Chainlink: The Data and Infrastructure Backbone of Web3

Token Takeaway: LINK;

Chainlink is the largest and most widely used decentralised oracle network, playing a foundational role in connecting smart contracts with real-world data. Working with leading financial institutions worldwide, Chainlink aims to become the industry-standard oracle platform that bridges traditional capital markets with decentralised finance.

While LINK, its native token, has underperformed compared to many major crypto assets over the past few years, the underlying network has steadily evolved into one of the most critical pieces of Web3 infrastructure. This Token Takeaway dives into Chainlink’s fundamentals, explores its expanding suite of services, and examines the value proposition of LINK.

Overview

Chainlink was introduced in 2017 by the blockchain startup SmartContract to address a key limitation in smart contracts. Now known as Chainlink Labs, the company was founded in 2014 by Sergey Nazarov and Steve Ellis.

Smart contracts are essentially self-executing agreements written in code that automatically execute predefined actions when certain conditions are met. However, their reliability depends on the accuracy of the data they use. In other words, smart contracts are only as good as the information they’re fed. As they operate entirely within the blockchain, they can’t directly fetch real-world information such as asset prices, interest rates, or sports scores. Therefore, to function properly in real-world scenarios, they need access to secure, trustworthy and tamper-proof data sources.

Enter Chainlink. At the time of launch, there were no reliable, decentralised solutions for bridging on-chain and off-chain worlds. Chainlink emerged as a decentralised oracle network designed to provide smart contracts with verified data from the real world in a secure, censorship-resistant way.

In September 2017, Chainlink raised $32.1m in an Initial Coin Offering (ICO) of its native LINK token. Early backers included Nirvana Capital, Limitless Crypto Investments, George Burke, and Fundamental Labs, marking the official launch of what would become one of the most important infrastructure layers in blockchain.

Today, Chainlink has grown far beyond simple data feeds. It now offers an extensive suite of products, including automation tools, cross-chain messaging, and compliance, positioning itself as a foundational oracle and infrastructure project powering the next generation of decentralised applications.

What Problem Does Chainlink Solve?

As an example, take Aave, the largest decentralised lending protocol. Aave is powered by smart contracts that enable users to borrow and lend assets in a fully automated, trustless manner. But for Aave to work, its smart contracts need accurate, real-time information such as the current market price of assets like ETH, the amount of collateral a user can borrow against, and when a loan should be automatically liquidated to prevent bad debt.

When someone deposits 10 ETH as collateral, the Aave smart contract needs to know that 10 ETH equals $38,880 at that moment, not because it “sees” the market, but because it’s fed that data from outside the blockchain.

If this data comes from a centralised or manipulable source, the entire system’s integrity collapses. If a bad actor controls the data feed, they could manipulate price information to prevent their own liquidation or exploit loans. That would completely undermine the “trustless” nature of decentralised finance (DeFi).

This is where Chainlink comes in. Chainlink provides secure, decentralised, and tamper-proof data feeds that power protocols like Aave. Instead of relying on a single source, Chainlink aggregates data from multiple high-quality providers and delivers it to smart contracts through a network of independent nodes. Effectively ensuring that the data layer of DeFi is as secure and censorship-resistant as the blockchain itself.

Chainlink Architecture

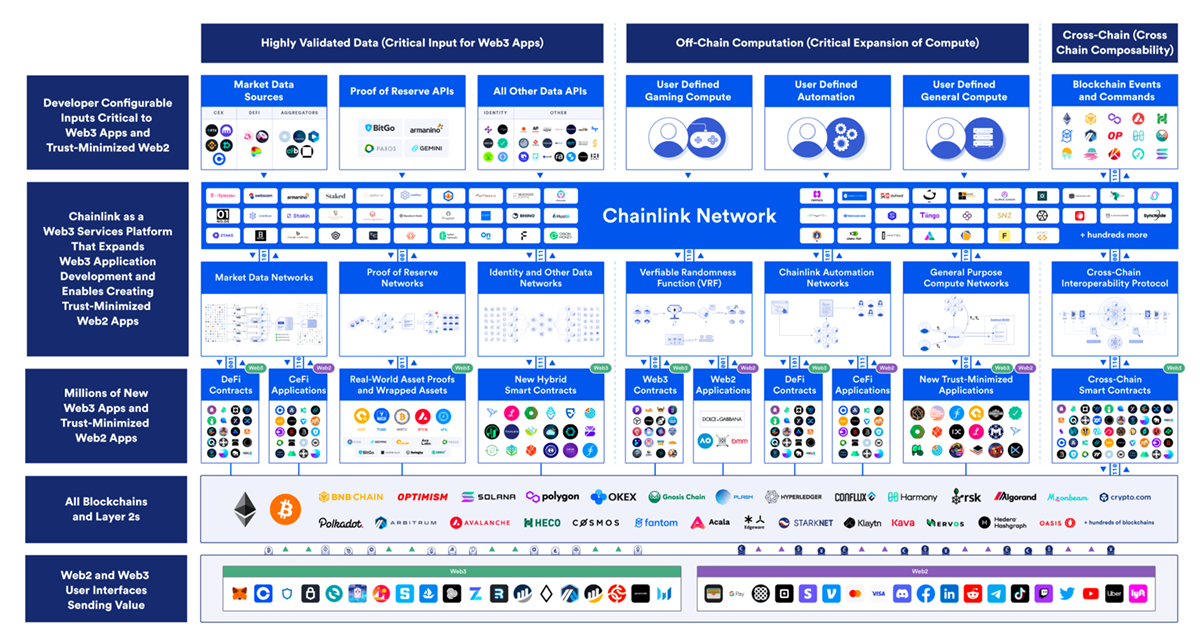

Chainlink is more than just a data feed provider; it’s a fully-fledged decentralised infrastructure network that connects the on-chain and off-chain worlds. The infographic below illustrates how Chainlink sits at the centre of a massive ecosystem spanning blockchains, decentralised applications, and traditional web services.

Chainlink Architecture

At its core, Chainlink acts as a middleware layer, bridging blockchain smart contracts with real-world data and off-chain computation. This means that any blockchain application can securely interact with external systems like APIs, traditional databases, or even other blockchains, without compromising trust or decentralisation.

Chainlink's architecture can be thought of in three layers:

- The data and computation layer (top): This includes all external sources such as market data providers, APIs, and off-chain computation services.

- The Chainlink Network (middle): Here, decentralised oracles (Nodes) fetch, verify, and deliver this data securely to smart contracts.

- The application layer (bottom): This is where DeFi protocols, CeFi platforms, gaming apps, and other smart contract systems consume Chainlink’s data and computation services to operate seamlessly.

In essence, Chainlink provides the backbone infrastructure for Web3, offering reliable data, automation, and cross-chain functionality to numerous applications across Ethereum, BNB Chain, Polygon, Solana, Avalanche, and beyond.

Chainlink Services

Chainlink Market Data Feeds

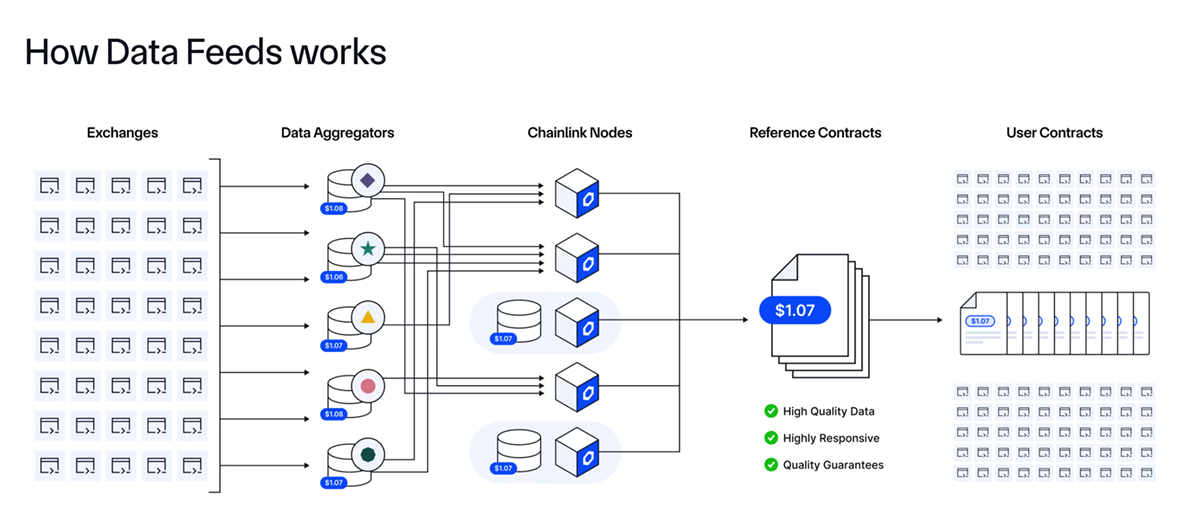

One of Chainlink’s most widely used services is its Market Data Feeds. These are decentralised price oracles that aggregate price information for assets like BTC, ETH, and stablecoins from multiple premium data providers. Each feed is powered by a network of independent nodes that pull data from different exchanges and APIs, aggregate it, and deliver a verified, tamper-proof price to the requesting smart contract.

How Does Chainlink Data Feeds Work?

This service underpins the entire DeFi ecosystem, from lending platforms like Aave and Compound to derivatives protocols like Lido and Synthetix. Without reliable price feeds, none of these applications could function in a trustless way. Chainlink’s market data networks ensure consistency, accuracy, and reliability even during periods of extreme market volatility.

Cross-Chain Interoperability Protocol (CCIP)

The Cross-Chain Interoperability Protocol (CCIP) represents Chainlink’s most ambitious step yet.