The Black Hats Don’t Have Quantum Computers

ByteFolio Issue 196;

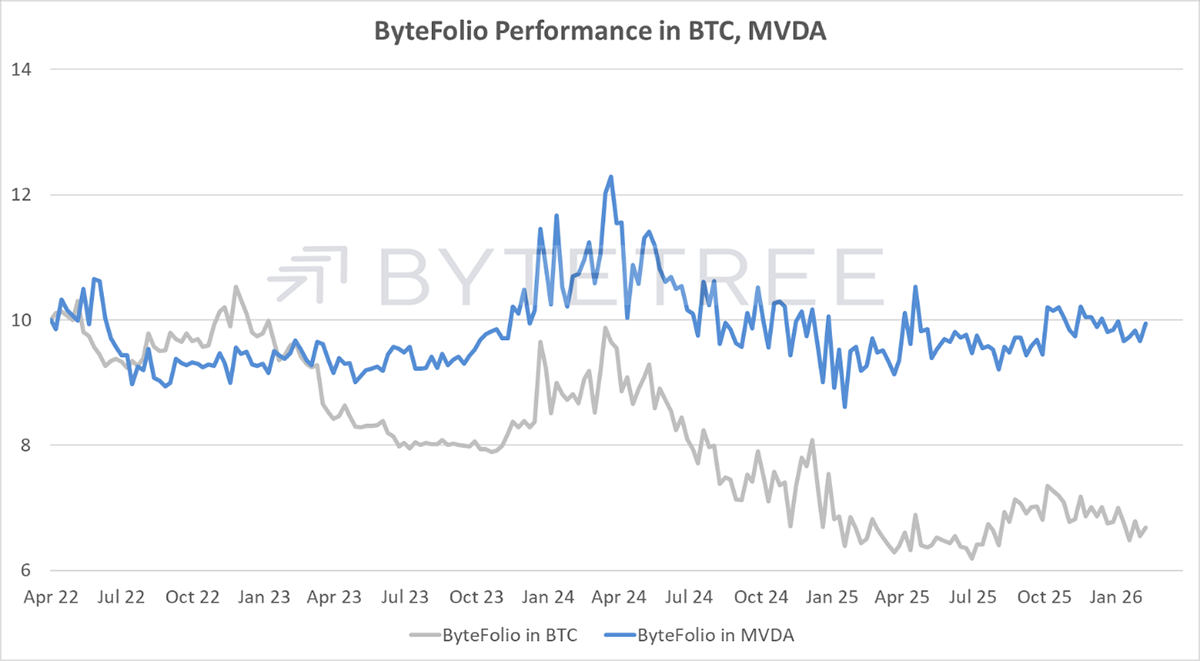

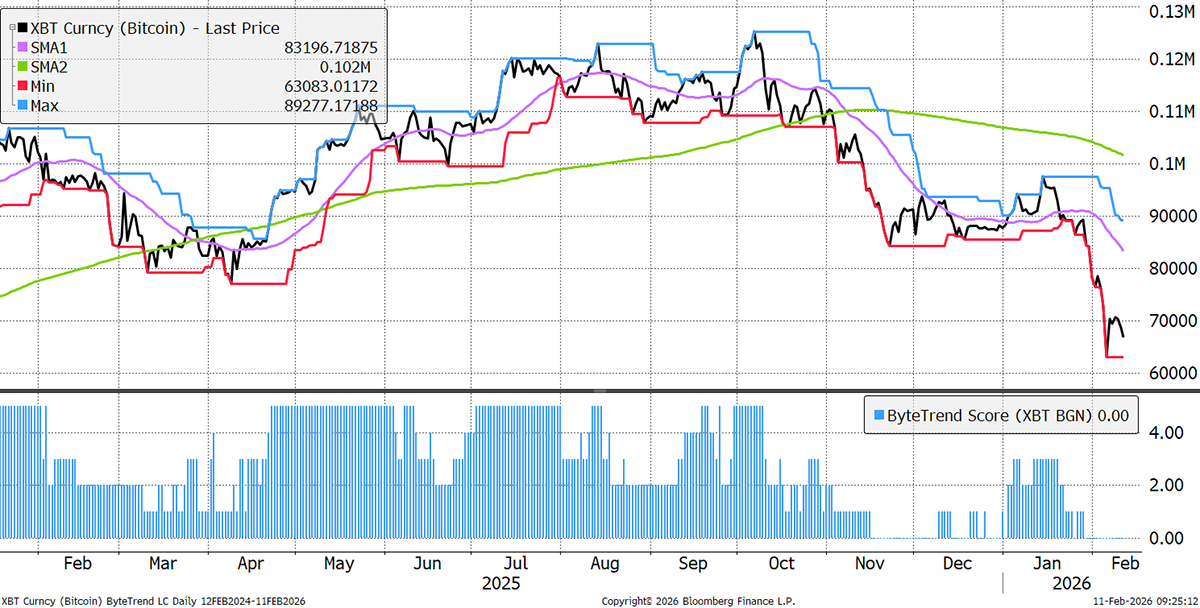

Bitcoin’s ByteTrend Score remains zero, after a severe fall in recent days.

Bitcoin

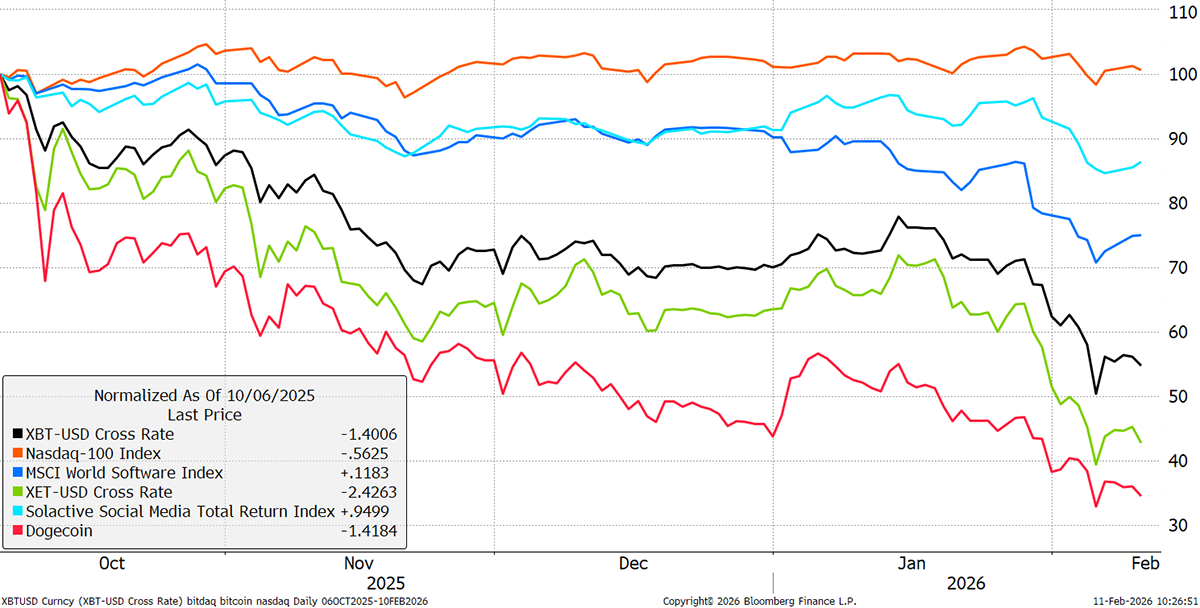

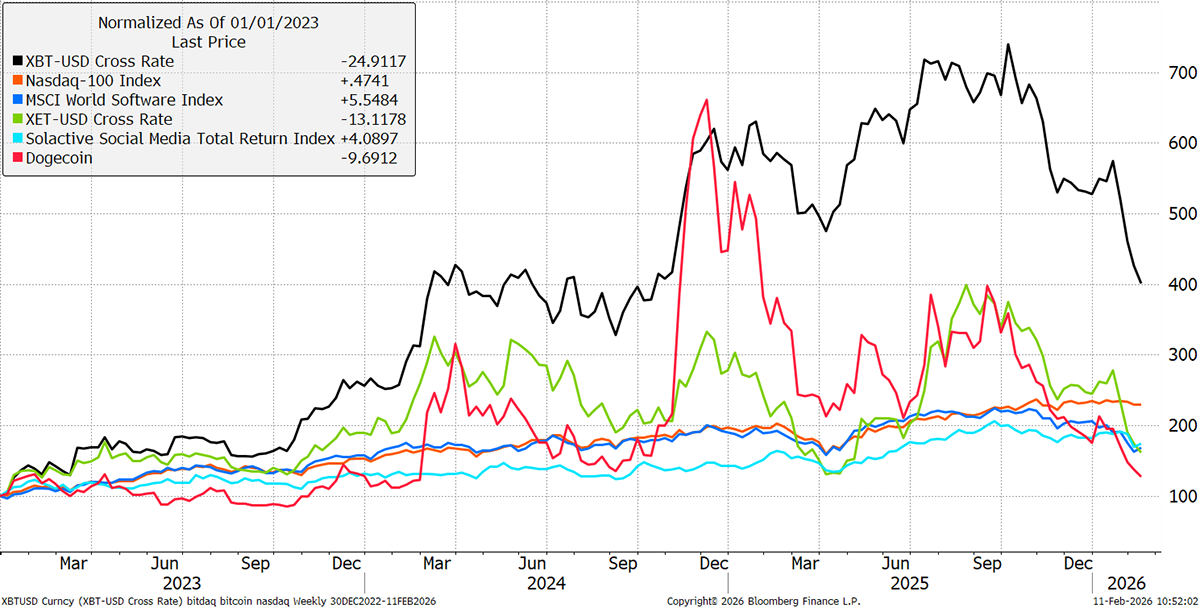

This move has been linked to the general malaise in tech stocks, which makes sense to me. The correlation has always been high. Bitcoin has fallen more than tech since the October 2025 high, but has, unsurprisingly, fallen less than Ethereum or DOGE. The Nasdaq has been surprisingly resilient.

Bitcoin, Technology and Crypto – since the October 2025 High

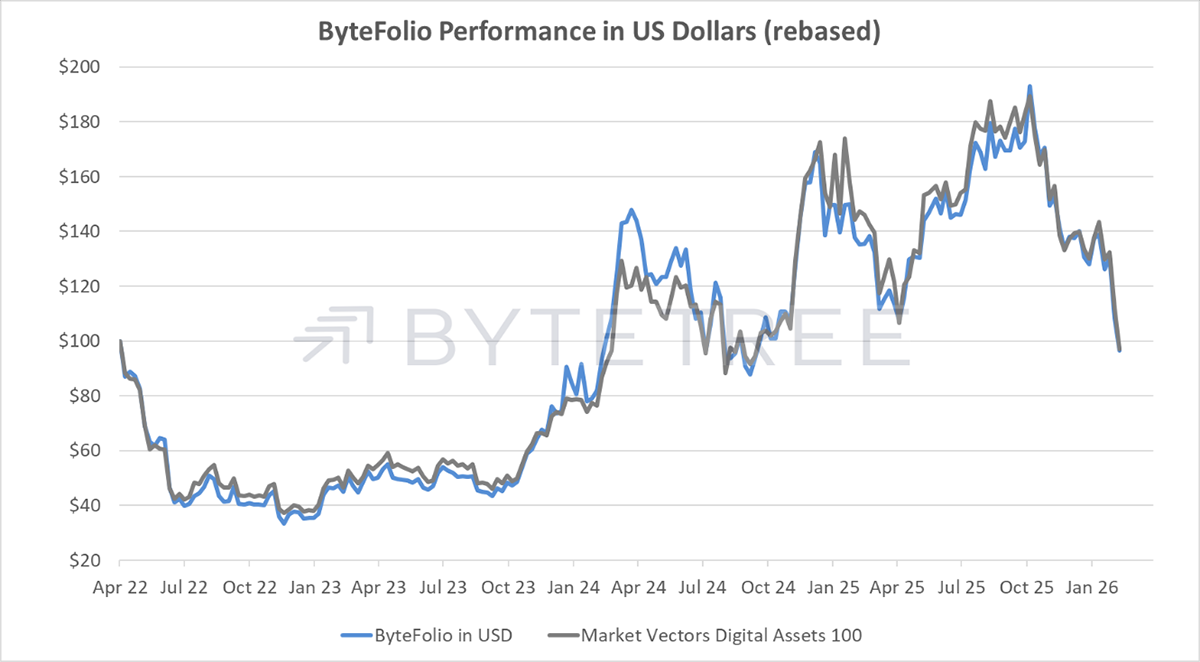

Lengthening this chart to the start of the bull market in January 2023, the picture looks very different. The Dogecoin rally happened at the time of the US election, when Trump returned to office. That soon fizzled out, and however you look at it, Bitcoin is miles ahead of tech and crypto this cycle. Perspective matters. Bitcoin is down, but it is still the king.

Bitcoin, Technology, and Crypto – since January 2023

The Trump hopes for crypto were high. There was the GENIUS Act, which worked wonders for stablecoin issuance. Many lawsuits against crypto entities were also dropped, increasing operational freedom in the US. But one thing that never happened was the Strategic Bitcoin Reserve. They may accumulate and HODL government crypto held from seizures, but there have been no government purchases. In that sense, Bitcoin has fallen back to the pre-Trump levels, in November 2024, at $67k.

Bitcoin Levels and Returns

That pre-Trump level is also the area of the 2021 price highs, with multiple tests of both support and resistance over five years, at the current levels.

There was also this article posted on Sunday by the Financial Times, saying that Bitcoin was $70,000 too high, when the price was $70,000. Except that it was published with the headline at $69,000 and changed later in the day when the price rose by $1,000.

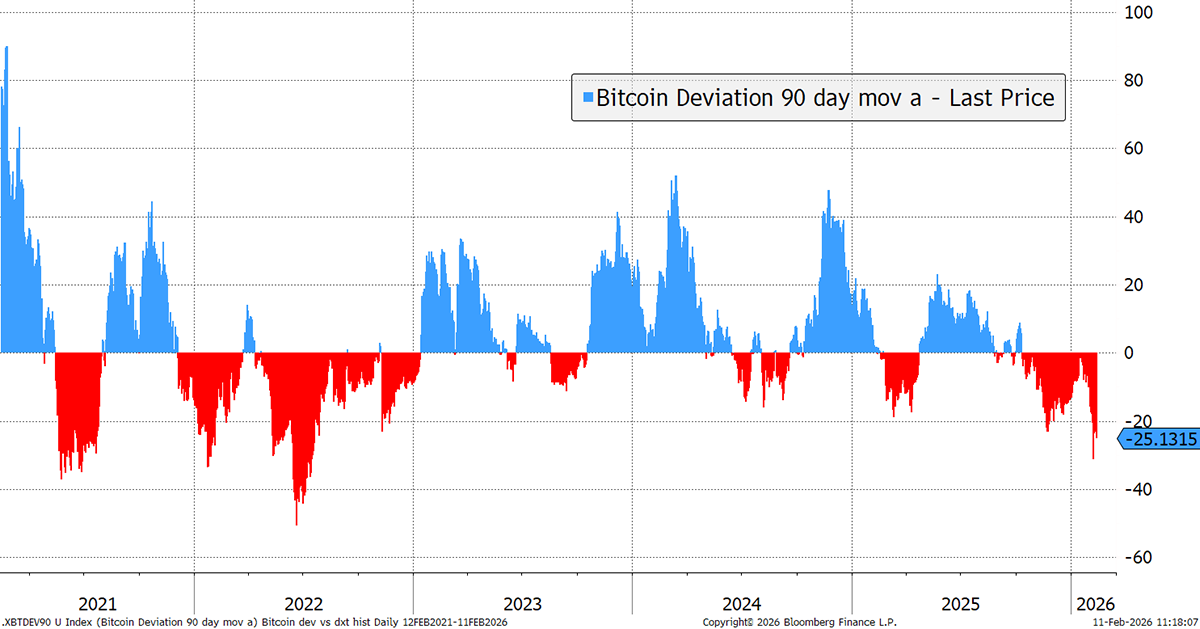

Comedy, but Bitcoin sceptic Jemima Kelly didn’t publish this high-conviction, end-of-Bitcoin call last October, when it would have been a brave call, but rather when it was already massively oversold.

Bitcoin Deviation for 200-Day Moving Average

That has got to be as good as an Economist cover story to mark a turning point.

Then there’s the threat of quantum computing…

Why the threat to Bitcoin’s oldest wallets is real, distant, and entirely survivable

By Mark Griffiths

Every so often, an article comes along predicting the collapse of Bitcoin because quantum computing can quickly decrypt old wallets, including Satoshi’s 1.1M bitcoins that still sit in exposed, old P2PK UTXOs. The fear is that these bitcoins flood back into the network, crashing the price. But this scenario is hardly an imminent threat, and there is still time to prevent it.

Firstly, the quantum computer capable of such an attack is still a long way off and would require many orders of magnitude more capability than today’s machines are capable of. Cryptographically relevant quantum computers (CRQCs) capable of breaking Bitcoin’s more vulnerable parts are still years away, and their development is largely done in the open; there are far bigger targets than Bitcoin.

And secondly, the criminal hackers (the Black Hats) can’t simply build a quantum computer in a shadowy basement and launch a surprise zero-day attack on the blockchain. They take teams of thousands, billions of dollars, and access to special, exotic tech.

However, some in the Bitcoin community are already working on a solution. They see the threat as real but distant, and the tone is measured and not panicked. Solutions are coming, and the biggest threat is complacency.

The answer, so far, looks cautiously encouraging. Satoshi's coins aren't going anywhere — in every sense of the phrase.

Yet the solution is to upgrade the Bitcoin architecture …

That will happen a long time before the threat approaches, and when it does, it will be in the hands of the White Hats, long before it reaches the Black Hats. I doubt the White Hats’ highest priority will be Bitcoin.