Tech Weakness Drags Bitcoin

ByteFolio Issue 193;

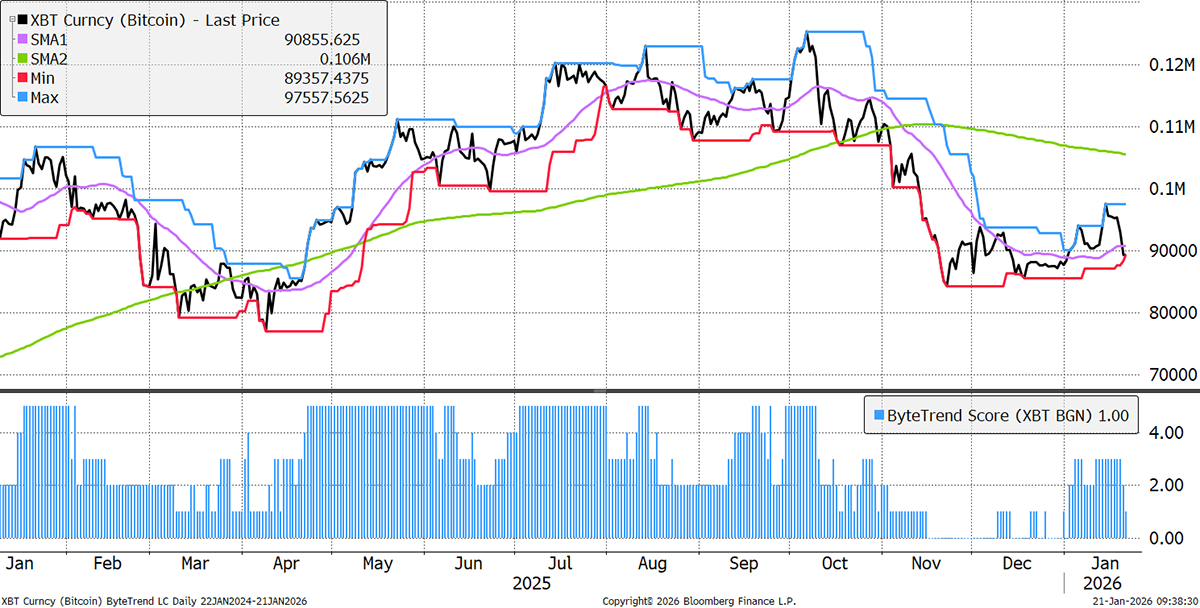

Bitcoin’s ByteTrend Score has dropped back to a 1. There is no new low yet, but this is clearly a setback.

Bitcoin

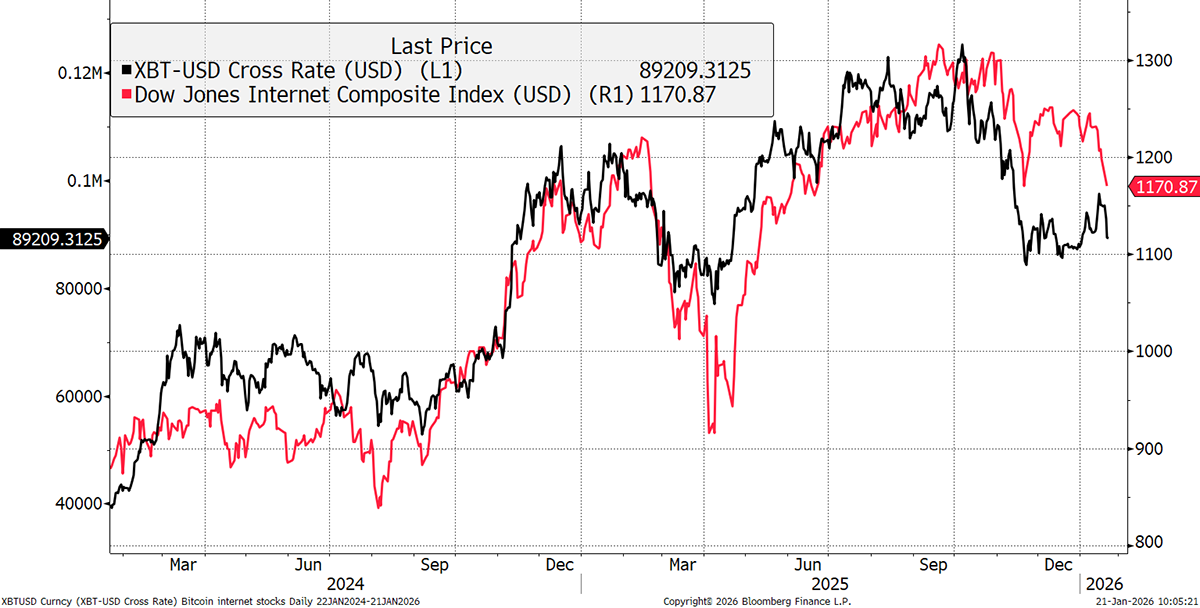

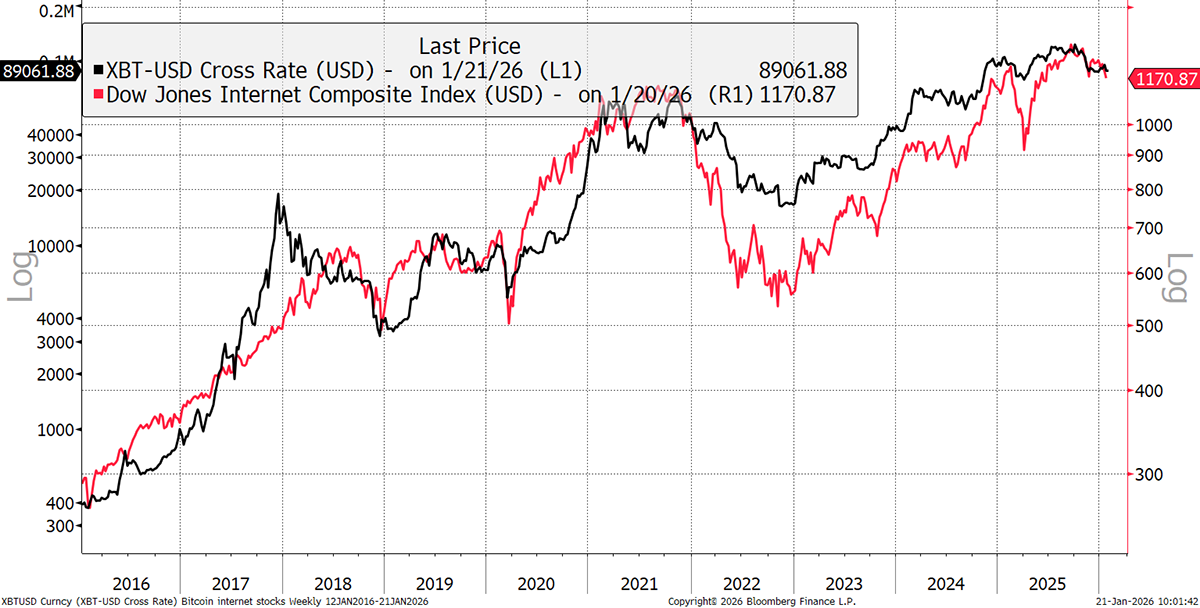

Blame technology stocks, whether they be the Magnificent 7, cloud computing, cyber security, cloud storage, ecommerce, digital payments, eSports, artificial intelligence, or even data centres. After one hell of a ride for the internet stocks since around 2012, the technology bull market is over. Bitcoin has always been correlated with the technology sector, and so it should come as no great surprise that a weak tech sector equates to a weak Bitcoin.

Bitcoin versus Internet Stocks

That link is evident not just in the short term but over the past decade. The up and down cycles are the same, but obviously Bitcoin has generated much higher returns, which is why I need two axes. The Internet index is up 296% over the period, and Bitcoin, 23,510%, which is a staggering outperformance. Correlation is directional similarity, but not the return.

Bitcoin versus Internet Stocks – Past Decade

Of course, the internet is not dead, and neither is Bitcoin. Prices are falling because they are exhausted after a super-strong rally.

There is confusion here because the Bitcoin fans talk about monetary debasements, a falling dollar, geopolitical chaos and so on, which are exactly the same arguments made by the gold fans. Yet my simple take is that these are real-world issues and are therefore more relevant to gold than Bitcoin. After all, the central banks are buying gold, not Bitcoin. Gold is the reserve asset for the real economy, and Bitcoin for the digital economy.

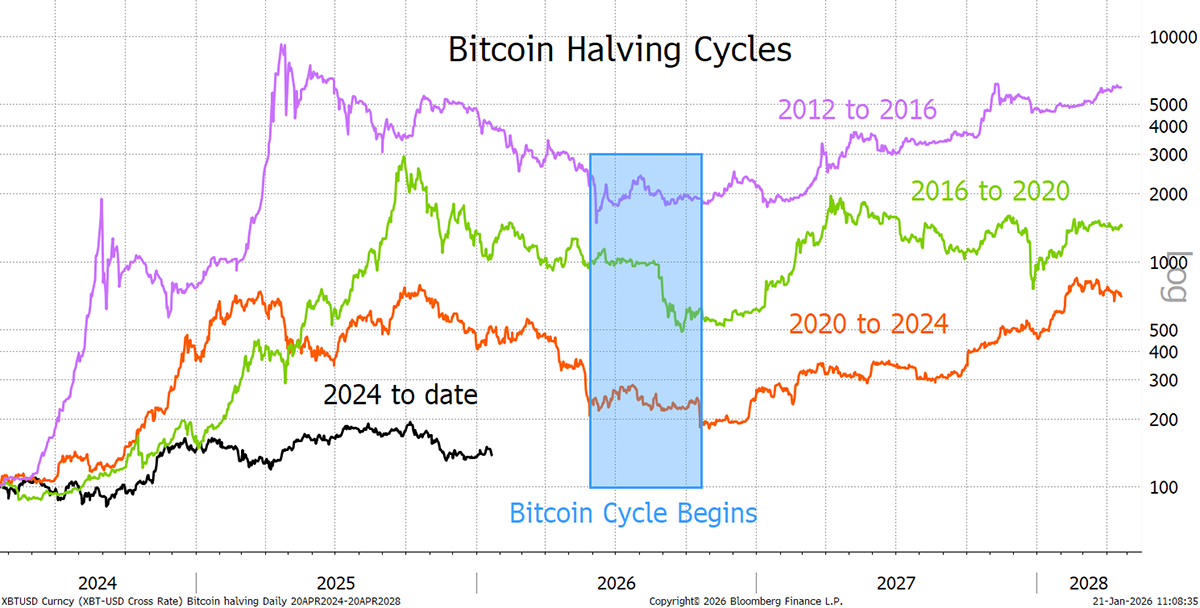

Cycles come and go in financial markets, and for Bitcoin, the up cycle began two years before halving. That means later this year, when the technology sector has had time to cool off, things should get much better.

Bitcoin Halving Cycles

These are tough times for digital assets, but as always with bear markets, this is when the greatest innovations are built, ready for the next cycle.