Equity Momentum Wanes

With bonds in crisis mode, this is a good time to revisit market momentum and look at the state of equities. This time last year, I wrote about the momentum crash, which would potentially end this bear market. We had a situation where the worst-performing stocks, the losers, were heavily oversold against the best performers, the winners.

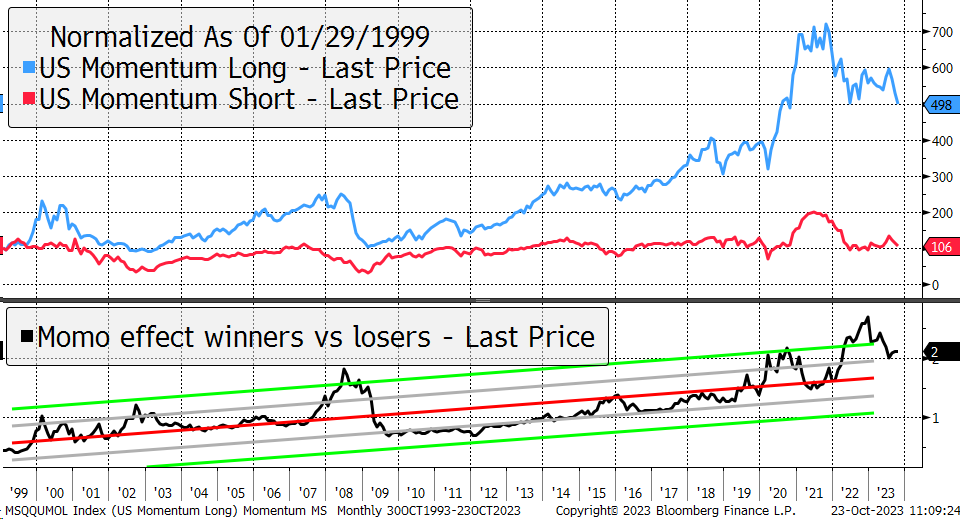

Winners and Losers

The winners are blue, and the losers are red. The back line is blue divided by red. The momentum effect (momo) was super strong after the 2020 pandemic stimulus but has reversed. The winners are now falling again. This is centred around big tech, which has proved to be a formidable force. Many of the stocks report Q3 earnings over the coming days, so it will be an interesting time, and given high expectations, it won’t be hard for them to disappoint.

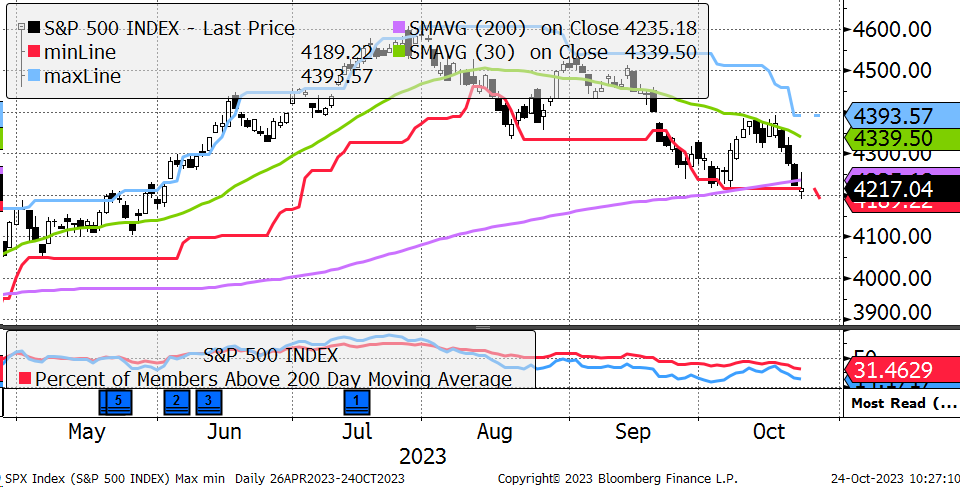

The technical picture for the S&P 500 has deteriorated. The price is below the 200-day moving average. And breadth (% of stocks trading above their 200-day moving averages) has fallen. Notably, on ByteTrend, the S&P 400 is now in a 0-star downtrend. It’s only the very biggest stocks holding it all together.

S&P 500 Fades

Upper chart, price, moving averages and max min line. Lower chart breadth.

What’s also evolved is that the defensive quality stocks, which are rate sensitive, are under pressure. I have mentioned luxury goods, but add utilities, consumer staples, and healthcare stocks to that list. Traditionally, these are safe havens but are now facing the same fate as REITS (property), which were hit hard last year.

Normally, in a crisis, we see interest rates fall. This time, rising rates are the crisis. Little wonder there is so much confusion. There was a sharp reversal last night, but that could happen if bonds were recovering or, equally, a false move if they were still falling. With deficits so large, it is hard to imagine a surge in demand for bonds.

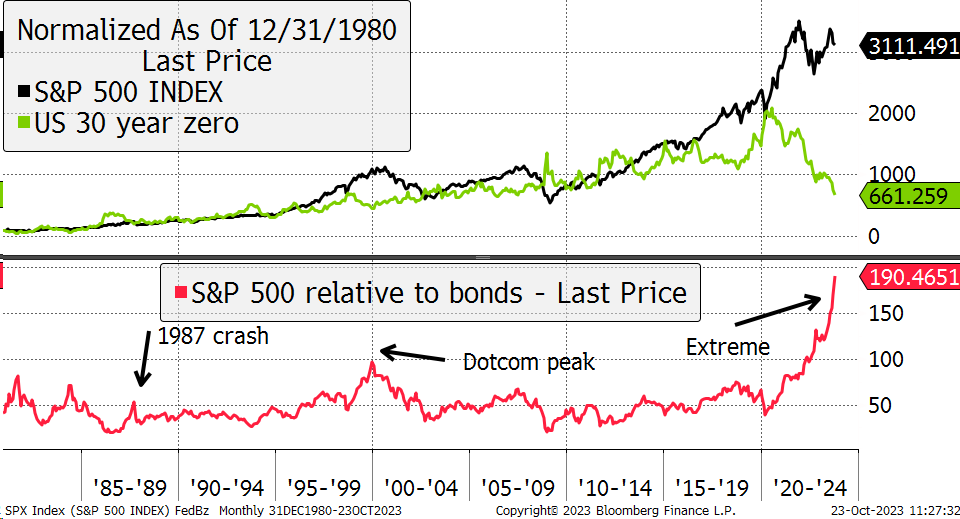

In recent sessions, the S&P 500 has made a prominent lower high, and it cannot ignore the collapse in the long end of the bond market. The stretch between bonds and equities is extreme, even more extreme than in the previous times I have highlighted this chart. It gets worse.

The Great Divergence

A bear market, and possibly a crash, is likely, but whether that is now or later is less certain. Our equity exposure is modest but not zero. I believe the things we own are cheap and have therefore already crashed. You will have also seen how quickly they can recover after a market knock. Clearly, I am on high alert to remove anything that no longer stacks up. Things change, and we must respond accordingly.

But equally, everything I have written is public information, and there are few secrets. For a crash, it seems we need even worse news than we currently have, as there are still plenty of willing buyers. That’s essential because as long as there’s a tsunami of money looking for a home, asset prices remain firm.

The current hotspot appears to be Bitcoin, and perhaps gold too, but to a lesser extent. Bitcoin surged last night, providing confidence that $30,000 is the new floor. It is defying expectations, and I suggest you read my last ATOMIC if you haven’t already. It’s an important development, and I think its role in the next cycle will defy expectations. Embrace Bitcoin.

These are uncertain times, but markets do not disappear. They evolve, and I believe we are doing the right thing. We are travelling at half speed, ready to pick up.

In Soda, I am waiting for index-linked bonds to pick up on higher inflation expectations, which I noted on Friday. And later, when the time is right, I hope to buy undervalued investment trusts, small caps and cheap regional exposure.

In Whisky, I will add to equities when risks diminish.

Action:

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd