Never Doubt the Best Performing Asset

ByteFolio Issue 194;

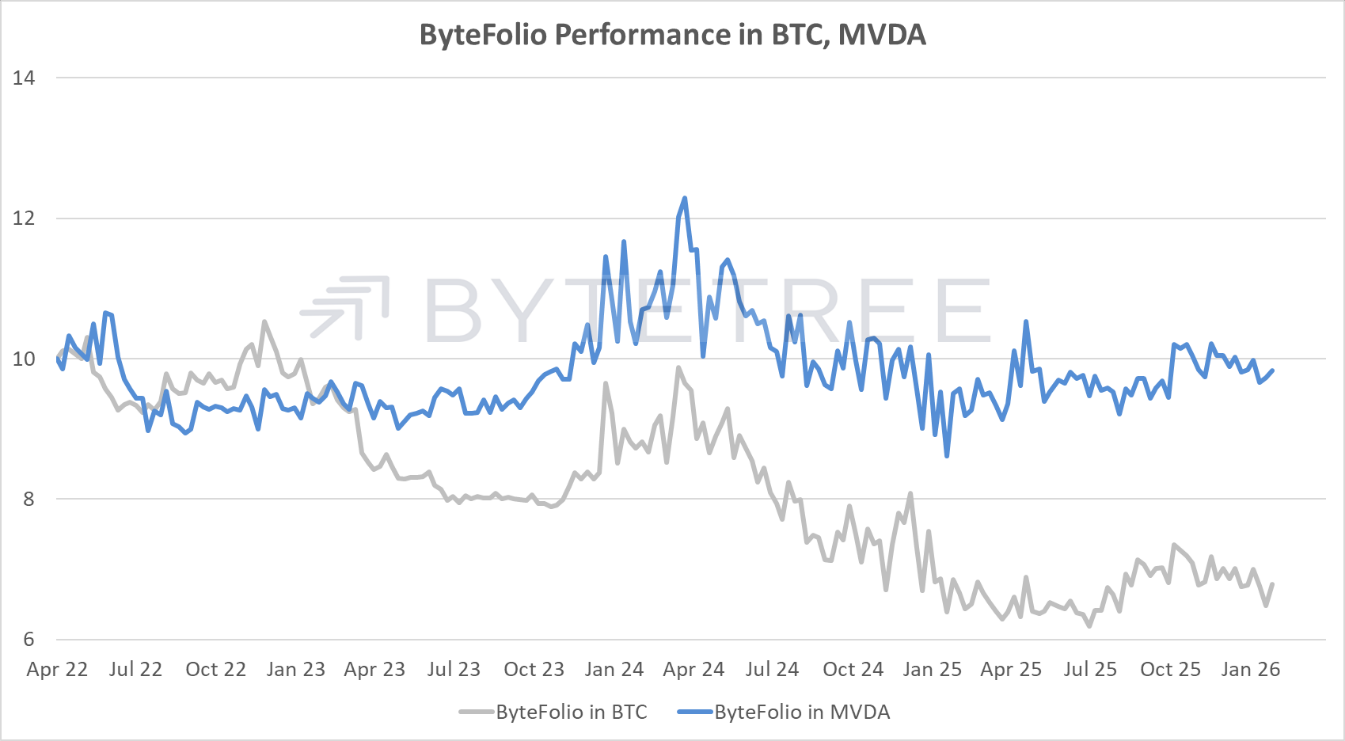

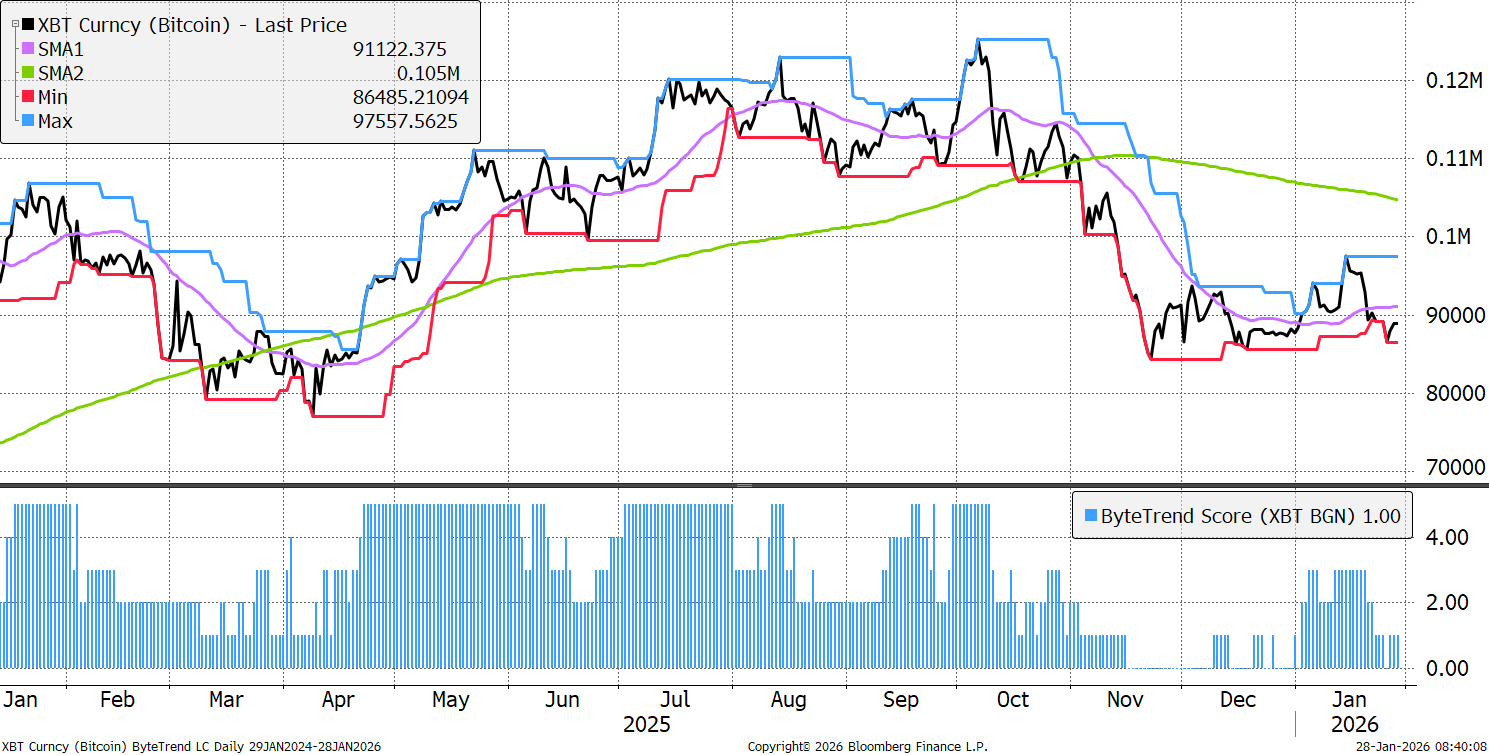

Bitcoin’s ByteTrend Score stays at 1. There is still no new low, and with a slumping dollar, perhaps we should expect more.

Bitcoin

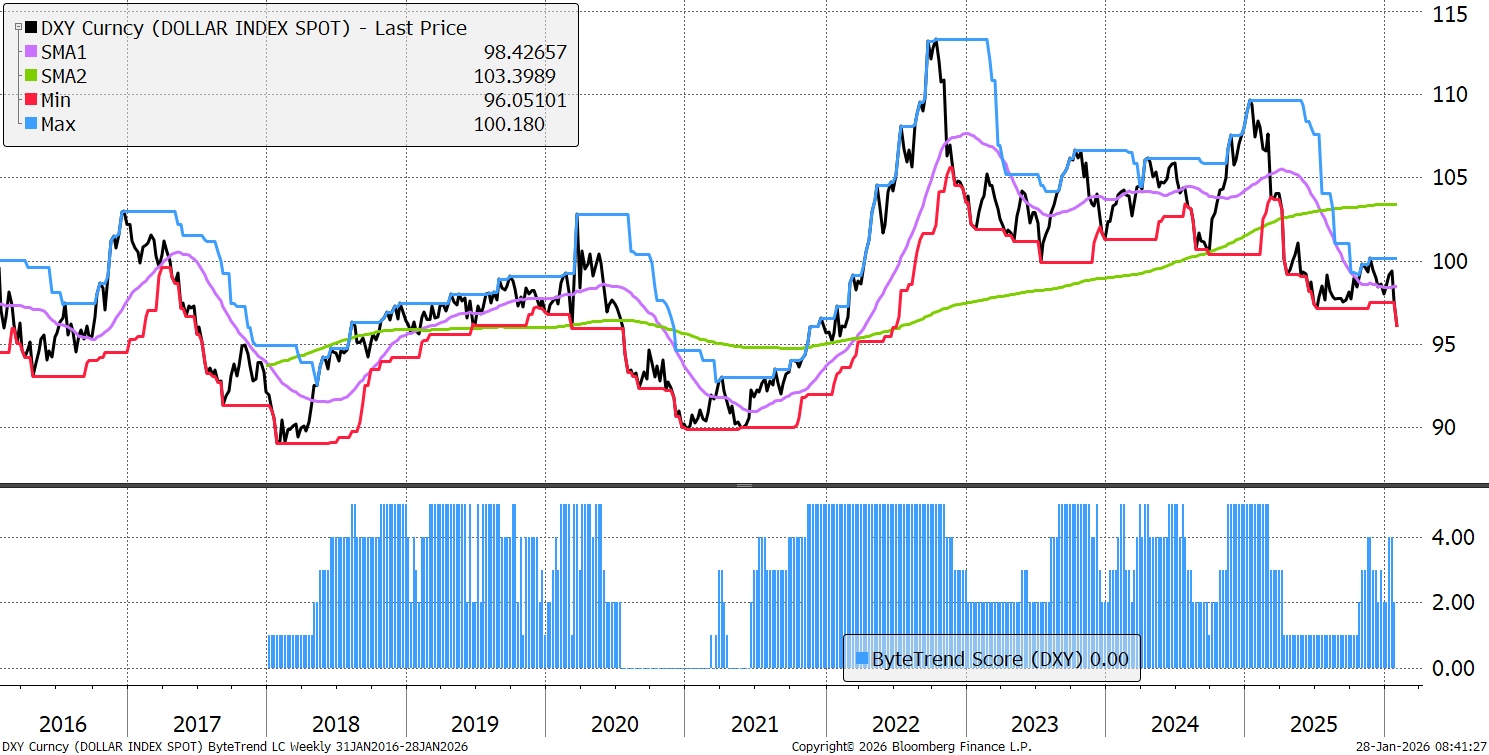

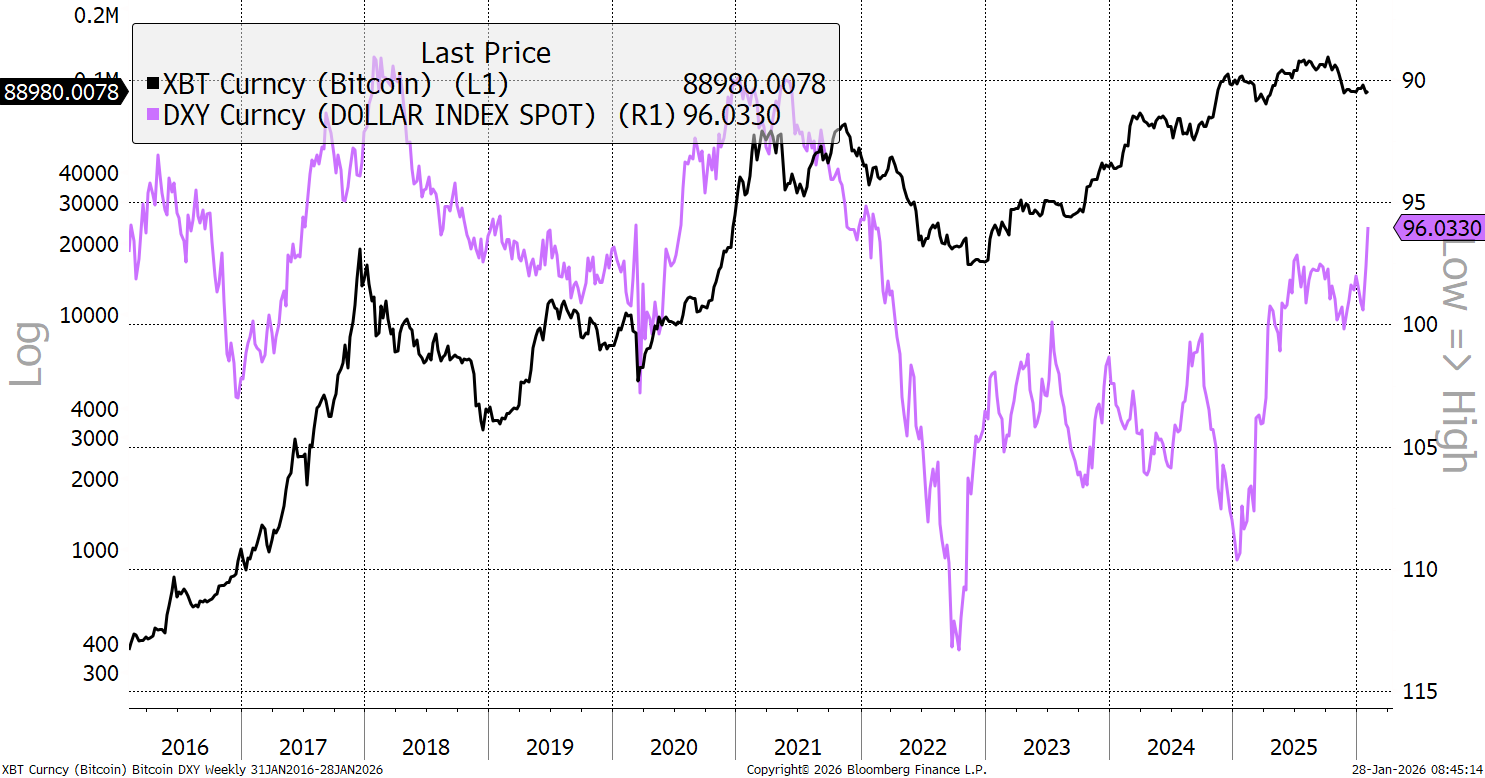

The dollar dropped to a zero on the weekly charts, which is a big deal.

It has been falling for a year, and the benefits have been felt in Gold rather than Bitcoin. The dollar story is important and should be supportive for risk in general, but why is Bitcoin the slouch?

The US Dollar Index

Historically, a weak dollar has been a Bitcoin bonus. It is shown (in purple, inverted) with close links in 2017/18/20/22, but less so since, in terms of correlation. Yet it is easy to forget that dollar weakness has been a theme since October 2022.

Bitcoin and the Dollar (Inverted)

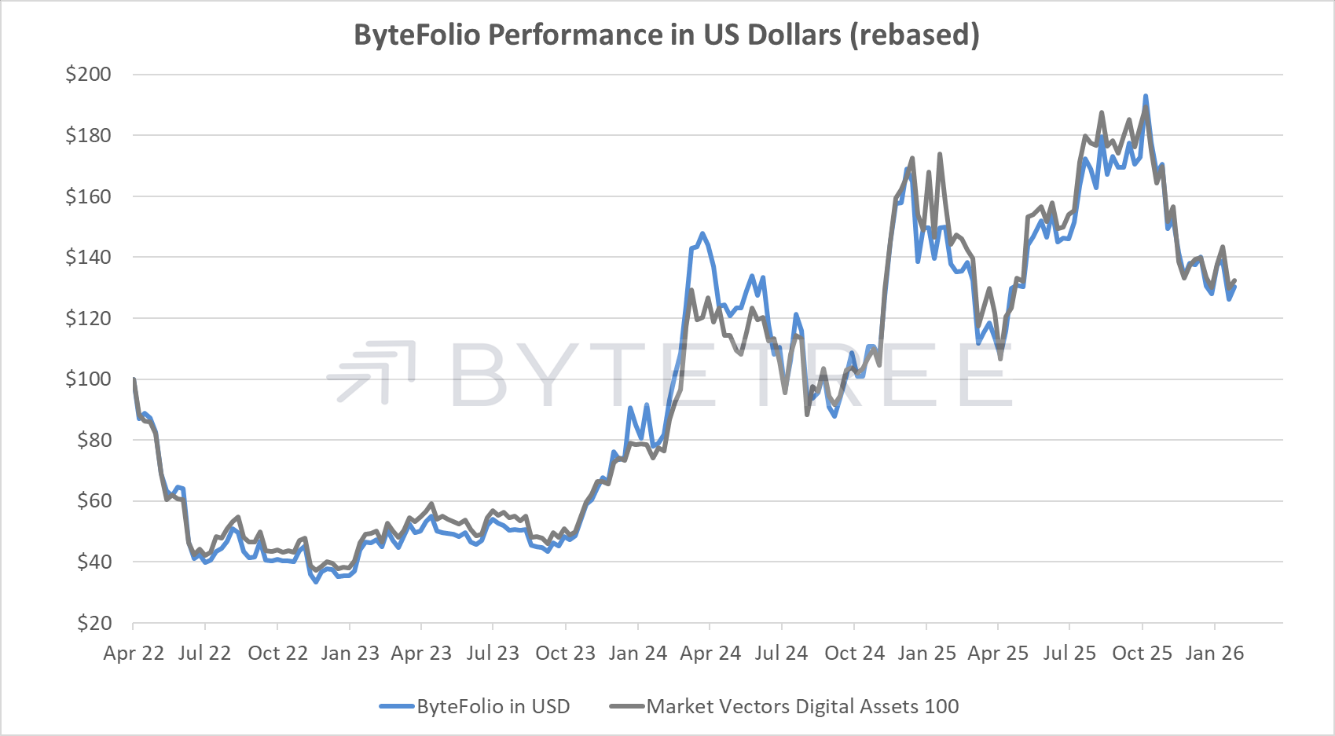

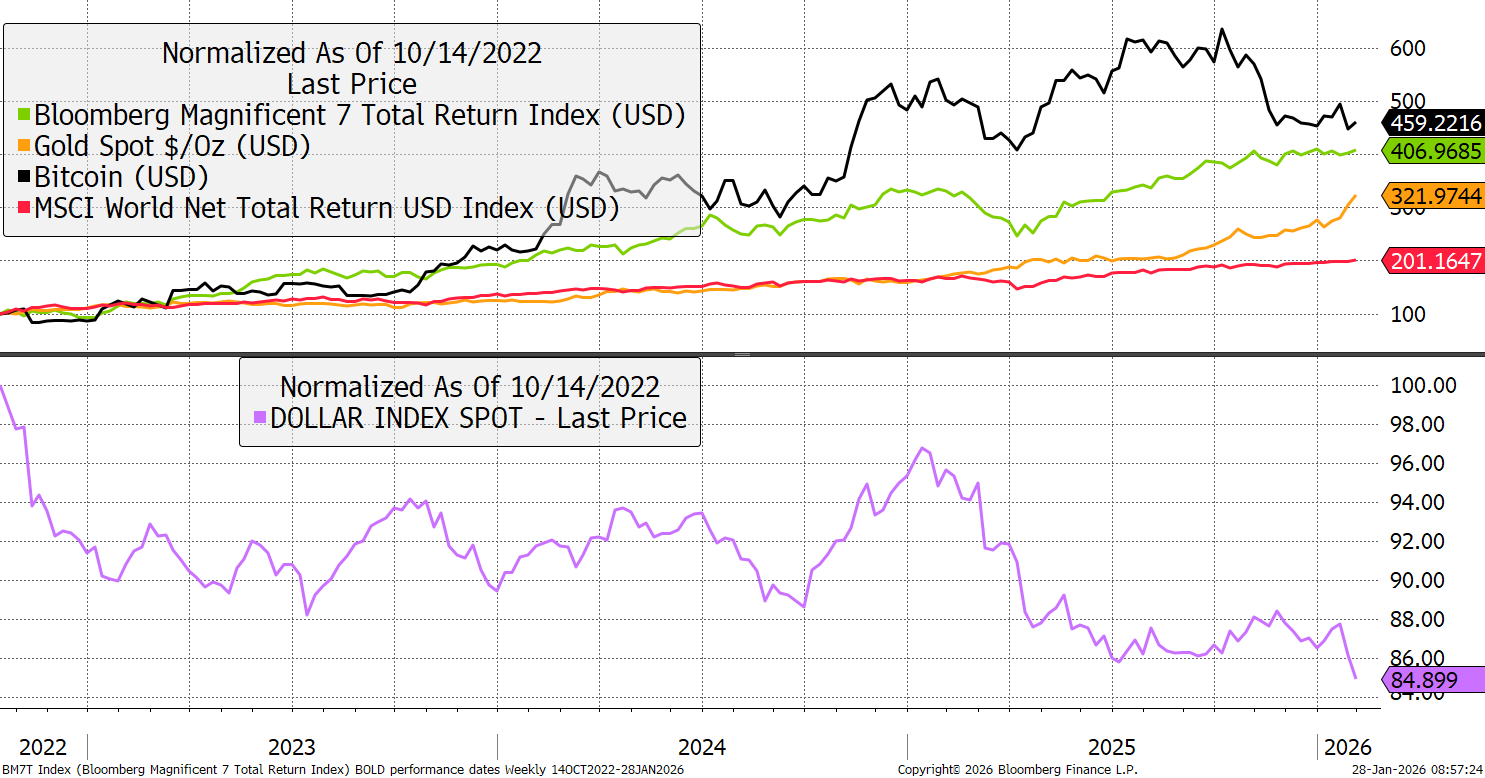

The reality is that Bitcoin has been the best-performing asset in this weak-dollar environment. Global equities have doubled since the dollar peak, which coincided with the bottom in equities. Gold has trebled, the Mag 7 quadrupled, and bitcoin even more. Maybe Bitcoin just got ahead of itself, which, let’s face it, is something Bitcoin excels at.

Bitcoin Number One, Since The Dollar Peak in 2022

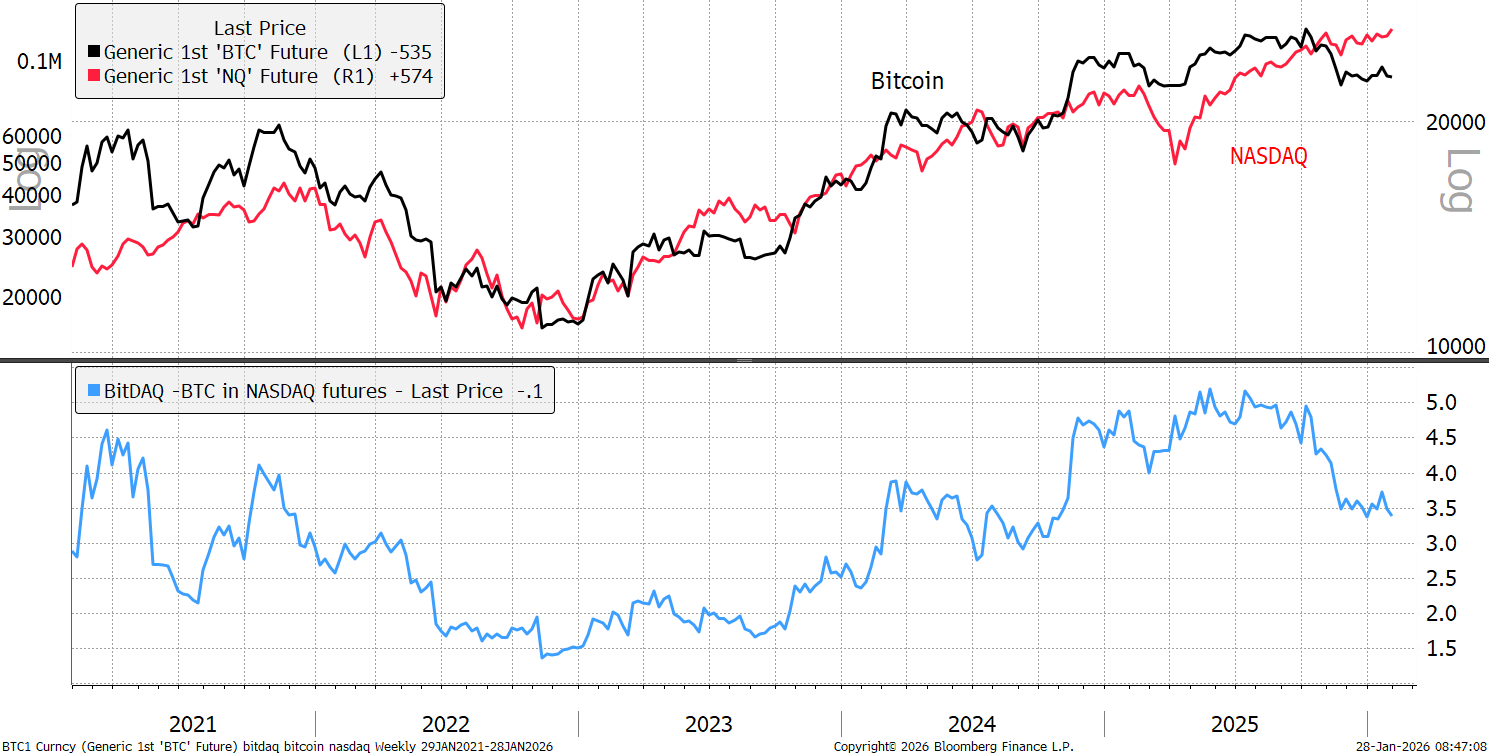

The BitDAQ, or Bitcoin in Nasdaq, remains soft, but an optimist might point out that 3.5 (blue) is over twice the 2022 low.

Bitcoin in Nasdaq

Another thought, has anyone noticed US inflation expectations? If this continues, it won’t be ignored by Bitcoin for long.

US 10-Year Breakeven Rate

If Bitcoin were dying, the price would be much lower by now, and it isn’t. As regular readers already know, Bitcoin is in the weakest part of the cycle, which the smart cookies know is the best time to buy.