Curve Finance: Specialising in Stablecoins

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: CRV Token;

Curve Finance is a decentralised exchange designed for highly efficient stablecoin trading. Curve has a TVL of $8.77 billion, making it one of the largest platforms in DeFi. In this Token Takeaway, we take a plunge into DeFi with Curve and analyse what this platform has to offer and the benefits of holding their native token CRV.

Centralised vs Decentralised Exchanges

If you have previously bought or sold crypto, your first point of contact would most likely have been through a centralised exchange (CEX) such as Binance, FTX, or KuCoin, to name a few. CEXs use a business model similar to traditional institutions such as NYSE or NASDAQ and generally offer strong liquidity and regulatory assurances, which can be especially important for institutional clients.

A decentralised exchange (DEX), on the other hand, is a peer-to-peer marketplace where transactions occur directly between crypto traders. The benefits of using DEXs include lower transaction fees and the ability to hold your assets directly. A study conducted in October 2021 by KPMG concluded that DEXs, such as Uniswap, were charging a 0.05% transaction fee on $100,000 trades while comparatively, Binance and Coinbase were charging upwards of 0.1%. However, DEXs have their disadvantages, such as not having any customer support, and traders are usually left to their own devices to diagnose problems they experience.

Deciding which type of exchange to use boils down to two things. A CEX is probably the best option if you prefer the ease of use. If lower fees and more control over your digital assets are important to you, then a DEX is the way to go.

What is Curve Finance?

Curve Finance was founded in 2020 by Michael Egorov, a Russian scientist who previously co-founded NuCypher. It is a decentralised exchange that primarily specialises in the swapping of different stablecoins. The platform charges 0.04% in fees and provides low slippage by focusing on assets that behave similarly, e.g. stablecoins or tokenised Bitcoin. By focusing on stablecoins, Curve allows investors to avoid more volatile crypto assets while still earning high-interest rates from lending protocols. Compared to other DEXs, the Curve model is particularly conservative in that it avoids volatility and speculation in favour of stability. This approach enables institutional and retail investors to provide liquidity to liquidity pools while minimising the risk of impermanent loss.

Alongside the ability to swap stablecoins, Curve Finance also rewards users that provide liquidity to the exchange. Liquidity pools remove the need to match a buyer with a seller, and instead, users trade in and out of a pre-funded pool of tokens, which results in a more efficient transaction. Curve is able to achieve this through an Automated Market Maker(AMM) protocol that relies on a mathematical formula to price assets. AMM replaces the need for an order book with an algorithm that prices assets accordingly.

While some might consider Curve's focus on stablecoins as a limitation, it actually allows it to outcompete the competition in this niche. As mentioned above, Curve deals only with similarly priced assets, enabling Curve to minimise impermanent loss, fees, and slippage. Whereas an AMM like Uniswap features liquidity pools made of completely different assets like ETH and BTC, a Curve liquidity pool is comprised only of stablecoins like DAI, USDC, and USDT, or is made only of wrapped bitcoin tokens like wBTC and renBTC.

Curve DAO Token

In August 2020, Curve protocol launched its proprietary token on Ethereum with the ticker CRV. This ERC-20 token acts as the governance token of the Curve DAO, the decentralised autonomous organisation that runs on the protocol.

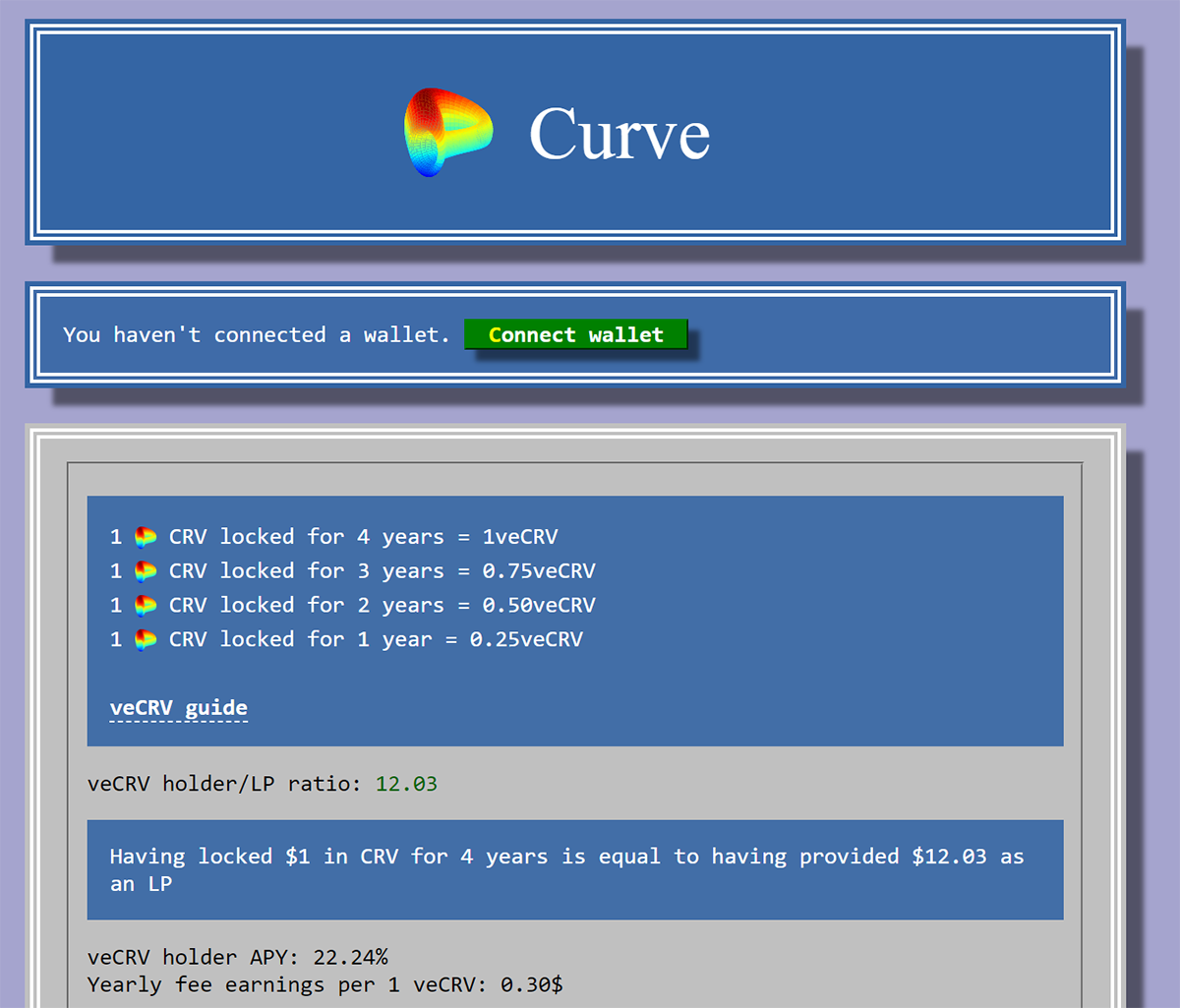

As seen from the image above, CRV can be staked for fixed periods in the Curve DAO to receive vote escrowed CRV (veCRV). Holders of veCRV can participate in governance and receive staking rewards.

Users can decide how much CRV to lock up and for how long, with the incentive to receive more veCRV for locking up larger amounts for longer periods. Anyone with a minimum number of veCRV tokens can propose an update to the protocol, which ranges from changing fees, changing where fees go, creating new liquidity pools, and adjusting yield farming rewards. Currently, the standard fee on all pools is 0.04%, half of which goes to liquidity providers and another half to all veCRV holders.

Tokenomics

The circulating supply of CRV is approximately 457.92 million tokens, with a max supply capped at around 3.03 billion. 62% of CRV has been allocated and distributed to liquidity providers. The remainder of the supply is distributed as follows: 30% to shareholders, 5% to the community reserve, and 3% to employees.

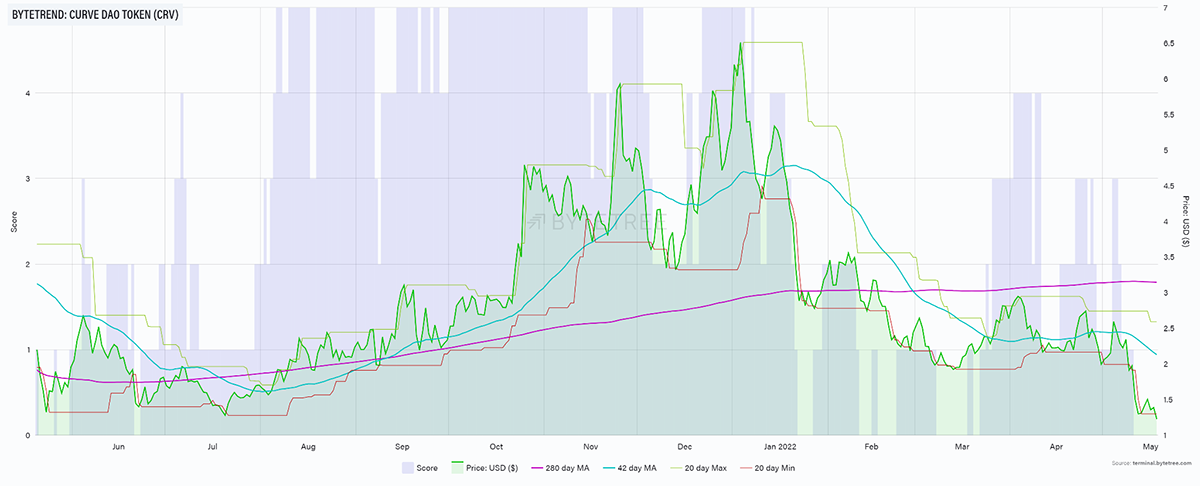

As shown in the ByteTrend chart above, CRV hit its all-time high of $6.52 in early January 2022, no doubt fuelled by the platform having a record TVL of $24 billion around the same time. Since then, TVL on Curve fell steeply due to a crash in the overall TVL on the blockchains where Curve Finance is deployed. Consequently, the bullish run for CRV ended shortly after and has kept at a level pace up until recently. The May price drop for the CRV token is attributed to the flash crash of Terra LUNA and the de-pegging of UST that followed.

CRV is currently priced at around $1.24, with a market cap of $566.8 million.

Long Term Catalysts

More than 80% of the world’s central banks have considered launching a central bank digital currency (CBDC), according to a report published by PWC. The Bahamas and Nigeria already have a legal digital tender in use, while many other countries will undoubtedly follow.

This sentiment is bullish for the Curve ecosystem, as in the upcoming years, we are likely to see substantial growth in the stablecoin market, which will subsequently increase Curve’s role in the market.

One current downside is that Curve Finance does not offer any CDBC staking options on its platform. However, this can change depending on the proposals set forward by veCRV holders to update the protocol.

Conclusion

The appeal and potential of Curve Finance are not all that apparent at first glance. You may find it difficult to assess the value of a platform that only allows you to trade between assets worth the same amount. However, Curve Finance has found its niche by enabling users to exchange stablecoins in an easy and cost-effective manner while providing some of the best fee and slippage rates. This unique selling point has enabled Curve to become an essential part of the DeFi sector in a relatively short period of time.

The future of Curve Finance ultimately depends on the proposal voted on by the Curve DAO. Provided the members of the DAO have the best intentions for the protocol, I believe Curve Finance is here to stay and will grow to become the go-to place for decentralised exchange of stablecoins and tokenised Bitcoin.