FTX: An Alternative to Binance's Market Dominance?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: FTT;

Crypto exchanges saw accelerated growth in 2021, with Binance as the market leader. One exchange that rose up the ranks and established itself as one of the top crypto exchanges was FTX. FTX, marketed as an exchange “by traders for traders”, has quickly become one of the crypto sector’s top futures and derivatives exchanges. In this Token Takeaway, we will analyse FTX and its native token, FTT.

The number of global crypto owners almost tripled, from 106 million in January 2021 to 295 million in December 2021. If crypto adoption continues at this staggering rate, we are on track to reach 1 billion crypto users by the end of 2022.

In 2021, the influx of users generated $24.3bn in trading fees for these exchanges, as stated in a report published by Opimas in March 2022. This figure even surpassed the revenue generated by traditional stock exchanges such as NASDAQ and NYSE. In regard to crypto exchanges, Binance led the charge in 2021, but there is still plenty of room for other exchanges. This is the opportunity for FTX.

FTX Overview

FTX is a relatively new cryptocurrency trading platform based in the Bahamas and was founded by Alameda Research CEO Sam Bankman-Friedand former Google engineer and Alameda Research CTO Gary Wang. The exchange opened its doors for trading in 2019 with the goal to address the gaps in the crypto futures market. Since its inception, FTX has established itself as a top centralised crypto exchange with a market evaluation of over $32bn.

The exchange has quickly built up a reputation by offering several products that may appeal to both retail investors and professional traders. For new investors, FTX offers spot trading on its platform, and for traders, FTX supports the trading of futures, stocks and leveraged tokens. To date, FTX supports over 400 cryptocurrencies, and the selection is constantly growing as FTX adds more options to their trading platform.

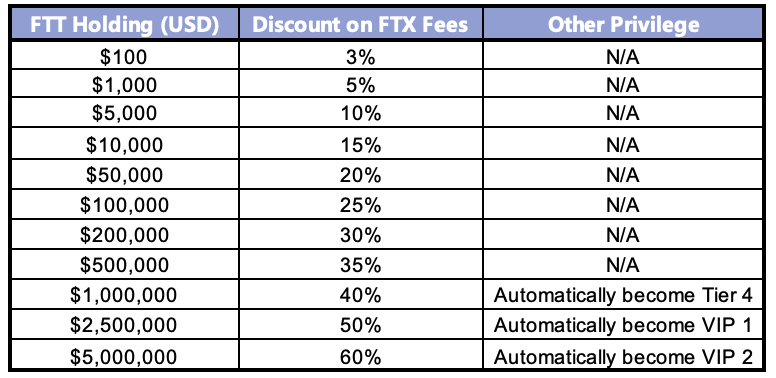

FTX has a tiered trading structure, with the lowest tier listing 0.020% and 0.070% in maker and taker fees, respectively. Comparatively, Coinbase Pro’s lowest tier charges 0.40% in maker fees and 0.60% taker fees. In addition to FTX tiered discounts, there are further fee discounts for FTT holders, i.e. the FTX native token.

Funding and Partnerships

In 2021, FTX raised $900m from more than 60 investors, including the venture capital firms Paradigm and Sequoia Capital and the private equity group Thoma Bravo. If that wasn’t impressive enough, in January 2022, FTX raised an additional $400m from large investors like SoftBank, Paradigm, Tiger Global and the Ontario Teachers’ Plan Pension Board, valuing the platform at $32 billion. FTX’s global volume monitor shows that the exchange now averages $16.9bn in daily trading volume.

The marketing team at FTX have acquired some incredible sponsorship deals. In June of 2021, FTX acquired the name rights to the most dominant esports organisation, TSM, for a $210m deal. This strategic partnership embarks on a new set of industry-leading initiatives and specifically seeks to invest these resources into esports and gaming over the next five years. Another e-sport related partnership was with Riot Games' League Championship Series (LCS) for an unprecedented, seven-year partnership and the longest esports and crypto crossover in history.

In a first-of-its-kind partnership between Major League Baseball (MLB) and FTX, the FTX patch will be worn by MLB umpires debuting at the ‘21 All-Star game and by all umpires at MLB regular season and postseason games. This partnership will undoubtedly create increased brand awareness for FTX among MLB viewers.

Apart from sports-related partnerships, FTX has partnered with payments giant Stripe. They aim to deliver a new seamless onboarding and identity verification flow for users joining the exchange, as well as powering payments for users adding funds to their FTX accounts. This partnership will enable a seamless payment experience for users looking to pay in with debit cards, credit cards, and Automated Clearing House (ACH) transactions directly from bank accounts.

In March 2022, FTX announced that they are partnering with AZA Finance to expand the use of digital currencies and the web3 in Africa. AZA, which offers services including Treasury functions and payments in 10 African countries, plans to build digital infrastructure to connect African markets to the global web3 economy. This partnership should allow FTX to capitalise on Africa’s fast-growing population, which is expected to double by 2050, and the already rapid adoption of digital technologies by Africans who often have little access to traditional banking services.

FTX has also onboarded some well-known celebrities as shareholders and global ambassadors. These include Tom Brady, Gisele Bundchen, Stephen Curry, David Ortiz, Kevin O’Leary, Udonis Haslem, to mention a few.

What is FTT?

FTT is an ERC-20 token and is the backbone of the FTX ecosystem. The token has been carefully designed with incentive schemes to increase network effects and demand for FTT, with a burn mechanism to decrease its circulating supply.

As mentioned previously, FTT holders are eligible for discounted trading fees, ranging from 3% to 60%, depending on the amount of FTT held. What particularly caught my eye was that the discounts are applied according to the USD value of the FTT tokens you hold, which, in my opinion, is a lower entry requirement for newcomers. To access similar discounts on other exchanges, you would need to hold a specific amount of the exchange token, and if the token sees a price surge (looking at you, BNB), then those holder discounts become inaccessible to many.

Furthermore, FTX has an insurance fund to protect traders from clawbacks. When and if this fund sees a positive price action, FTT holders can receive a free bonus payment. This is what FTX refers to as socialised gains.

Another important aspect of FTT is the supply, as it is deflationary. FTX aims to burn 50% of all FTT in the long run, which can lead to a bullish price action, provided there is still demand for the FTX token. Lastly, FTT can be used as collateral on FTX, which, combined with reduced trading fees, could further increase the demand for FTT, especially amongst large crypto traders.

FTT Tokenomics

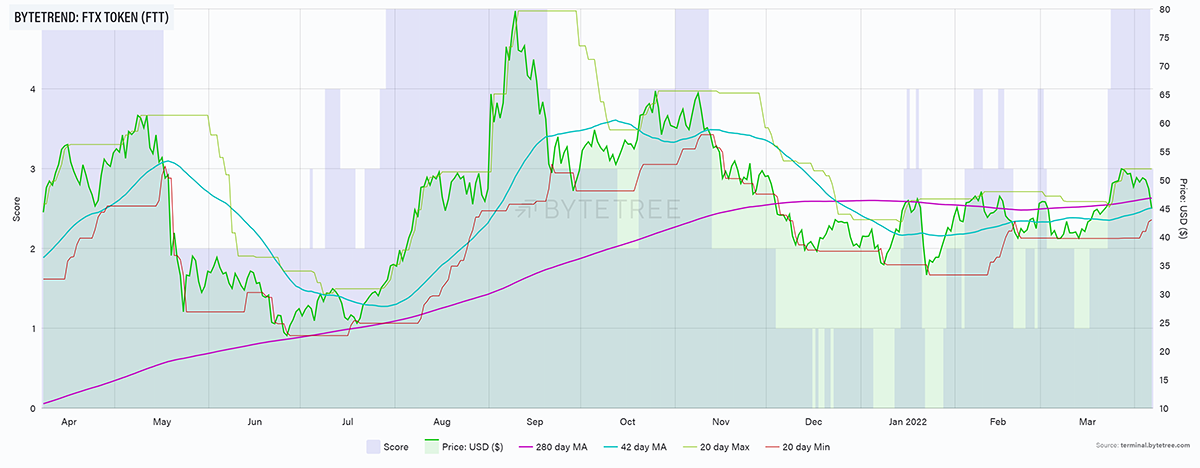

FTT was first listed in April 2019. After seeing substantial growth of 22% in the past month, FTT is priced at around $50.43, with a $15.88bn market cap. FTT has also demonstrated a strong and relative price trend up until recently, holding a 5-star rating on ByteTrend since the latter half of March 2022.

The circulating supply of FTT is approximately 266.07m tokens, with a max supply of around 333.16m. FTT tokens bought from FTX will have a transaction fee, one-third of which will be utilised to repurchase FTT tokens that later become a part of the burning process. To date, over 16.8m tokens have been burned, and an additional 116,140 FTT are pending to be burned.

FTT had its longest bull run from Sep 2019 to May 2021, lasting for 614 days. During this time, FTT increased from $1.1497 to $61.4848, resulting in a mind-boggling return of 5247.9 %.

Recent Announcements

In late February 2022, FTX announced its Future Fund. This philanthropic fund empowers ambitious projects through investments and grants. To qualify for this fund, a project needs business strategies that aim to improve humanity’s long-term prospects. This fund plans to distribute at least $100m in 2022 and is particularly keen to invest in massively scalable projects that could grow to productively spend tens or hundreds of millions of dollars per year.

The scope of projects covered by the Future Fund includes, but is not limited to:

- Development of artificial intelligence,

- Reducing catastrophic biorisk

- Safeguarding societal values, cultures and beliefs

- Improving economic growth

- Building great power relations

- Developing space governance

This fund will undoubtedly enable FTX to form key partnerships with bleeding-edge technology startups. How this fund may prove to be beneficial to the FTX ecosystem is yet to be determined.

In March 2022, CoinShares, one of the largest crypto investment firms in Europe, and the FTX crypto exchange partnered to launch a new physically-backed Solana (SOL) exchange-traded product (ETP). The product will be listed on Germany’s major digital market Xetra and is the fourth ETP rolled out by CoinShares in 2022. The physical staked Solana ETP is launching with 1 million SOL in seed capital, allowing investors to get 3% in staking rewards. This ETP will undoubtedly further solidify FTX’s position in the European market.

Another recent announcement came from FTX Europe, as it became the first firm to receive a licence to operate a crypto exchange and trading house in Dubai. The licence enables the exchange to trial crypto derivatives for institutional investors while also exposing crypto traders in the Middle East to the FTX ecosystem and indirectly to the FTT token.

Conclusion

FTT has a variety of utility within the FTX ecosystem, and the benefits FTT provides for crypto traders should keep the demand for the token relatively high. Another reason why I believe there will be high demand for FTT is the passive income that the token enables through its socialised gains programme.

In a short span of time, FTX has become one of the most popular crypto exchanges, which is reflected in the bullish price action for FTT. As the FTX exchange expands and onboards more users to their ecosystem, this momentum will undoubtedly continue.

Comments ()