Bitcoin and Gold Take the Stage

Disclaimer: Your capital is at risk. This is not investment advice.

I’ll be writing more about ByteTree’s Bitcoin and Gold Index (BOLD) next week for the end-of-month rebalancing report. Last month, the BOLD Index was rebalanced to Bitcoin’s highest-ever target weight of 25.5%, with Gold down to 74.5%. Following a great run for both assets, especially Bitcoin, the weight has risen to 29.1% Bitcoin at last night’s close. This is BOLD in action because next Tuesday, the BOLD Index will move back towards the target weights, taking some profit in Bitcoin, and adding some Gold, in the process. This is Bitcoin and Gold accumulation in action.

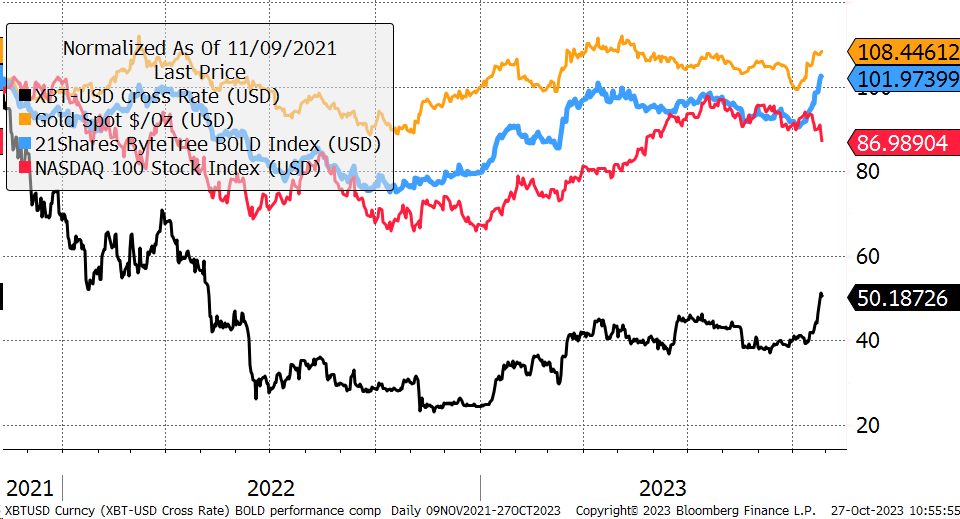

The chart starts at Bitcoin’s all-time high on 9 November 2021. Since then, Gold is up 8.5%, and Bitcoin is down 49.8%. Yet BOLD is up 2% despite having an average exposure to Bitcoin of circa 23% over the period. If you ever doubted the power of rebalancing uncorrelated assets, here it is. Without rebalancing, Bitcoin and Gold investors would be down around 5.5%, making BOLD 7.5% better over this period.

BOLD Up, NASDAQ Down

I will go into more detail next week but think of rebalancing as a long-term asset accumulation strategy, where you end up with more of both assets.

Moreover, few seem to notice that BOLD is ahead of the NASDAQ 100 Index. And over the past week, BOLD has spiked while the big tech dominated NASDAQ has slumped. Big tech is expensive, and following underwhelming results this week, the sector no longer grows fast enough to justify premium prices. Besides, much of the “growth” is a result of cost cuts. Admittedly, they had plenty of room to reduce costs, but real growth comes from sales rather than costs. It’s the end of an era, and tech investors should jump ship.

I gave a talk on Bitcoin and Gold in London two weeks ago, which you can watch here.

A Week at ByteTree

The legends Robin Griffiths and Rashpal Sohan were back for their regular end-of-month dose of gloom in the AAA Report.

Robin wrote, “When the experts try to form scenarios… the outcome is inevitably a higher price for oil, more inflation, and lower economic growth.”

Remarkably, US growth remains explosive, fueled by the largest government deficit in living memory. Rashpal surpassed himself when he said, “if there’s one asset you want to own in the current market environment, it’s gold”. I agree.

In the Multi-Asset Investor, I did an update on market momentum, reiterating we still have to wait. But that doesn’t mean we can take a nap because things are changing, and they’ll start printing money again soon. Be ready.

More importantly, I keep coming back to the merits of index-linked bonds, which are an alternative to gold. They are compelling, and there are few asset classes in the world better prepared for the coming environment. Think of them as Bitcoin and Gold in a suit.

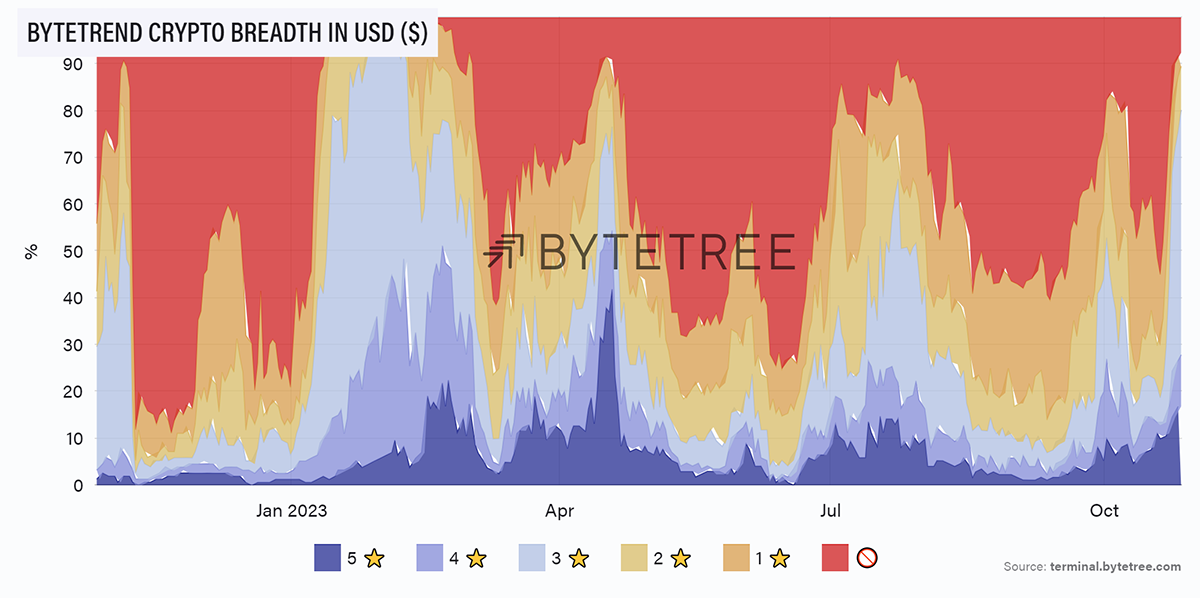

Meanwhile, in crypto, Uptober is certainly living up to its name. Bitcoin’s bullish momentum has spread to the altcoins, with 16.9% of crypto tokens on ByteTrend scoring 5-star bullish trends (dark blue) against USD, while a mere 7.6% of tokens are on bearish 0-star trends (red).

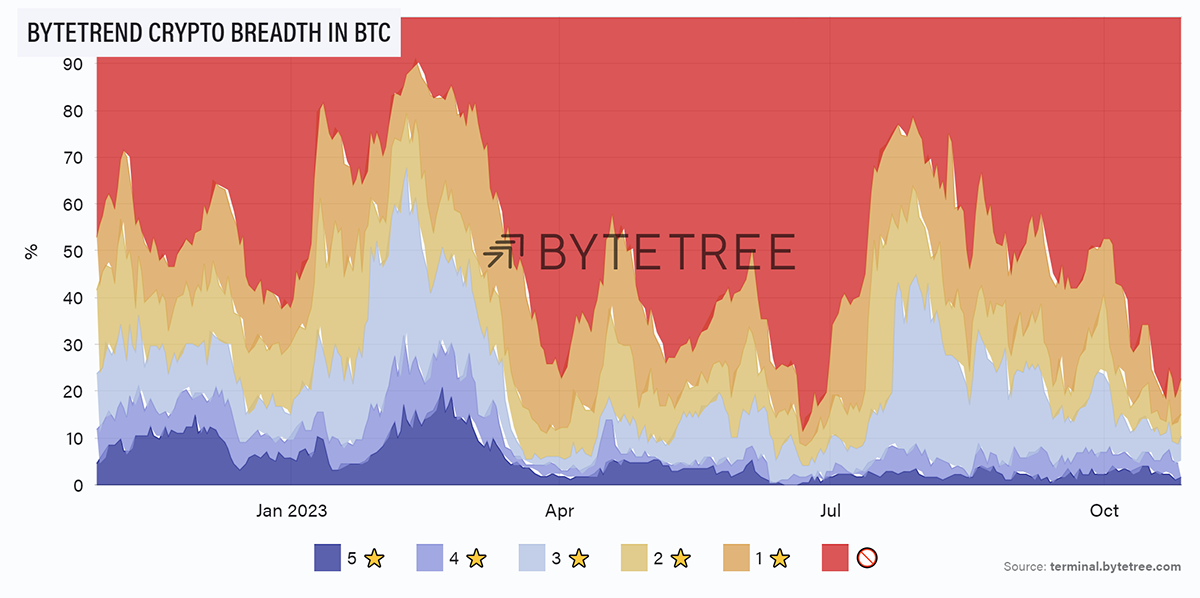

However, Bitcoin is undeniably strong, with only 1.8% of crypto tokens on ByteTrend currently outperforming it. If you haven’t already, make sure to follow ByteTrend Crypto on Twitter for daily score updates.

ByteFolio covered this topic in more detail this week and also highlighted some recent news in the altcoin space.

This week also saw a new update from Token Takeaway, where Ali looked at The Open Network (TON) and its native token Toncoin. TON, originally developed by the messaging app Telegram, has frequented the news in the past few months after its growth in marketcap propelled it to 11th place in the overall crypto market. This puts it ahead of well-known protocols like Polygon and Chainlink, but is the ranking well-earned?

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()