The Yen and the Big Dig

Trade in Whisky;

Before I get to today’s trade, I want to comment on Japan.

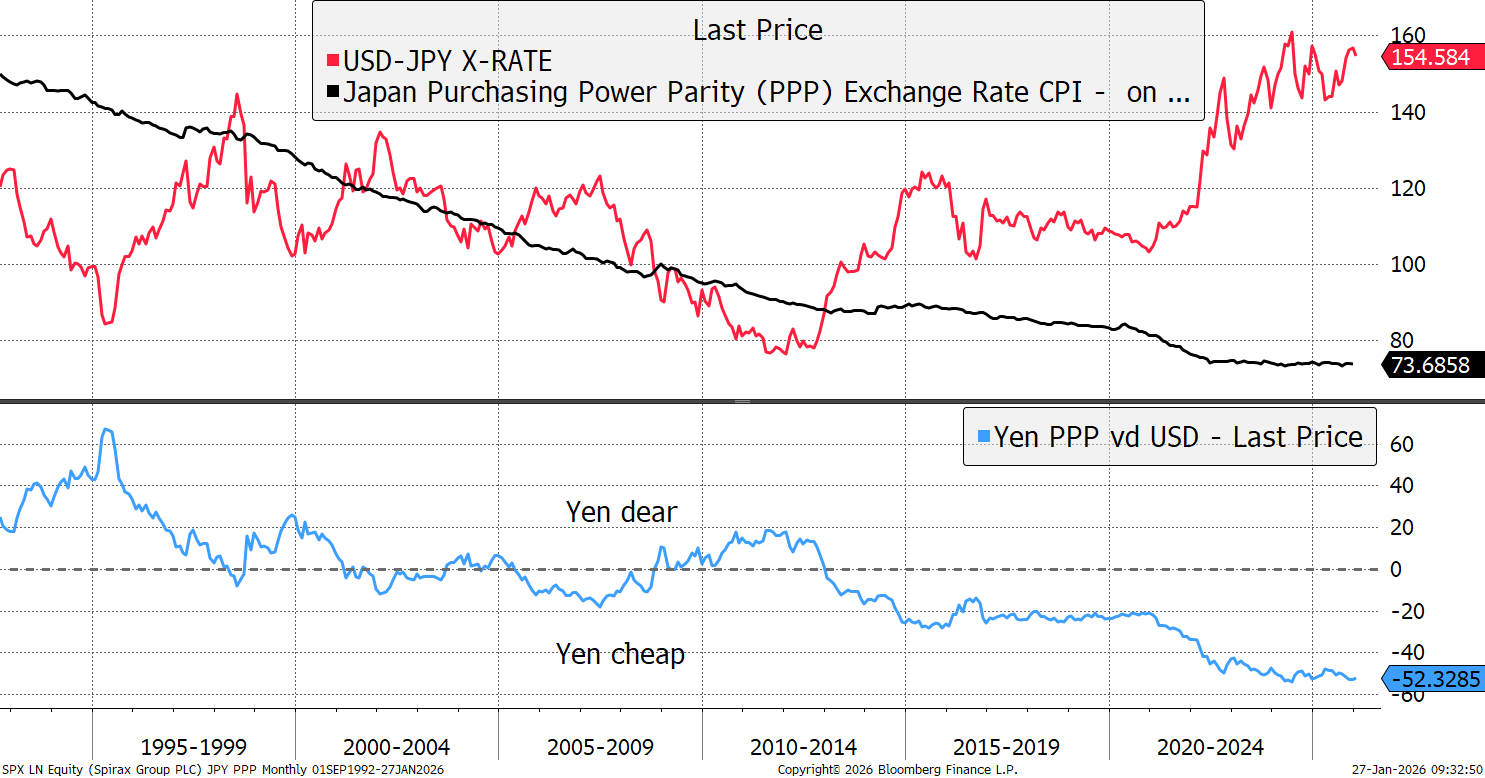

Although just a blip at first sight, the yen rallied 3.5% on Friday. The Bank of Japan had recently met and decided to hold interest rates once again, by an 8-1 vote. They maintained a hawkish stance, citing a weak currency and rising inflation. What they probably didn’t say is that after three decades of deflation, higher inflation is a policy goal. According to purchasing power parity, which is usually right even if it takes a decade or two, the yen is 52% undervalued against the US dollar.

Japanese Yen Purchasing Power Parity

The yen, once the alternative to the Swiss Franc as a bedrock of stability, has been a poor performer in recent years. Since 2011, it is down by nearly half against the Chinese Yuan. It is often said, by those in the know, that you cannot devalue your way to greatness. It should come as no surprise that the best-performing economies and markets are accompanied by a strong currency. Is Japan different?

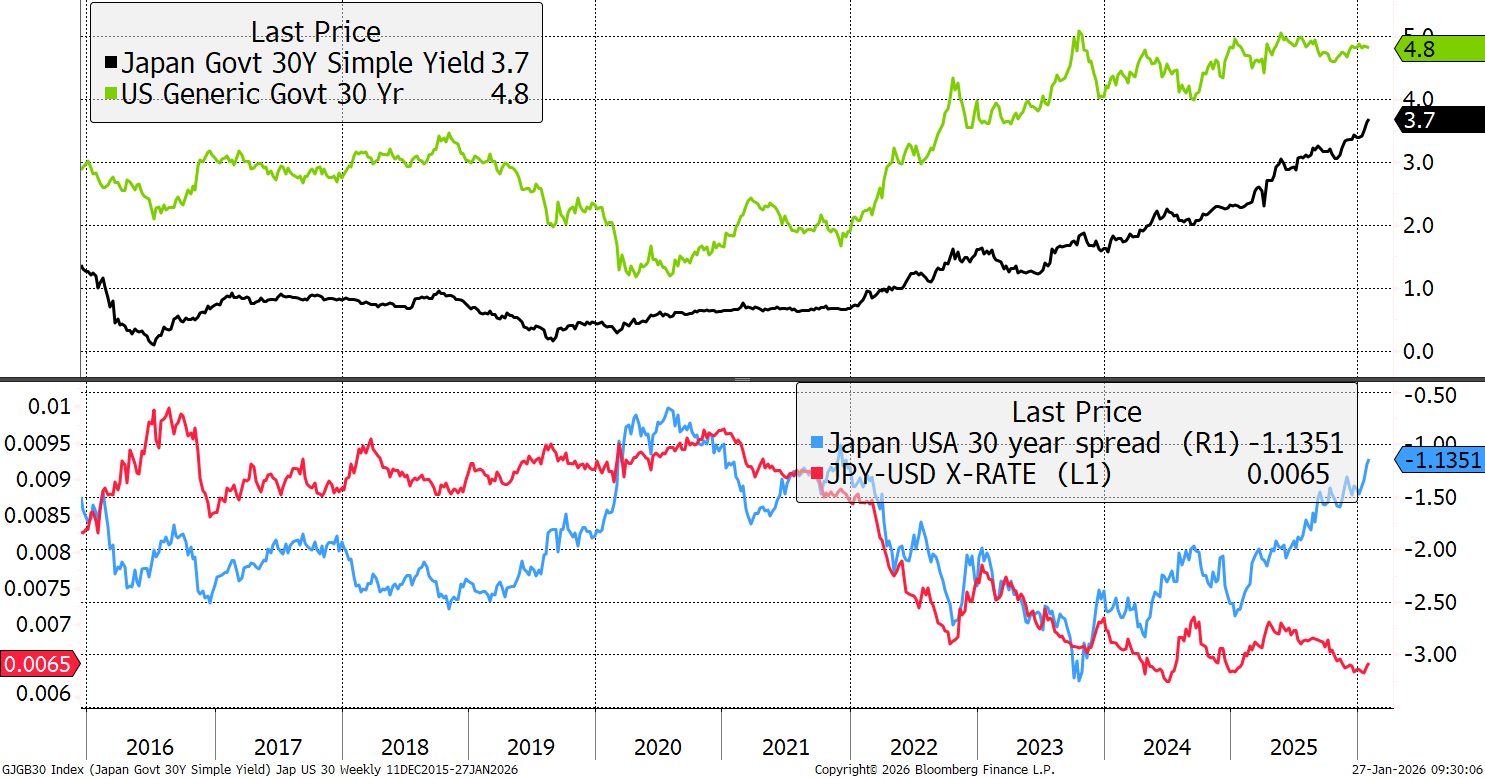

There has been much concern as Japanese long government bond (JGB) yields (black) have risen sharply, from near zero to 3.7%, thus normalising against US Treasuries (green). The spread (blue) has been rising sharply, and that ought to drive the yen back towards fair value. I believe that a rally in the yen could come as a shock to financial markets, as it has in the past. A strong yen repatriates capital from abroad, thus sucking the life out of markets.

US and Japanese Bond Yields and the Yen

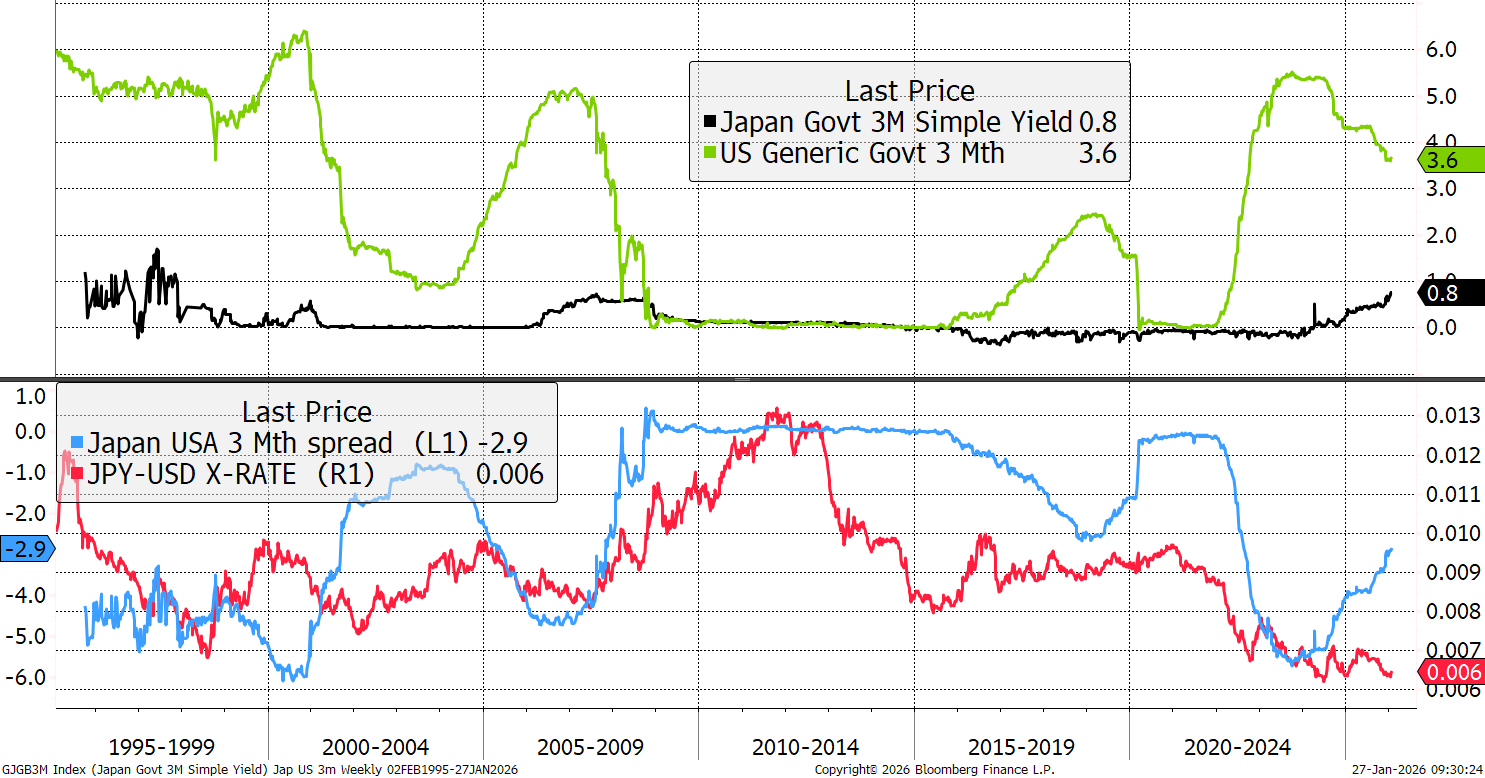

While the yield spread is close to normal, it hasn’t budged the yen, at least not yet. One thesis is that currency traders don’t buy the long bond, they trade FX for cash, and are therefore exposed to short-term interest rates rather than long-dated bond yields. Therefore, it is interest rates that matter much more than bond yields. In Japan, the 30-year yields are at 3.7%, while 3-month rates are at 0.8%. In jargon, that means the yield curve is steep.

US and Japanese Interest Rates, and the Yen

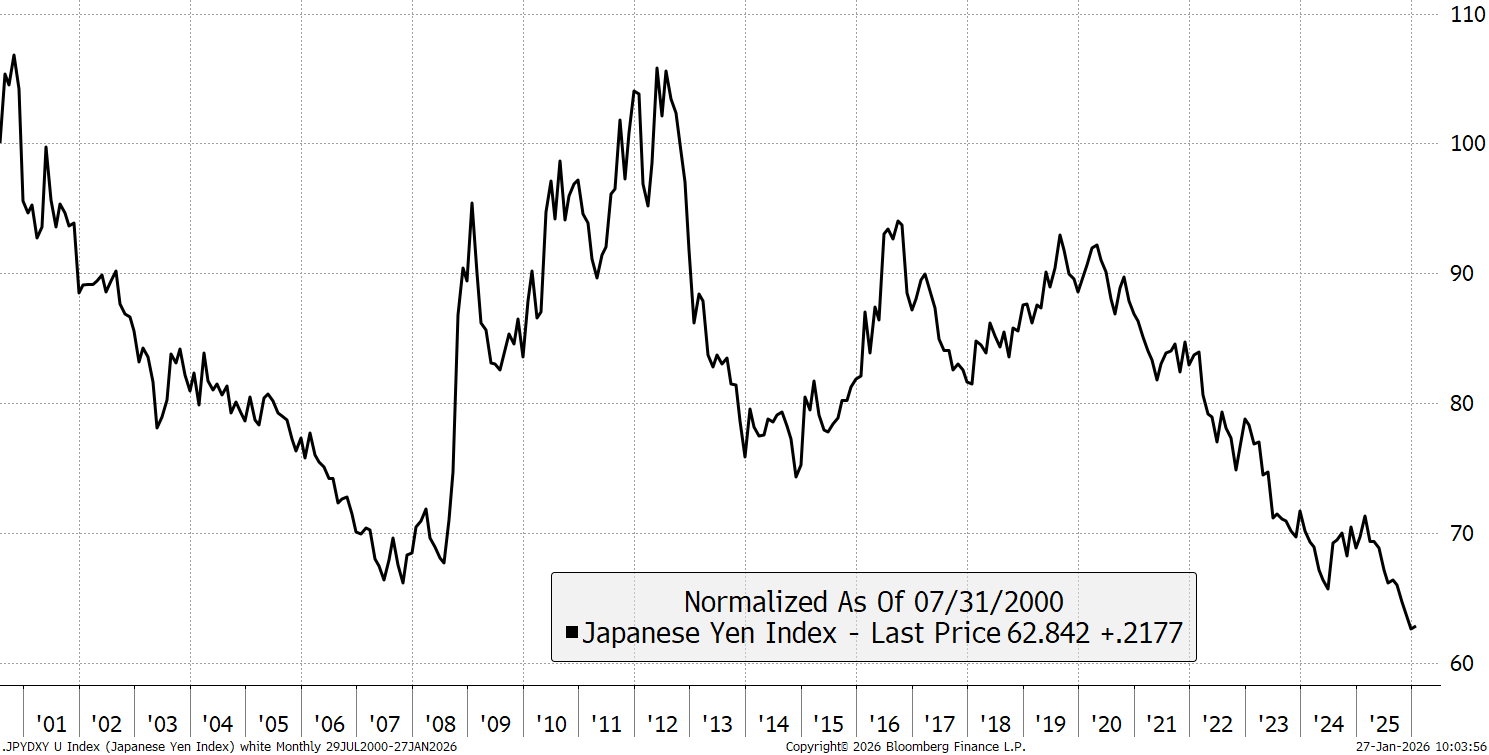

With the yen remaining soft for so long, it has become clear that no one wants a shock rally in the yen because it could potentially implode financial markets. It would cause the selling of US treasuries and other assets, which would happen if the yen surged, as borrowers rush to close their short positions on the yen. We saw this in 2008, and again in 2016. There was a small rally in the summer of 2024, which caused a 10% correction in major stockmarkets, and so it is easy to see why a dirt-cheap yen is uncomfortable for investors.

Yen Index – versus a Global Currency Basket

We hold Japanese assets, which have performed well despite the weak yen. Corporate profits have been surging, and the Japanese market has started to beat the world, after a three-decade slump.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd