Gilts Surge, Cheap Oil, and BOLD

Trade in Soda;

There’s a huge story in financial markets today, as BOLD was listed on the London Stock Exchange this morning, and we’ll get to that. But first, the other big story, which is gilts. I shall also update you on Metlen.

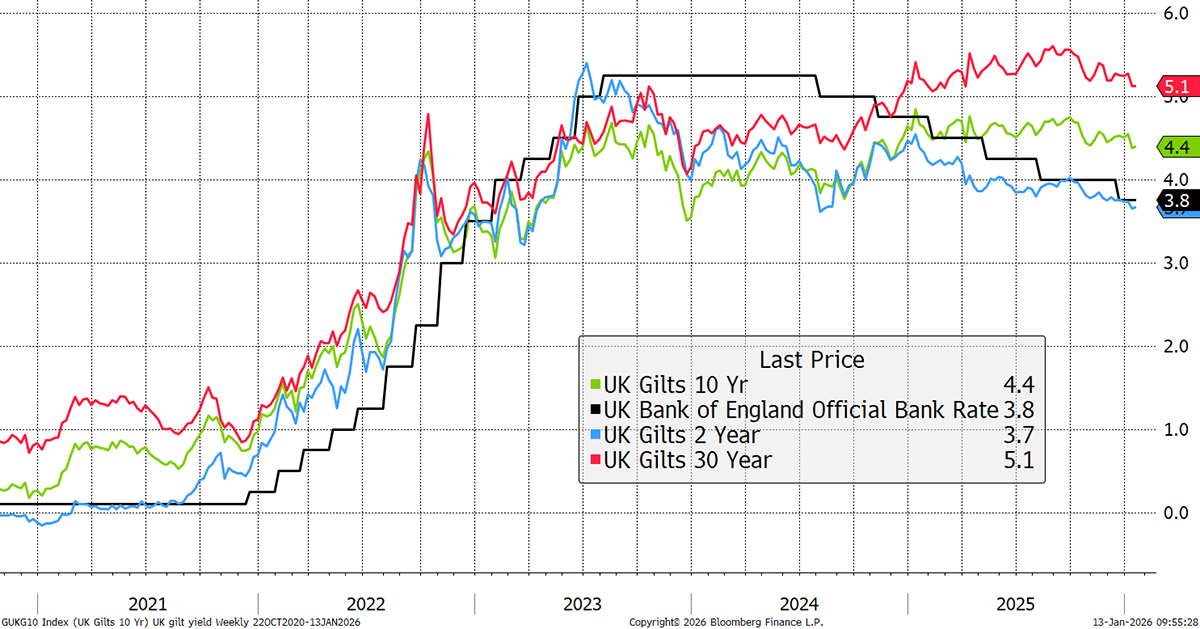

Last year, there were fears that the gilt market was out of control. Yields were rising, more so than in any other developed country, as borrowing costs were running out of control. Yet more recently, we have seen interest rates fall, and the long-dated gilt yield follow suit. This suggests that the gilt market is less concerned with public finances than it was, which comes as a relief.

UK Bond Yields

The concerns over the UK national debt haven’t gone away, but are no longer in the spotlight. I would suggest that the rise of the FTSE 100 in Q4 has coincided with falling bond yields. Markets like stability.

It could also mean that the economy is slowing, which it probably is, but we should never forget that stockmarkets and economies are different things in the medium term but joined at the hip over the long term.

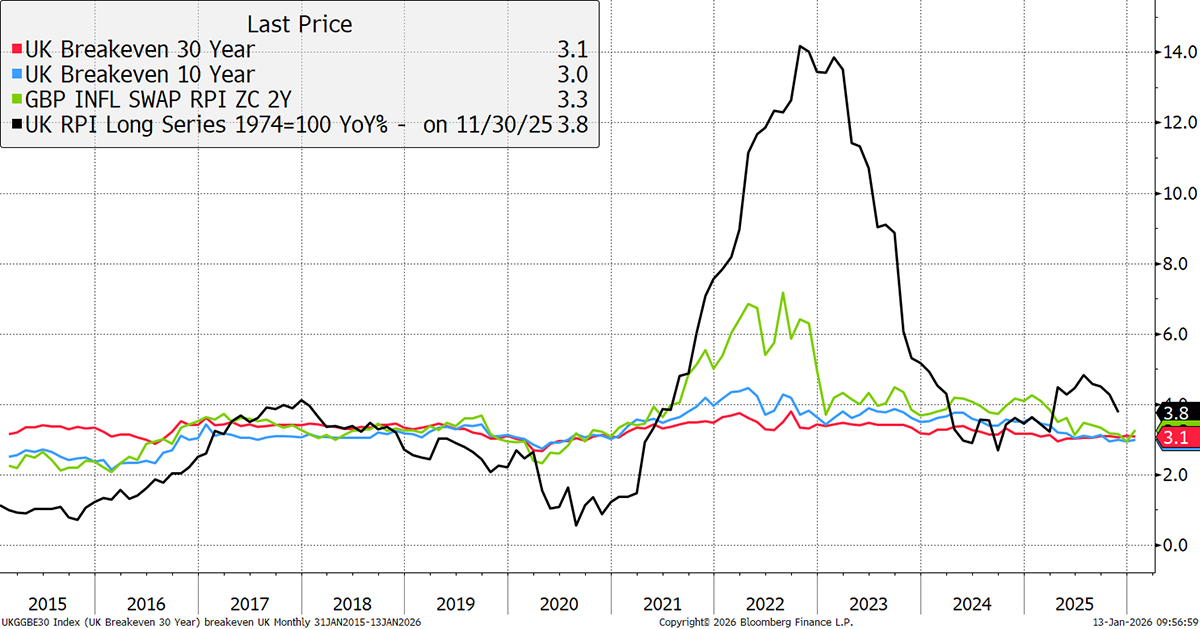

Reported inflation is also lower, and long-term inflation expectations, while still above the 2% target, have been well behaved. They haven’t fallen, but they haven’t risen either. Again, a sense of stability in the air, which has been supportive for the equity and bond markets.

UK Inflation Tamed

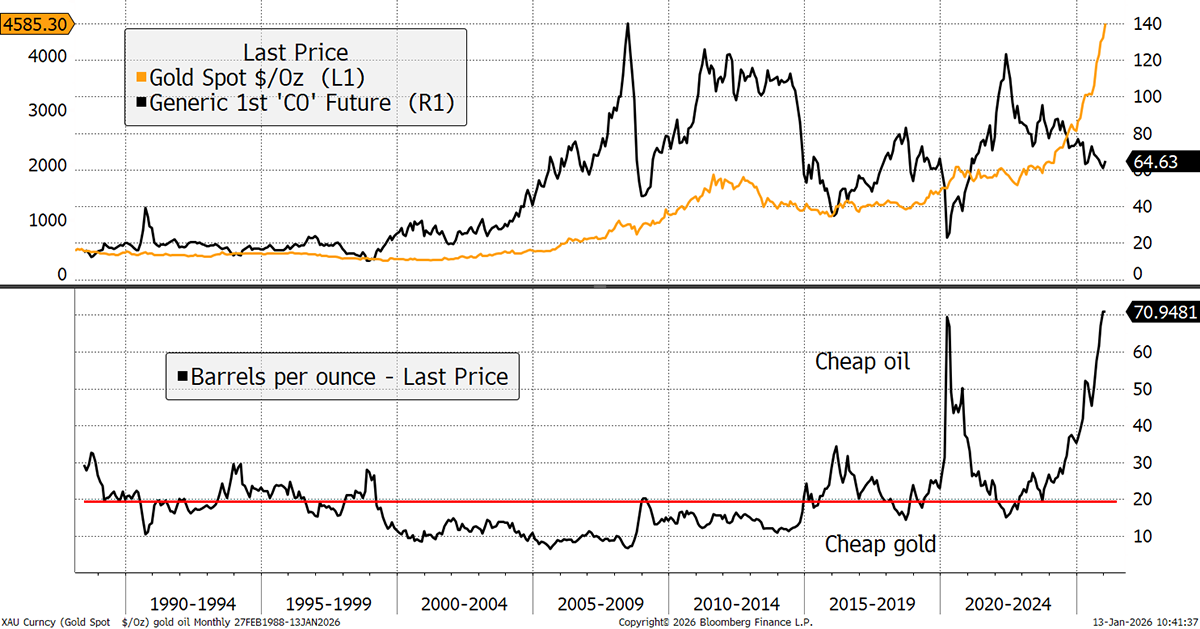

While our masters will gladly take credit for falling interest rates and lower inflation, one reason for lower consumer prices is cheap oil. Trump is keen on drilling, and global supply is currently outstripping demand. Yet demand is still rising, albeit at a slower pace than in the past as electrification grows.

The consensus opinion on oil is bearish, yet I see that the supply glut has been well flagged, and that financial speculators have the lowest position since 2010. Being an oil bull is a lonely place to be. Furthermore, the oil-to-gold spread is even higher than at the peak of the pandemic when transport ground to a halt. This is getting ridiculous.

Gold versus Oil

I read that Venezuela, which has the world’s largest oil reserves (according to Venezuela), will not see restored production for up to 10 years, even with help from the US. Russian infrastructure is being attacked regularly, and Iran is in disarray. In the noughties, oil led gold, but gold still rose. This time, gold leads oil. I cannot imagine a scenario where commodities break ranks and do not see a group move as is commonplace. With oil so cheap, the market so short, sentiment so weak, and everyone a bear, there’s only one thing to do.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd