Apple Is Worth More Than the FTSE 100

Disclaimer: Your capital is at risk. This is not investment advice.

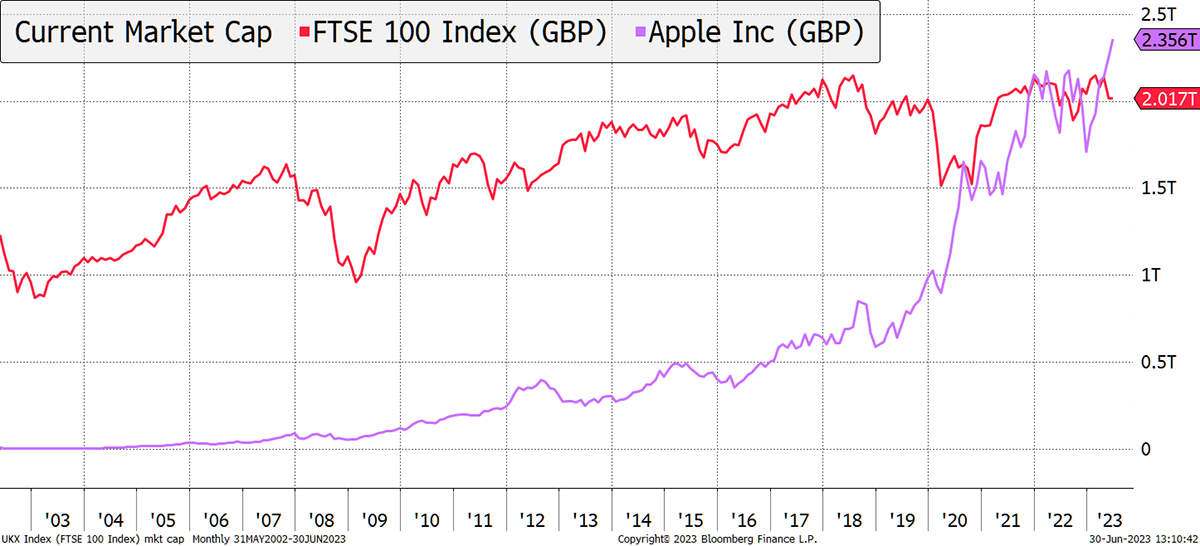

In recent days, the value of Apple has surpassed the FTSE 100, an index of the UK’s top 100 public companies.

Apple is worth more than the FTSE 100

It is a shocking revelation, and what could it mean?

- Apple is the most perfect company, with huge cashflow and a dominant market position. It can do no wrong.

- UK institutional investors and regulators have turned the FTSE into a “Jurassic Index”, as Paul Marshall described it, which is dominated by banks, oil and mining while lacking technology stocks. And since oil and mining have become pariahs, what will be left?

- This is a monumental asset bubble which overvalues Apple and undervalues the FTSE.

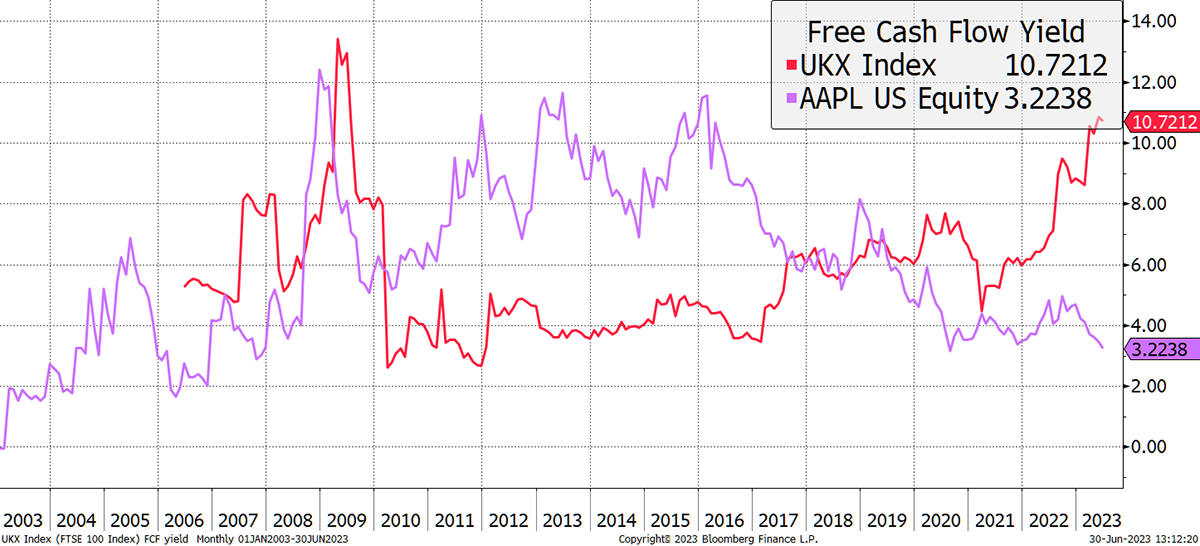

There can be no doubt that Apple has been a great success, and this is a remarkable feat. It is also interesting that back in 2016, investors had a chance to buy Apple shares at a free cashflow yield at over double the level of the FTSE, but that situation has since reversed. Today, the FTSE generates 10% free cashflow, versus Apple’s 3%.

FTSE Prints Money

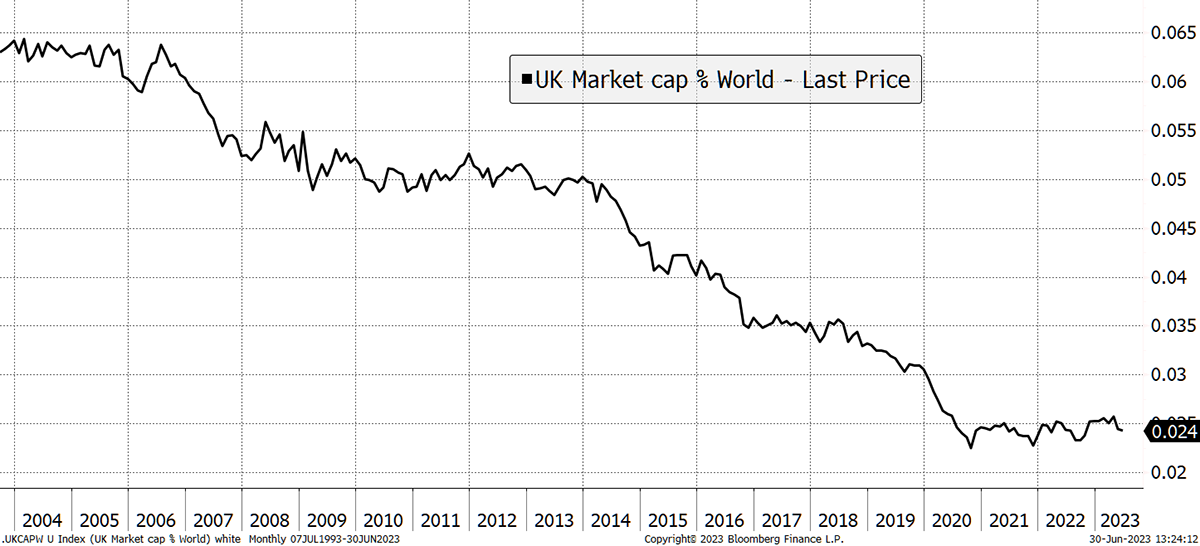

There can be no doubt that the FTSE offers much better value, but of greater concern, and acknowledging the second point, the FTSE is shrinking relative to the rest of the world. London’s coffee houses of the 18thcentury would be outraged. The FTSE has fallen from 6% of the global market cap to 2.4% this century.

FTSE Loses Share to Global Bourses

Losing the market share of listed companies on this scale is a national embarrassment. Policymakers, institutions and regulators should all share a part of the blame. But you also must consider the rise of markets such as China, which have grown from nothing into a $10 trillion market, despite poor performance.

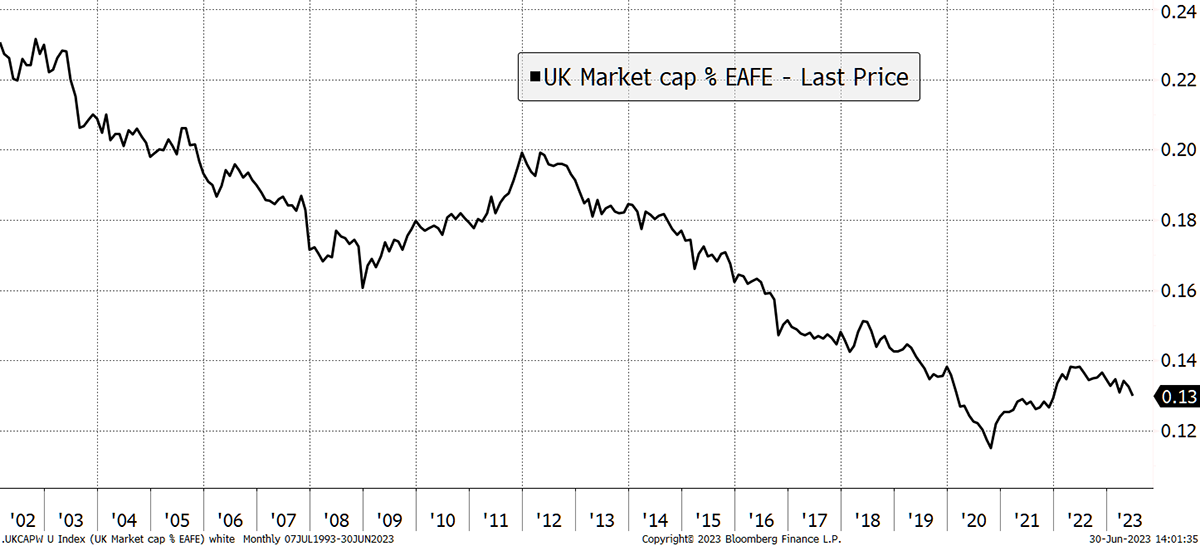

Given the US market is so technology-heavy, and emerging markets have seen capitalisations balloon, I compare the value of the FTSE to the developed world ex-USA. That is EAFE, an acronym for Europe, Australasia and the Far East. This is a fair fight, but still, the FTSE has seen its share of EAFE fall from 23% to 13% over the past two decades.

FTSE versus EAFE

There can only be two conclusions, both of which have nothing to do with Apple. One is the UK market really is dirt cheap, and the other is that it has been regulated to death.

ByteTree This Week

The star of the week goes to Robin and Rashpal’s Adaptive Asset Allocation Report. They are in no doubt that we are in the midst of a stockmarket bubble and are warming to bonds. They are convinced we face an imminent recession and urge caution.

In The Multi-Asset Investor, I asked if the Gilt Bear was over. If we get that recession, it probably is, but the message wasn’t so much to buy bonds but to point out that the risk of holding bonds has fallen considerably. If it’s not the bottom right now, it can’t be far away, at least in this cycle.

In the crypto development space, the 2023 topic is currently dominated by rollups technology. Aiming to address Ethereum’s shortcomings in network congestion and high transaction fees, several new layer-2 protocols have emerged in the past couple of years. Having covered Arbitrum (ARB) in our previous Token Takeaway, this week, Seran Dalvi looks deeper into Optimism (OP).

Finally, in ByteFolio, we looked at bitcoin dominance. It is remarkable how the crypto industry has 69% of the total value in BTC (50%) and ETH (19%). The remaining 26,000 tokens have to fight over the other 31%.

It’s like Apple versus the FTSE all over again.

Have a great weekend,

Charlie Morris

Founder, ByteTree