Trades in Whisky;

2025 is turning out to be a good year for investors. Well, at least it is for active investors, perhaps not so much for the index funds. I am only too aware that in some years, the index funds, that are happy to own any stock at any price, have it the other way around. This is our year, and so we must enjoy it while it lasts.

In recent weeks, I have repeated that I don’t want to change anything, because the portfolios are working well. But things are now going too well, and I feel a sense of responsibility to diversify, particularly in The Whisky Portfolio. The irony is that this is normally straightforward, because you simply take profits from large positions. But the performance has been broad based, and so few things stand out. Luckily, I have a BOLD plan, which I’ll get to, but first, an update on the Japanese election.

Japan

Japan has an election this weekend for the Upper House. That’s less than a general election, but the people are concerned. They don’t like higher inflation, which is something they are not used to. They are also concerned by the impact of tariffs. The ruling party is a loyal US supporter, but that position is getting harder to pitch. Inflation disproportionately impacts the elderly, and Japan’s demographics exacerbate that. Over 60s typically make up two thirds of the votes in an election.

Although it’s low by Western standards, immigration is also an issue. One party has a “Japan First” policy as their focus, named SanSeiTo which means Do it Yourself. Investors have long feared “Japanification” in the West, but this time, it seems to be working the other way around.

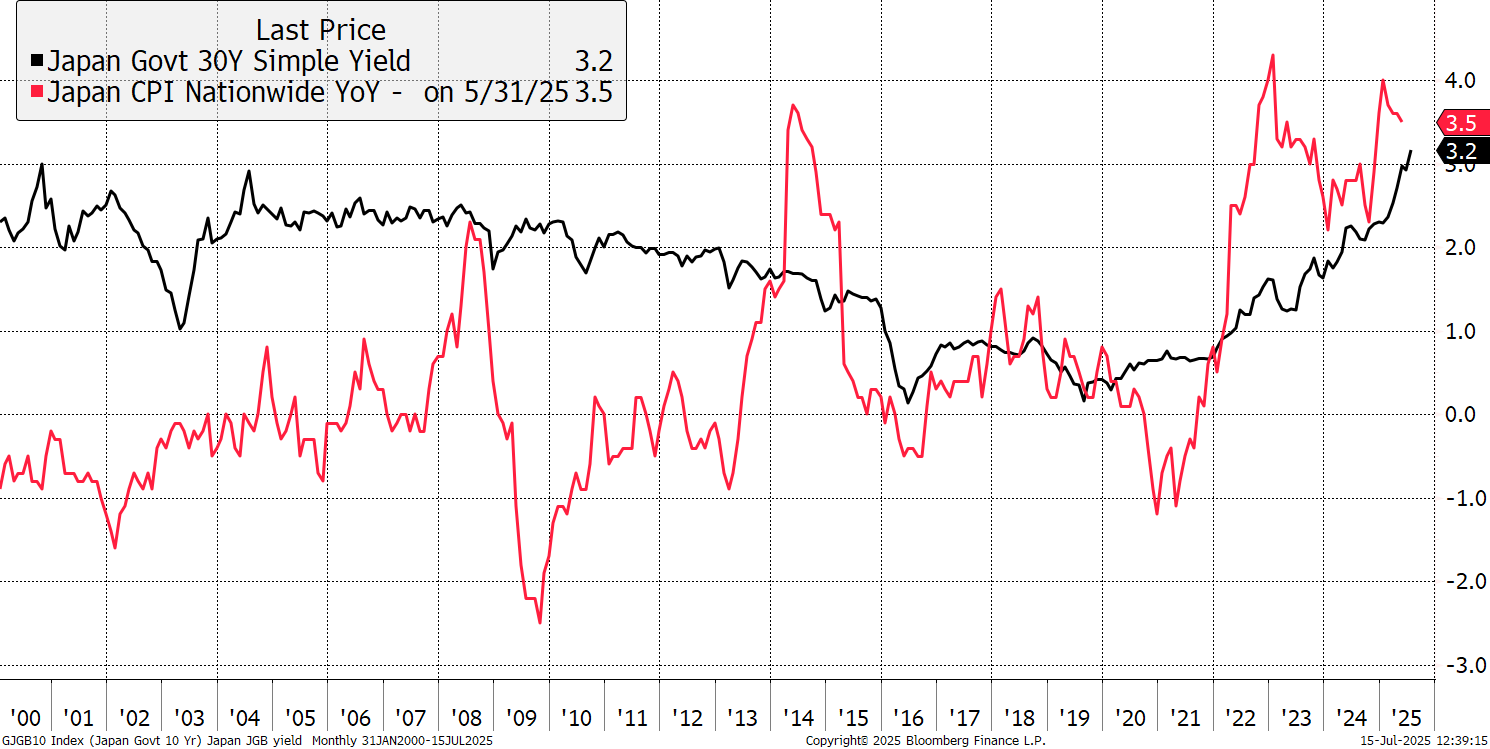

Just like we experienced in the West, rising inflation has pushed up Japanese bond yields, somewhere closer to UK and US levels. 3.2% for the 30-years is still low, but it was practically zero in 2019. Yet interest rates are still low, and will have to rise, but it seems this is unlikely to happen quickly, meaning the yen could remain soft for a while yet.

Japan Long Bond Yield and Inflation

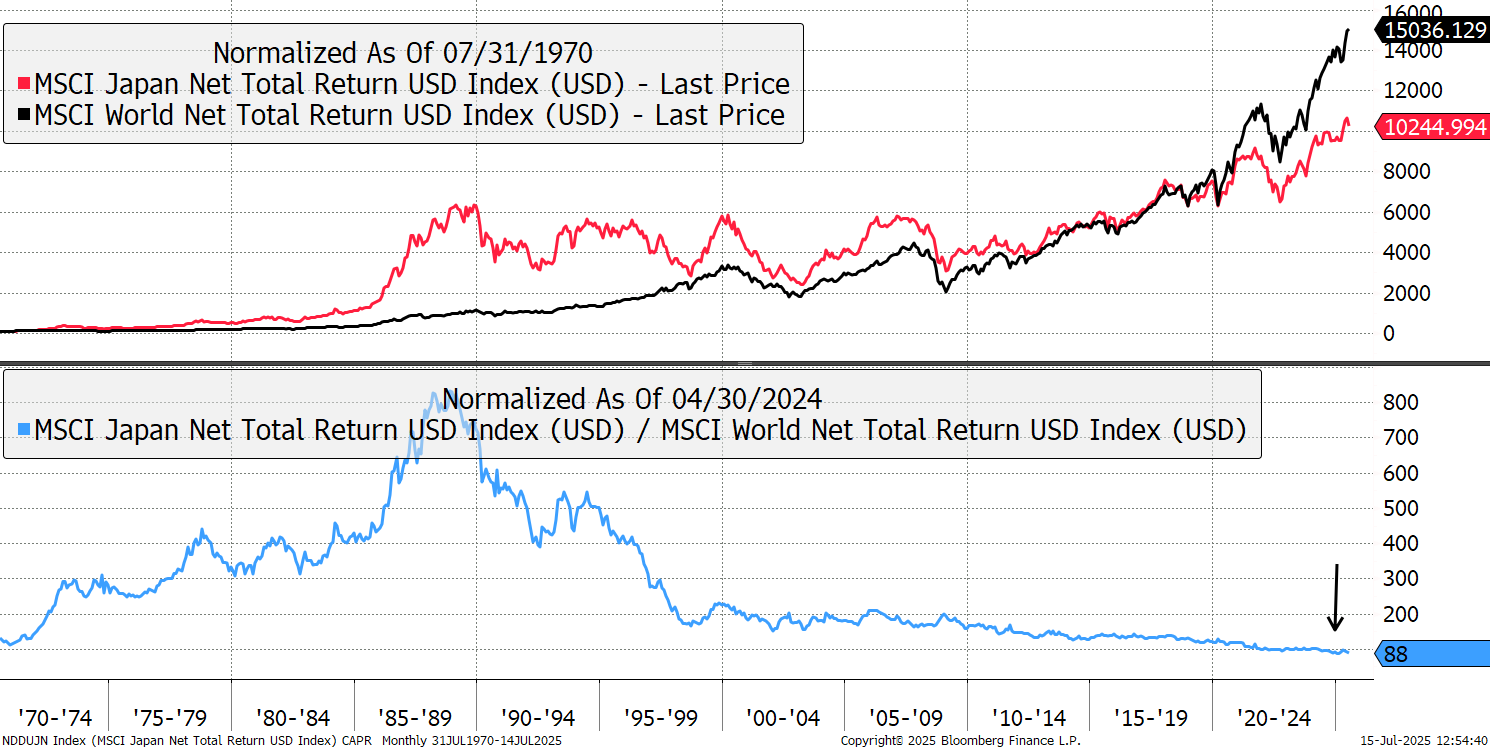

I mention this because there is a modest position in a Japanese equity ETF in the Soda Portfolio. In 2022, investors assumed that rising rates in Europe and the USA would kill the stockmarket, yet the opposite happened. Higher rates fuelled the banks, which spilled over into the rest of the market. Tariffs are a short-term issue for sure, but it’s the longer-term picture that interests me more. Japanese equities absolutely smashed it into 1988 and have lagged the world ever since. They’ll have to turn up sooner or later.

Japan Relative to the World

Having been 7 times ahead (blue line) in 1988, 55 years later they are 12% behind. They are still above their all-time low in January, and if they trade below that, then I’ll have to rethink. But so far this cycle, higher rates have done wonders for share prices, meaning some of the financial textbooks will need to be revised. The election may cause a stir, but we are all learning that change is one of the few things we can be sure of.

Crypto Week

It’s crypto week in the White House. They have proposed the CLARITY Act, i.e. the Digital Asset Market Clarity Act, which provides a legal framework for crypto. They have also proposed the GENIUS Act, i.e. the Guiding and Establishing National Innovation for US Stablecoins Act, which enables stablecoins to thrive in the USA and beyond. These new laws will put the US in a strong position to lead the crypto revolution.

Many still think crypto is an elaborate Ponzi Scheme, but it most certainly isn’t. Stablecoins will soon become a direct threat to banking as we know it. They’ll have great success in global payments, and quickly, but will take much longer to thrive in loans and deposits.

It all comes back to Bitcoin, and the price broke out to a new all-time high, touching $120,000. It’s been quite a journey from 6 cents in 2010.

Bitcoin Price

I rarely discuss Bitcoin in The Multi-Asset Investor, because I write about it every week in ByteFolio. I also write about gold in Atlas Pulse. A friendly reminder of ByteTree’s incredible FREE services. We also produce Global Trends, a quick read on Monday lunchtime, which will keep you more informed on global equity markets than the pros.

Such a large move has made the Whisky Portfolio over-exposed to Bitcoin and gold, and my simple plan is to trim them back together, and back to the BOLD target weights. The trouble is that the gold miners and silver have done well too. What to do?

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd