Safety First

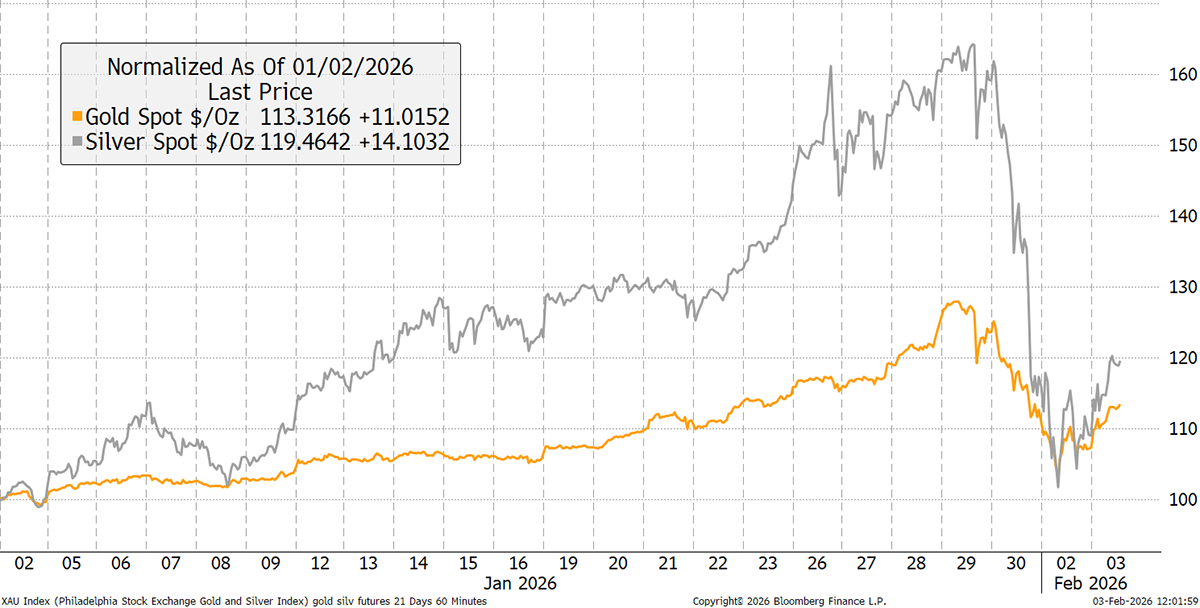

No doubt you have been watching the price of silver in recent days. It has been one hell of a drop, making the fall in the gold price seem placid. Even more remarkable is the fact that both assets are still up on the year.

Gold and Silver in 2026

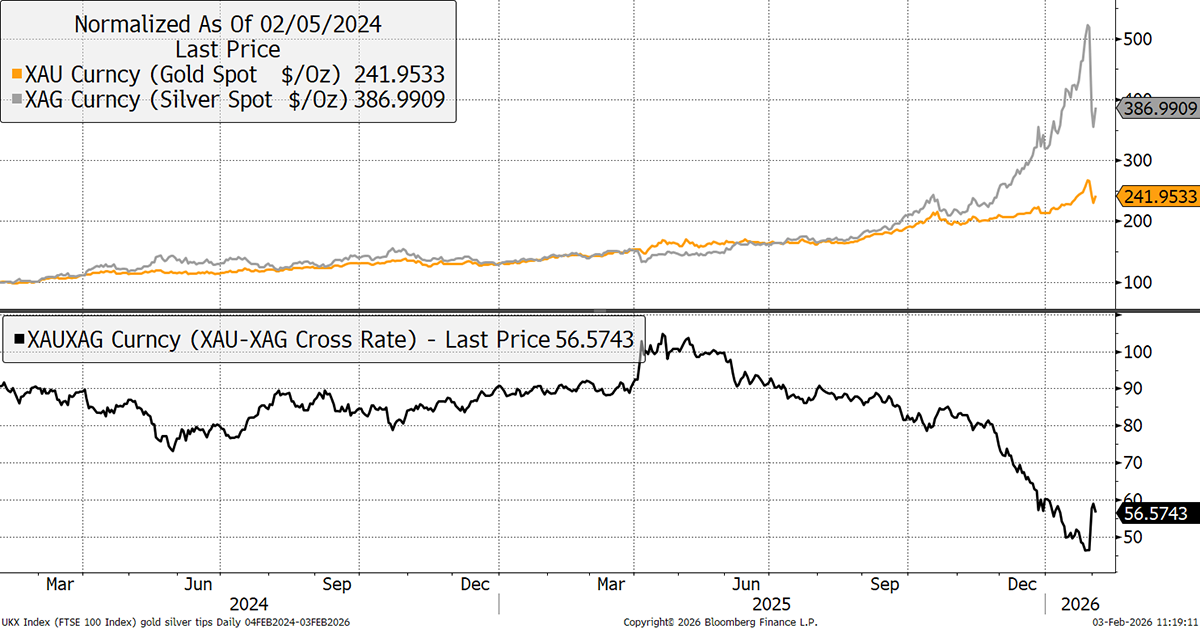

I believe you make the case for investing in gold and then allocate to silver if you believe the gold-to-silver ratio (GSR) will fall, so you get a little extra. The GSR dropped below 44 last Monday, spiked to 63 on Friday, and now sits at 56. Holding silver is highly profitable while the GSR is falling, but pointless while it is rising. Still, we are better off having held silver in 2025, as returns have been materially higher than gold.

Gold and Silver – Past Two Years

When the volatility picks up, I believe it is right to reduce exposure. We have done that twice. Firstly, in October, and secondly, just two weeks ago, at a slightly higher price than where it trades today. Silver exposure is now 4.4%, so it is low enough not to cause too much damage. I will be watching the GSR closely from here, as things settle down.

The fall in gold and the miners has been less material. Soda has a long-term allocation to gold, which could be reduced if I sensed a gold bear market. So far, I don’t, but fully acknowledge that prices got ahead of events. Gold is the long-term store of value, and the central banks continue to boost their reserves. But that narrative has gone too far, too soon, and so it is time to ask difficult questions.

I would think we have had the worst, and a recovery will ensue. The good news is that the miners will soon enter earnings season, and the likelihood is that their results will far exceed expectations, even after accounting for the recent falls. Let’s not ignore President Trump’s latest tweet, demanding a $12 trillion strategic US metals reserve. The long-term demand for strategic and precious metals is not going away.

In recent days, I have written much about the metals, and so I won’t repeat myself:

- Atlas Pulse, “Gold Driven by Geopolitics, not Macroeconomics”.

- Venture, “Precious Metals Correction”.

- BOLD Report, “Bitcoin and Gold Correction”.

Please have a look at those for the deep dive.

These past few days in precious metals remind us how quickly things can change, and why diversification is so important in portfolio management. I want to remind you why I hold quality stocks in the portfolios, and plan to add more.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd