Is Bitcoin the New Gold...

Disclaimer: Your capital is at risk. This is not investment advice.

...an Escape from China or a Tech Stock?

There is often chatter about Bitcoin’s link to gold. Given it was built around the idea of gold, that’s not surprising. More recently, the fall in the Chinese Renminbi is claimed to be a driver for the recent surge in Bitcoin.

After all, a billion Chinese people supposedly want to get their money out of the country, and Bitcoins will do that at the touch of a button. I will show you that these links have some merit, just not that much. There is, however, another comparison that works like a treat. It turns out that Bitcoin has more in common with tech stocks than anything else. I’ll go through each in turn.

Bitcoin vs gold

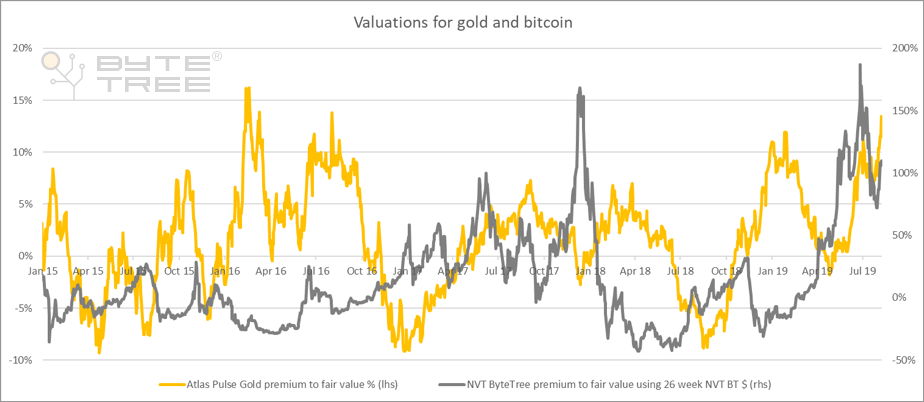

I have been writing Atlas Pulse on gold (and Bitcoin to a lesser degree) since 2012. I developed valuation models for both assets that show when they are overcooked and when they are shunned. I value gold by comparing it to long-dated TIPS. Gold and TIPS are highly correlated because they are both driven by real interest rates. If gold rallies but TIPS don’t, then gold surges to a premium valuation and vice versa.

For Bitcoin, I have used the 26-week NVT BT $* to determine the premium to fair value. 26 weeks is a fairly long time for Bitcoin, but it seems to have a better fit than the nearer time frames I experimented with. A high reading deems Bitcoin to be expensive and vice versa. Looking at the chart, these assets seem to have little in common. If they did, their premiums would move in sync. That said, I would agree that the fit has been strong in recent months. Perhaps Bitcoin is becoming the new gold, but there’s little evidence of that so far.

* For more information on NVT-BT $, read this blog post.

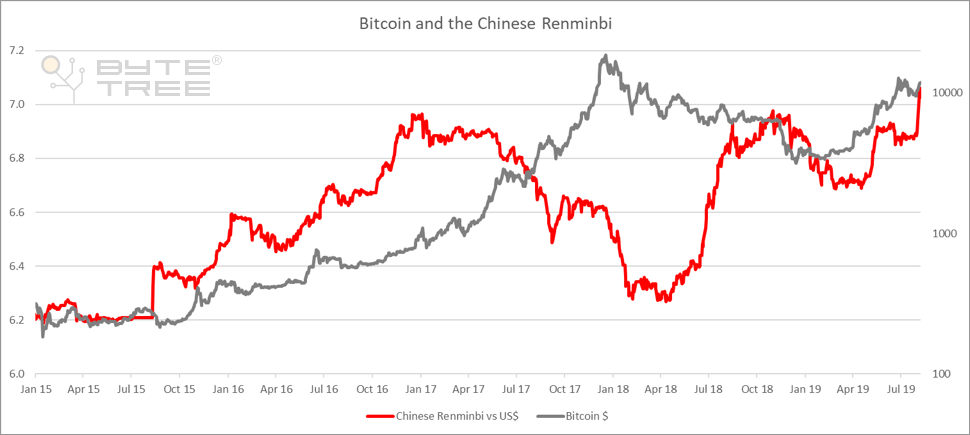

Bitcoin vs Chinese Renminbi

Next, we’ll look at the Chinese Renminbi. Both Bitcoin and the Renminbi rose together in 2015 and 2016. I recall, at the time, people were getting excited about money flooding out of China. Yet that trend reversed in 2017 when the Renminbi strengthened against the dollar (red line falls). Then in 2018, the Renminbi resumed its selloff while Bitcoin fell by 80% — the China story didn’t seem to help Bitcoin in its hour of need. By November 2018, the Renminbi strengthened, which coincided with a Bitcoin break below $6,000. That last downward move in the 2018 bear market was brutal, yet it did mark the end of the bear. The Bitcoin breakout occurred on 2 April 2019, and the fit between the pair has been pretty good ever since. This pair has a relationship, but it is a long way from being strong.

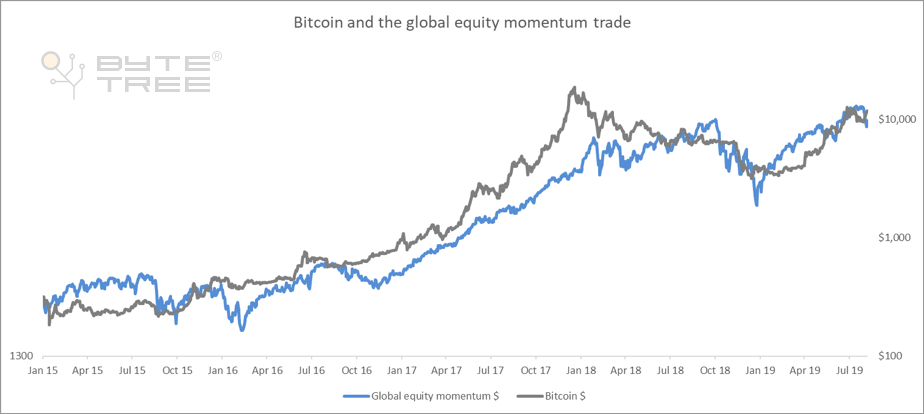

Bitcoin vs equity momentum

My last chart shows you Bitcoin against the global equity momentum** trade as represented by an ETF that trades in London (ticker IWFM LN). This close fit doesn’t surprise me because global equity momentum is currently dominated by technology stocks. It stands to reason that Bitcoin is linked to the internet trade that dates back to the 1990s because it was born there and thrives within it. Bitcoin seems to have more in common with Snapchat or Facebook than it does with gold or the Renminbi. I accept that some of the relative moves are imperfect, but generally speaking, the trends are well synchronised. It goes without saying that Bitcoin moves 10x relative to the stockmarket — in both directions.

** Equity momentum is where you select companies based on their strong past performance. This strategy is successful over the long term but suffers from periodic severe crashes. Under current market conditions, momentum stocks are acting as a safe haven and trading at high prices. The explanation is that tech companies are largely unaffected by a slowdown in the economy or trade wars etc. I have shown a similar chart before on Medium that compares Bitcoin to social media stocks.

Summary

Spurious correlations are always fun. Earlier this year, a chart did the rounds showing the tight fit behind the price of Bitcoin and avocados. The trend was even justified as Bitcoin is favoured by the youthful types, as are avocados. All those HODL profits were supposedly spent on overpriced breakfasts, causing a surge in demand. But it wasn’t to be because avocados have seasonal pricing. They surge in the spring and collapse in the autumn, presumably something to do with farming. It was only ever a coincidence in spring 2019 as both avocados and Bitcoin were rising at the same time.

In this piece, we have looked across the asset classes. Gold and TIPS swing between discounts and premiums. If Bitcoin were gold-like, you would reasonably expect some sort of link here because macro fears would respond similarly to both assets. The Renminbi may be a strong contributor to Bitcoin performance some of the time, but certainly not all of the time. But when it comes to tech stocks, Bitcoin fits like a glove. And that shouldn’t surprise you at all.

Our research demonstrates that the most important price driver behind Bitcoin is the network effect. The more people that use the network, the more valuable it becomes, something that equally applies to tech stocks. Bitcoin is a tech stock. Recognising this some years ago, we set out to measure the value of Bitcoin by measuring its network. And that is why we built ByteTree. Please take a moment to have a look at the data.