Is the Gilt Bear Over?

Trade in Whisky;

The challenge in 2023 has been the divergence between the economy and the markets. In normal dark times, you’d just buy bonds and be patient, but this cycle has its quirks. It has coincided with the sharpest interest rate hikes in living memory, making bonds extremely risky. After last week’s hike to 5% by the Bank of England, and the pause by the Federal Reserve, much of that risk around further rate hikes is now behind us.

That is, at least for the time being, because the next cycle is another matter entirely. I suspect inflation will fall quite sharply over the coming months but it has an annoying habit of bouncing back when the good times return. This is what is meant by inflation volatility, a discussion for another time.

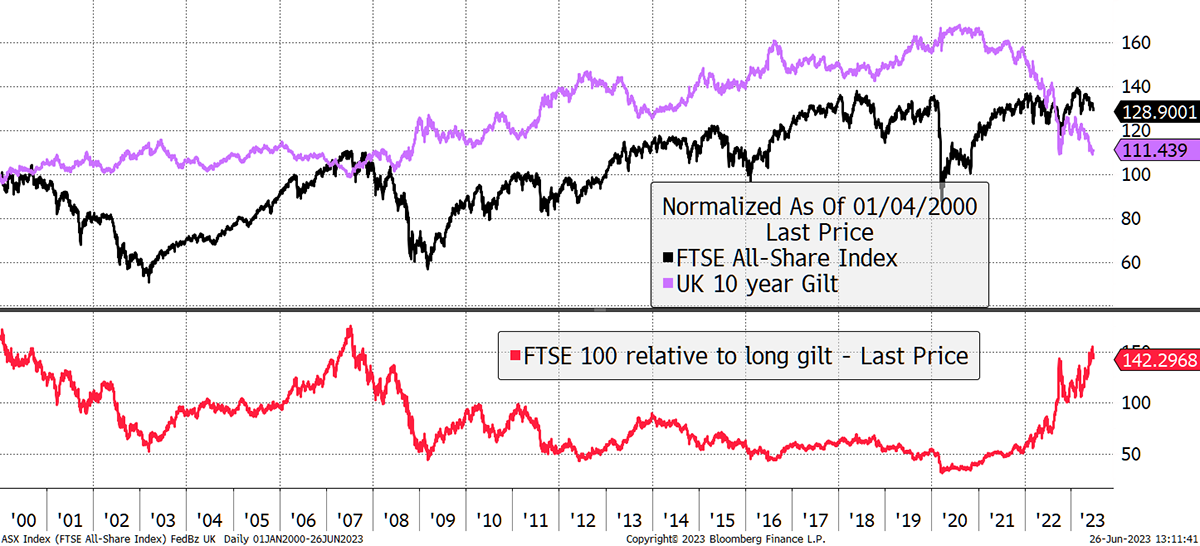

I have shown the equity bond chart for the USA many times. Here is the FTSE All Share vs the UK long-dated gilt. Equity outperformance (red) has been gargantuan, while bonds have sunk. I believe a turning point is upon us, and as confidence in the bond market returns, the selling pressure on equities could escalate.

UK Equities versus Bonds

Last week’s rate hike by the Bank of England from 4.5% to 5% was ignored by the bond market. The 10-year gilt yield had been 4.5% and has since fallen to 4.3%. You would normally expect the long bond yield to rise in response to higher rates, but it did the opposite. The message from the bond market is that policy is too tight, the economy will turn down, and interest rates will fall again. That means the bond market is close to the bottom because a recession is either imminent or already here.

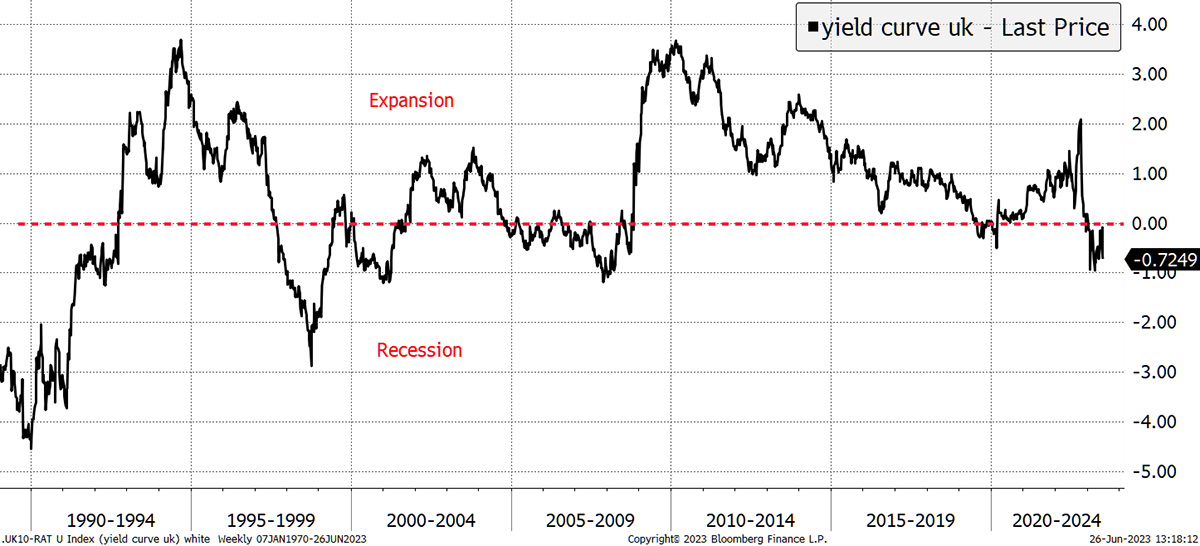

UK Yield Curve Is Forecasting a Recession

It seems the Governor of the Bank of England was late to raise interest rates and has since overdone it. Inflation will come down regardless of rates because the pound is strong, the economy is slowing, and China is devaluing.

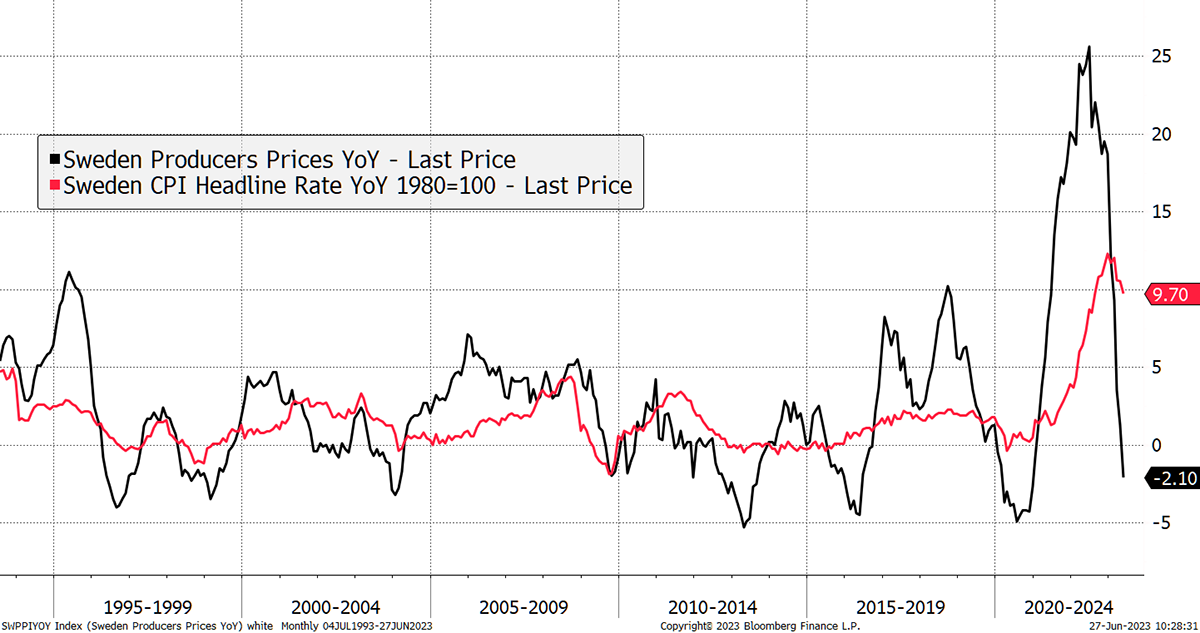

Evidence comes from falling producer prices (PPI), and Sweden is a good example. This morning they reported a PPI of -2.1% over the past year. PPI is more volatile than CPI (consumer prices), but it tends to lead. Where PPI goes, CPI follows.

Swedish Prices

It is a similar situation elsewhere, and here in the UK, PPI has also dropped back into negative territory. To clarify, we know that CPI is coming down in most countries, but we do not yet know where it will land.

A firm bond market, paying over 4%, is increasingly attractive when a downturn is on the way. When rates ease, it also means the pound will likely soften, which will be music to the Soda portfolio as most investments are international. For example, gold, emerging market bonds, index-linked bonds, CGT and RICA, and even some of the equities are non-domestic.

A combination of a rising pound and rising rates is why Soda is down this year. Mainly the pound. In both cases, a reversal will come about before too long. If the pound is falling, an international portfolio looks good, and if the pound is flat, then it makes no difference. A strong pound comes and goes periodically, but it never seems to last. A falling pound is something to look forward to and is most likely to happen when markets come under pressure.

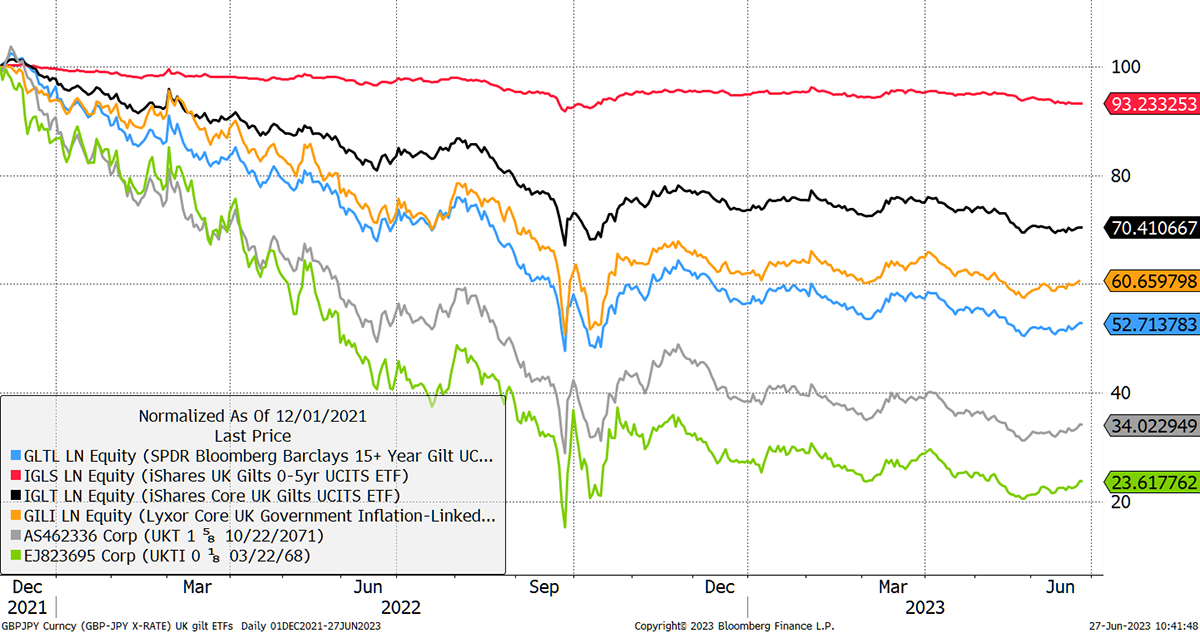

Is the Gilt Bear Over?

I show six different gilts or gilt ETFs:

- Red 0-5 year conventional ETF

- Black all market conventional ETF

- Gold all market inflation-linked ETF

- Blue 15+ year conventional ETF

- Grey, an ultra-long-dated conventional bond

- Green, an ultra-long-dated inflation-linked bond

Take a moment to see how these have behaved since the rate cycle began. This is the bond market in action, and few will have ever seen these sorts of moves ever before.

Gilt Duration and Volatility

You can clearly see that the red short-dated ETF is more cash-like (dividends not shown) in contrast to the riskier long bonds, one of which fell 83% last autumn.

I bought GLTL (blue) last summer, the long bond, when it was heavily oversold. Bonds rallied, only to slump again. Fortunately, I cut the position for a small loss in August, a month ahead of the Kwarteng budget. But even that is nothing like as risky as the ultra-long bonds, which are solid rocket fuel. If inflation came back in a big way, few investments would perform better than the 2068 inflation-linked bond.

Today, we are now back at those levels of last September, and the market seems to have turned, but we can’t be sure. I am not adding gilts this week, but getting you all warmed up because the turn seems to be close at hand. Risk in the bond market has decreased significantly.

But we must not forget that RICA and CGT own both bonds and inflation-linked bonds. The CG Real Return Fund comprises international, mainly US, inflation-linked bonds. Gold is essentially a bond issued by God, and we also hold emerging market bonds. Furthermore, the yen is correlated with interest rates, and when they turn down, it will likely surge.

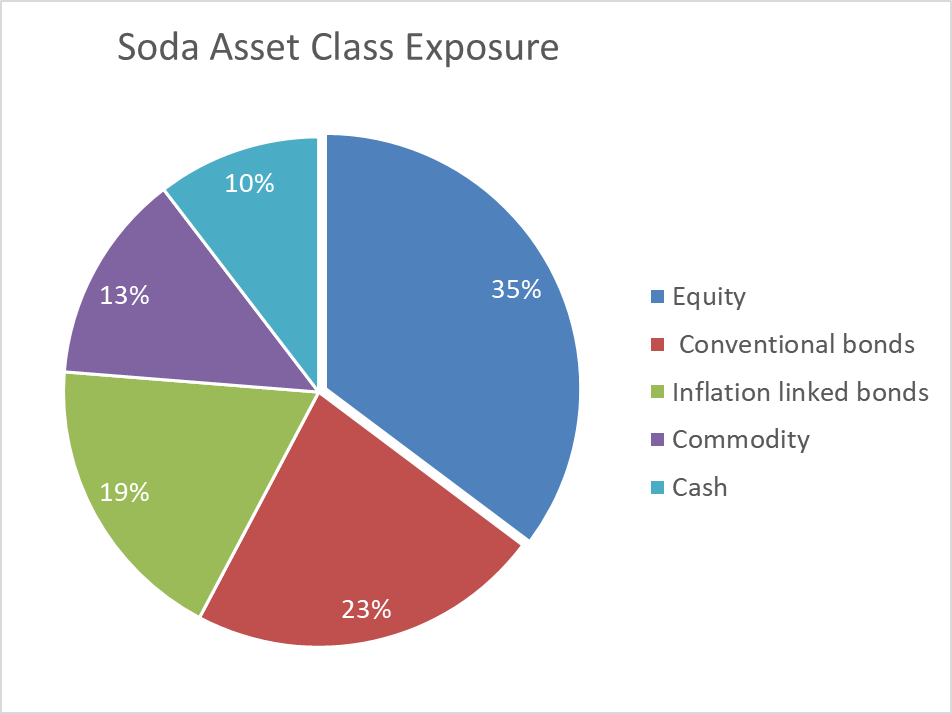

None of the bonds held has a particularly high duration, so it is more like the top half of the chart above than the bottom. But we already have meaningful exposure in the Soda Portfolio, which I show on a look-through basis, including what’s inside the funds held. I have included the yen as a conventional bond because that’s how it behaves.

I am warming to bonds, but perhaps we already have enough.

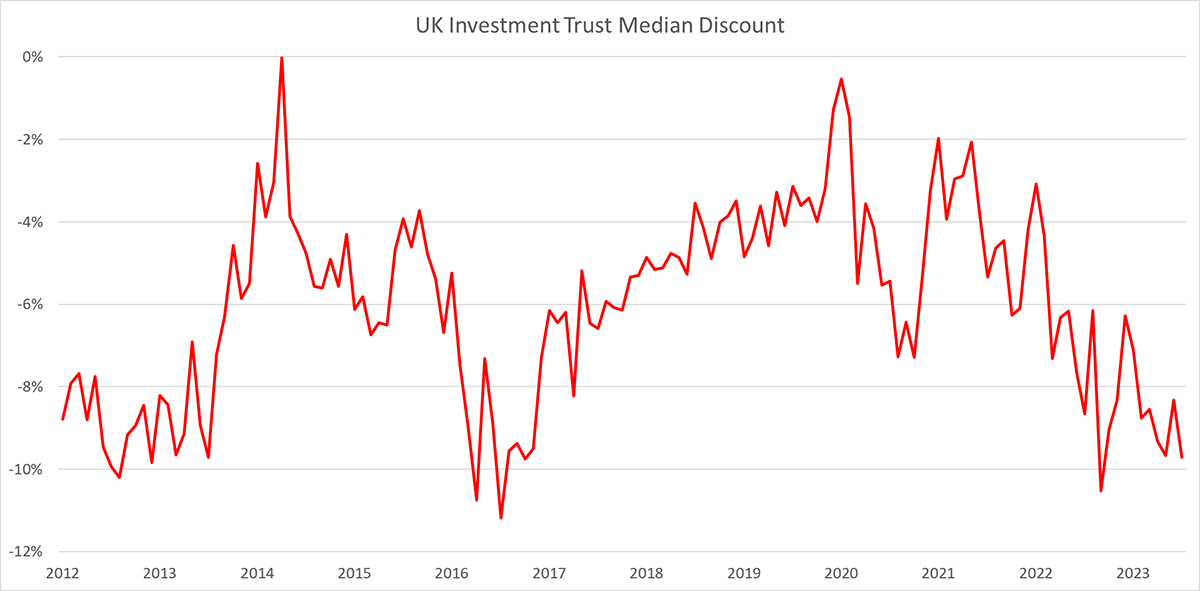

Investment Trust Discounts

I also want to briefly mention investment trust discounts. A combination of mergers in the UK wealth management sector and general regulatory outcomes have reduced liquidity in UK closed-ended companies, or investment trusts. I show the median discount for the sector over the past decade.

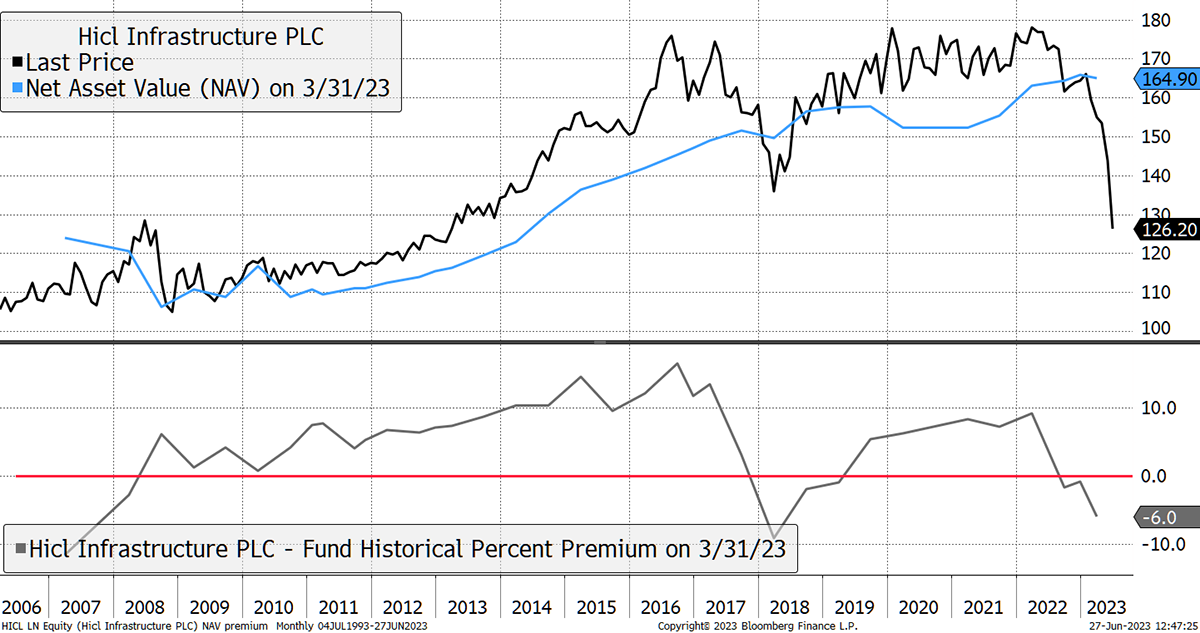

The worst performers of late have been private equity, property and the recent darlings such as renewables and infrastructure. Here’s HICL, which I have been wary of for years.

Infrastructure Under Pressure

This part of the market has come under huge pressure, especially renewables. It is good news for the next cycle because many of these will be attractive buys at high yields. But we are not there yet. Keep it liquid.

Our investment trusts hold liquid assets. SMT is an exception and holds some private investments, but the discount already reflects that. I am not sure how committed I am to SMT and other tech holdings, but if the Nasdaq deteriorates, I will turn seller.

Selling Thailand ETF (XCX4) in Whisky

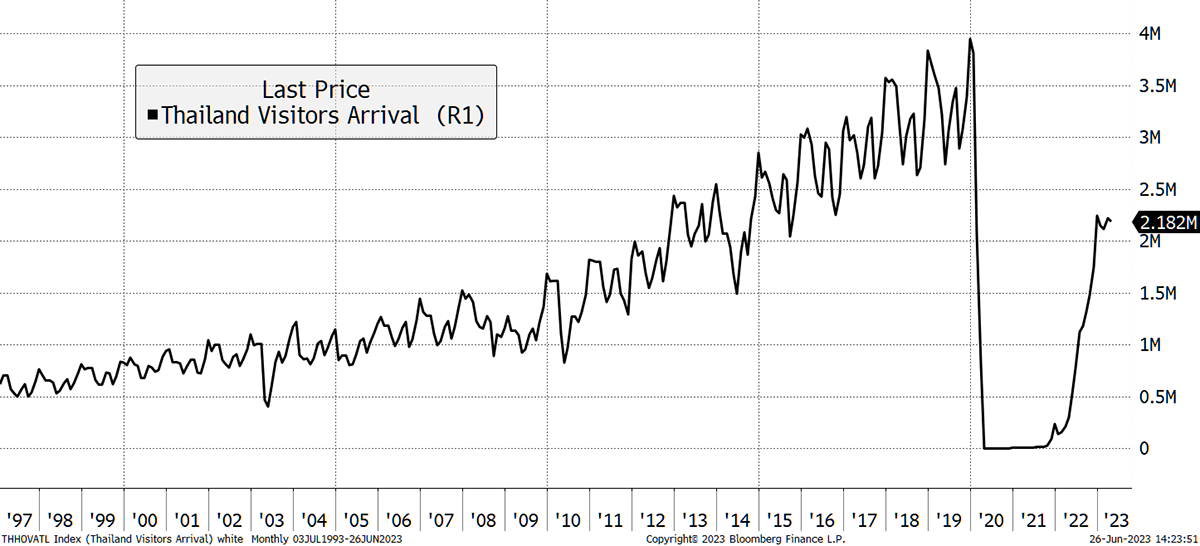

Things aren’t right in Asia, and it seems to be being dragged down by a weak China, where rate cuts have already begun. Thailand’s expected tourist boom has been disappointing, and most Asian markets are softening.

A Slow Recovery in Thai Tourism

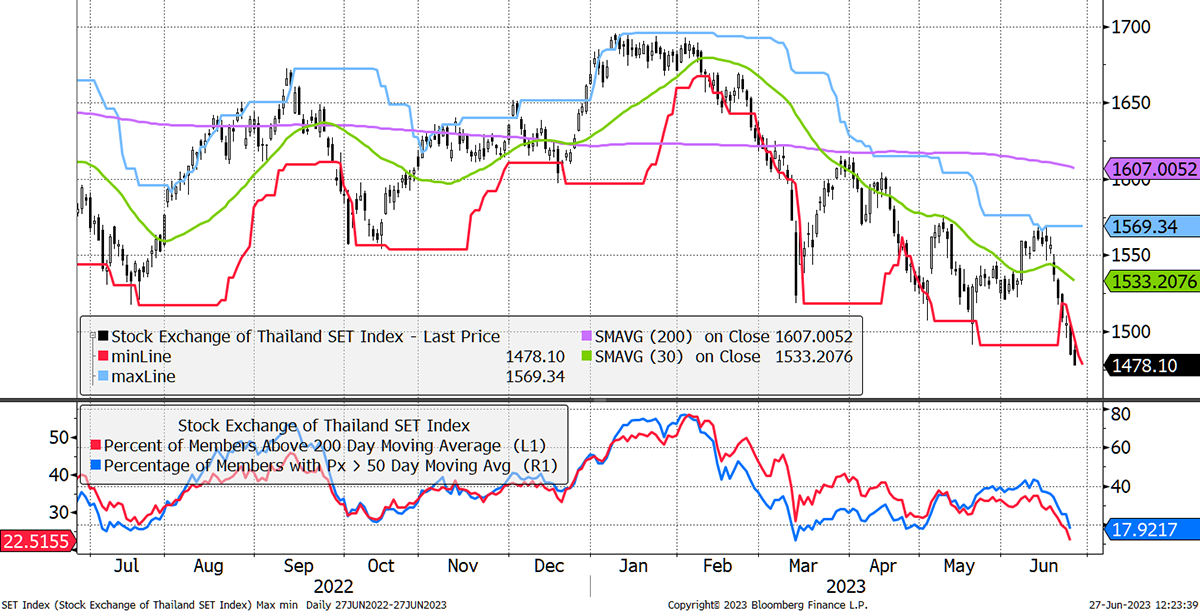

The Thai market technicals have deteriorated, with trend and breadth resembling a bear market. Thailand is a sell.

Thailand Makes a New Low on Weak Breadth

Action:

Sell Thailand ETF (XCX4) in Whisky

Postbox

Thanks for your invaluable guidance through this period of high uncertainty. I find some comfort in Stan Drunkenmiller's recent comment that this is the toughest environment he's ever invested in!

Glad to be in good company. What’s unusual is the deep wedge between fundamentals and asset prices. Then add complex geopolitics and a cold war on top of that. I am certain that fundamentals will always win out in the end, and I look forward to those days returning. In the meantime, the plan is to embrace diversification and steer clear of trouble.

Regarding PayPal, I am equally bemused by the significance of the fall. I have been toying with the idea that maybe the stock is being priced as 'ex-growth' now, as its revenue is predicted to be single digits over the next few years. With competition from Apple Pay etc (and DeFi?), maybe this is the reason for such a depressed multiple.

And

Paypal announced $900m of cost-cutting measures driven by activist investor Elliot Management… With bold restructuring and savings plans in place, investors will likely be scrutinising whether PayPal can fulfil its promises to cut costs and boost its operating margin next year. We’ll be keeping up with all the developments, so stay tuned.

And

Over the years, I used PayPal when buying & selling on EBAY. But now, since bank transfers have become so much faster & easier, and since credit card protection has become better understood and more dependable, I’ve simply dropped using PayPal. Many online retailers now seem to try to get me to buy through PayPal’s payment system, however I’ve always resisted because it generates unnecessary admin/emails etc., and I’ve no reason to think that others also don’t now share my same reluctance to use PayPal. I could well be wrong, however I suspect that PayPal will have suffered enormously since EBAY decided to dump their “PayPal partnership”.

Thank you for all the feedback and more. I think it has been derated because it is in slow growth mode, and the market position is strong. I think the price is right, but there is no rush, and we can wait for the trend to improve before we pounce.

On Bitcoin

I note that a subscriber mentioned Kinesis as a platform to trade crypto as well as tokenized gold and silver. This is true as is the fact that yields are earned from the holding of tokenized gold [KAU] and tokenized silver [KAG] on the Kinesis platform which gives it a welcome advantage overpaying storage for holding vaulted bullion elsewhere. I hasten to add that I am not employed by Kinesis either.

Noted, thank you.

Portfolios

New readers, please find a note at the end after the summary.

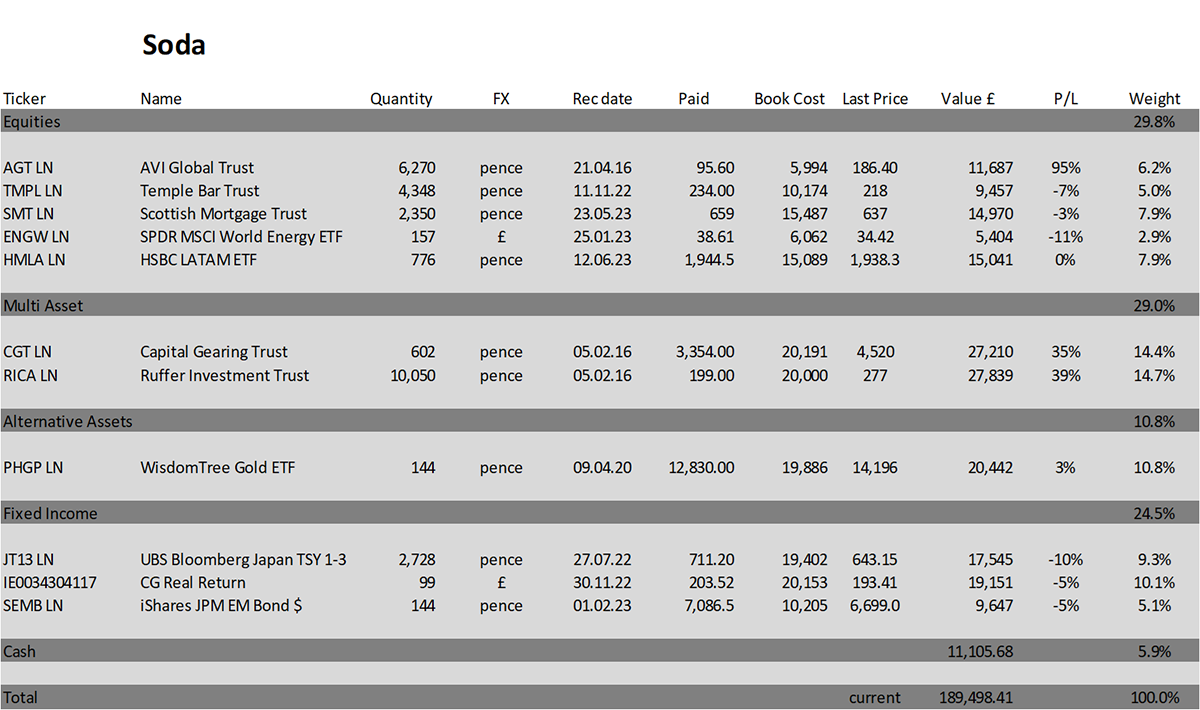

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 5.3% this year and is up 89.5% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

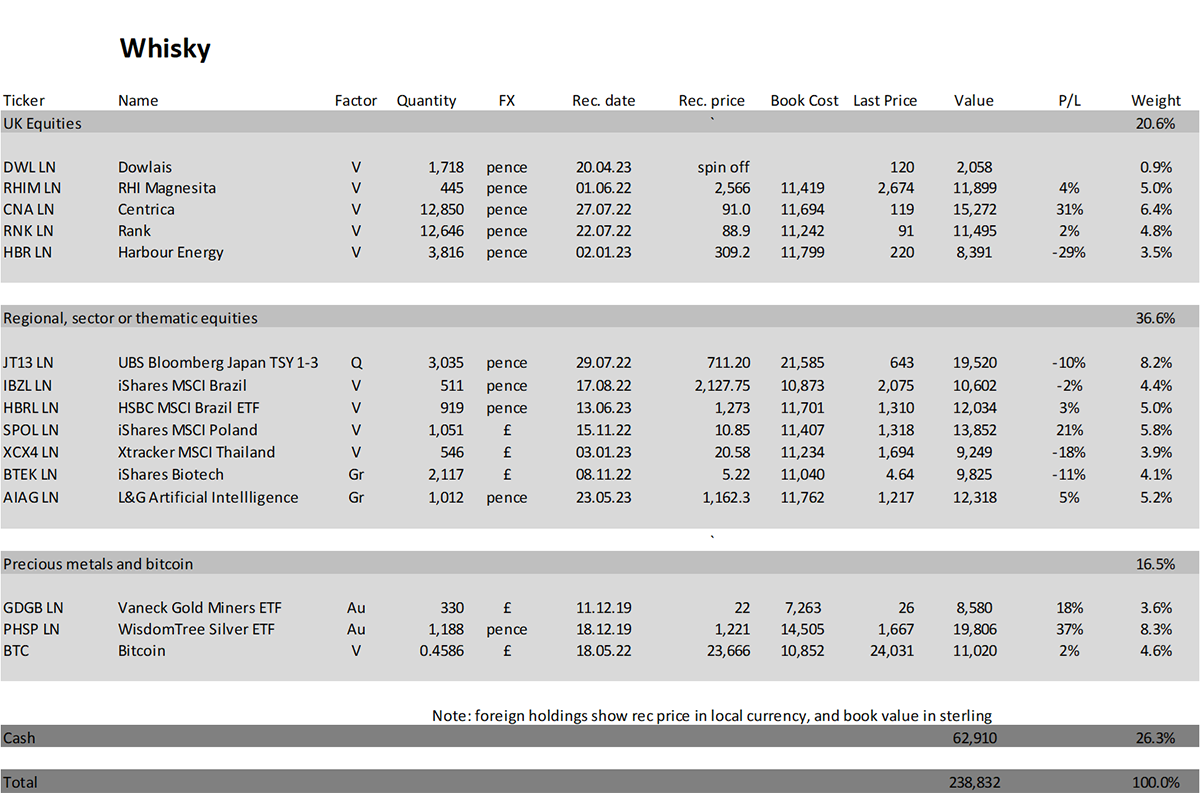

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.9% this year and up 138.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The portfolios have been overly active this year, not by choice but by events.

A coup in Russia led by a former hotdog seller. You can’t make this stuff up.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()