higher blob throughput and an increased gas limit appears to be absorbing demand more effectively, supporting the case that Ethereum’s recent scalability upgrades are working as intended.

Major Ethereum Upgrades in 2026

Looking ahead, Ethereum has two major upgrades scheduled for 2026: Glamsterdam and Hegota. Glamsterdam, expected in early to mid-2026, focuses primarily on performance improvements and making block production safer and more efficient. Hegota, planned for the second half of 2026, aims to tackle deeper architectural challenges tied to long-term sustainability and network resilience. Together, these upgrades signal that Ethereum’s scaling roadmap is still very much in motion.

Meanwhile, there is a broader discussion around scaling that continues to evolve. Recently, Vitalik Buterin noted that while Ethereum’s L1 is scaling rapidly, many L2s have struggled to fully inherit Ethereum’s security guarantees, noting that:

“the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path”.

This naturally raises concerns around the future design of rollups, security assumptions, and how tightly connected L2s should be to the base layer.

There is clearly a lot to unpack, and we will be publishing a deeper dive into Ethereum and its broader ecosystem soon. The upcoming article will explore these structural questions in more detail and assess what they mean for long-term value accrual within the network.

Subscribe to our free mailing list to receive a sample of the upcoming Token Takeaway report on Ethereum to your email.