Ten Years of Whisky and Soda

Ten years ago today, shortly after I left a 17-year stint at HSBC Global Asset Management, I took over the running of one of the country’s oldest financial newsletters, the Fleet Street Letter. In May 2015, Bloomberg’s Merryn Somerset-Webb, formerly the editor-in-chief at MoneyWeek, had asked me to take on the role. How could I refuse?

I accepted, but before I began, I walked across Spain on the Camino de Santiago, a 776km ancient pilgrimage from the French Pyrenees to Santiago de Compostela in Northwest Spain. On my million-footstep journey, which not only cleared my head, but also got me back into shape, I spent some time thinking about how I could make The Fleet Street Letter a success. Founded in 1938, it had a long line of former editors, including the founder, Patrick Maitland, the 17th Earl of Lauderdale, who famously predicted the outbreak of WWII in 1938. Then there was the successful entrepreneur, Nigel Wray, and Lord William Rees-Mogg, the former editor of The Times, and yes, Jacob’s father.

I would never be a giant as a political editor, but I knew I could be on the investment side. I came up with the idea of launching the Whisky and Soda Portfolios. These names signalled risk. Soda is clearly a safer option, and Whisky more potent, but clients would be able mix according to their personal taste.

The Soda Portfolio would be a balanced portfolio, along the lines of a traditional 60/40 equity/bond split, populated by investment trusts, funds, gold, and exchange-traded funds. Turnover would be low, and I would manage it with conviction. That means not hugging the index but focusing on more profitable asset allocation, good manager selection, and embracing value around the world.

Whisky is the equity portfolio. In the early days, I would pick UK mid- and large-cap stocks, adding high-conviction global exposure, through sector (technology, oil, gold mining etc.) and emerging market ETFs (Turkey, Pakistan, China etc). In more recent years, I decided to embrace more global stocks directly, mainly in Europe, but also in the Americas and Asia. The wider I cast the net, in terms of choice, the better the results became.

In the autumn of 2022, I resigned as the editor of The Fleet Street Letter and continued to manage the Whisky and Soda Portfolios at ByteTree. Bringing my affairs under one roof was overdue, and ByteTree enabled us to have a much closer relationship with our clients.

Ten years on from launching Whisky and Soda, how has it gone?

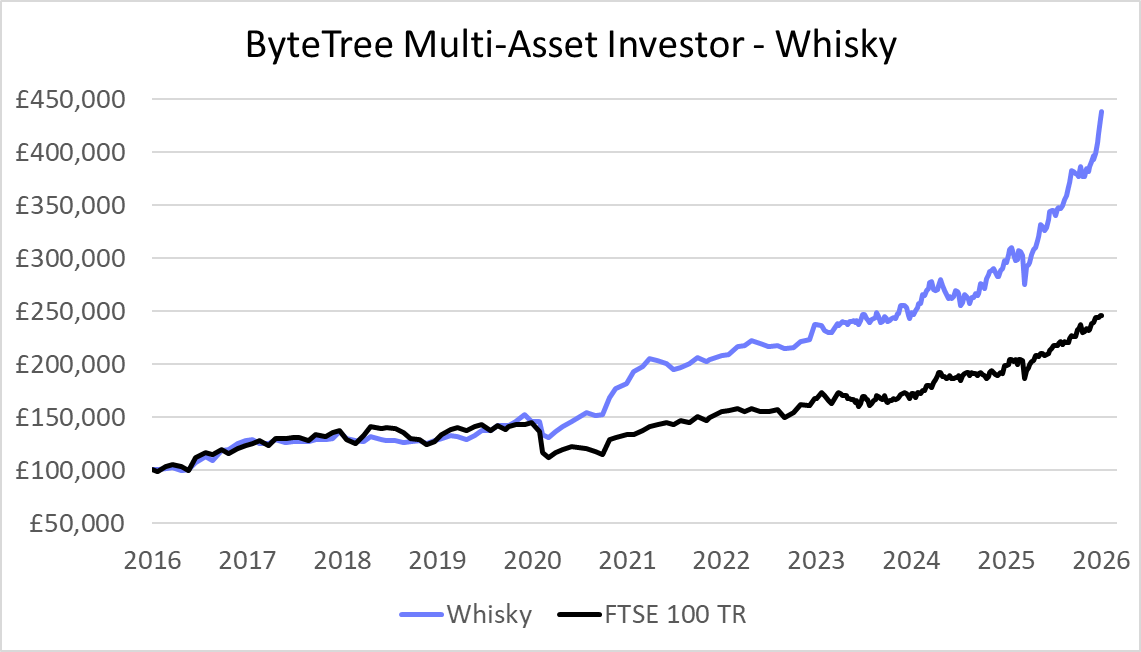

Whisky has performed well, with a breakaway from the FTSE in 2020. Performance was resilient during the pandemic crash, and thereafter, Whisky’s success is largely down to consistently good stock picking, and in recent months, the surge in precious metals. Going global has made it easier to find great investment ideas, as there’s always value to be found somewhere.

Over ten years, Whisky has returned 337.9%, vs 139.8% for its benchmark - a difference of 198.1%.

The ByteTree Whisky Portfolio Performance

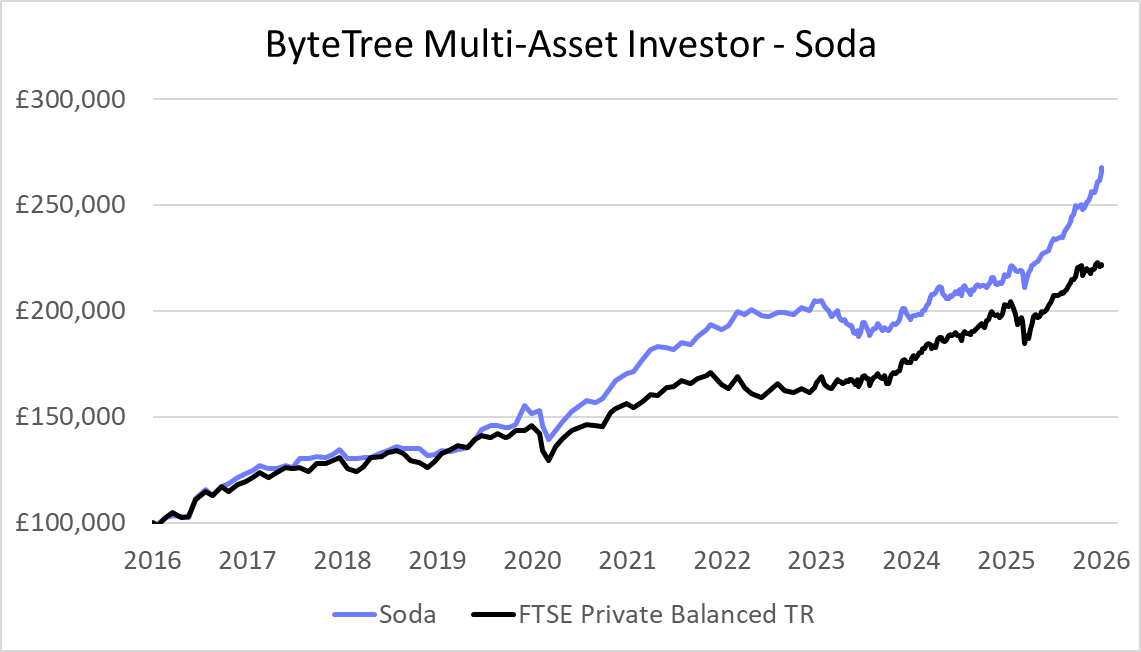

And for Soda, a pause in 2023/4, when I was reluctant to embrace the technology rally, but now back on track. As the US market, which has dominated markets since 2008, cools, it is the rest of the world’s turn to perform. This is where ByteTree is at its best.

Over ten years, Soda has returned 167.4%, vs the 118.3% for its benchmark, a difference of 49.1%.

The ByteTree Soda Portfolio Performance

I run these as model portfolios which clients can easily follow at home. They are delivered every Tuesday, with occasional flash notes at other times if market events require it.

That’s the past 10 years, what about the next?

We have grown our investment team, developed our research tools, and improved the way we deliver our research. The first ten years were proof of concept, and I am delighted to have recorded this precious moment. There is no time to celebrate, it’s straight back to work on this important mission.

Sign up to our free market commentary

I thank the clients for keeping the faith and sticking with me through thick and thin.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd