Mainstream Media Doesn't Get Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

Mirroring the latest AAA, the Multi-Asset Investor delves into Emerging Market bonds this week and adds a position to the Soda portfolio. Charlie Morris has now completed the re-positioning from his defensive stance in 2022 in both the Whisky and Soda portfolios. The timing has worked out well. Since publishing “The Everything Bear Might Be Over” on 15 November, markets have moved higher, and the US dollar has weakened.

Charlie tackled a hefty postbag this week, with a number of PREMIUM subscribers seeking clarification around his views on gold. The answer is that he likes gold, but there is a better way to express the trade at the moment than holding gold itself. The recent Atlas Pulse will give some cluesto non-PREMIUM subscribers.

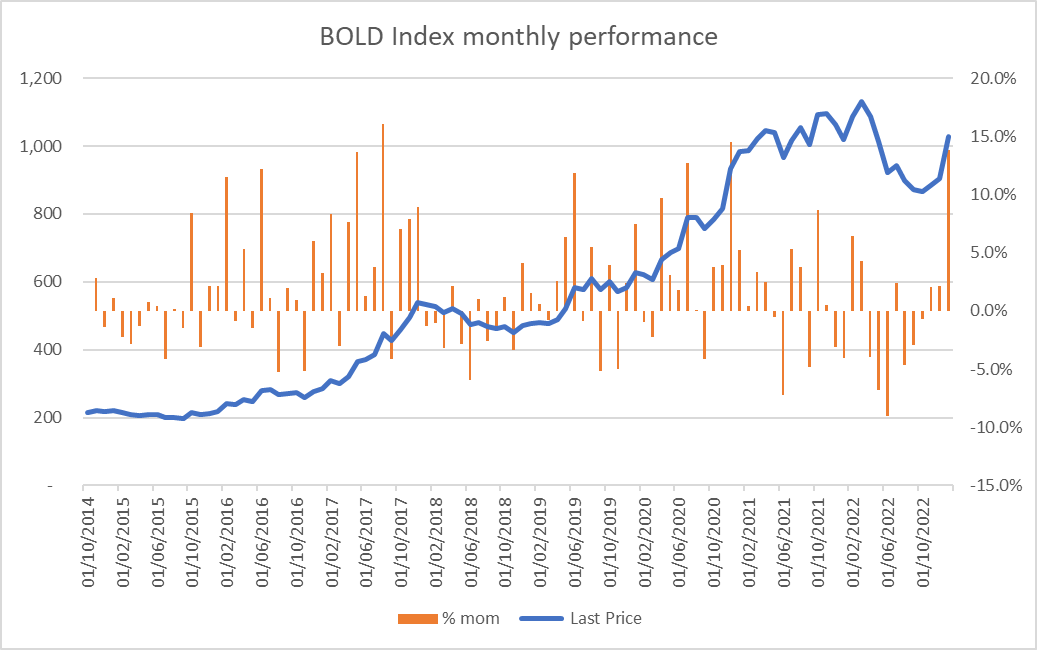

Speaking of gold, the January performance of our BOLD Index can’t go unnoticed. BOLD, which combines bitcoin and gold, had its third-largest monthly move since records began in 2014, as shown below. Two things of note:

- First, despite bitcoin having fallen 39% over the last 12 months, BOLD is unchanged over the same period. This shows how the two assets complement each other through cycles.

- Second, because bitcoin is becoming structurally less volatile, its weighting in the mix continues to rise. At the start of February, the weighting increased to 22.3% from 21.9% at the start of the year.

The structural decline in bitcoin’s volatility is important because it tells us that it is a maturing asset. It’s a vital feature of growing adoption and investability. Not that you’d believe it when reading the financial press, who continue to write in the most blinkered, partisan and illogical fashion about it, most likely to reflect the Luddite views of their comments section.

It’s odd that people who write about finance should be so dismissive of something that is so utterly fascinating, not just conceptually but factually. In the Times this week (thanks to all those who sent me the link!), Patrick Hosking got stuck into the idea of regulation with the usual cut-and-paste bilge:

“The entire industry is an abuse - a bubble that parts the credulous from their money, a system for the crooked to launder their cash and dodge taxes, a magnet sucking talent and capital away from more useful activities.”

It’s just incredible that someone who purports to serious analysis can write such a dreary, derivative and blatantly ill-informed sentence. Indeed, the article starts with:

“…the government is conferring a veneer of respectability on the activity that is not justified by the facts.”

Well, here are some facts:

- Every week the bitcoin network transacts around US$25bn worth of value.

- Once every 10 minutes, a block is processed where 13,448 nodes agree on all the transactions that have happened and stamp it for time immemorial. No single entity is in charge of that process. It is perfectly decentralised and never misses a beat.

- It is a monetary network that has never been violated.

- Approximately 70% of the world’s population live in countries which are either dictatorships or autocratic democracies. In other words, if the state decides to confiscate their assets, there’s not much they can do about it. Bitcoin is a global lifeline for the oppressed.

- Approximately 18% of adults in the UK own crypto of some form. Surely they deserve some protection from bad actors? Don’t forget it’s not the technology that has been the problem, it’s the institutions around it.

Bitcoin is now coming out of its third bubble/crash cycle. When has a financial asset ever done that? And each time, it comes out stronger and more widely embraced, and yet intrinsically unchanged. How can anyone with a grain of financial curiosity, never mind someone who makes a living writing about these things, not suspect that maybe there is something here that is likely to stay, and therefore governments should wrap their heads, and regulations, around it?

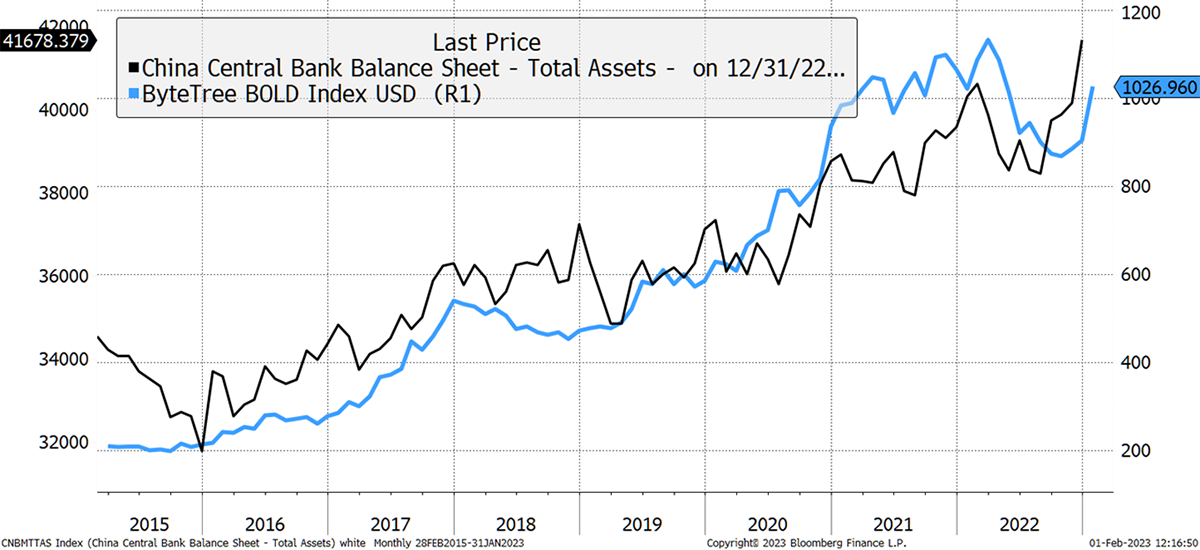

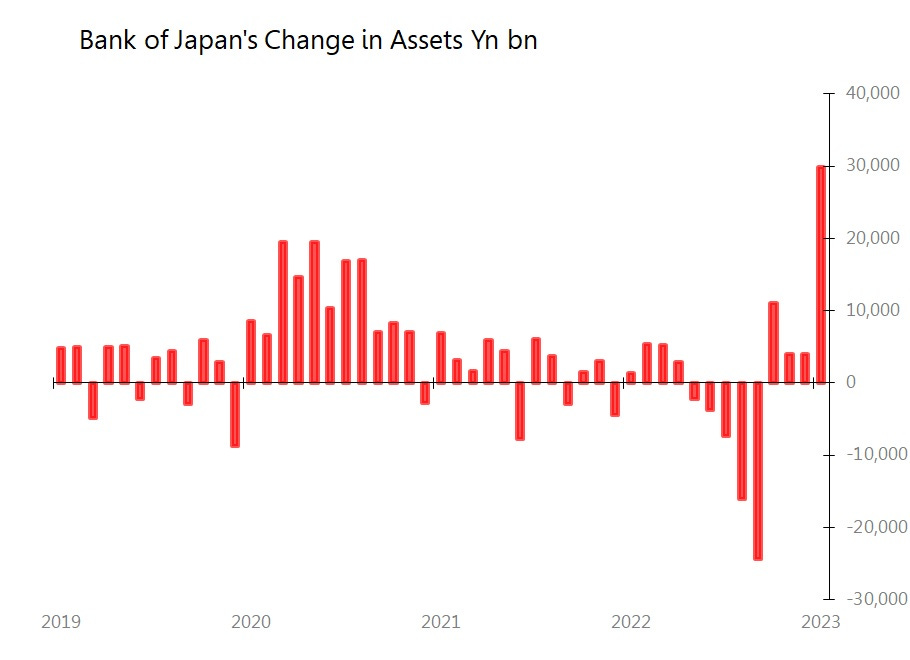

As if to prove the point, I show two charts. Don’t forget, bitcoin’s rise is in large part a response to continued currency debasement. The first, from this week’s Bitcoin and Gold Chart Book shows the growth of China’s Central Bank balance sheet. The second, which I have pinched from Michael Taylor’s excellent Coldwater Economics, shows the Bank of Japan’s. I mean, you can smell the smouldering rubber and burnt-out brake pads of Japan’s U-turn from here. As Michael says:

- This is a dramatic reversal of policy: as recently as September 2022, BOJ was shrinking its balance sheet quite aggressively.

- Now not only is BOJ running policy in direct contradiction to US and European central banks, this was the biggest monthly expansion since the beginning of 2010 at least.

Old habits die hard. This is what hard money is there for. After the latest rate rise from the Fed, markets are smelling the top of the tightening cycle. But how accommodative can they be if inflation remains elevated while growth slows? Or will they follow in the footsteps of China and Japan?

Money Printer Goes Brrr…

There is no activity in ByteFolio this week, which is stabilising after the recent fall relative to BTC. We reiterate that it’s our belief that we’re at the start of a bull market, and comment on factors driving Ethereum’s recent underwhelming price action.