The Importance of Macro in Understanding Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 29

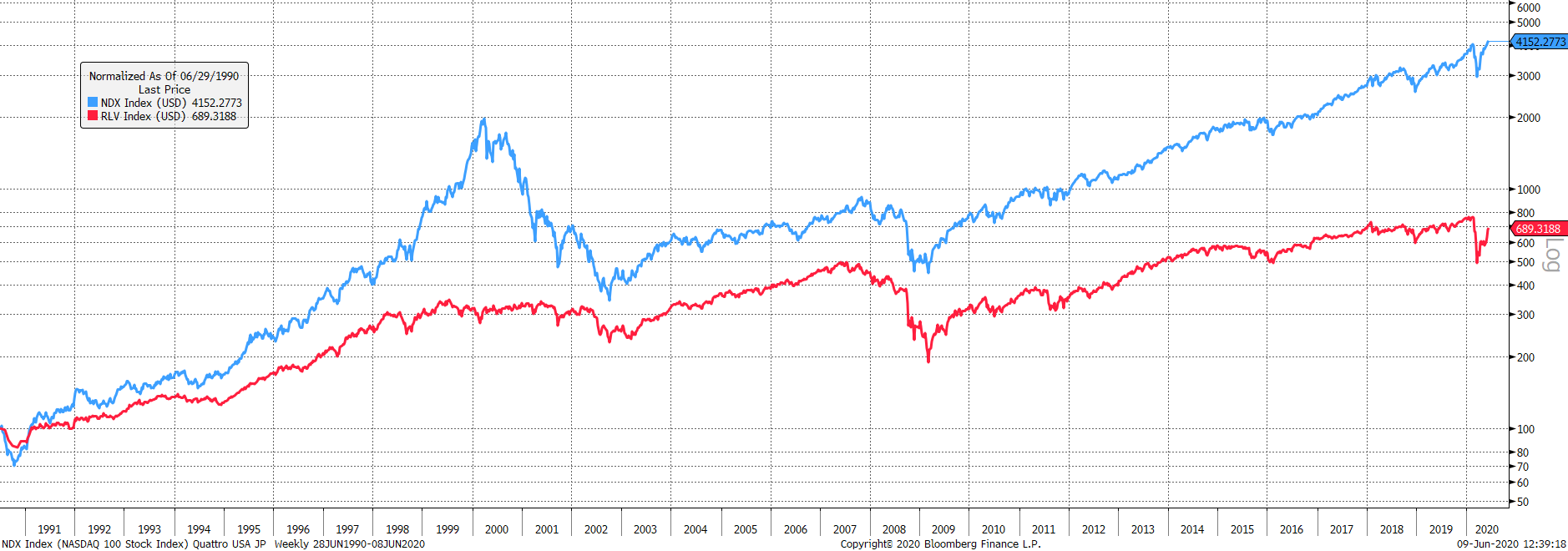

The old stockmarket is where the action is right now. One simple way to think about stocks is by looking at growth and value. Growth is the sexy stuff from Silicon Valley whereas value is the greasy old world ranging from banks to oil. Since 1990, growth has been the clear winner, notwithstanding the slump between 2000 and 2002.

The Nasdaq versus the old world

Looking at value relative to growth, value has started to outperform, just as it did 20 years ago. There are several reasons why the move won’t be as large as last time, as it was in 2000, primarily because the Nasdaq might be in a bubble, but it’s nothing like the year 2000. Now that was a real bubble.

Value starts to move

But value will outperform the Nasdaq for a while because the world is going back to work, the Fed is stimulating the economy and value is dirt cheap. Notice the year on year downtrend for this relationship. It accelerated downwards in 1998/9, just as it did recently. With the top five US stocks worth 11% of global total market cap (the whole of Western Europe is 15%), there is plenty to give back.

Just consider how much growth was brought forward by the lockdown? How many new subscriptions were there to Teams, Netflix, Apple Music, and how many extra Amazon deliveries? But as the lockdown comes to an end, I suspect that would be an odd time for many to subscribe to these services and Amazon parcels will slip back towards pre-COVID levels. That means tech is priced for perfection and is set up for disappointment.

The relevance to Bitcoin is that, as I have shown many times, it behaves like a tech stock. Here is Bitcoin compared to the NY FANG Index. There can be little doubt that they have become joined at the hip.

Bitcoin and FANGS

They have both had a good year, but then along comes this recovery trade, which has started to get going in a spectacular manner. The distressed old economy stocks have practically kept up with the FANGS and Bitcoin this year. Amazing.

Bitcoin, the FANGS, and the recovery trade

It is important not to think of Bitcoin in isolation. All asset prices are connected to varying degrees. I suspect we will get the Bitcoin breakout but not until the post-COVID recovery is complete, and the FANGS resume their upward journey. There is no rush. As the market saying goes, the longer the wait, the bigger the break.

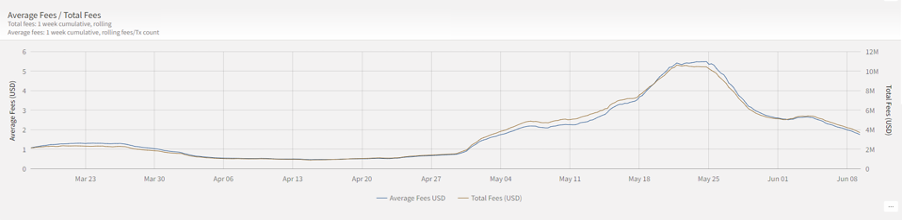

Onto the blockchain, fees continue to fall. This is good news because it enables cheaper transactions, but potentially bad news because it can show falling network activity.

Fees are sliding

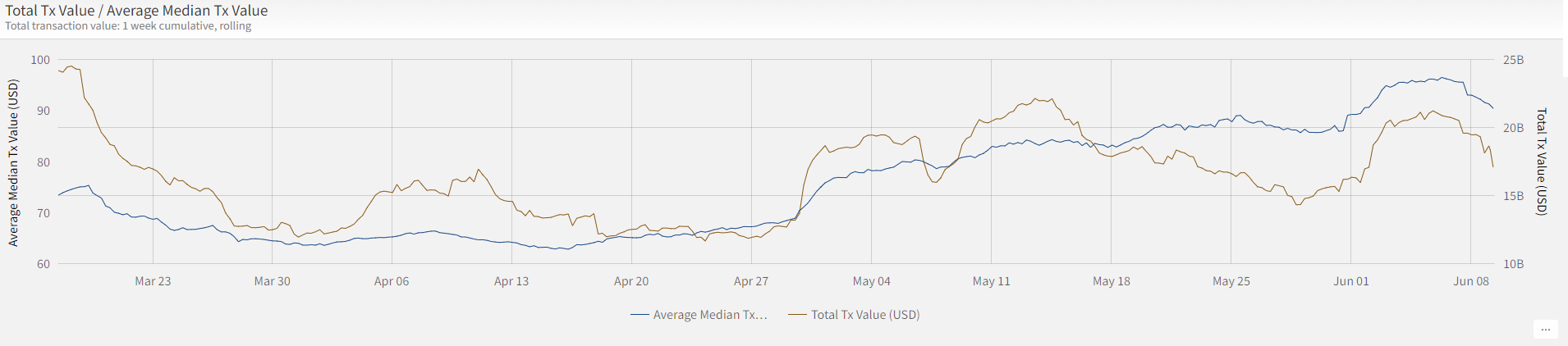

Sadly, Bitcoin seems to keep rejecting $20 bn per week of transaction value. This is the primary way that we value Bitcoin. For the price to go to $20,000, we need to see this double – at the very least.

The network rejects $20bn transaction value per week (again)

Summary

My macro two cents view is that Bitcoin is temporarily out of favour for the same reason tech is. There’s nothing wrong with tech, it just needs to take a break while the value rally plays out. Once it does, we might just see that breakout. And this time, the institutions will participate. It will be huge.