Silver Defies Gravity

Trades in Whisky;

President Trump was supposed to be a Bitcoin president, yet he has become a golden one instead. Bitcoin tends to do well when the economy is strong and things are getting better. It is often thought to be an expression of market liquidity. In contrast, the price of gold roars during times of uncertainty. It is said to shield against inflation over the long-term, be a timeless store of value, and be a safe port in a storm.

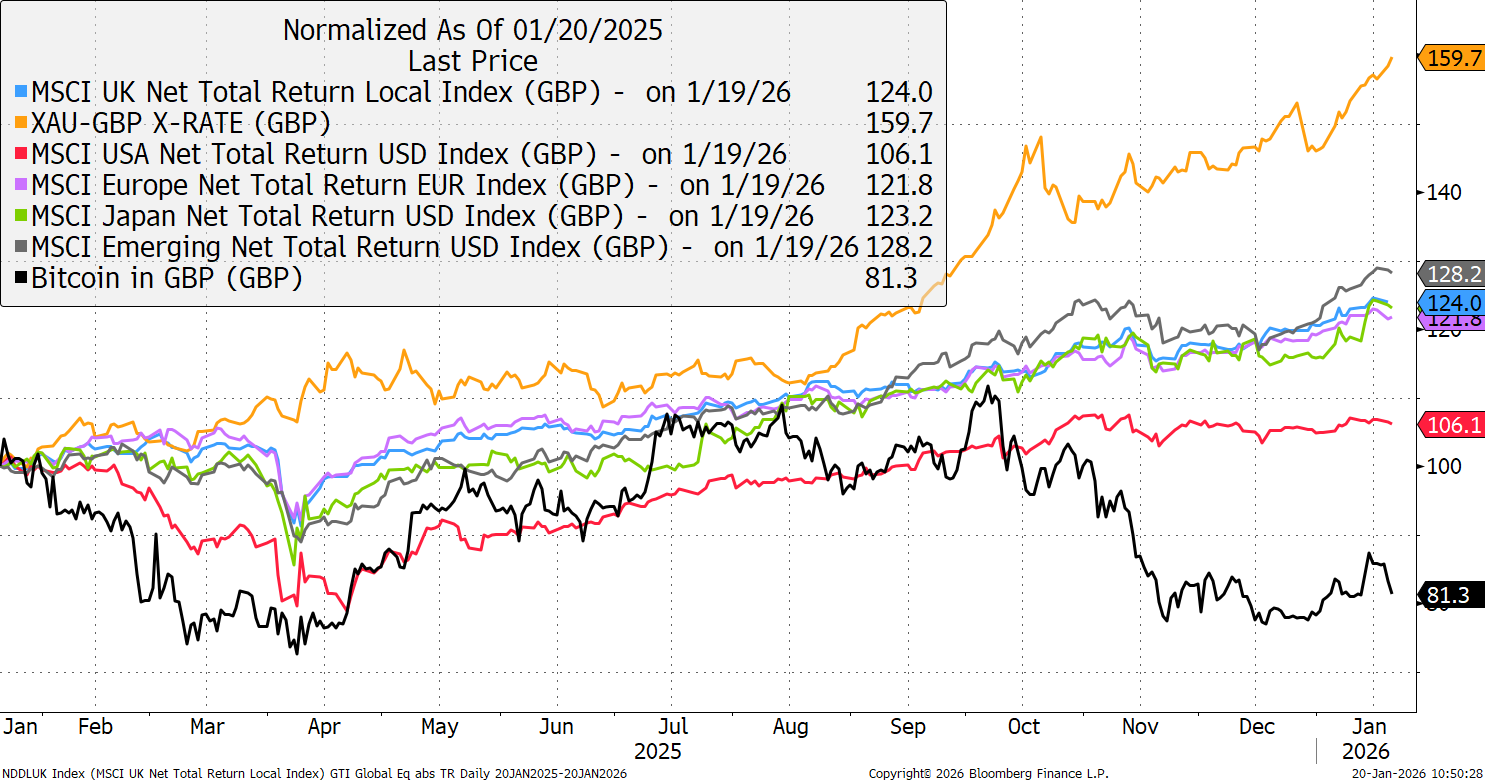

Global Equities, and the Leading Alternative Assets

There are other reasons for gold’s strength such as central bank buying by non-OECD countries, and the fear of currency debasement among others. Just as there are other reasons for Bitcoin’s recent weakness, such as the downturn in technology stocks, amplified by the fall in software and consumer internet stocks. In my opinion, gold is the reserve asset for the real economy, and Bitcoin for the digital economy. The internet is far from dead, merely taking a pause after a breathtaking surge in recent years. No doubt, the fortunes of Bitcoin and gold will reverse before too long, as they have done many times in the past.

But the real story here, is that since Inauguration Day, exactly a year ago, US stocks have risen by 6.1% while the UK, Europe, Japan and the emerging markets, are up between 21% and 28% in GBP. This is a major shift.

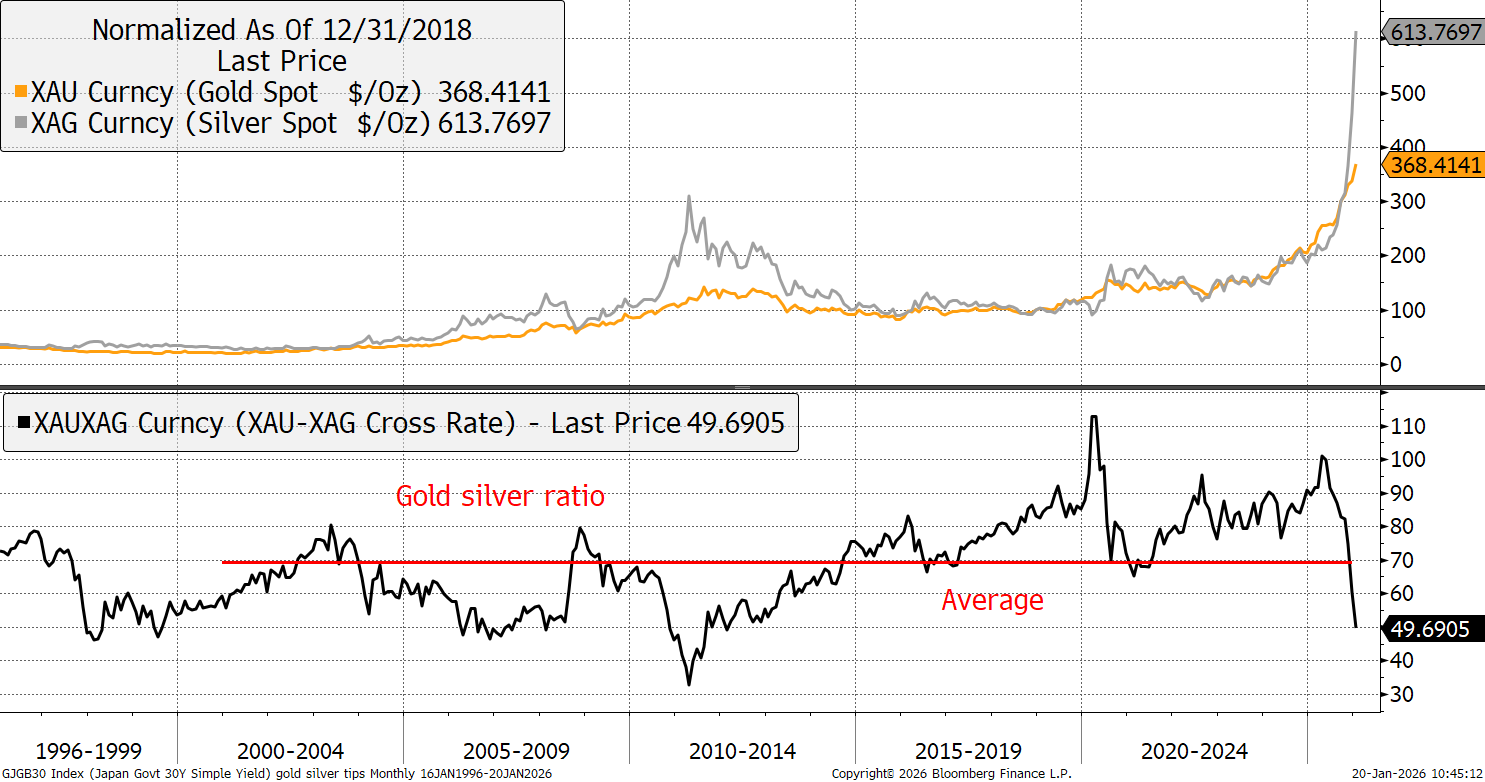

Even stronger than gold has been silver. Until a year ago, returns had been similar over three decades, but the surge in 2025 has seen silver return to levels we would historically consider to be rich. Last April, one ounce of gold bought 100 ounces of silver, and today just 49. The 30-year average gold to silver ratio has been 67.8. Silver is no longer cheap gold.

Gold, Silver, and the Gold to Silver Ratio

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd