Bitcoin Halving 2020; Then vs. Now

Disclaimer: Your capital is at risk. This is not investment advice.

Reviewing Past Predictions

Bitcoin’s network value has experienced parabolic growth over the last six months in line with a handful of other risk-on assets such as tech stocks. While growth was inevitable in hindsight, one must not forget that Bitcoin was worth just $4,600 this time last year. Anyone can speculate on price, but at ByteTree, we believe that Bitcoin’s market price is driven by two key factors: the network effect and macro positioning.

Our CIO, Charlie Morris, wrote this forward-looking piece in May 2020, titled “More Than Halving”. Now, ten months on, we look back on how the halving played out. Firstly, we asked whether Bitcoin’s price relative to speculative stocks would bring institutional participants, and secondly, whether an increase in Bitcoin’s network traffic post-halving 2020 would cause an outperformance of its previous 2019 bull-run (relative to speculative stocks).

“It seems like an age has passed since halving”

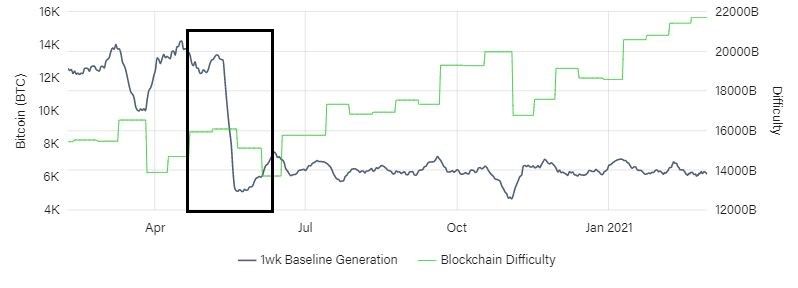

A Bitcoin halving occurs, on average, once every four years and halves the block reward, which is accountable for a large part of miners’ total revenue. In May 2020, the block reward fell from a weekly generation target of 12,600 BTC to just 6,300 BTC (see chart above).

Bitcoin’s May 2020 Halving

In May, many were speculating whether a halving would cause steep and positive price action for Bitcoin. However, at ByteTree, we chose a more data-driven angle when reviewing potential implications. Charlie Morris writes:

“Bitcoin is an asset, like many other assets, and over the past year, it does seem to be looking more conventional. That is probably a good thing because it implies that Bitcoin is maturing. The more people like Paul Tudor Jones that decide to come onboard, the more they will compare it to their other assets. The big gains in Bitcoin came about because it came to market at such a low price. The early Bitcoin trades implied a total network value of $250,000. You never get to buy stocks that low when there is such great potential ahead. In that sense, Bitcoin is a true outlier”

Nobody could have predicted the scale of high-profile investors that would proceed in the following six months; Stanley Druckenmiller, BNY Melon, Ruffer Investment, Massachusetts Mutual Life Insurance, Fidelity, PayPal, Apple, Elon Musk and Tesla are just a few of the names that have endorsed Bitcoin. It is fair to say that the current sentiment around Bitcoin shows a higher level of maturity, compared to 2017.

Not only have we seen vast institutional involvement, as Charlie alluded to in May last year, but Bitcoin’s narrative has evolved. Bitcoin is moving away from being compared to a speculative stock towards becoming a store of value, akin to digital Gold. Along with Bitcoin’s 550% price increase since May 2020, it is safe to say that the asset once pinned as a means for criminals to sell drugs on the dark web has grown into an institutionally attractive digital inflation hedge.

Bitcoin and Speculative Stocks

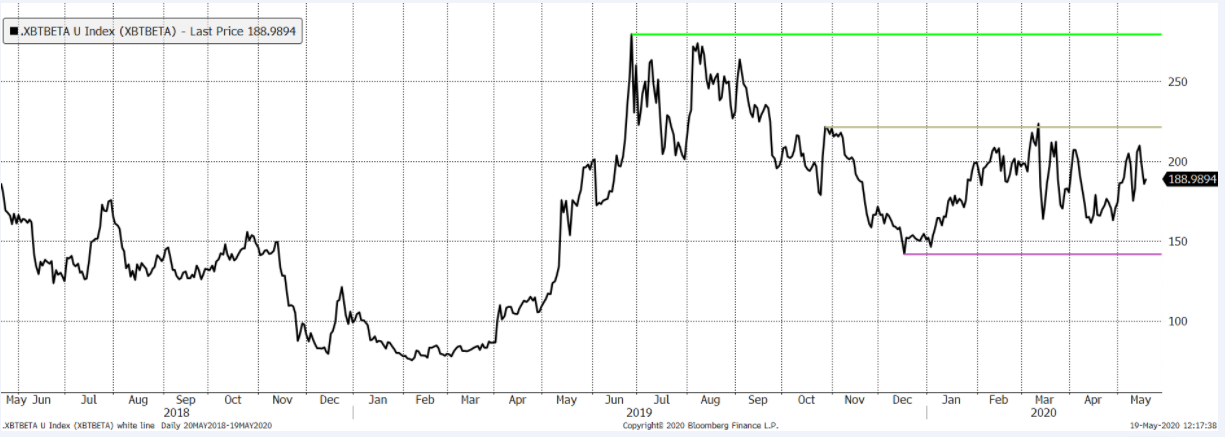

Speculative stocks are high beta, or high volatility, companies listed on traditional markets, here is Charlie’s analysis of the chart above:

“The three lines mark some reference points. The green line shows the relative high post-2018 bear market. The grey line takes us back to the pre-halving hype peak, and the purple line marks the late 2018 strength in stocks while Bitcoin was taking a break”

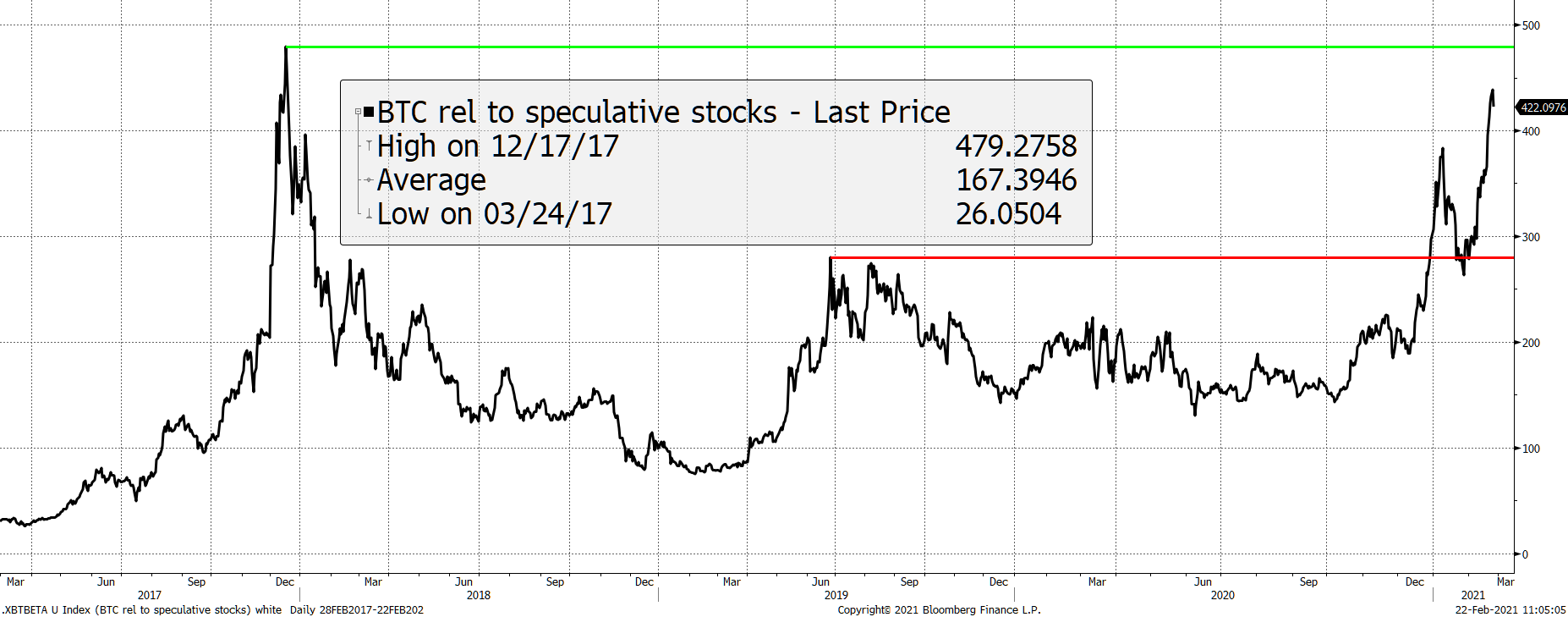

The red line, in this case, represents the relative high of the 2019 bull run and, Charlie goes on to say:

“Bitcoin needs to get ahead of the grey (215 level) line, which will see the next round of celebrity backers emerge. If it can challenge the green line (red in the above chart), expect some sensible old schoolers to get interested too.”

This is precisely what has been happening. Bitcoin’s relative price simultaneously broke those lines, and along with it came a flood of ‘old schoolers’, ‘celebrity backers’, and Bitcoin’s 19th double.

With the new types of investors entering the market and a much larger network effect, perhaps Bitcoin has a chance to reach an all-time high, relative to speculative stocks, indicating a true maturation from the risk-on asset group.

Bitcoin Network Traffic

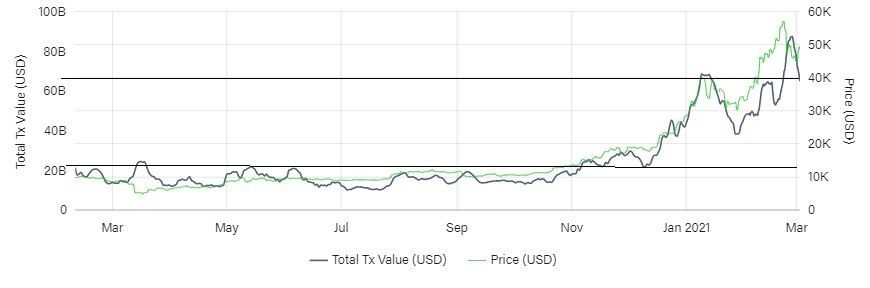

At ByteTree, we believe that a growing Bitcoin Network and an increase in institutional involvement are both key factors impacting the long-term success of Bitcoin as an immutable store of value. In his article from May 2020, Charlie highlighted the network traffic to be in the region of $18bn per week (see ByteTree Terminal), and stated that:

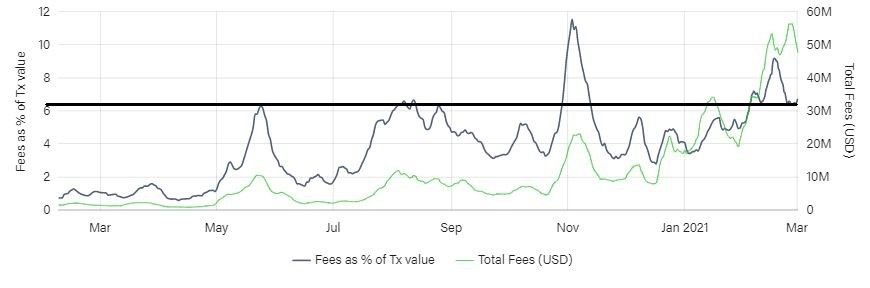

“Network traffic is $18 billion, but that needs to keep on rising if bitcoins want to push through the magical green line. The challenge here is that high fees will deter transactions. Over the past 24 hours, a transaction fee is $6.20.”

Since the new year, we have seen the fees relative to the transaction value grow exponentially. This chart is worth keeping an eye on as, at some point, fees will deter transactions, resulting in the Bitcoin Network slowing. As our view is that the network effect is key to the success of Bitcoin, a slowing network will have negative mid-term consequences and is likely to cause Bitcoin’s price to consolidate at the next available support level.

While fees were typically 1% of transaction value in May, they are now nearly 9% - a 900% increase. On the other hand, total network transaction value (also known as network traffic) has not experienced an aggressive increase, only growing by 300% - a third of %fees.

Although an expensive-to-use network has negative connotations, it is not as bearish as it sounds when Bitcoin has an increasing network value. Investors must realise that %fees above the yearly average is synonymous with a negative or slowing network effect because it signals a peak.

Summary

Charlie’s outlook is still very relevant when considering the current Bitcoin market; institutional involvement, the continuation of Bitcoin’s inflation hedge narrative, and its outperformance relative to speculative stocks are paramount to its future success. However, investors must not underestimate the dependency these aspects have on Bitcoin’s network traffic growing, and fees staying low.

Comments ()