The Everything Bear Might Be Over

Trade in the Whisky Portfolio

The much-anticipated CPI data on Thursday came in below expectations, and the market took it well. The message was that the end of rate hikes is within sight, and the stockmarket saw the third-largest momentum crash on record. This, very likely, signals a sustained about-turn for markets.

It is time to buy, and I have recently been adding to the portfolios, and I will explain why. I will also be adding the iShares MSCI Poland ETF (SPOL) to Whisky.

I want to re-examine the risk levels in the portfolios. They have been ultra-low risk this year, and recent purchases push them closer towards natural. They are still light.

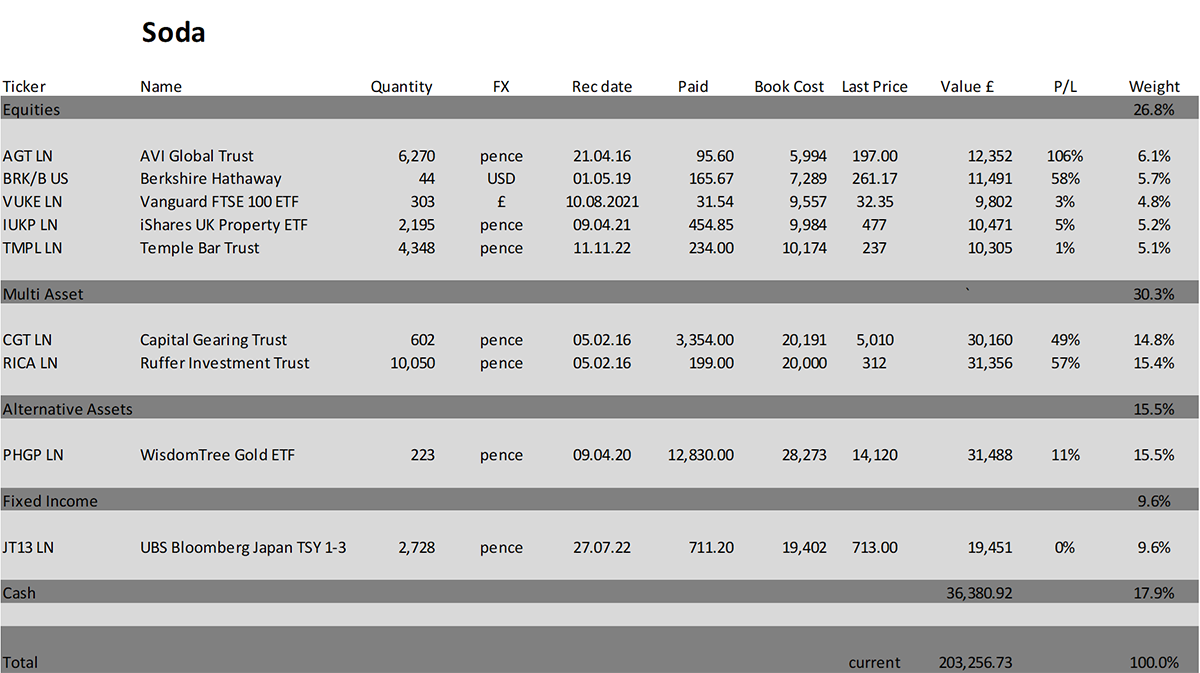

In the Soda Portfolio, direct equity exposure, including REITs, is 26.8%. Add the equity exposure held in the multi-asset funds (CGT 4% and RICA 2.1%), and our total equity exposure is 32.9%. The FTSE Private Balanced Index holds 60% in equities, which reminds us just how defensive we have been and still are. Had I not added UK REITS (IUKP) and Temple Bar (TMPL), equity exposure would be circa 22.9%, which is extremely low. This needed to be increased, and there is more to be done.

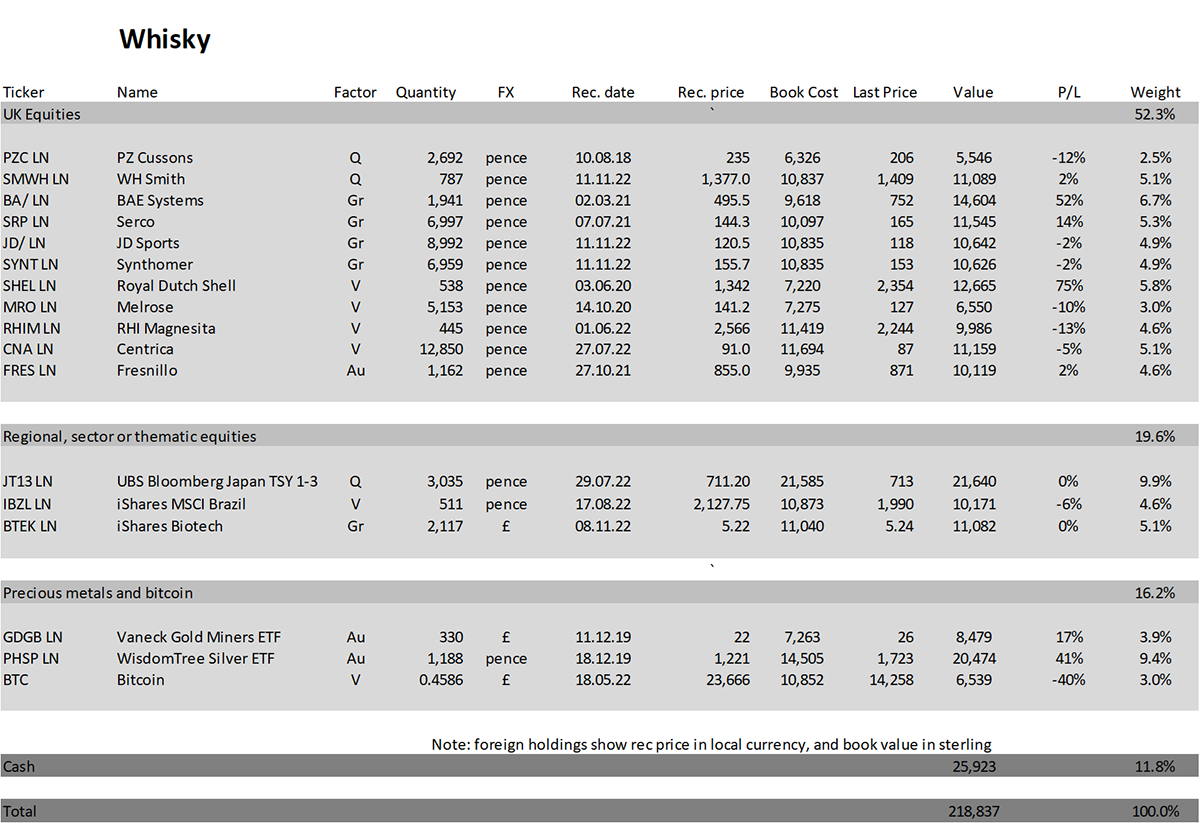

In Whisky, I have added Biotech (BTEK), JD Sports (JD), WH Smith (SMWH), and Synthomer (SYNT). This has increased equity exposure to 61.9%, with the rest in cash and alternatives. You will notice that these recent equity trades are deemed to be quality or growth. This is despite them all being, in my opinion, undervalued.

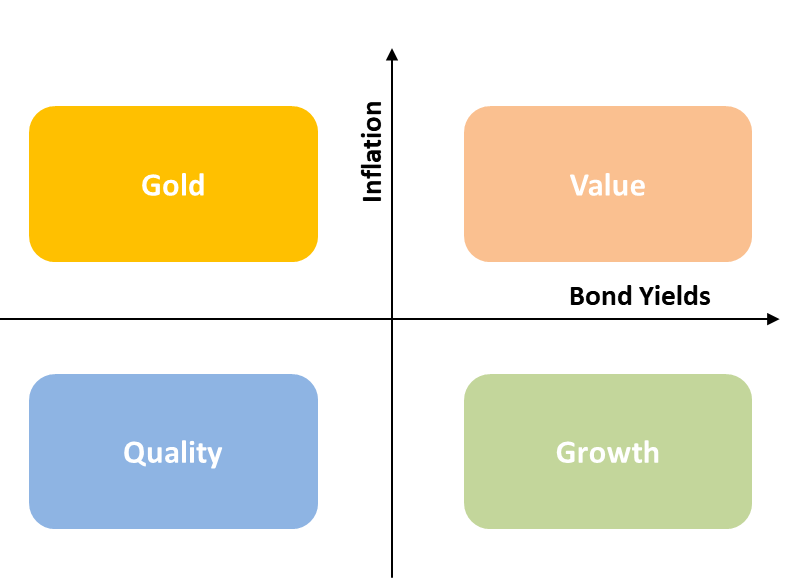

The Money Map

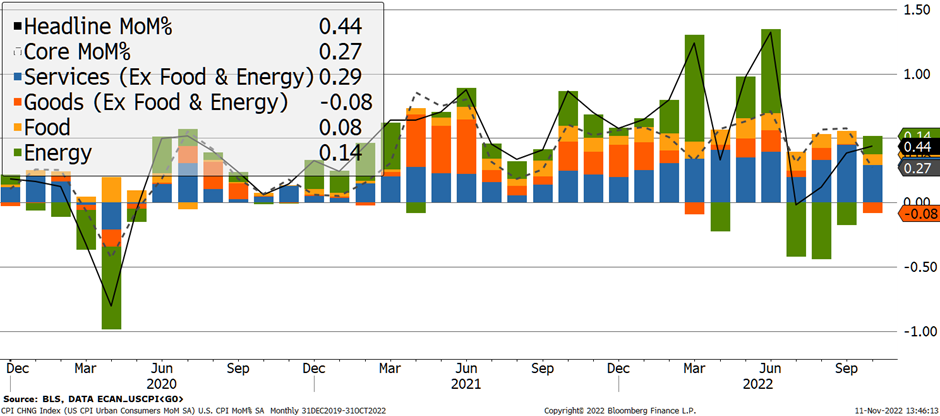

The US reported a lower CPI (inflation) of 7.7% for the year, which was 0.2% below expectations. The monthly number was a little more comforting, with headline inflation at 0.4% against the 0.6% expected. These numbers hardly tell us that inflation is behind us, but the strong market reaction demonstrates how oversold it had become. This has been a relief rally of historic proportions.

The cost of goods (orange) is probably what the market got so excited about, as the message is the Covid-related supply shock is behind us. The remaining inflation is left to food, energy, and services (wages and rents). If oil remains below $100, there will be a negligible positive contribution from energy in the inflation data by February. Wage pressures will remain, but cause for optimism may now be justified.

Inflation Cools

Source: Bloomberg

Using the Money Map, lower inflation takes us into quality and growth as opposed to value and gold.

Admittedly, commodities and precious metals rallied slightly last week, but that was mainly down the weak dollar (the pound has rallied back to pre-Truss levels). Copper and nickel led the way, and they are more closely related to the electric vehicle (growth) than heavy industry (value).

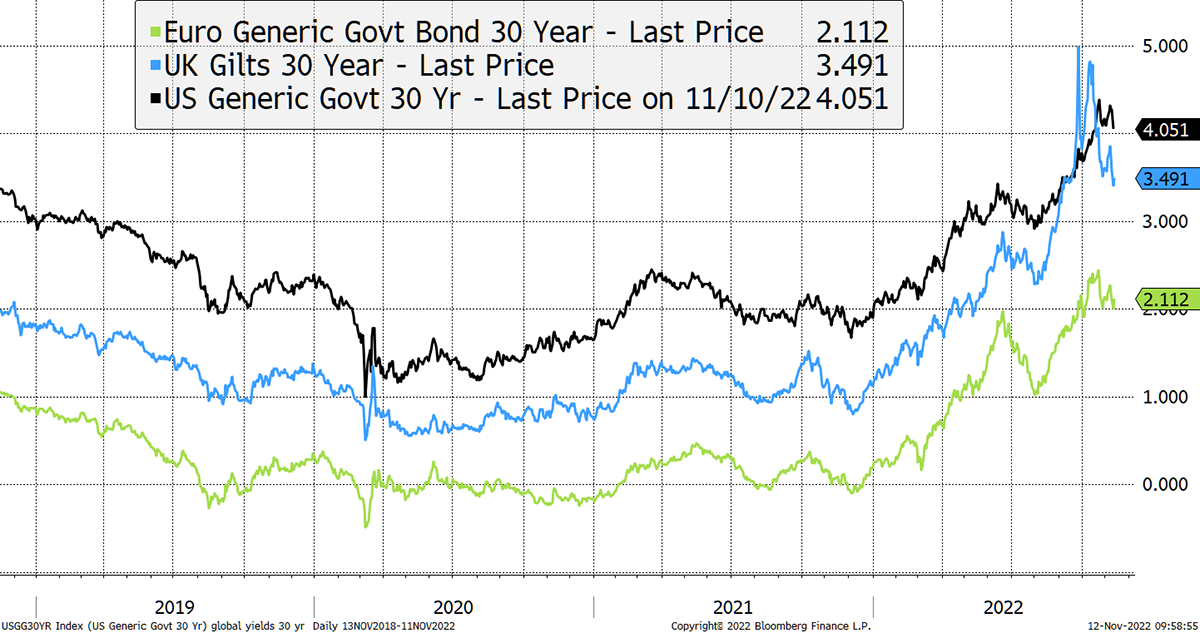

In recent years, when the stockmarket has fallen, we have come to expect lower bond yields. In 2022, equities and bonds have fallen in tandem. Bonds are normally the safe haven, but rates could no longer go lower, and that meant bonds became the problem. This means we can expect equities to rise when bonds rise (or yields fall), which is something we have to get used to.

If inflation is brought back under control, rate hikes will slow and then eventually ease. In which case, the bond bear market may be behind us. That’s perhaps jumping the gun, but it is easy to see how bonds could stabilise for weeks (probable), months (possible), or even years (perhaps), but it’s too early to say. In any event, that is what the financial market is now thinking, and it is time to buy.

Bonds Yields Fall as Inflation Undershoots Expectations

Source: Bloomberg

Lower inflation and lower yields would normally take us to quality, but the trouble is that most quality stocks are overvalued. They haven’t sold off very much and so, as a result, are unlikely to rally very much at all.

Besides, quality and gold rarely give the best returns in a risk-on environment. That’s the job of growth and value stocks.

As you know, 2022 is an unusual year, and we need to think differently. The rally will be most vibrant in the areas which have fallen substantially. In that sense, I have focused on cheap assets in general, which are essentially “fallen quality and growth”. The companies recommended generate cashflow and, without exception, are underpriced.

Momentum crash

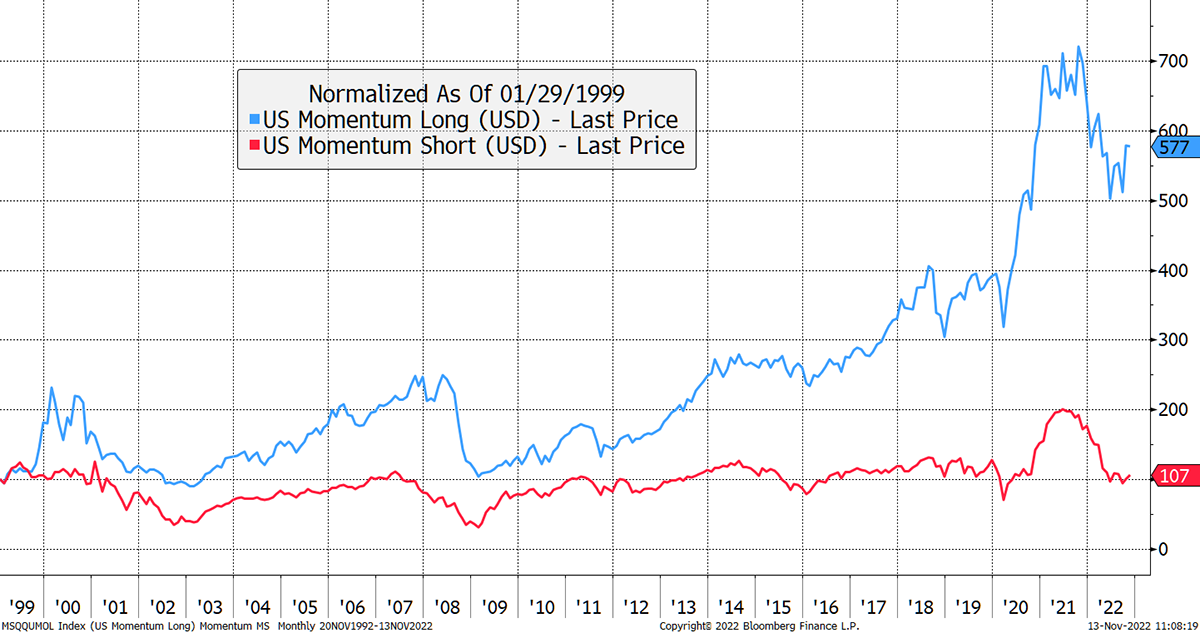

The market reaction to Thursday’s CPI data was too great to ignore, and according to my data, we just witnessed the third largest momentum (momo) crash in 22 years.

Momentum investing assumes that stocks that have outperformed in the recent past will continue to do so. This approach works until it doesn’t. A momo crash is a situation where prevailing trends make a U-turn.

From this point, the past winners stall while the past losers outperform. Momo crashes normally occur after a bear market. They either mark a tradeable rally or a new bull market. At this point, I don’t know whether this is the end of the bear market or not, just that this is a tradable rally, and the thing to do is buy.

The momo effect demonstrates the power of trends in financial markets. These indices from Morgan Stanley show how stocks with positive momentum (blue winners) do very well over time in contrast to negative momentum stocks (red losers) that don’t. The excess returns from the momo effect are staggering, but the strategy requires high turnover, guts and discipline. That is why it is best to buy a fund to pursue momo strategies.

Momo Wins by Locking onto the Winners, and Avoiding Losers

Source: Bloomberg

The iShares World Momentum ETF (IWFM) is one of my long-term favourites, but one to currently avoid. It rose 3% last week when the world index rose 7%. That 4% of underperformance is an illustration of how the winners are now struggling. It’s largest holding is Apple, with the rest of the portfolio populated by defensive sectors in 2022, such as healthcare and energy.

Last week I showed how Apple is overvalued, and it is hard to see how that works out well. Energy stocks may plod on, but the odds of them beating the market next year just dropped. I am not saying sell energy; just lower your expectations.

The winners versus losers chart highlights how momo can become dislocated. The great momo crashes occurred in 2000, 2002, 2008, 2016, 2020, and today.

Notice how momo is normally quite stable during bull markets and unstable during bear markets. The 2000 to 2003 bear market was a particularly long one, and the momo effect saw several swings. It could be that the current signal marks the end of this bear, or alternatively, it will be choppy waters for the next couple of years. In any event, we must take advantage of the signal which has sent us a powerful message.

The winners are at an extreme level versus the losers, and the turn has just begun. The strong market move late last week is the start of something big. There is so much more to this than a bear market rally.

Momo Crashes Are Powerful Reversals from Extremes

Source: Bloomberg

Consider that the stockmarket peak occurred in February 2021, which was 20 months ago. The bond market peak occurred in July 2020, which was 28 months ago. I was once told the average length of a bear market is 14 months, which means these are long periods of time. If rising rates were the problem, then knowing that it is coming to an end is very good news.

Valuations in the large defensive stocks, such as Apple, are horrendous. This will weigh on the mainstream indices, but under the surface, there is plenty of value. In Europe, for example, the Stoxx 600 Index has just 50 companies that rose in dollar terms this year, and nearly half the market is down by 30% or more.

When conditions are right, which they seem to be, all change. Never bet against a momentum crash. Last week I made four recommendations, and my reasoning is outlined below.

Temple Bar Investment Trust (TMPL) - 5% in Soda

Founded in 1926, TMPL applies a fundamental and value approach to UK equities. Given UK equities are cheaper than most other markets, I would expect UK value (which includes quality and growth stocks) to do well over the next few years. I like their portfolio and deem them to be good fund managers. TMPL trades on a modest 5% discount to the net asset value, which has been quite stable, and the fund pays a 3.6% dividend yield. I believe this will sit well within Soda.

WH Smith (SMWH) - 5% in Whisky

SMWH is well known to you all. However, it has become an increasingly international business focusing on prime sights in airports. I once paid £6 for a plastic biro at an airport WH Smith store, which explains why this company has such high margins. The best form of revenge is to buy the shares. After a slump from Covid, sales have bounced back and continue to grow. However, the shares have lagged reality. This is a great company that is undervalued and a very conservative way to gain exposure to travel. The shares yield 2.2%, but I expect this to increase as the Covid travel shock dissipates and SMWH increases their payout.

JD Sports (JD) - 5% in Whisky

JD is well known on our high streets but has grown into a global sports business. They sell the cool kit that the kids want and do so with surprisingly high margins. The company is still growing but has seen the shares more than halve in price over the past year. It trades below 10 earnings, which is compelling for such a well-run business, with high returns on capital. The shares are heavily oversold, and that is the opportunity. The shares trade on 9x expected earnings, which is low compared to the past.

Synthomer (SYNT) - 5% in Whisky

SYNT is a chemicals company specialising in “high-performance, differentiated and highly specialised products that are applied in key industries such as adhesives, coatings, construction and health and protection.” The shares have collapsed this year as the global slowdown hurt demand for chemicals, along with high input costs. The fear was their debt was too high and that the company might need to have a rights issue.

However, management have stated that they will exit some non-core businesses where they do not have a dominant market share, which will bring debt levels back under control. The market now deems the company’s outlook to have improved. The debt ratings agencies deem the company to be stable, and Kuala Lumpur Kepong BHD has signalled a desire to increase its stake beyond the current 26%. I see this as an exciting turnaround and a deep-value opportunity. It trades on 5x expected earnings.

Risk

I deem SMWH and JD to be medium to high risk. They are cash-generative companies that are very liquid (easy to trade). SYNT is also medium to high risk, but slightly less liquid than the other two. TMPL is a diversified investment trust and is medium risk.

Finally, there is one more trade that I would like to recommend.

Buying 5% iShares MSCI Poland (SPOL) in Whisky

Poland neighbours Ukraine, which explains the stockmarket’s derating over the past year. Ukraine is a cause for concern, but Poland is a member of NATO and the European Union, and fears over their security are overdone.

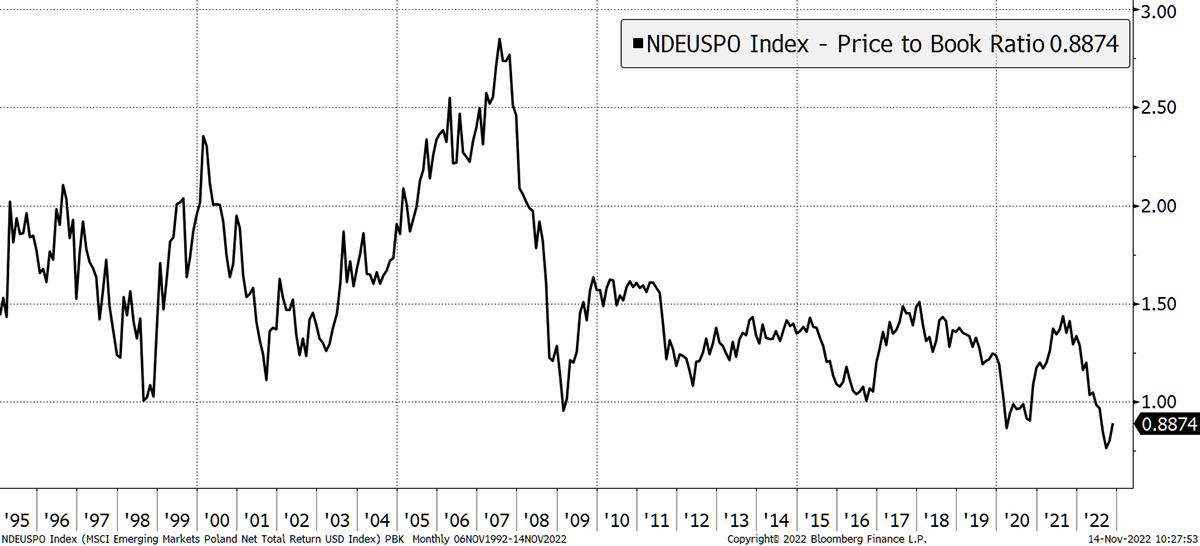

With 27 years of trading data, the MSCI Poland Index has dropped below book value. This is lower than the emerging market crisis of 1998, the credit crisis of 2008 and the Covid crash in 2020. Poland’s stockmarket is dirt cheap.

MSCI Poland Is Cheaper than Ever

Source: Bloomberg

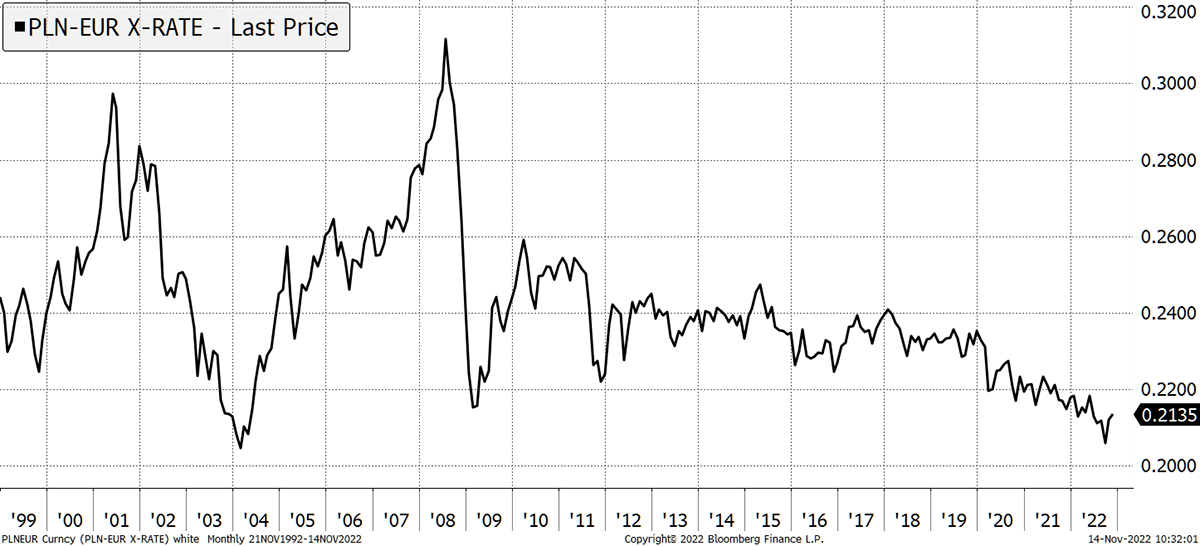

The currency is also cheap. The Zloty has lagged the euro (and the pound) since 2018 and appears to be turning up.

Cheap market with a Cheap Currency

Source: Bloomberg

SPOL holds 15 holdings, making it quite concentrated for a country fund.

It is quoted in sterling and does not pay a yield, but you receive the dividends as capital. Financials makes up 36% of the index and energy 20%.

I highlight the largest holding, Polski Koncern Naftowy (PKN), an oil refinery and distribution business. It trades on 2.5x expected earnings, 0.4x book and pays a 5.5% dividend yield with good credit. It is an example of the compelling value that is currently on offer.

Risk

The Polish economy has unsurprisingly come under pressure, but that is why the market is so cheap. SPOL is concentrated for a country fund, but given it holds 15 companies, this is less risky than a single typical large cap single stock. On the basis that the FTSE 100 would be medium risk, I believe SPOL is medium to high risk.

Action: Buy 5% iShares MSCI Poland ETF (SPOL) in (Whisky)

Postbox

Thanks for the timely market update Friday, which did catch me by surprise. I have seen a number of investors give reference to this rally we are witnessing as being a bear market rally. Stating that bear market bottoms do not occur with an inverted yield curve, nor do they occur with the FED still hiking, as is the case for now. Do you see this rally as a tradable end of year bear market rally? Or are we looking more at an investment and a longer time horizon with the stock market forward looking through this recession towards a new business cycle. I recognise, when the facts change (Fed talking of slowing down, CPI lower, China edging towards re-opening), then it is prudent to react. So please can you enlighten me on why your opinion has shifted as such, thanks. What does the coppock curve look like? I think I need more convincing to follow through on these latest ideas.

I hope the momentum crash thesis helps. This is not a normal bear rally but a rally combined with massive internal market rotation, a changing view on rates and a plunging dollar. I have never seen a major reversal forecast by the media or a professional consensus, and I never will. It is impossible because things change at the point of maximum despair. I may be wrong, but not because there are doubters out there. That, if anything, only strengthens the case.

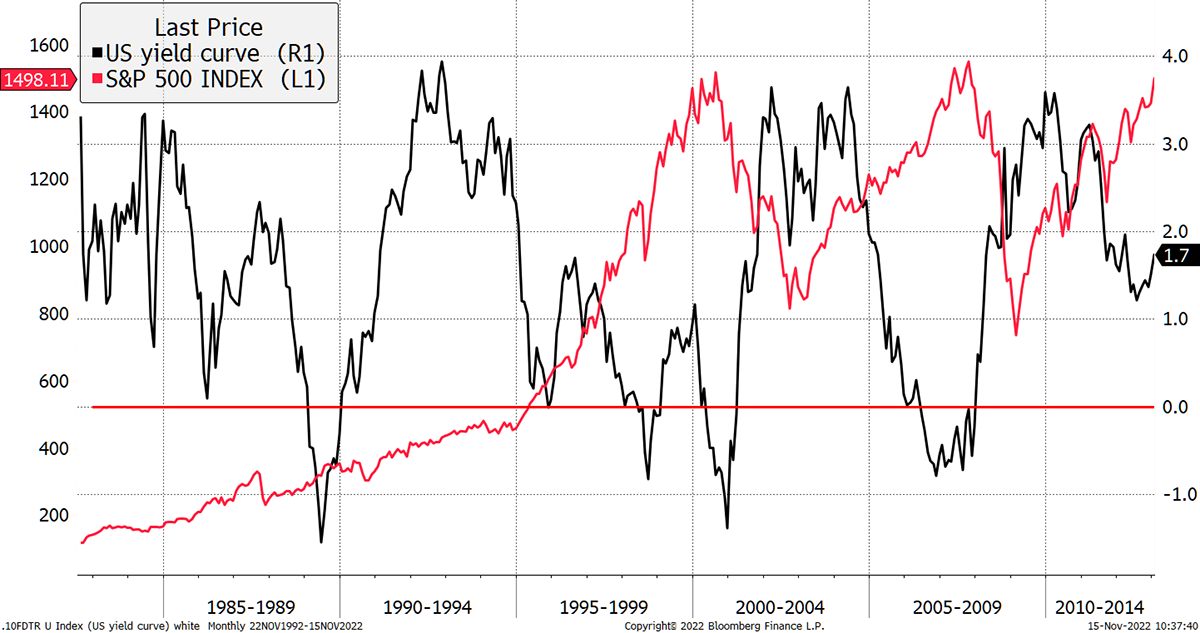

The yield curve is an interesting point as we rarely see an inverted yield curve (long rates below short rates) trigger a rally. But we have done in the past. Sadly, you have to dip into the 20th century, which many don’t do these days. 1998 was a good example, as rates were cut at the time of the Long Term Capital Management (LTCM) crisis. Thereafter, the market surged from an inverted yield curve.

Then in 1995, the yield curve was briefly flat, which led to the greatest advance of US equities throughout the era Greenspan described as irrational exuberance.

Equities and the Yield Curve

Source: Bloomberg

I once recall David Harding, one of the UK’s most successful quant hedge fund managers (Winton), telling me that their research across many different markets showed how the yield curve has no predictive power on equity returns at all. But it is useful for making economic forecasts which is a different thing. I am not forecasting an economic upturn but a stockmarket upturn. Economics is the present; markets are looking ahead.

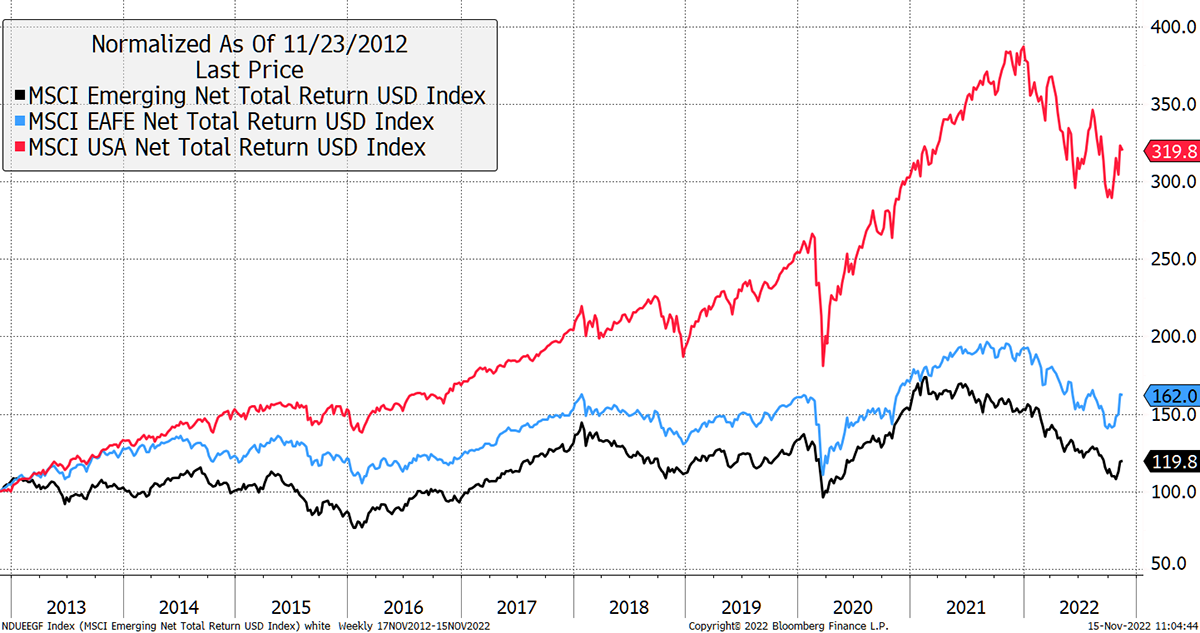

I am unsure whether this is a tradeable rally or a change in trend. The former feels right when talking about US equities, but when I look at emerging markets, or Europe Asia and Middle East (EAFE), valuations are attractive. Could it be that the US struggles while the world excluding US delivers higher returns? I have a high conviction that active managers who do their job properly will be able to beat the market while taking less risk.

No Bubble in EAFE or Emerging Markets

Source: Bloomberg

Coppock is a great indicator for part-time investors. I wrote about that a few weeks ago as a farewell piece to Southbank readers to leave them with a simple plan for the future (my departure will finally be announced next Tuesday). The Coppock Indicator has not spoken on US equities and will take time to turn, but it has given buys on Brazil and Indonesia.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 5.1% this year and up 103.3% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.8% this year and up 118.8% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

It was wonderful to hear the news that Biden and Xi had agreed nuclear war is a bad idea and that they won’t invade Taiwan anytime soon. Then Buffett sneakily bought a major stake in Taiwan Semiconductor. It is always nice to be in good company with Buffett, and he has a successful record of buying the market when it is cheap. It also signals a shift for Asia, and perhaps Xi wants to embrace capitalism after all.

Add Asia? It looks like I have some work to do.

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd