Ruffer Allocates to Bitcoin - UK Wealth Managers Will Follow in Time

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 56

Before we start, there is a conflict of interest to report. In my capacity as the editor of the Fleet Street Letter, I recommended one of the Ruffer Funds in 2016 and still hold it to this day. From time to time, it has caused me some stick, as readers complain that the fund only goes sideways. I have defended them over the years by explaining that in the race between the hare and the tortoise, the tortoise wins. Ruffer’s strategy has always been off-piste and yet seems to win in the end.

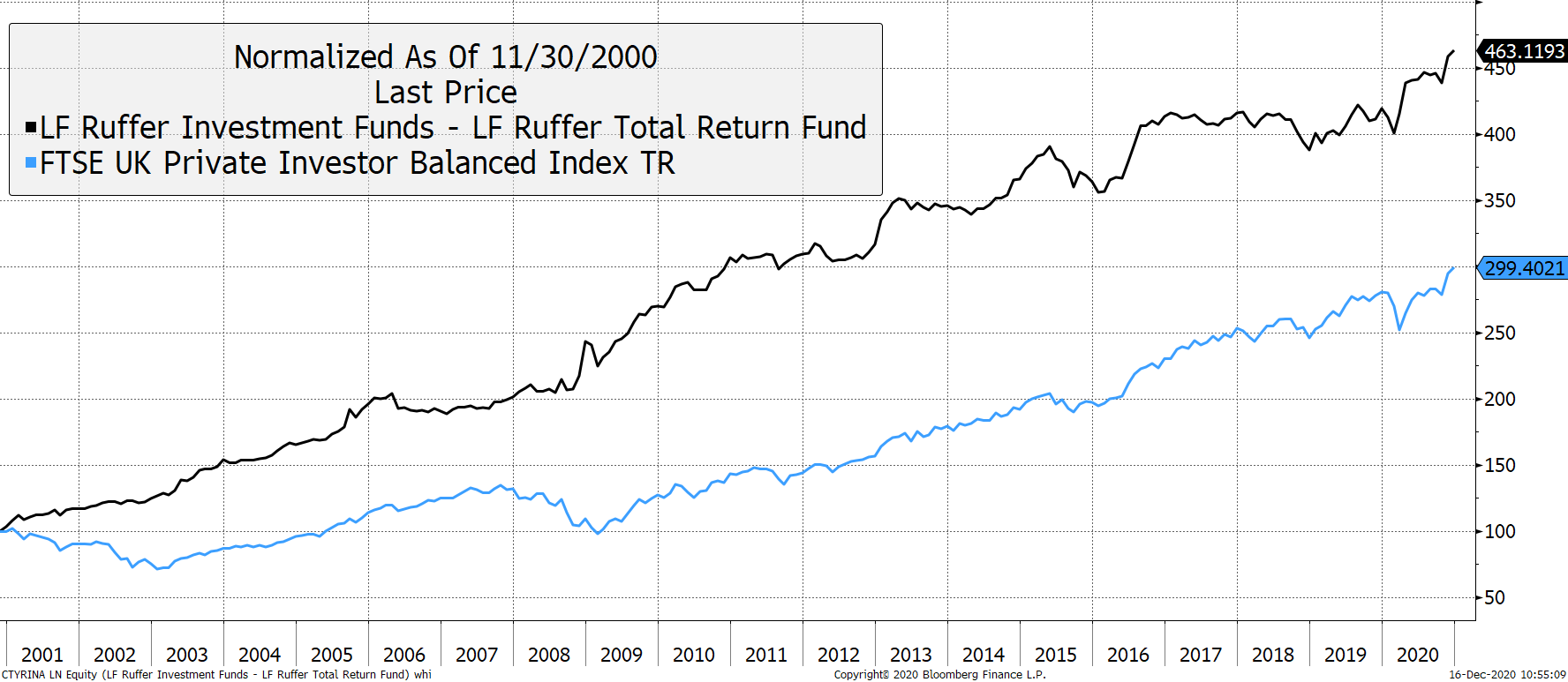

Ruffer track record versus a typical balanced portfolio

Ruffer was founded by Jonathan Ruffer in 1994. He is an accomplished student of economic history and spent many years as the strategist at Rathbones (a successful but conventional UK wealth manager). His objective was to achieve absolute returns for clients, by which he meant not losing money over a rolling 12-month period.

His approach is to always be prepared for both greed and fear at the same time. He sees risks to the portfolio on every side, so counterbalances risk asset exposures with large dollops of insurance. He doesn’t claim to be able to time the markets, so holds high-quality bonds in attractive currencies and equities in varying proportions but does not leverage the positions.

In 2008, the Ruffer portfolios avoided losses despite being long only. Hedge funds had the ability to go short, yet that didn’t save them. Many blew up. Ruffer didn’t need to short the market to protect their portfolios because they understood something that few did at the time. With a banking crisis and a deflationary (remember the oil price was high and the consensus was inflationary) shock coming, the price of government bonds would soar. He was right, and with a little help from a weak pound and a strengthening Japanese yen, the firm managed a positive 2008 for their clients.

I have met him on a few occasions. He pitched me his fund in 2007/8, ahead of the crisis. It was simple yet brilliant. He clearly knew what was happening, with an impending banking implosion around the corner. Quite apart from raving about the long bond and inflation-linked bonds, he was even excited by 5-year gilts, which threw me as I likened them to watching paint dry. He was right of course, as they surged in a way most of us felt wasn’t possible. On another occasion, I saw him in the quiet carriage on the train heading north. I gave him a note I was reading on deflation. He smiled, thinking who he?

Ruffer buys Bitcoin

They manage around £20 billion of assets. Many of their clients hold the multi-strategies funds, which is where they house “the weird stuff”. This fund now has a significant allocation to Bitcoin. This might be modest in the big scheme of things, but noteworthy nevertheless, as this must have been hotly debated internally. The multi-strategies fund does adventurous things, such as hoovering up one-month VIX call options last year for “50 cents”. They are now selling calls on gold. They have their finger on the pulse.

The presumption is that they view Bitcoin as an inflation hedge rather than a technology. Other inflation hedges widely held within the firm include 35% in inflation-linked bonds, both foreign and domestic, and some inflation-sensitive equities.

Their largest stock is Lloyds Bank at 2.5% of all assets. Bitcoin maximalists will be rolling around with laughter on hearing that. They also own Barclays and Nat West. Carry on laughing! They see value and understand that banks are inflation-sensitive too. Recall in 2007/8, they didn’t own the banks, yet now they do. They were a bubble then, but not now.

Implications

I’m guessing Ruffer are on board with the standard macro narrative. An exposure of, say 2.5%, to Bitcoin could make a meaningful difference to the upside but won’t make much of a difference to the downside. It’s an easy number to justify, which is why it’s a number I happily suggest when an investor calls regarding our Bitcoin funds.

This news is important because they are a well-regarded firm among UK wealth managers. They can no longer pretend Bitcoin is irrelevant, a fad or too speculative. I believe UK wealth will have to find ways to follow suit.

Ruffer are in, and they are not speculators. Speculators buy tech stocks and Ruffer have few. They understand intrinsic value, while avoiding bubbles. They see something here, having undergone rigorous due diligence. They have carefully weighed up the risk versus the opportunity, and Bitcoin has come out on top. That doesn’t make it right, nor risk-free, but it is always comforting to be on the same side of a trade as Ruffer.