The Silver Surge

Trade in Whisky;

I hope you had a good break over Christmas and the New Year. I was ready for a rest after a busy year, but I didn’t quite manage to turn off my screen as silver surged over Christmas, making an all-time high on Boxing Day. European markets were closed, but China was open.

Gold versus Silver

Webinar: The Multi-Asset Investor Q4 2025 Review

The Quarterly Review Webinar will take place on Thursday, 8 January, at 4 PM GMT. Please do send in your questions ahead of time to charlie.morris@bytetree.com.

There were all sorts of theories as to why silver surged, but I think it’s simple. With gold in a bull market and silver being undervalued until recently, conditions are right. After a 45-year wait, it’s time.

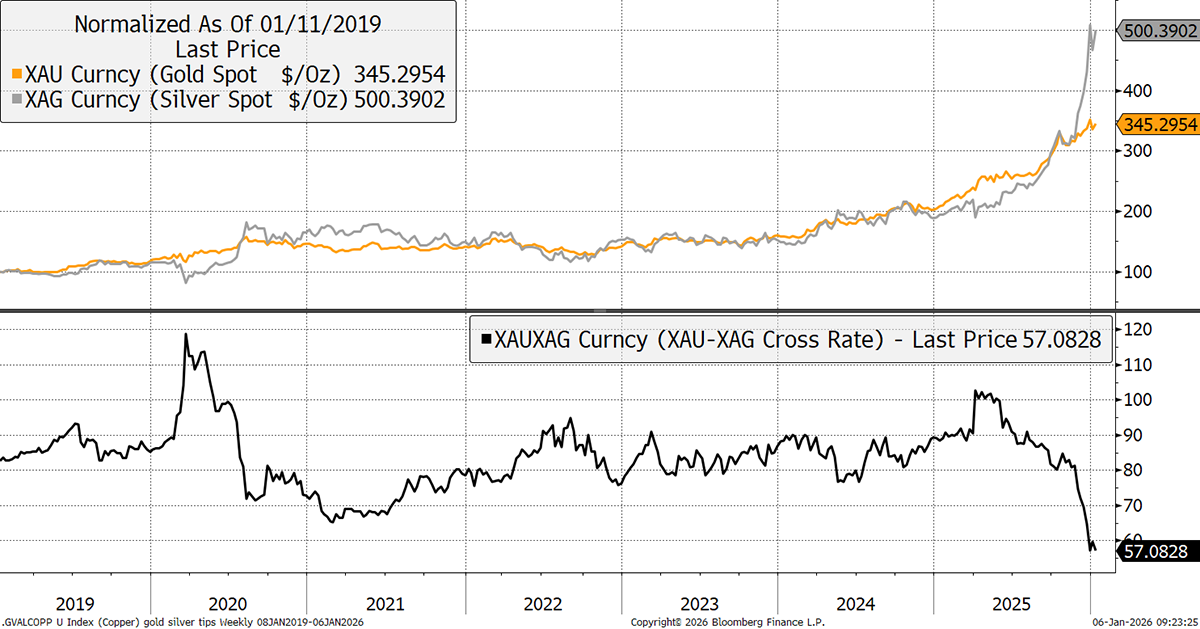

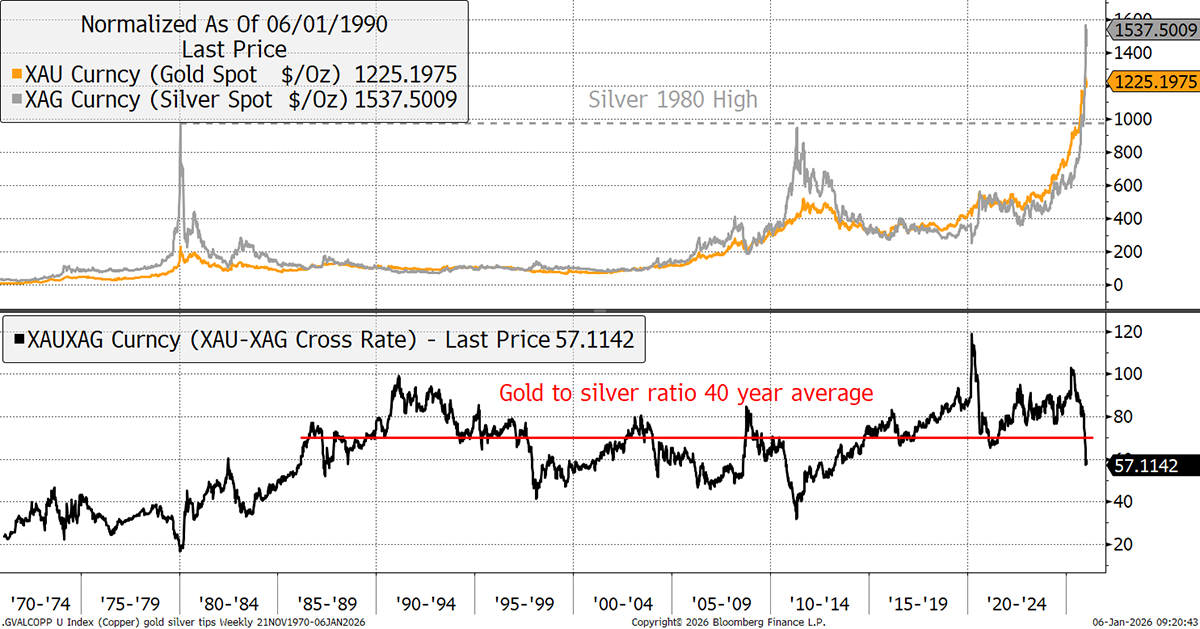

During the pandemic crash of 2020, silver slumped while gold held up, making it the cheapest it had ever been relative to gold, with a gold-to-silver ratio approaching 120. Today, that is 57, which means silver has done twice as well as gold since that low. A ratio of 57, where one ounce of gold buys 57 ounces of silver, puts silver into overvalued territory, or below the 40-year average, something rarely seen over the past decade.

Gold versus Silver since 1970

I was happy to hold silver when it was in cheap territory, in the knowledge that sooner or later it would positively surprise. Today, the opposite is true, as sooner or later, silver will disappoint. But it is too early to worry about that because the silver market is tight, the trend is strong, and when you are onto a good thing, it’s best to let it run.

I took profits in October by halving a highly profitable position. A little egg on my face, perhaps, but the position size, along with gold miners, had become extreme. I intend to stand by the precious metals and let them run because there is high demand, and for good reason. The world continues to be an unstable place, which brings us neatly onto Venezuela.

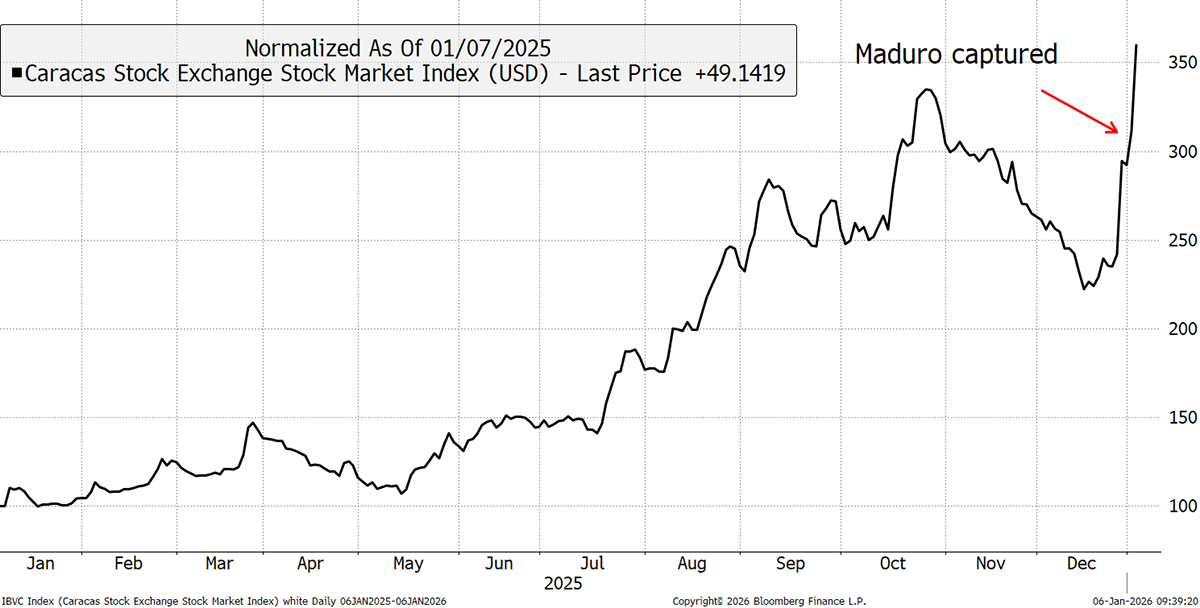

President Maduro was captured over the weekend, when the stockmarket was closed. With high inflation, the Bolivar fell 80% last year, as it seems to do most years. In contrast, the Caracas Stock Exchange rose 1,644% in 2025, but a lesser 206% in USD. Curiously, a large rally took off in the week before the President’s extraction. The locals must have known something was up.

Caracas Stock Exchange

Hyperinflation is obviously a bad thing and shows a system in breakdown. Yet under such conditions, the stockmarket becomes a real asset, or at least what is left of it. In Venezuela, the top four stocks are banks, and the fifth is in alcoholic beverages, which I’m sure is an essential ingredient in such an environment.

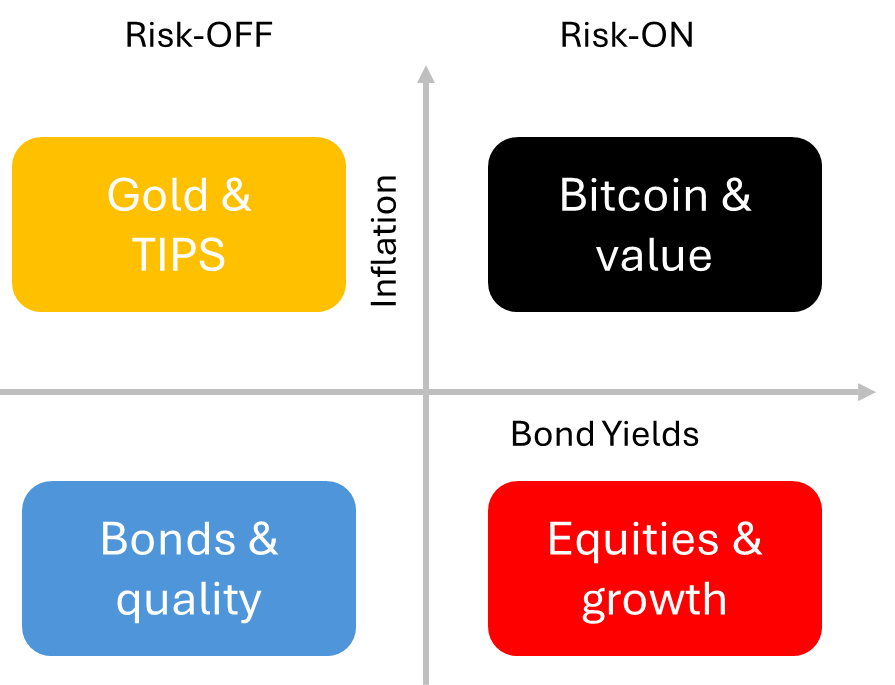

Many assume that banks fail in hyperinflation, but they don’t. Provided what comes in exceeds what goes out, they remain solvent. They also have access to foreign markets and are able to maintain their real value. We have seen this in Zimbabwe, Argentina, and even in the Reichsmark Germany. It makes total sense that the banks sit in the top right box of The ByteTree Money Map, in value alongside commodities.

The ByteTree Money Map

US oil stocks took it well too, as they are likely to benefit from high refining volumes. Financials were also strong, but the main beneficiaries were speculative stocks. Last October, I covered the correction in speculative stocks, which are now reasserting themselves. How long does this last?

High Versus Low Volatility Stocks

What has fared worst in the few days that make up 2026? Quality stocks. The stocks that will prove resilient when this great bull market finally tires. We stick with them because a strong portfolio is a diversified portfolio. If we were all in silver and racy stocks, the numbers would look good, but our life expectancy would rapidly diminish. And at some point, our wealth to boot.

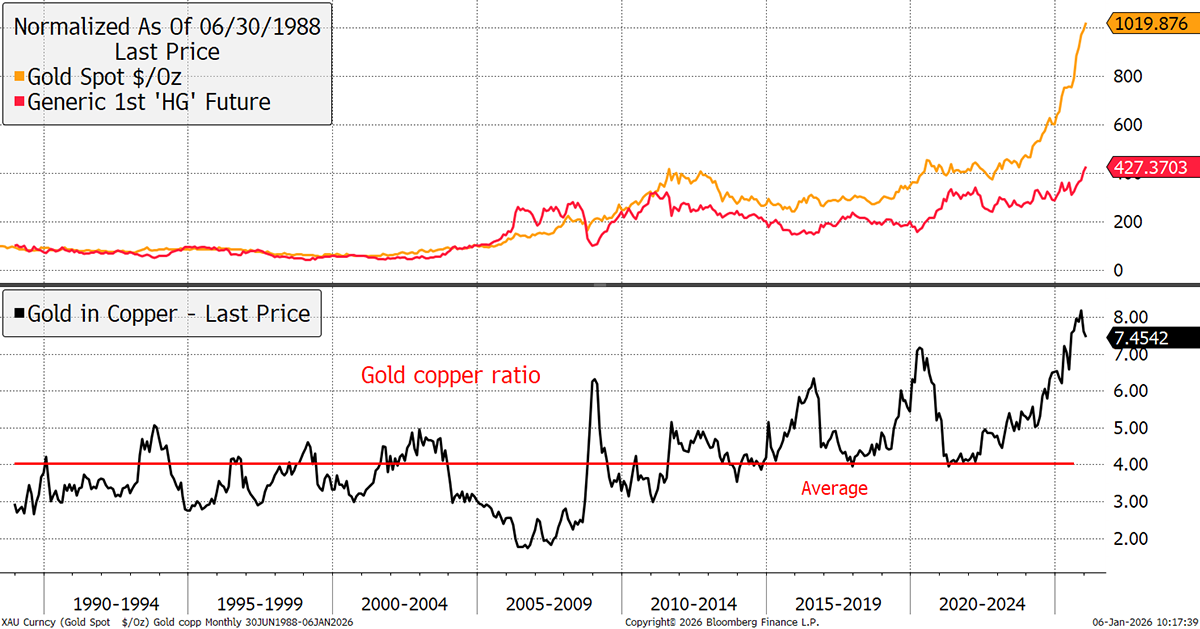

That said, we are starting to see the industrial metals take on gold, which is unsurprising given how far they have lagged behind this cycle. I showed this gold versus copper chart in yesterday’s Venture, and the price of copper has started to outperform gold, as the ratio (black) turns down. In relative terms, copper was twice that of gold in 2007, during the construction boom in China. Today, it is half gold, implying a 4x relative move if it were ever to regain those dizzy heights. I doubt that happens anytime soon, but it has happened before.

Copper versus Gold

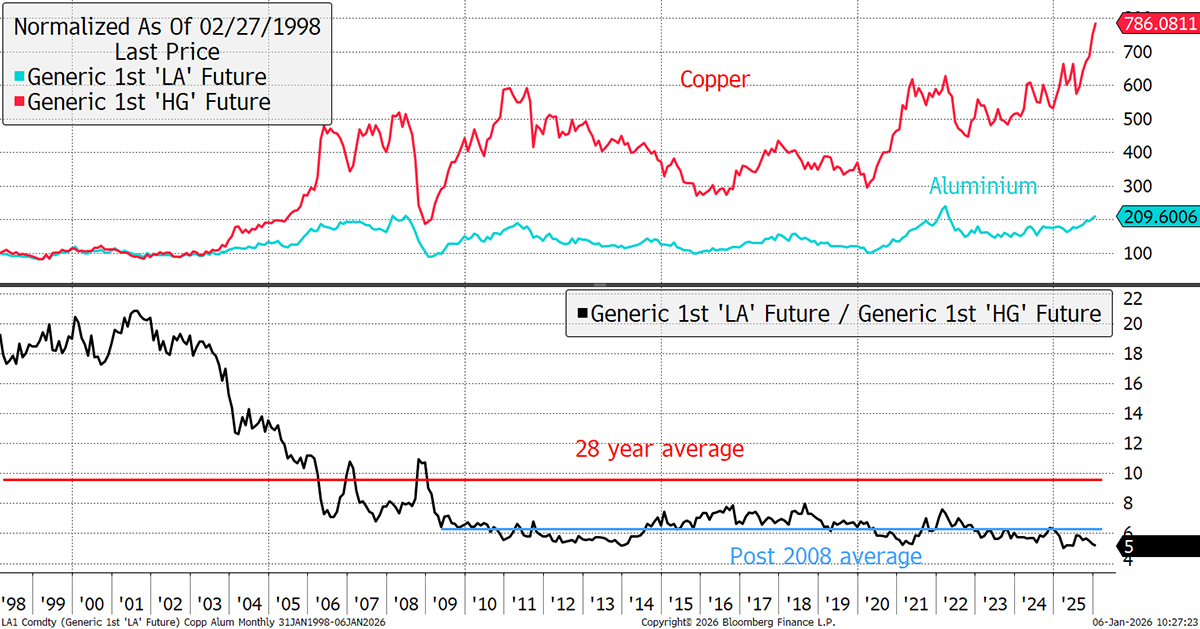

As I said, copper boomed ahead of 2008 and has enjoyed a sustained revaluation, leaving aluminium behind. Aluminium comes from bauxite, which is relatively plentiful, meaning the cost of aluminium production is closely linked to the price of electricity as its manufacture is an energy-intensive process.

Aluminium versus Copper

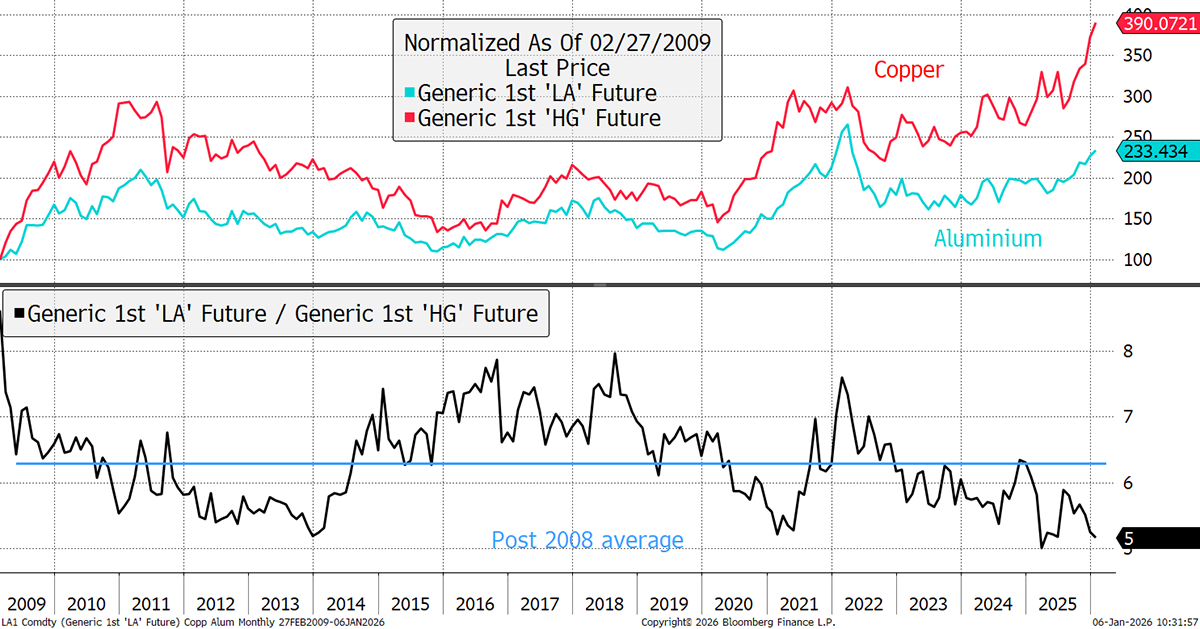

Zooming in, since 2008, copper and aluminium have traded closely, but aluminium has started to lag once again, while both metals are in an uptrend. We have some copper exposure via Glencore and the BlackRock World Mining Trust, but my sense is to add aluminium, which will likely follow suit.

Aluminium versus Copper since 2008

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd