Waiting for BCA

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio 67;

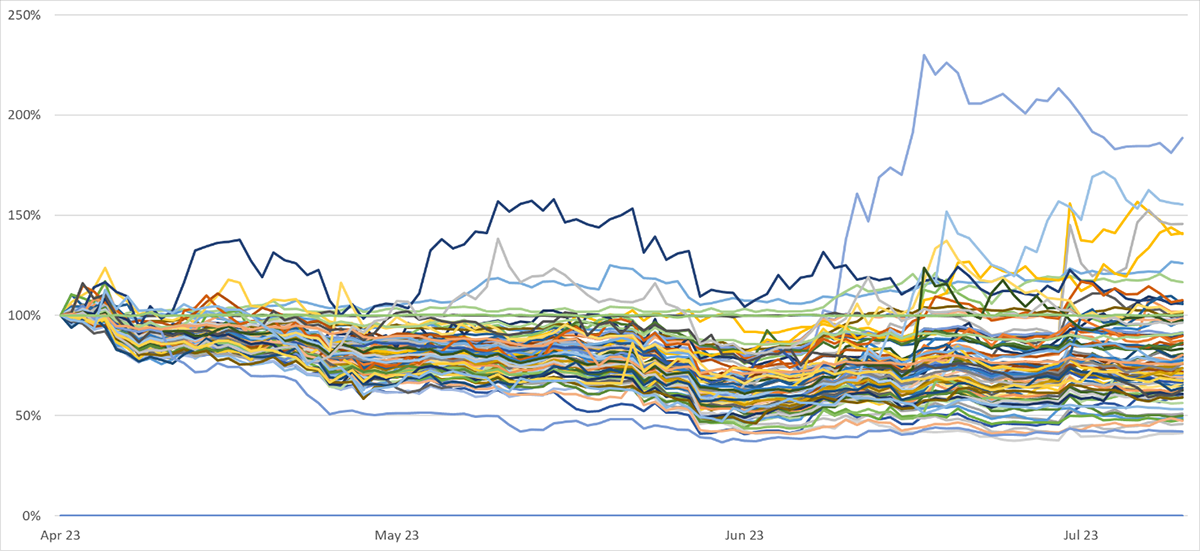

Looking at the performance of the top 100 tokens since April, few have made money, with the median down around 24%. The blue one that has doubled is Bitcoin Cash (BCH).

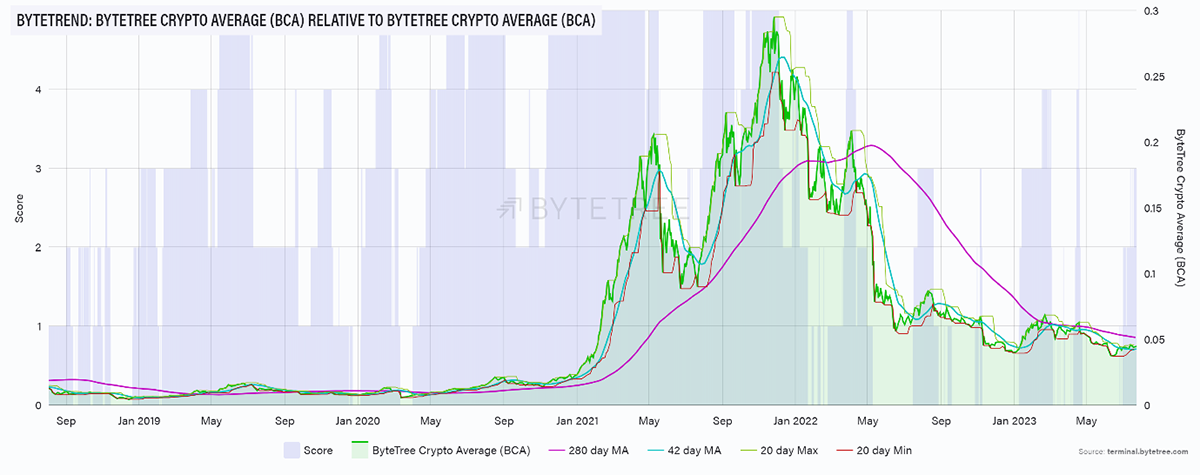

A much clearer way to visualize crypto strength is with our ByteTree Crypto Average (BCA). It’s just risen to a 3-star trend in USD, but still not signalling a bull market.

Sometimes I think this is one of the most valuable tools we have created. The last great signal came about in May 2020, around the time of halving. Look what happened to ETH… 13x!

Generally speaking, I would say it is much safer to chase alts when BCA has a 5-star trend.

A 5-star BCA could come in the coming months, but we have to get through the seasonal weakness in September. Thereafter it’s Uptober. We can look forward to that.

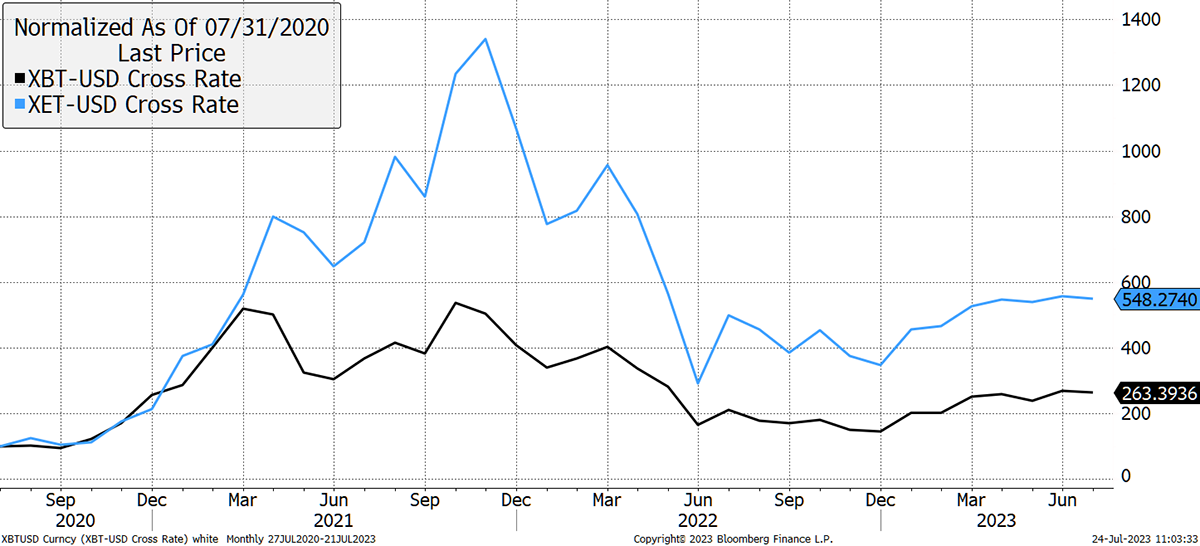

Bitcoin is trading back below $30,000 but is still within an uptrend.