More Than Halving

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 26

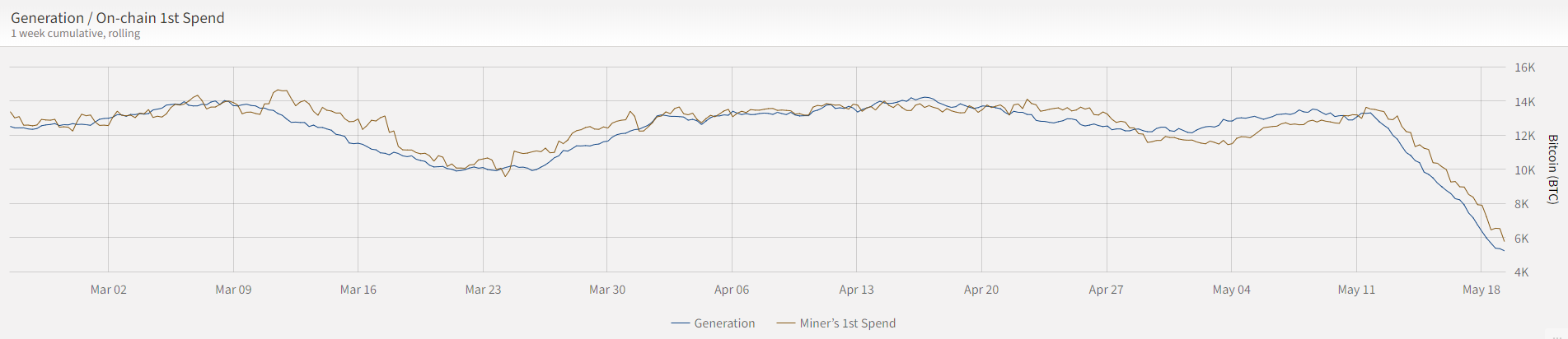

It seems like an age has passed since halving, yet it was eight days ago. Over the past seven days, we had expected to see 6,300 Bitcoins created in contrast to the previous 12,600 weekly target.

Of course, the network difficulty adjusts that, so it never is right on target, but by design, 6,300 per week ought to become the new normal. Yet this past week has seen just 5,269 new Bitcoins created. Conclusion, mining has become too difficult, and the next adjustment will see a sharp drop.

We were supposed to see a little over 2% inflation, yet that is a mere 1.5%. If the miners selling fewer coins into the market was supposed to lift the price, then this past week casts doubts on that theory. Fortunately, ByteTree never believed it in the first place. Any holder of Bitcoin is free to sell, not just the miners, so why focus on them? Because it’s easy to do, and it is a lazy analysis.

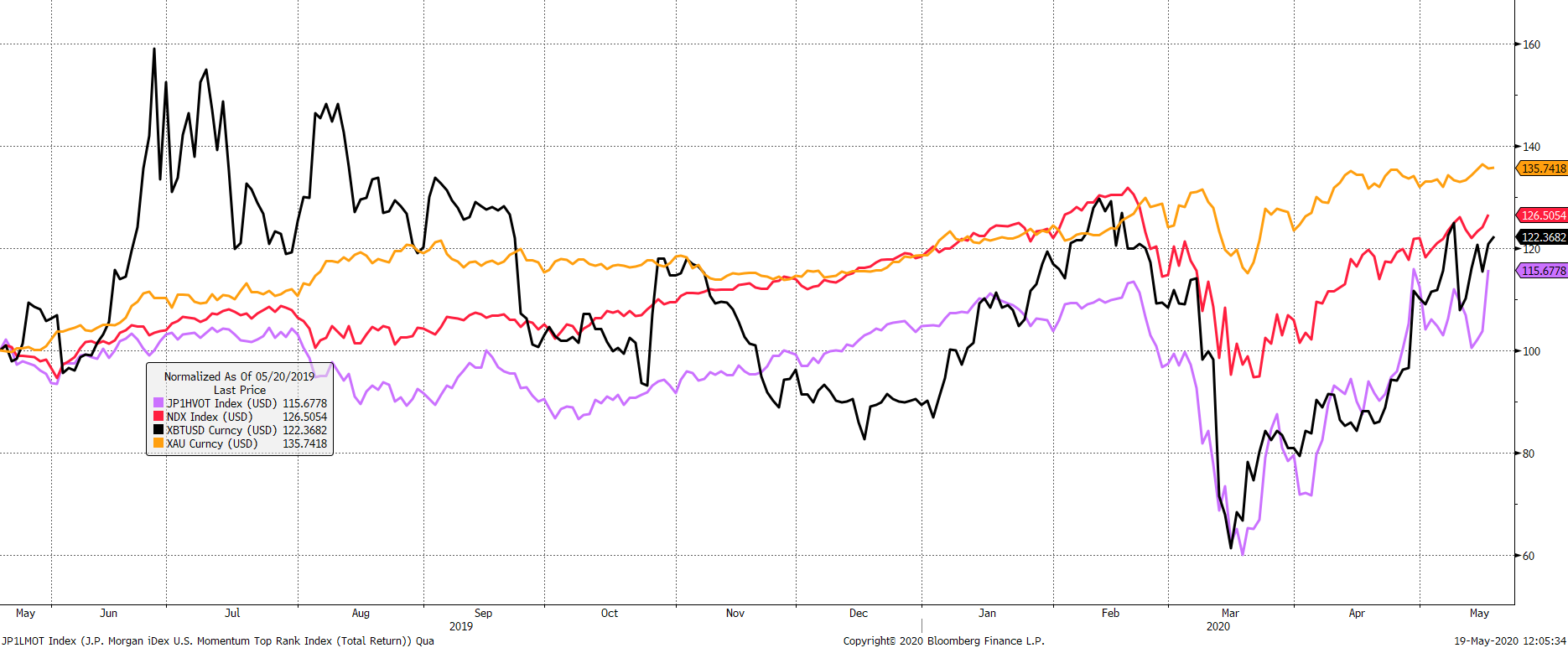

Bitcoin is an asset, like many other assets, and over the past year, it does seem to be looking more conventional. That is probably a good thing because it implies that Bitcoin is maturing. The more people like Paul Tudor Jones that decide to come onboard, the more they will compare it to their other assets. The big gains in Bitcoin came about because it came to market at such a low price. The early Bitcoin trades implied a total network value of $250,000. You never get to buy stocks that low when there is such great potential ahead. In that sense Bitcoin is a true outlier.

Bitcoin becoming more mainstream

The correlations have increased across the board, but the link that stands out are speculative stocks. I have long said, that Bitcoin has much in common with internet stocks, but they have become highly profitable and mature businesses. The likeness to speculation stocks (high beta or high volatility) stands out. If that holds, and more people start to see it that way, then relative performance becomes key; that is Bitcoin relative to speculative stocks. Rising means Bitcoin is winning and vice versa.

Bitcoin relative to speculative stocks

The three lines mark some reference points. The green line shows the relative high post-2018 bear market. The grey line takes us back to the pre-halving hype peak, and the purple line marks the late 2018 strength in stocks while Bitcoin was taking a break. Bitcoin needs to get ahead of the grey line, which will see the next round of celebrity backers emerge. If it can challenge the green line, expect some sensible old schoolers to get interested too. But it goes without saying that a visit to purple line will see capital flight.

That seems to be unlikely because the network demand model scores a healthy 6 out of 6. Fees were $8.7 million last week. Recall they were just $1 million a month ago. This is huge and tells us that the miners demand higher fees to manage their affairs. Network traffic is $18 billion, but that needs to keep on rising if Bitcoins wants to push through the magical green line. The challenge here is that high fees will deter transactions. Over the past 24 hours, a transaction fee is $6.20. It makes the postman look quite competitive, even if he takes a little longer.