Back to $100K

ByteFolio Issue 183;

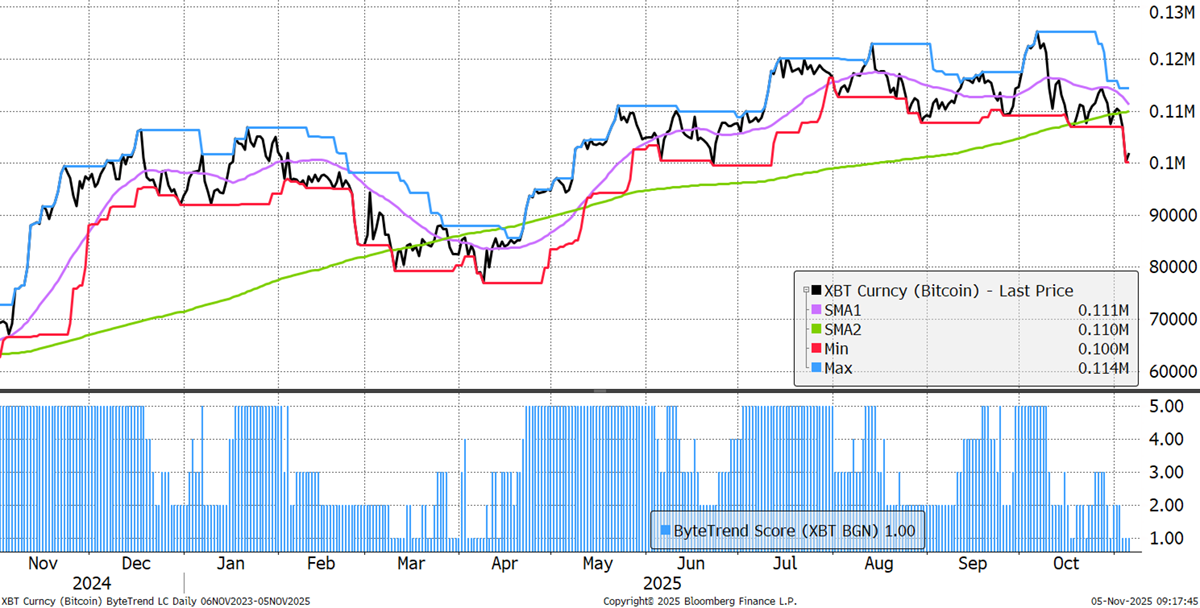

Bitcoin’s ByteTrend Score stays at 1, but the price of Bitcoin tested $100k on Tuesday. It bounced. The 200-day moving average remains upward-sloping, but the other factors incorporated in the ByteTrend indicator are now negative.

Bitcoin Bull Market

Time to roll out the major levels. $100 and $1,000 were first seen in 2013; $10,000 came in 2017; and $100,000 came in November 2024. There is no need to get too bearish on Bitcoin at this point, but a correction is underway. Perhaps $100k holds.

Bitcoin Major Levels

The past year shows the $100k level in detail. This has the potential to be a major support level, as it has been tested so many times. But bad things can happen, so we shouldn’t count on it. Should it hold, that would be deemed to be very bullish. The other point is that the price of Bitcoin will soon be flat for the year as last autumn’s rally is washed out. Bitcoin is in no way overbought and is underhyped.

Bitcoin $100K

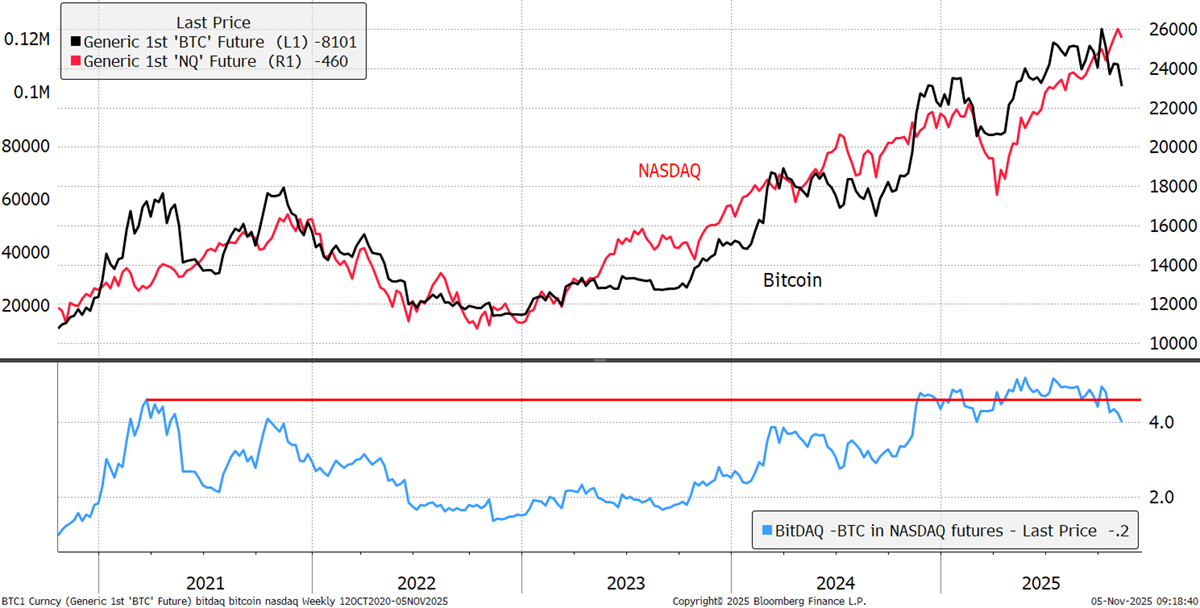

Over the years, Bitcoin has been a leading indicator of risky assets in general. It moves up and down before the technology sector. Bitcoin is likely forecasting a correction in technology stocks.

Bitcoin vs Nasdaq

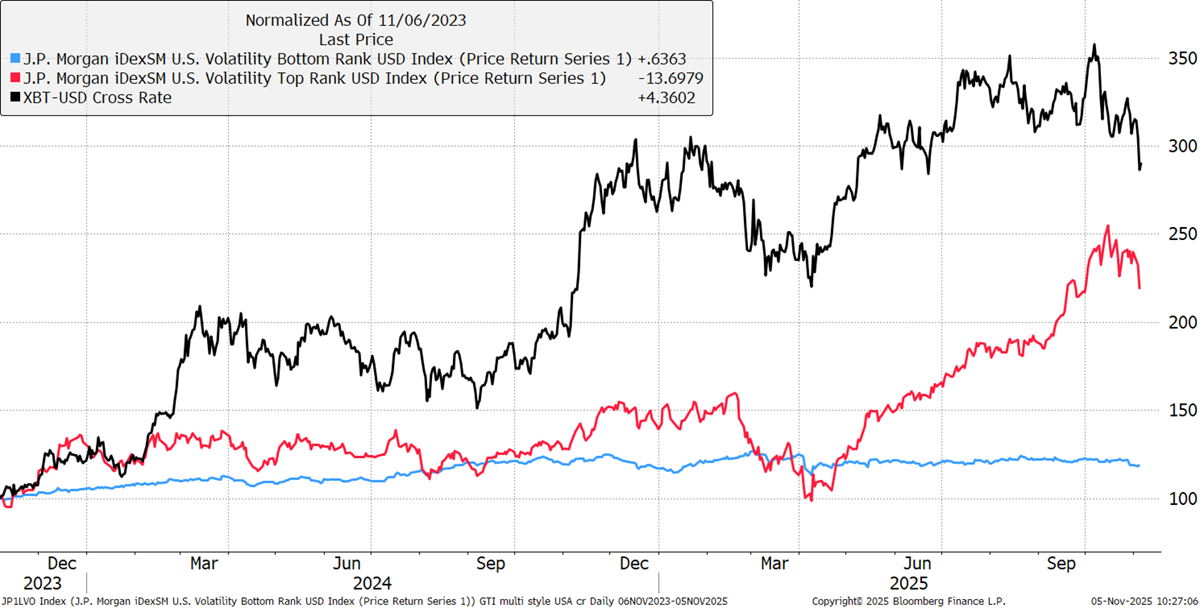

The correlation between Bitcoin and high volatility stocks is even closer than it is with big tech above. The big difference is that Bitcoin has been a better performer over time. It led the bull market in equities in 2023/4 and rolled over in February this year, ahead of the Tariff Crash in April. Bitcoin is warning investors to sell their racy AI stocks.

Bitcoin, High Volatility Stocks, and Low Volatility Stocks

No one likes a Bitcoin correction, but the positives are clear. It is a high-performance, highly liquid, alternative asset that the global institutions barely own. They’ll own it one day, and that underpins the long-term bull case.

Stay bullish.