Gold, Yen and Finding the Recession

Disclaimer: Your capital is at risk. This is not investment advice.

Finally, we see the beginning of the long-anticipated monetary normalisation in Japan. This is the only country in the world to still have negative interest rates, which is odd given inflation has been rising, albeit modestly to Western Economies. This ultra-loose policy has seen bond yields remain close to zero while the yen has slumped.

The Bank of Japan kept its target rate for the 10-year bond at 0% but stated the upper limit of 0.5% was now a reference point rather than a ceiling. It will still be buying government bonds each day, which is good to know. At least someone is still unapologetically printing money with style!

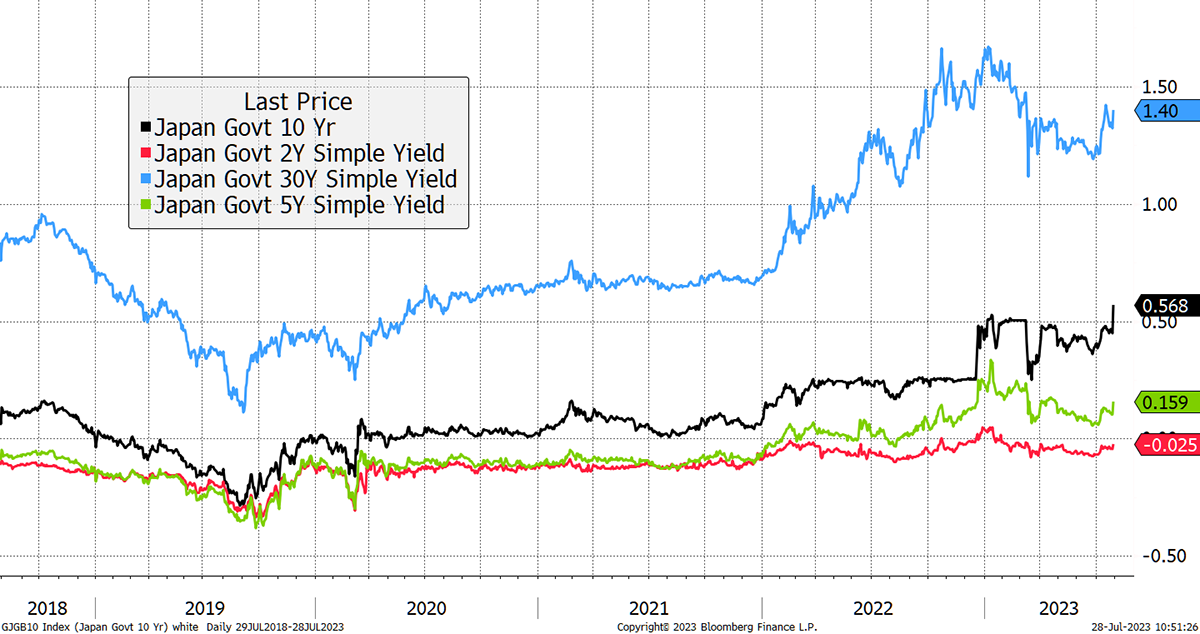

I’ll fly through some key charts. The first shows how the 30-year Japanese Government Bond (JGB) yield is somewhat free in comparison to the shorter-dated bonds. The 2-year has a negative yield, the 5-year 0.15%, and as of the announcement, the 10-year rose above 0.5% for the first time since 2014.

Japanese Bond Yields Jump

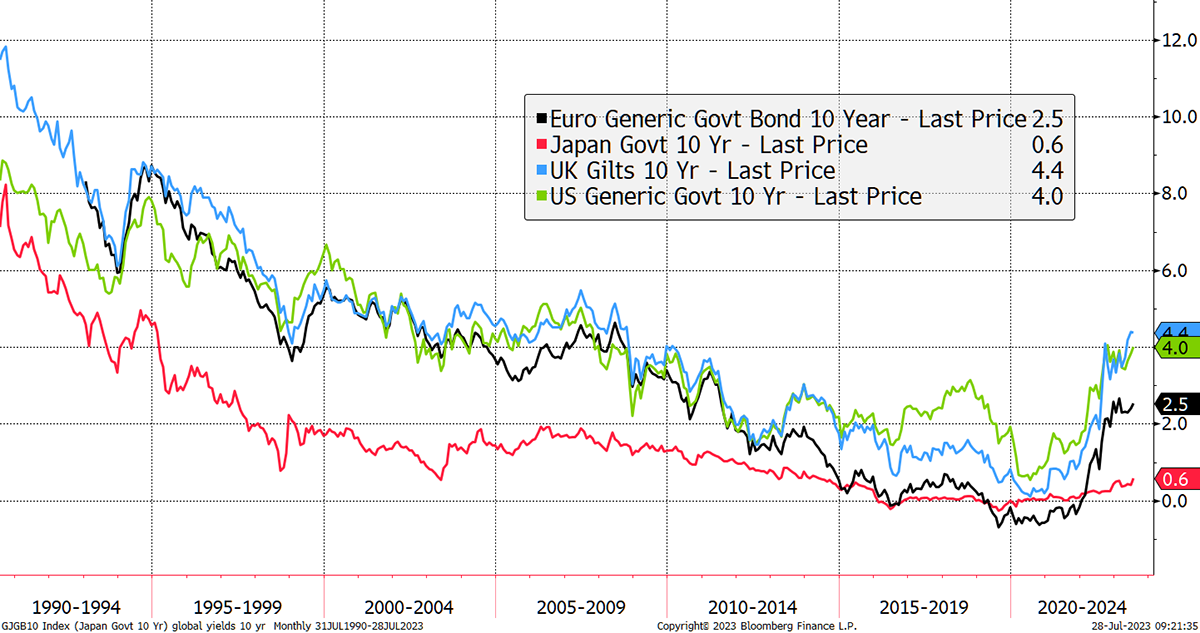

How does 0.56% compare with the rest of the world? Back in the day, JGBs traded in the pack with Europe and the US. They went much lower as inflation persistently undershot, periodically going negative as the economy was deleveraging following the 1990 bubble. That was one of the greatest bubbles of all time. There is a long way for JGB yields to go before they catch up with the rest.

Global 10-Year Yields

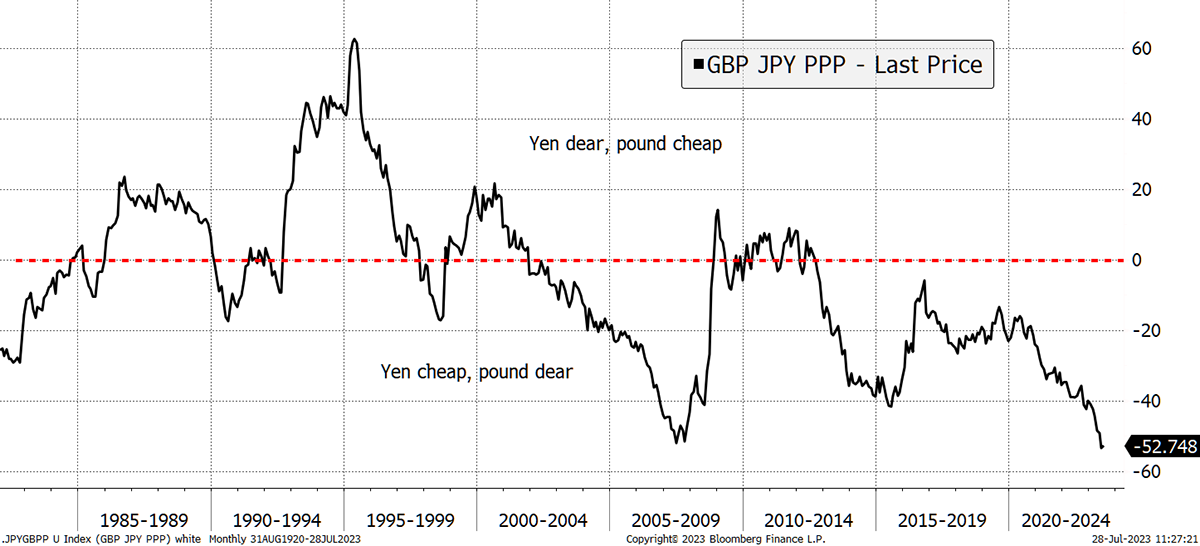

This ultra-loose policy encourages foreigners to borrow in a “carry trade”. The loans are made in their billions of yen as investors help themselves to the free money and put it to work elsewhere. That has pushed back down the yen to the cheapest levels seen in half a century, with echoes of 2007.

Yen Purchasing Power Parity

The pressures build up, and when the system hits a breaking point, as it did in 2008, the yen can appreciate suddenly, just as the financial system is imploding. This makes the yen a fabulous source of portfolio protection, something I discussed with the managers of both the Capital Gearing Investment Trust (CGT) and the Ruffer Investment Company (RICA), which you can view on our YouTube Channel.

So far, CGT is winning with 1,100 views against RICA’s 543. Admittedly CGT had a 7-day head start, but we should be placing bets on this. I see this as a fierce competition.

Both funds hold Yen, as does the Multi-Asset Investor. It hasn’t worked, at least not yet, but the BOJ announcement may well be the start of a very profitable trend. The important point is that, with bonds still a source of uncertainty, there are very few portfolio diversification trades, or hedges, out there. That’s why the yen is so attractive to investors concerned about risk. What makes this even more compelling is that the speculative positions are heavily net short. Those concerned that the equity bull market is built on sand should consider holding yen.

I also wrote about Gold in Atlas Pulse issue 84. I continue to question and find justification why gold trades close to $2,000 against my fair value closer to $1,400. With interest rates rising and inflation seemingly easing, there ought to be natural downward pressure on gold, but there isn’t. It must surely be linked to the lack of safe havens in a world that has lost trust in its bond markets.

In the Adaptive Asset Allocation Report, the legendary Robin Griffiths, with his sidekick Rashpal, were still searching for the recession, which I gather is the most anticipated recession in history. Yet Jay Powell from the Fed is no longer forecasting one. That means it’s definitely coming.

Finally, don’t forget the ByteTree Crypto Average (BCA), a powerful little indicator for the next alt season.

I will be away next week but will be back on Monday, 7 August. ByteFolio will be published on Monday as normal. The Multi-Asset Investor may manage a paragraph or two on Tuesday but forgive me if I bow out.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()