Bitcoin Divorces Tech

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 34

Having a multi-asset class background, I have always wanted to learn more about the external factors that make an investment tick.

Like every asset, Bitcoin has its own fundamental drivers, but can’t escape the winds and tides that can have an overwhelming influence from outside. From 2010 to 2012 or so, it is fair to say that Bitcoin was finding its place in the world and external forces didn’t seem to matter. But ever since, it has been more connected than many people think.

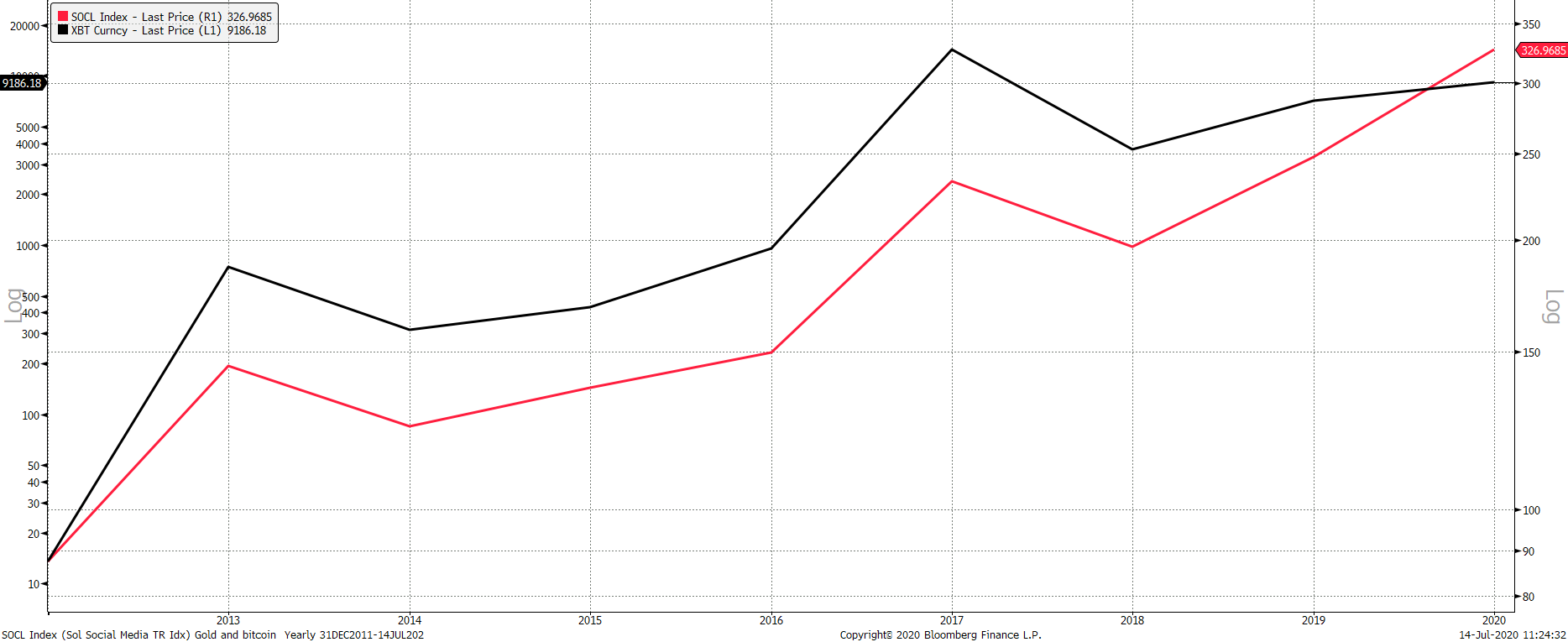

Some time ago, I highlighted that Bitcoin had much in common with internet stocks, and social media stocks in particular. In my opinion, the link was that they were both network effect situations based around the internet. Social media exchanges pictures of cats, while Bitcoin exchanges billions of dollars every day. This link has not necessarily shown up on day to day price moves, but over the longer term, the year by year link is inescapable. For whatever reason, Bitcoin and social media have risen in and fallen in sync. They both rose in every year except for 2014 and 2018, when they both fell. Coincidence? Don’t be ridiculous.

Bitcoin and dotcoms

The last chart ends at the beginning of this year. Clearly the axes have different scales, as Bitcoin has outperformed everything, but the shape and direction of the moves have much in common. Not only were the up and down years a match, but the slope of the calm and bubble years was too. The assumption must surely be that internet investors in general, are keen followers of Bitcoin.

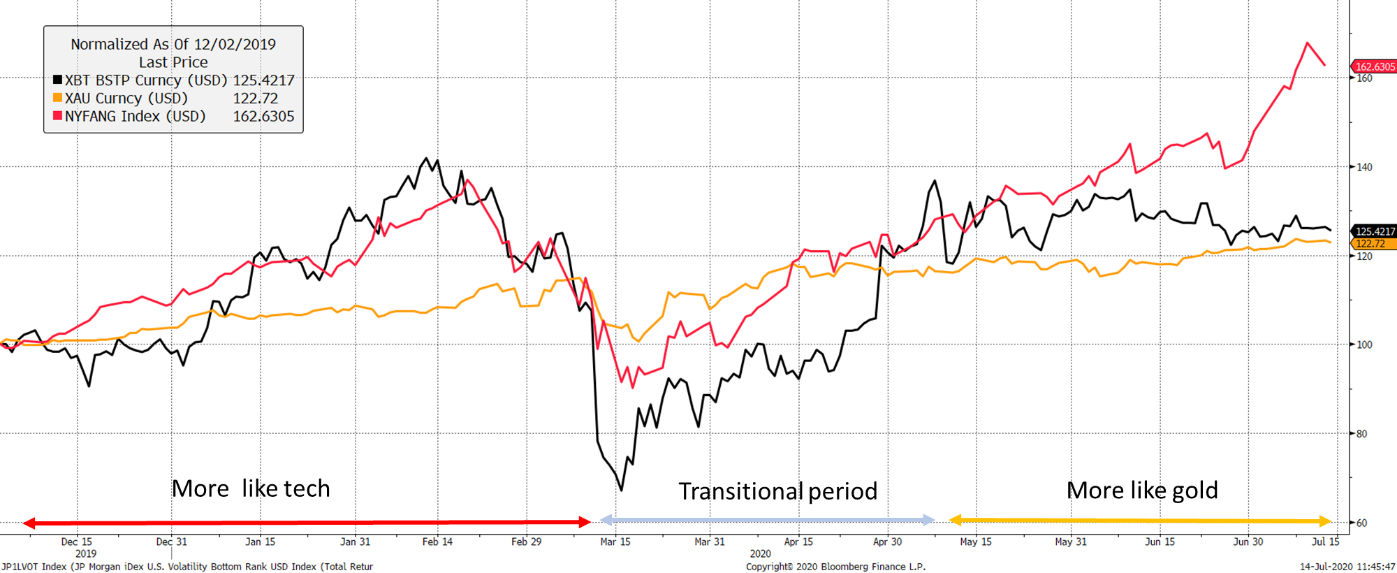

Moving onto 2020, an interesting year by any measure, you can see the link to Bitcoin and the NY FANG+ Index (leading internet stocks). Bitcoin and the FANGs were joined at the hip until COVID came along. Bitcoin broke down harder and faster, only to recover in late April. Since that time, Bitcoin has become becalmed, while the FANGs (and Tesla) have surged.

Bitcoin divorces tech (and has a fling with gold)

As I highlighted last week, Bitcoin volatility has collapsed to just 23%, which is below the Nasdaq (25%) – a rare occurrence. Since November, gold and Bitcoin have become a performance match and the link to speculative tech has waned. Bitcoin seems to be ignoring the Fed liquidity-induced surge that has driven tech. If this follows through, it will be great news, because Bitcoin’s macro credentials will become clearer. A divorce from tech would be a welcome outcome.

The tech bubble is clearly in its late stages, and Bitcoin could be the great switch. The Nasdaq surge this year has added around $3 trillion to its value. If a little bit of that headed towards Bitcoin, a new all-time high would be a done deal. I am not suggesting that Bitcoin is primed to surge in the short term. Indeed, a tech collapse will shake asset prices across the board. But this could be an opportunity for Bitcoin to find a new path. That would be a fabulous outcome.

ByteTree Data

I wanted to share an insight. Regimes change and Bitcoin in 2011 is a very different animal to Bitcoin in 2020. To that end, and now there are two whole years of data, ByteTree did a backtest from mid-2018 to see what has changed in recent history to longer periods. In total there were around 10,000 data tests, so it was a substantial project. Most things didn’t surprise us much, but some things stood out and I’ll highlight a simple transaction model.

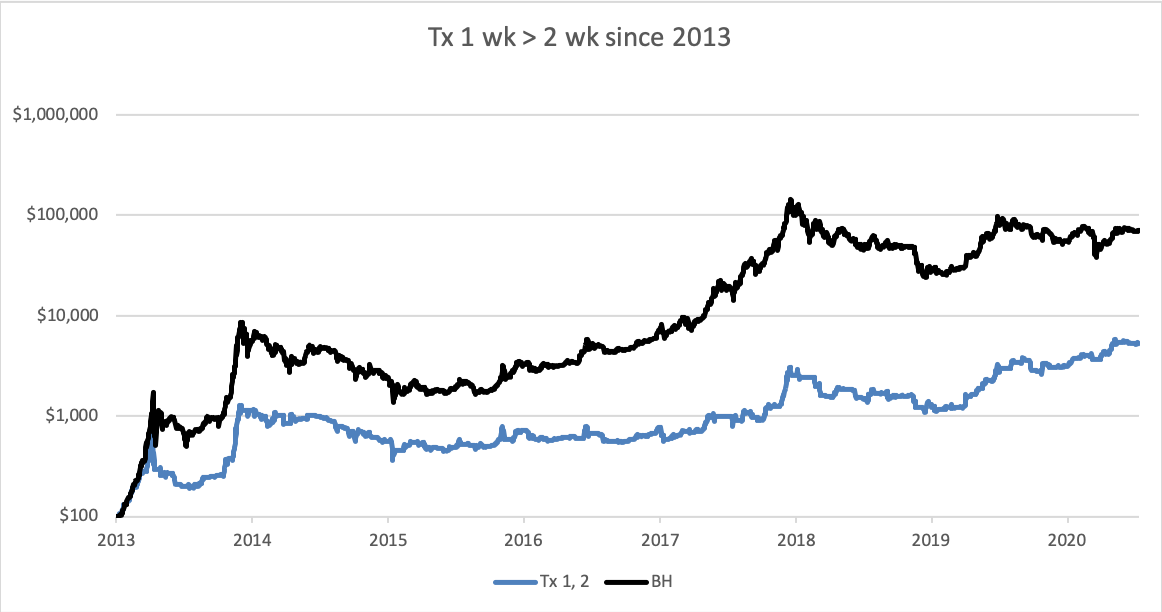

Take the weekly number of transactions and the bi-weekly transactions (average over 2 weeks). When the 1 week Tx > 2 week Tx, then own Bitcoin, else stay in cash. Since 2013, this strategy has been hopeless.

Long when 1 wk Tx > 2 wk Tx since Jan 2013

You’d have missed out on a fortune following this strategy as it kept selling the bull runs in 2013, 2016 and 2017, yet has been defensive during bear markets, by avoiding the worst losses. That’s unsurprising because it avoids the periods of network decline (when transactions are falling).

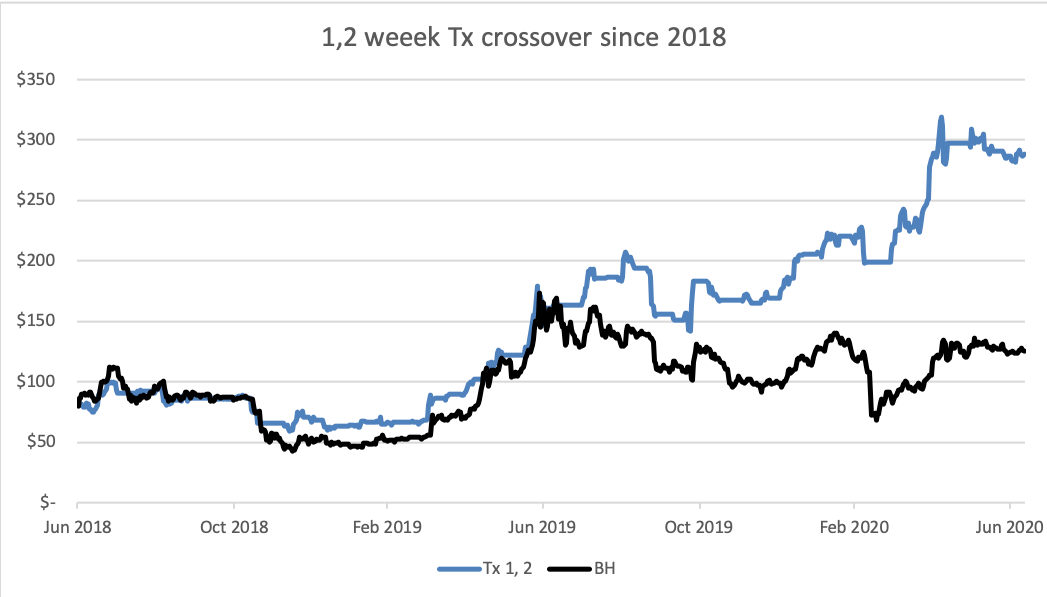

But since 2018, during a range bound market, Bitcoin has made little gain in two years. Yet this simple strategy has consistently dodged the bears, and recovered more quickly during the bulls.

Long when 1 wk Tx > 2 wk Tx since Jan 2018

The strategy has a high turnover, but if you have efficient market access, then it’s a great idea. But here is my Top Tip. Do not follow this model when the market starts trending. If Bitcoin makes a new all time high, it’ll be time to HODL.

A little taster of what awaits our premium clients in due course.

Network Demand Health Model

The latest score is 4 out of 6 which is healthy. However, Bitcoin still trades at a premium to the ByteTree fair value at $7,358. If tech blows up, then the turbulence will put pressure on all asset prices. Yet, I expect any decline to be modest compared to tech, and that will be a very bullish set up over the long-term.

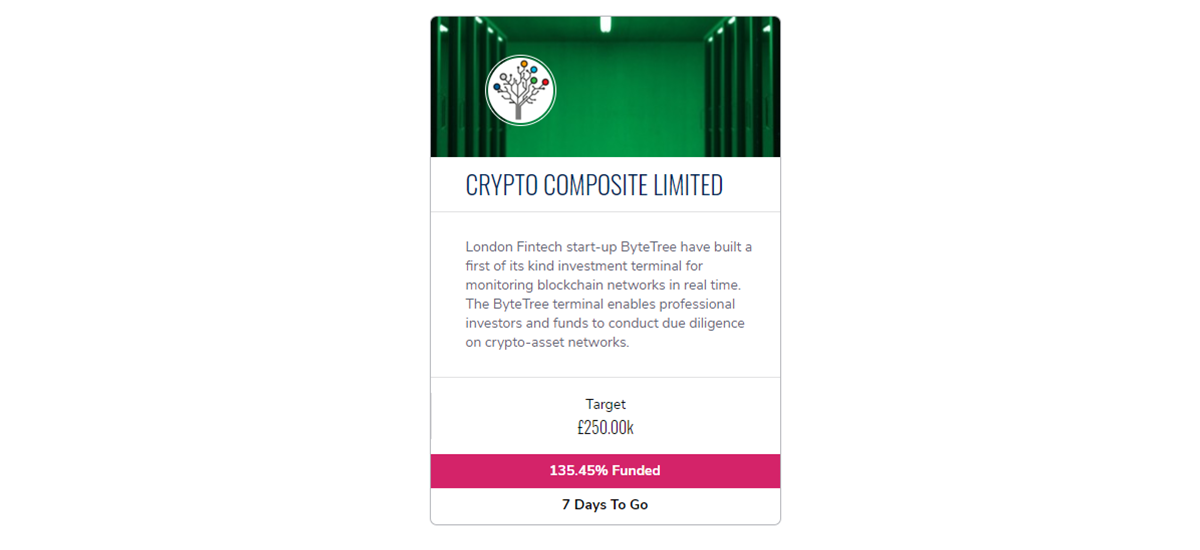

ByteTree fundraise

With just 7 days to go, I am delighted to say we are 35% oversubscribed with a further 15% of pledges.

Thank you to those who have taken part. The offer will be closed on Tuesday 21st July or when we reach the hard cap. If you would like further details please email investors[at]bytetree.com.

There’s no time to lose.

Summary

The waning of the link between tech and Bitcoin in recent weeks is interesting. A few weeks of data shouldn’t mean anything, but we are living through a generational tech bubble. These things don’t happen often, and the good news is that Bitcoin appears to be an outsider. Perhaps the physical separation of Bitcoin from traditional finance has held it in good stead. The exclusion from major indices such as the Nasdaq and the S&P 500 means that it has avoided the wider liquidity surge. Thank goodness for that.

Comments ()