Venture: Precious Metals Correction

Issue 106;

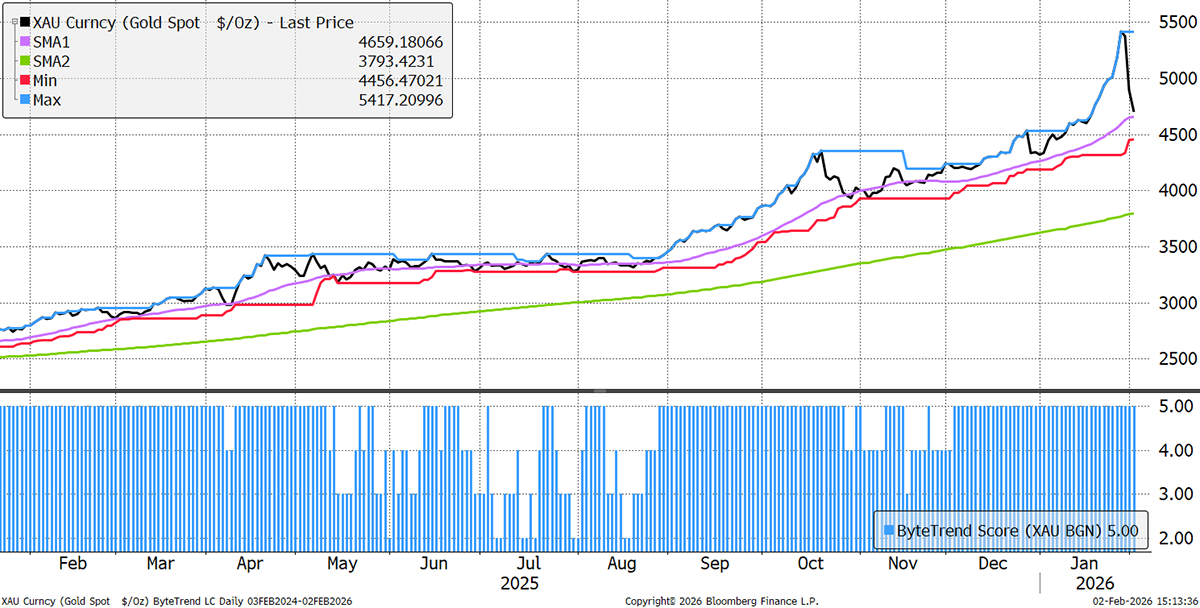

After a few brutal days in precious metals, I wanted to highlight some key charts before we get into some portfolio updates. Let’s start with the gold price, which fell by 8.9% on Friday and another 4.9% today. Remarkably, it has returned to its 30-day moving average and remains in an uptrend.

Gold USD ByteTrend Score 5 – Daily

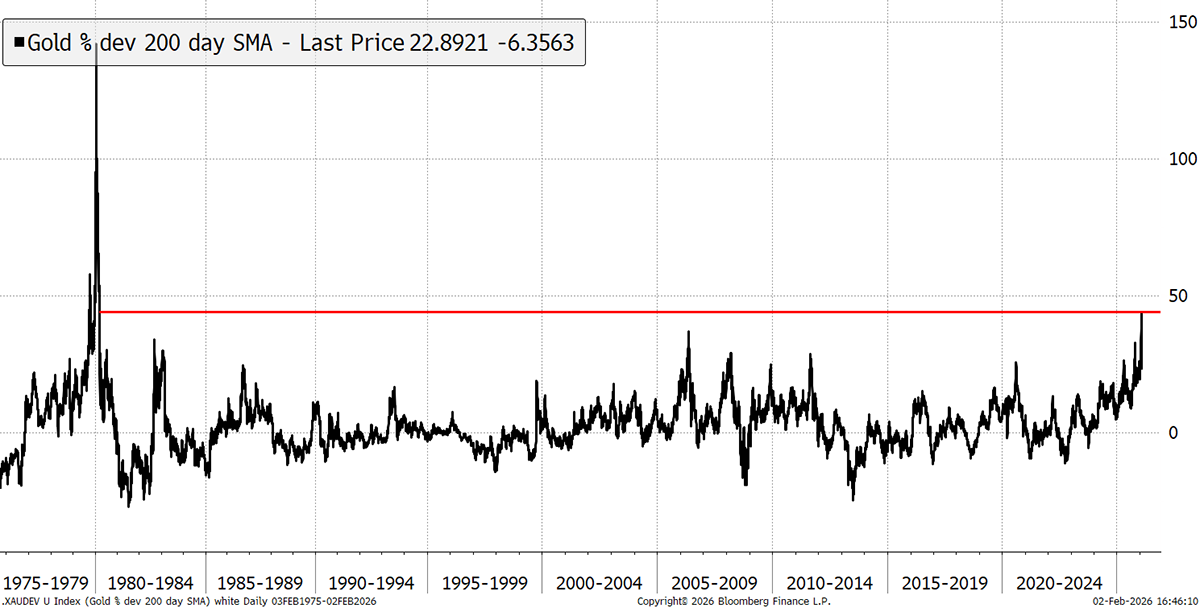

Since 1975, gold’s top ten weakest days are shown in the table below, and Friday’s move came fourth. Most occurred in the 1980 price crash, after the greatest bull of all time. One occurred in 2013, when real interest rates spiked, and another in 2008, when the world liquidated. The only comparable fall occurred in 2006, when gold last corrected from an overbought level within a bull market. I put this down to a historically overbought market.

Gold: Top 10 Weakest Days since 1975

| Date | Change |

| 22/01/1980 | -13% |

| 28/02/1983 | -12% |

| 15/04/2013 | -9% |

| 30/01/2026 | -9% |

| 17/03/1980 | -7% |

| 26/03/1980 | -7% |

| 04/01/1980 | -7% |

| 20/02/1980 | -7% |

| 13/06/2006 | -7% |

| 10/10/2008 | -7% |

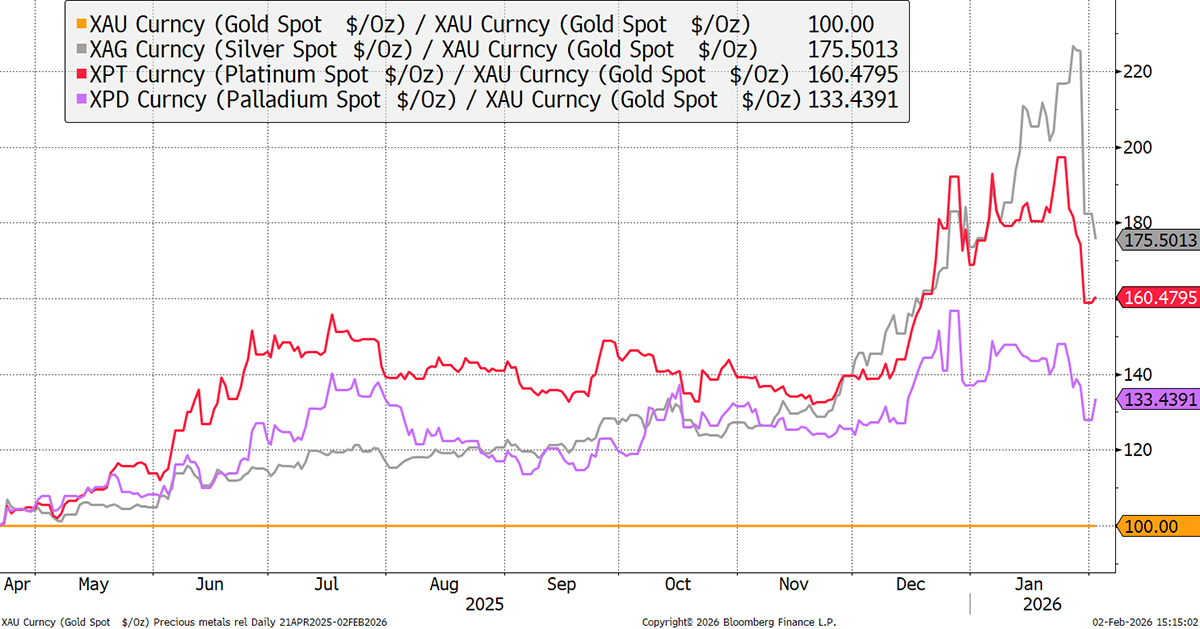

The relative performance of precious metals to gold tells the story. Silver was the leader, and palladium the laggard. Much of the excess performance came about since the end of November. The size of corrections is roughly proportional to the prior rallies.

Precious Metals Relative to Gold

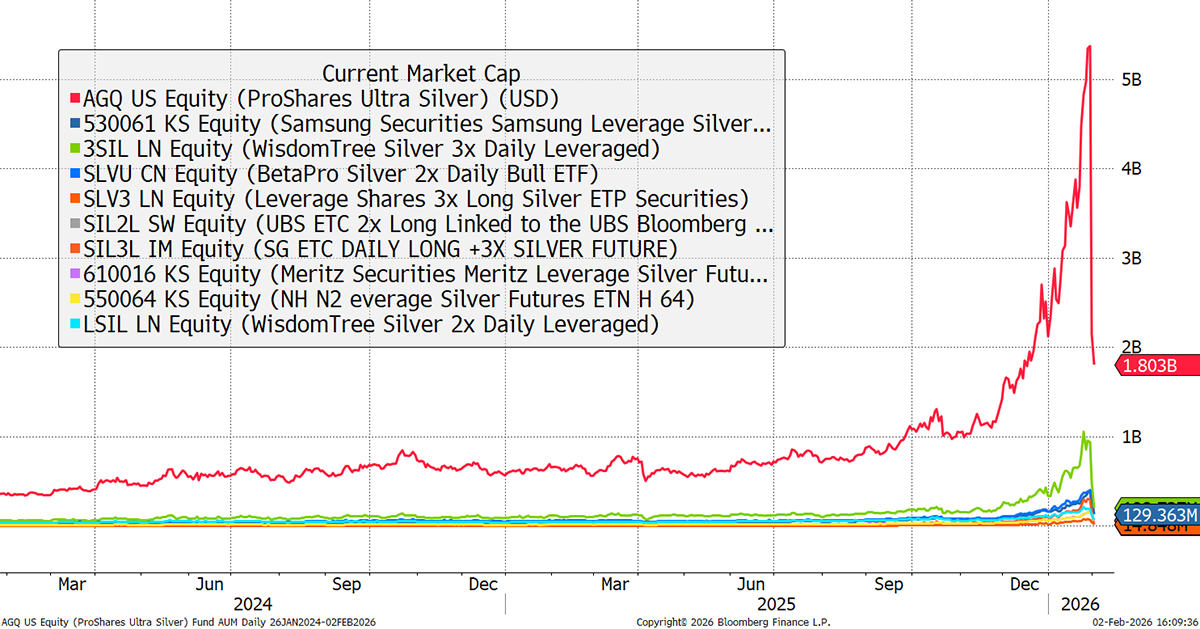

Silver has seen the price fall 32% since last week’s peak. There are more leveraged silver ETFs around the world than many had realised. They have wiped out $5bn, with AGQ giving up the most ground. As the silver price ground higher, the leveraged products grew from aggregate assets under management of just over $1bn in October to $7.5bn last week. Until last week, 3SIL was up 8x since late October, and it’s still up 2x after the price crash.

Leveraged Silver ETFs

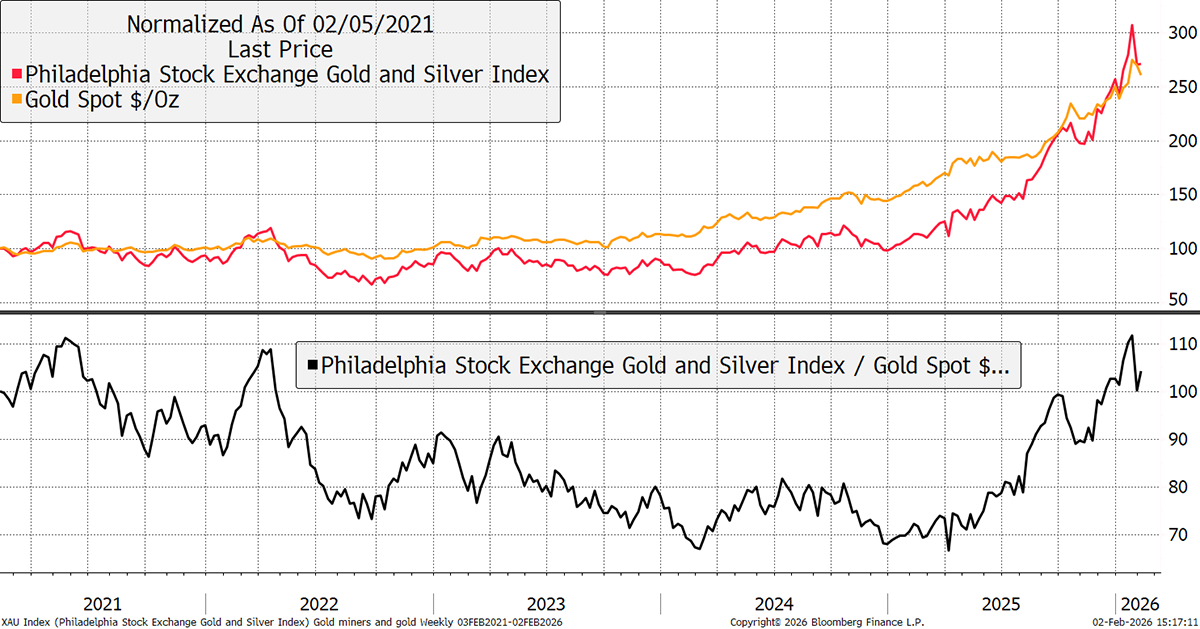

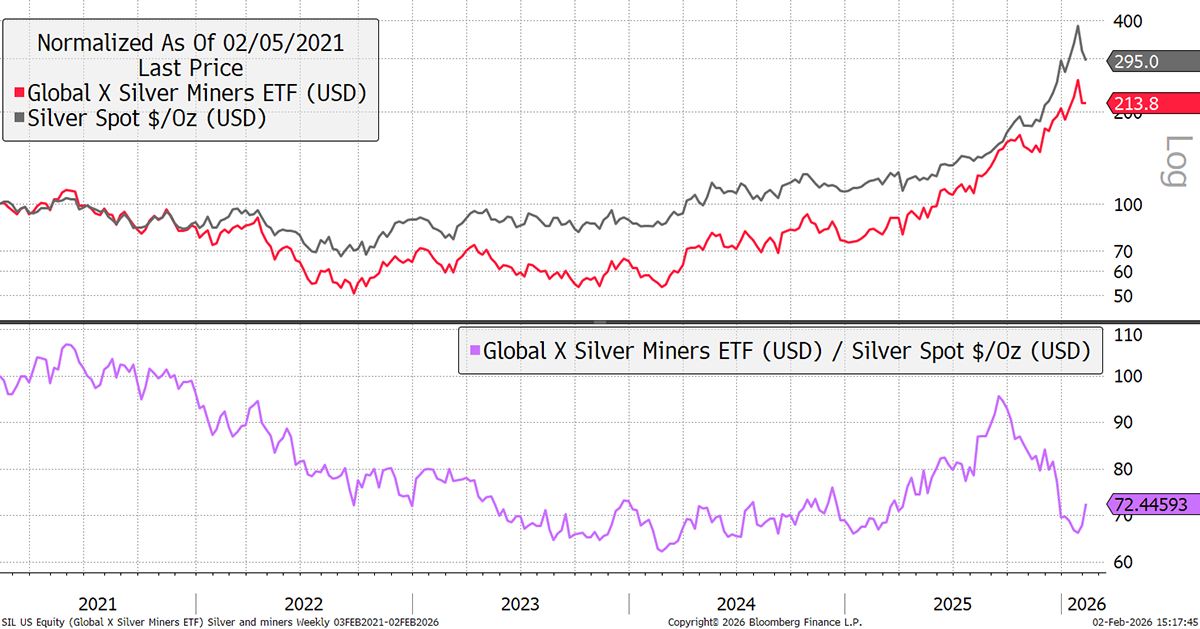

Most of ByteTree Venture’s interest exposure is through the miners. They have behaved relatively conservatively in comparison to leveraged ETFs. The miners have only matched the gold price over five years, when you might reasonably expect more upside. This has cushioned their downside in the recent correction.

Gold and Gold Miners

For the silver miners, even more so. They have heavily lagged silver in the post-October boom, which again, is now a blessing. Their lagging performance suggests investors didn’t fully trust the silver price. The silver stocks have fallen by less than the underlying silver price.

Silver and Silver Miners

The cat is out of the bag, and precious metals will sooner or later settle down. The narrative got ahead of the price. Last week, gold traded 44% above its 200-day moving average, a level only beaten in 1979. That was too far, too soon.

Gold Deviation from Trend

The central banks have underpinned this rally, and it is right to assume that they will turn out to be a stabilising force over the coming months and years.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd