Bitcoin and Silver Pari Passu

ByteFolio Issue 189;

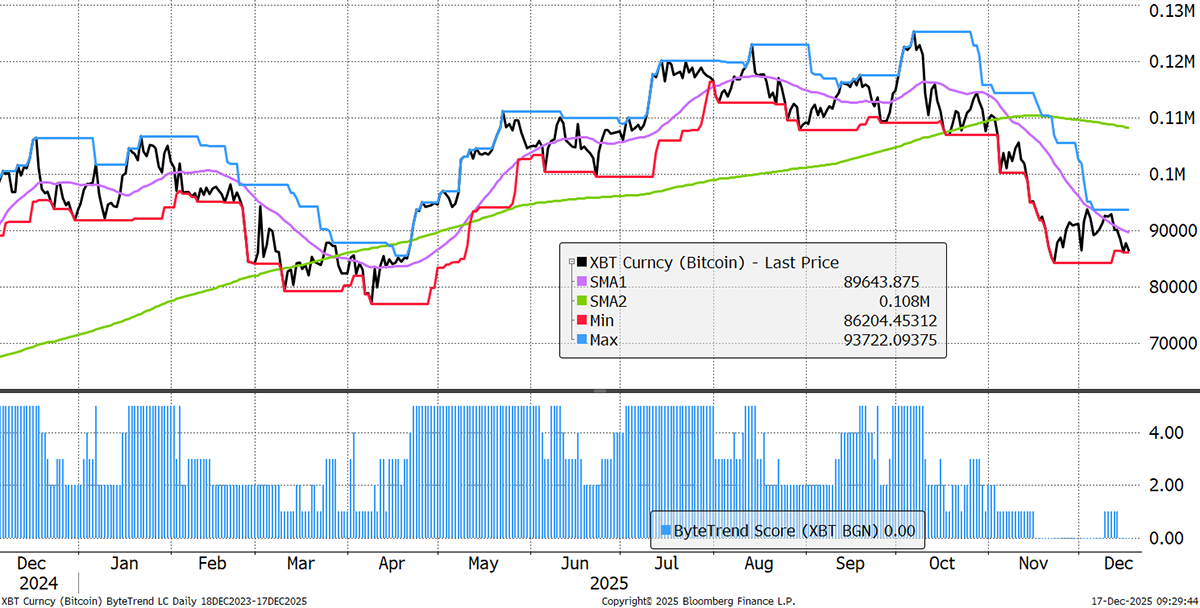

Bitcoin’s ByteTrend Score has been downgraded to a zero trend score again. The counter rally didn’t last, and it is hard to be bullish at this point, other than simply going against the crowd. That said, the recent low is above the April low, which is something.

Bitcoin

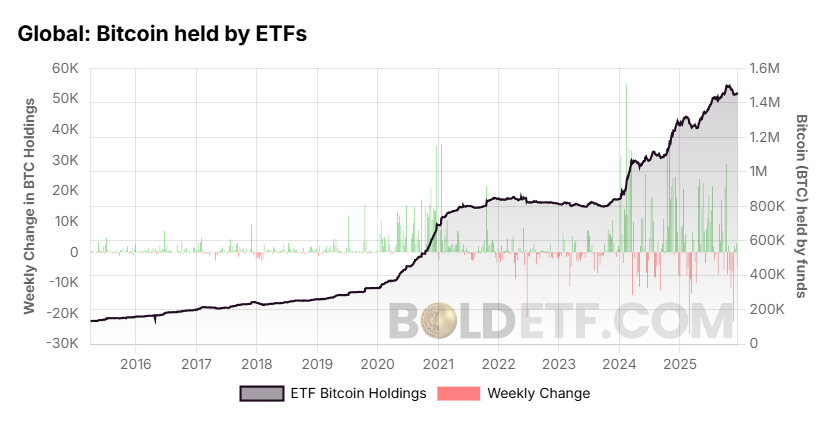

You can’t blame the ETFs for this because, since 2015 (includes Grayscale and XBT Provider), they hold 1.5 million BTC. There have been modest outflows, and that number is stable.

BTC Held by ETFs

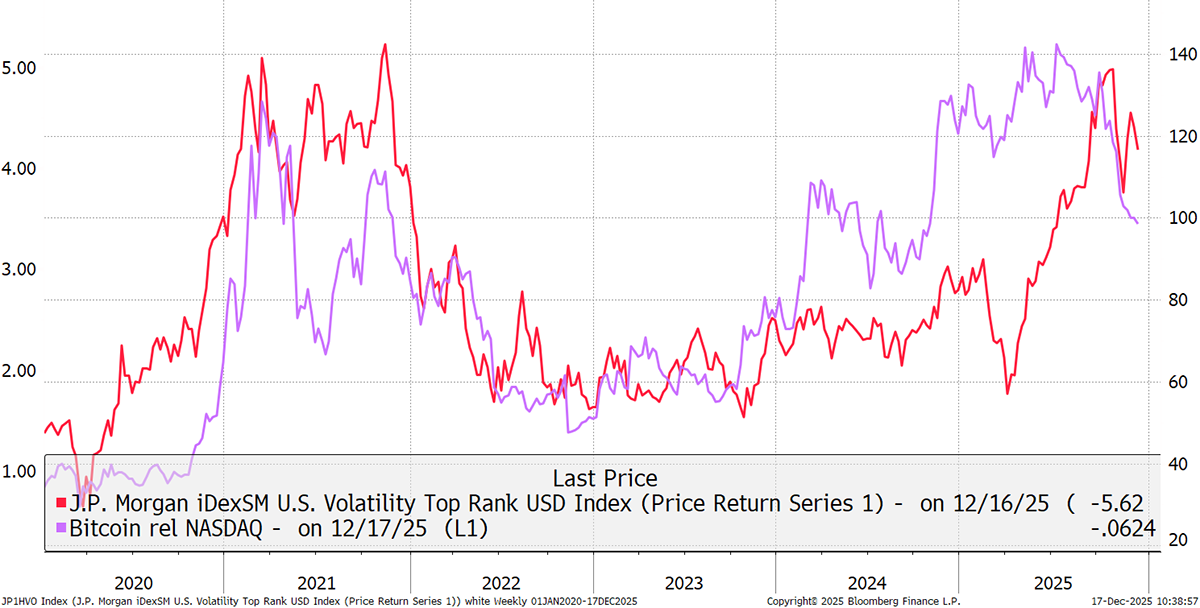

Bitcoin in Nasdaq (purple) is falling, but we saw this in 2021, during the pandemic bubble. It’s imperfect, but a significant part of Bitcoin’s current weakness stems from its linkage to risky assets.

Bitcoin in Nasdaq vs Speculative Stocks

Bitcoiners can’t ignore the bull market in precious metals, which continues to roar. Bitcoin killed investor demand for silver post the 2011 boom, leaving it in the doghouse for years. Silver is back, and since the BTC high in late 2017, it’s headed towards pari passu.

Bitcoin versus Silver

I remain bullish on silver, but it won’t go on forever. I suspect that when the rally runs out of steam, Bitcoin will step in.

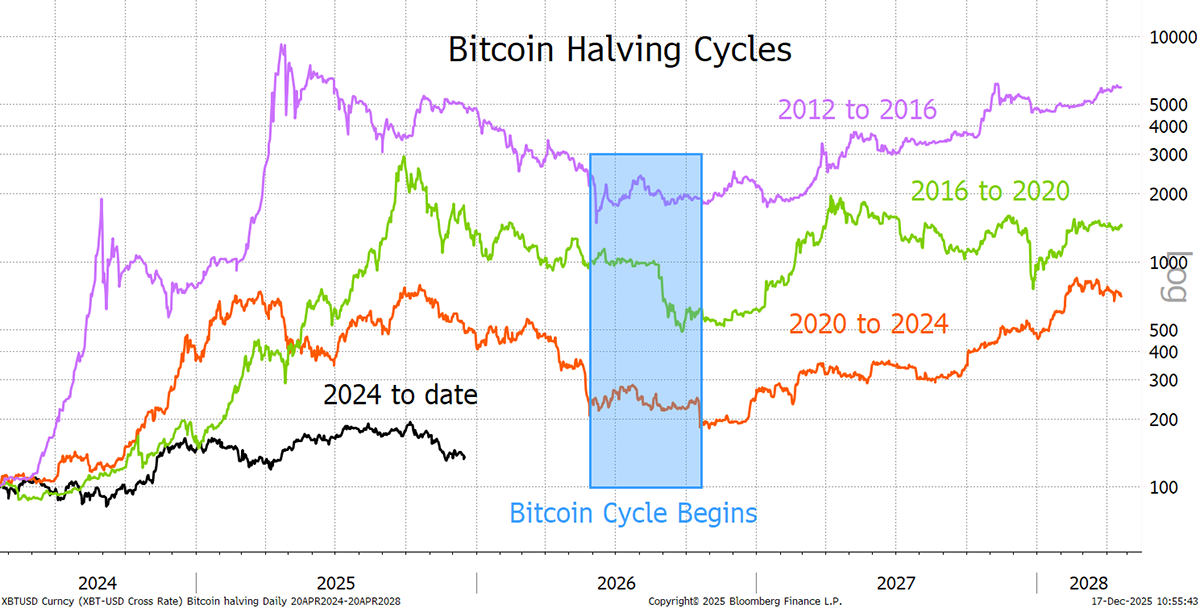

Bitcoin Halving Cycles