ByteTree Quarterly Investor Letter – Q4 2025

Since 2013, our mission has been to help people invest better. We do this by delivering actionable, high-quality, contemporary investment guidance at an affordable price. With all the information out there, we help investors by distilling our advice into model portfolios, explaining every new investment recommendation in real time.

In this Q4 2025 update, I shall review the model portfolios, named Whisky and Soda, which I have been managing since January 2016. These are covered in The Multi-Asset Investor, which is published on Tuesdays. I shall also touch on some of our other services.

Letter from Charlie Morris, CEO

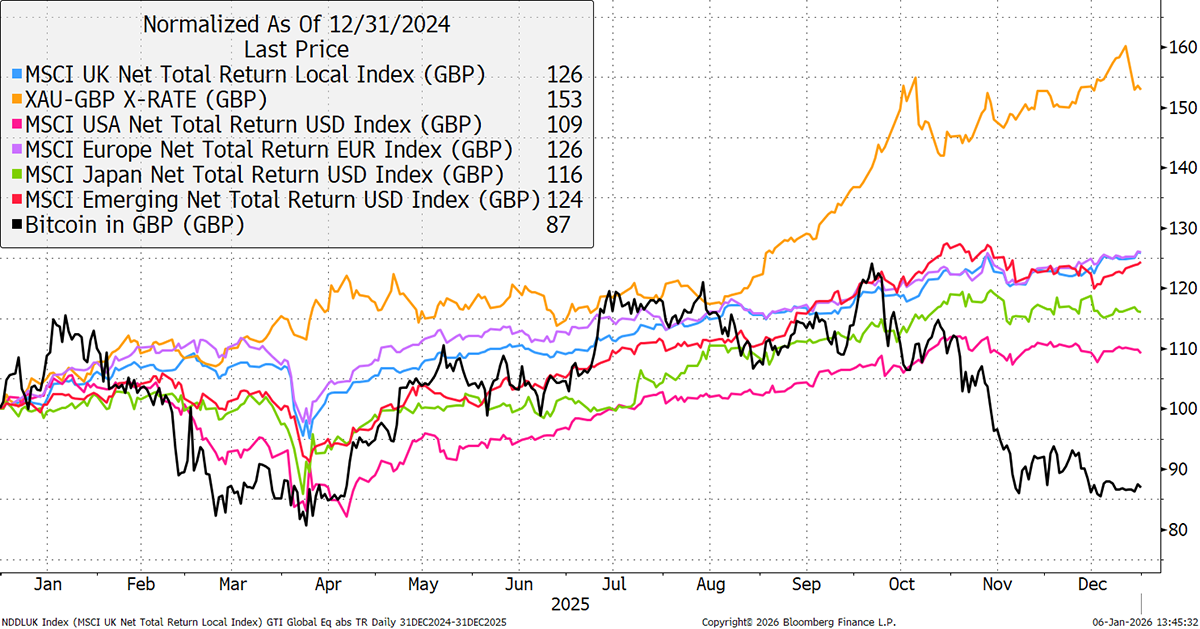

In 2025, stockmarkets were once again strong, but unlike recent years, the USA was left behind, returning 9.2%. The rest of the world fared better, with Europe returning 26%, the UK 25.8%, emerging markets 24.3%, and Japan 16%.

Global Equities, Gold, and Bitcoin in 2025

Currency movements against the weak dollar explain much of that performance as the Euro rose 13.4% (vs dollar), the Pound 7.6%, the Renminbi 4.4%, and the “weak” Yen 0.3%. It was the dollar that had a weak year.

A weak dollar was a tailwind for stockmarkets and, above all, the gold price, which beat all major equity markets. Yet Bitcoin, which is normally inversely sensitive to the dollar as well, fell by 13.1%. Gold’s strength was primarily driven by geopolitical concerns as the People’s Bank of China bought record amounts as they seek to hold neutral reserve assets. Bitcoin’s weakness was a late affair as the price cooled in Q4 alongside the pullback in technology and high-volatility stocks.

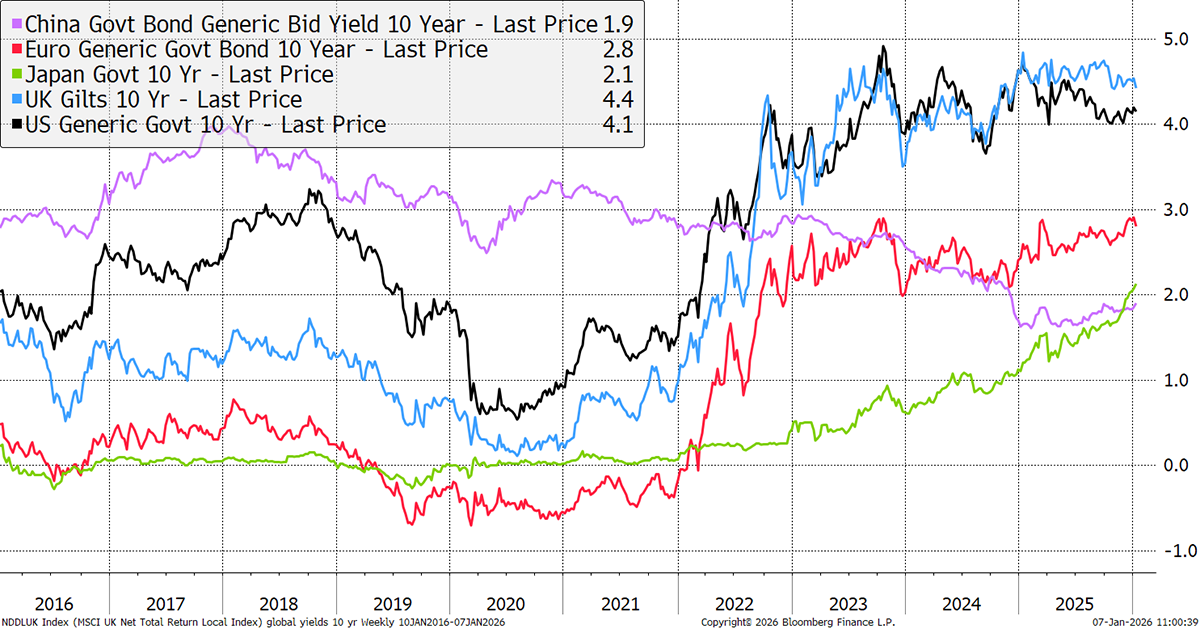

Bond yields fell in the UK after a sticky period over fiscal deficits, but lower inflation won the day, aided by a low oil price. It seems that Trump’s strategy is to run the economy hot, while keeping inflation contained via cheap energy. This partly explains his actions in Venezuela and the eagerness for increased production. Bond yields in the USA fell even faster. In Europe, they rose from low levels, but the big moves came from Asia. Chinese yields have been falling while Japanese yields have been rising at the fastest pace in years, as they normalise their bond market.

Global 10-Year Bond Yields

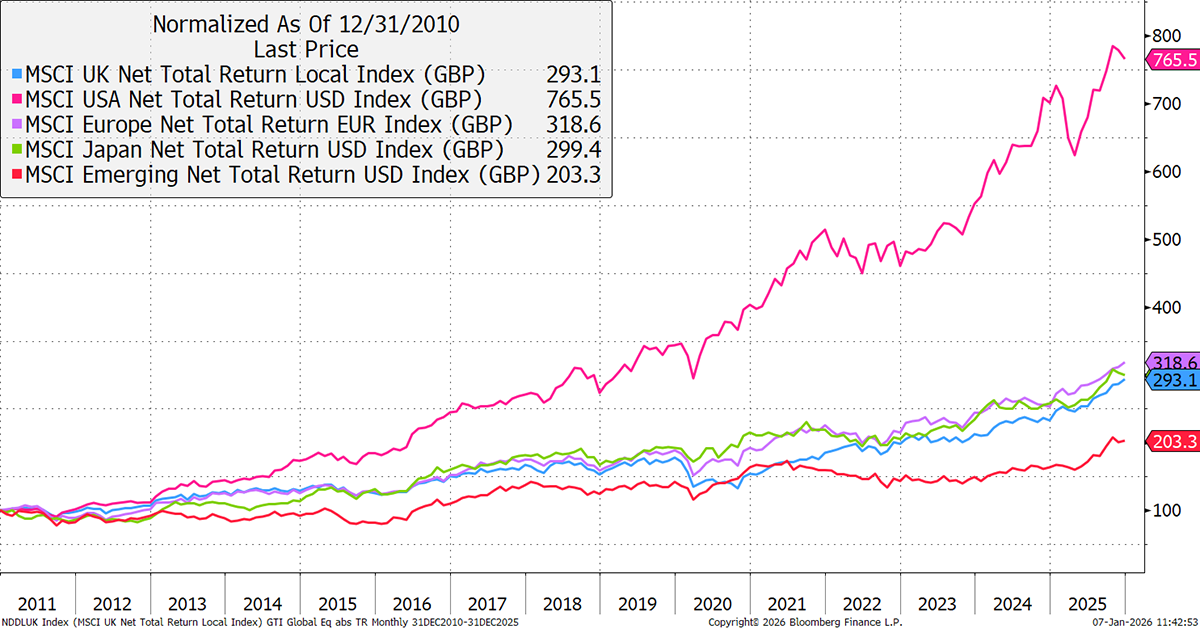

I want to take this opportunity to highlight the scale of the bubble in US equities. Many say the high returns are justified because the technology revolution is real, and US companies dominate it. That is probably true, but my concern is that high valuations lead to lower future returns. I am less concerned with the revolution in technology and AI, which will no doubt lead to worldwide improvements in productivity, but rather more with the impact on investors’ returns. The gap between the US and the rest of the world has been extreme.

Global Stockmarkets since 2011

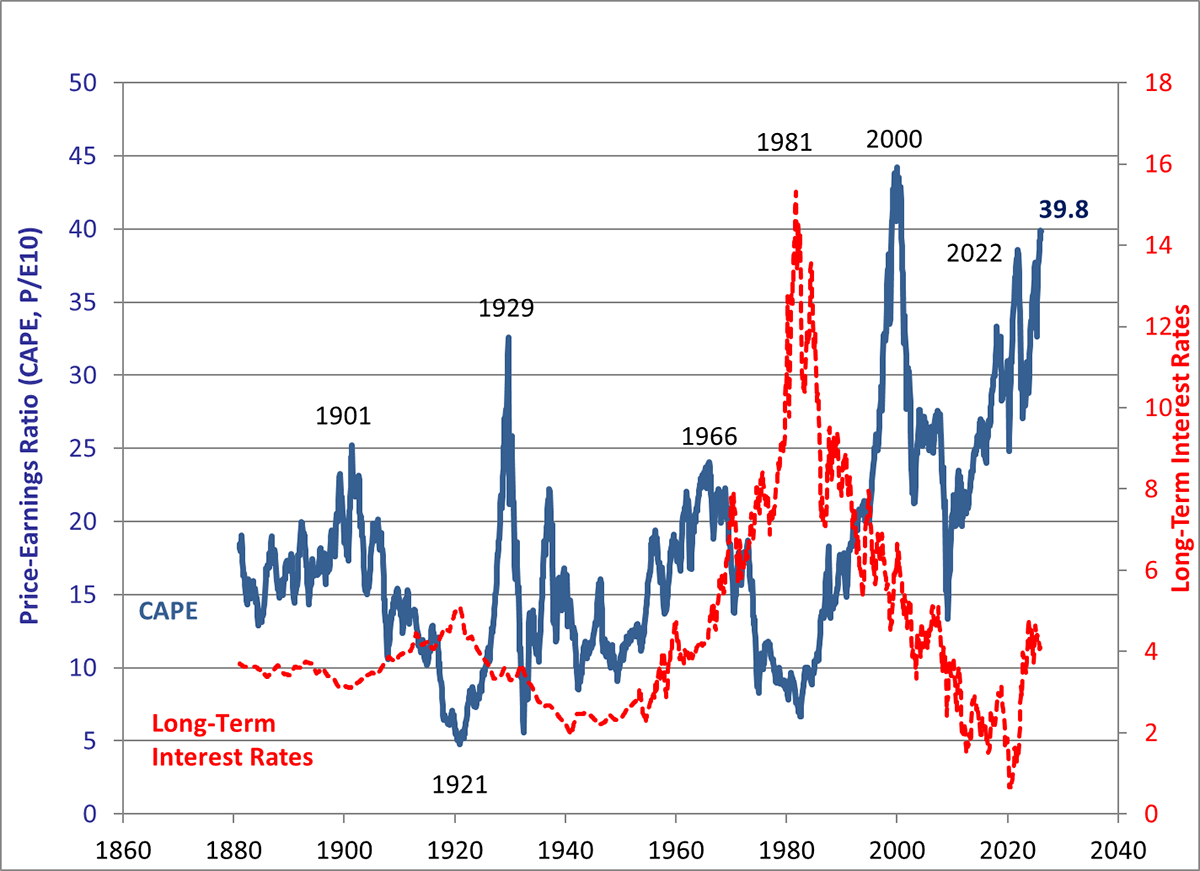

Created by Carl Case and Robert Shiller, the Case-Shiller Cyclically Adjusted Price-to-Earnings Ratio (CAPE) is a long-term market valuation model. The CAPE ratio for US equities is 39.8x, which is the second-highest reading on record.

US Equities CAPE Ratio

Shiller plots the “excess CAPE Yield” in blue below. That is the earnings yield (CAPE inverted) less the real 10-year bond yield. This shows investors how much “excess return” they can expect from equities over the inflation-adjusted risk-free rate available from government bonds. This was high in 1921, in 1932 after the great Wall Street crash, and in 1982 after a painful period in markets during the 1970s. The excess CAPE yield was low in 1929 before the crash, in 1970 ahead of that rough decade, and in 2000 at the peak of the dotcom bubble.

Excess CAPE Yield (ECY) and Subsequent 10-Year Annualised Excess Returns

The green line shows the subsequent 10-year rate of return as it actually happened and therefore is set back by ten years. In 2025, we now know that in 2015, the stockmarket returned 14% of excess returns over bonds for the next ten years, but we didn’t know that then. The power of this chart is how accurate it has been in the past for anticipating future “expected returns”. With an excess CAPE yield of 1.5%, we can reasonably expect the S&P 500 to do very poorly over the next decade.

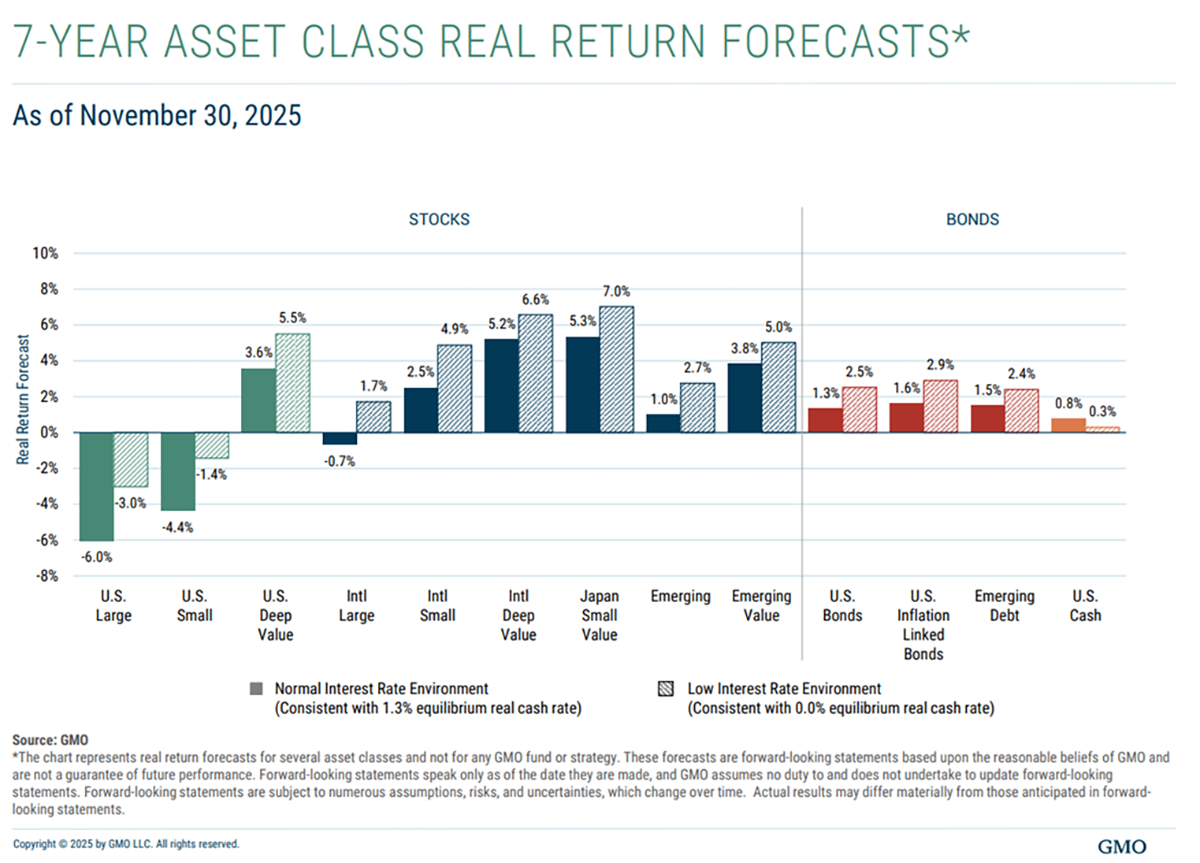

A similar idea was published by the fund manager GMO. They use current pricing models to anticipate returns over the next seven years by asset class. They also split out the forecast by interest rate environment, whereby low rates will boost equity returns and vice versa. They favour small-caps, especially in Japan and emerging markets. Above all, they favour deep value, which is what I focus on, and this is why. They are cautious on both US large- and small-caps. As for bonds, they expect to see positive real returns, which contrasts with this dataset published five years ago, which showed negative expected returns. That proved to be correct.

GMO: 7-Year Real Return Forecasts

I highlight this long-term thinking because it is important that investors understand it. The US market may fly for a few more years, or it may slump; nobody knows. But over a longer time horizon, it is very likely that non-US equities beat US equities, just as they did after the dotcom crisis for a decade.

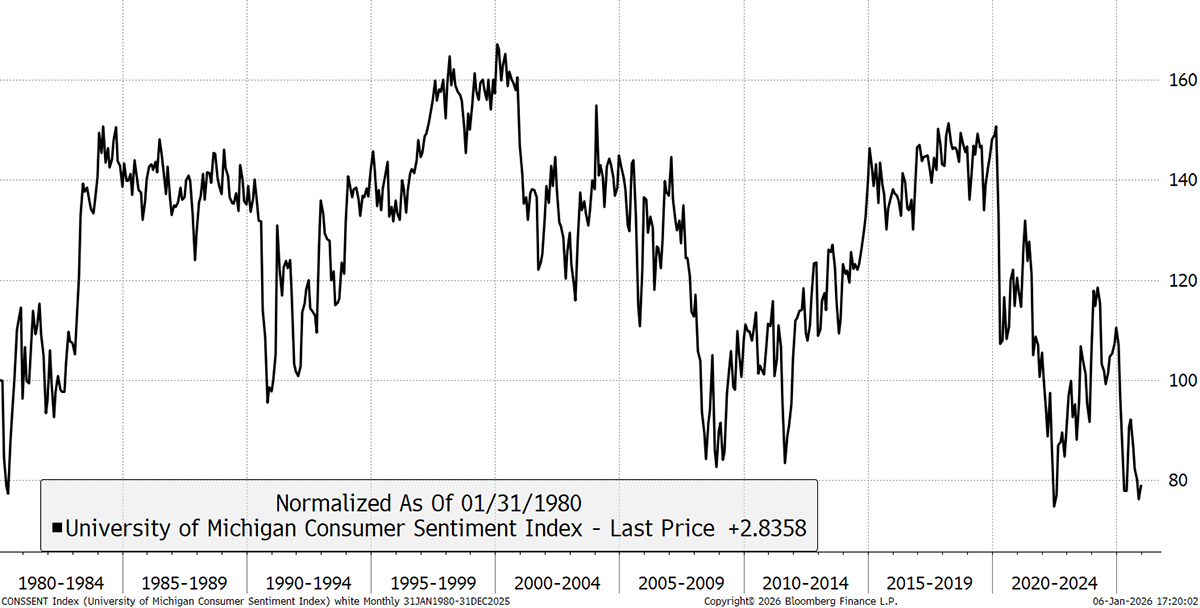

Finally, you cannot ignore how tough these times are for consumers. Current readings are in line with the 1980 recession, the financial crisis, and the pandemic. Stocks have risen while the consumer has remained under pressure, in what some call a K-shaped recovery.

Consumer Sentiment

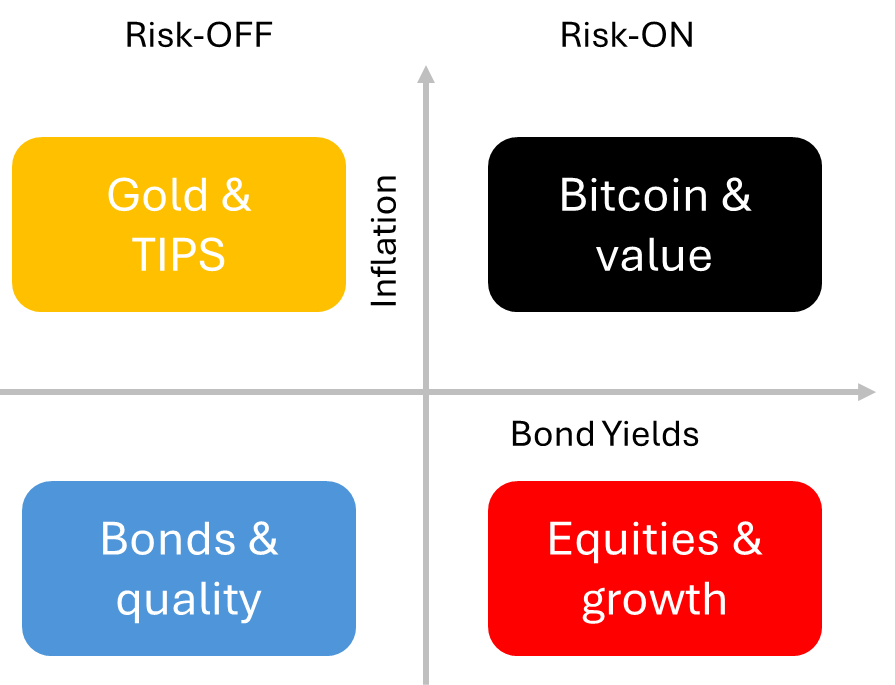

These are not normal times, whatever normal actually means. At ByteTree, I build diversified portfolios, which represent good value across countries, asset classes, and sectors, and balance them according to the Money Map.

The ByteTree Money Map

It is an investment process I have been refining for many years, too many perhaps. Some years are good, others less so, but I am always consistent in my approach, finding opportunities backed by fundamental value.

The Multi-Asset Investor

The Whisky Portfolio

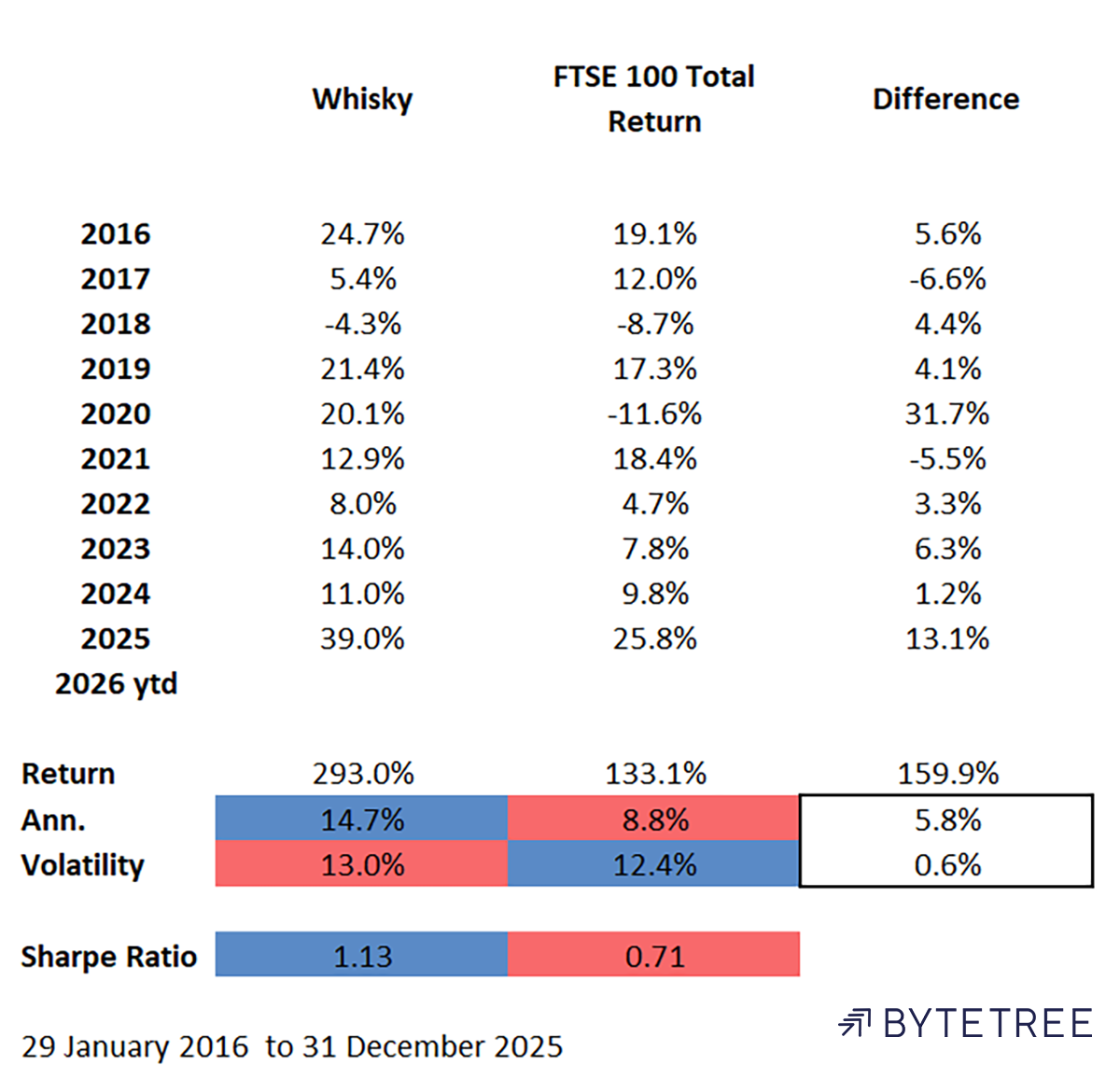

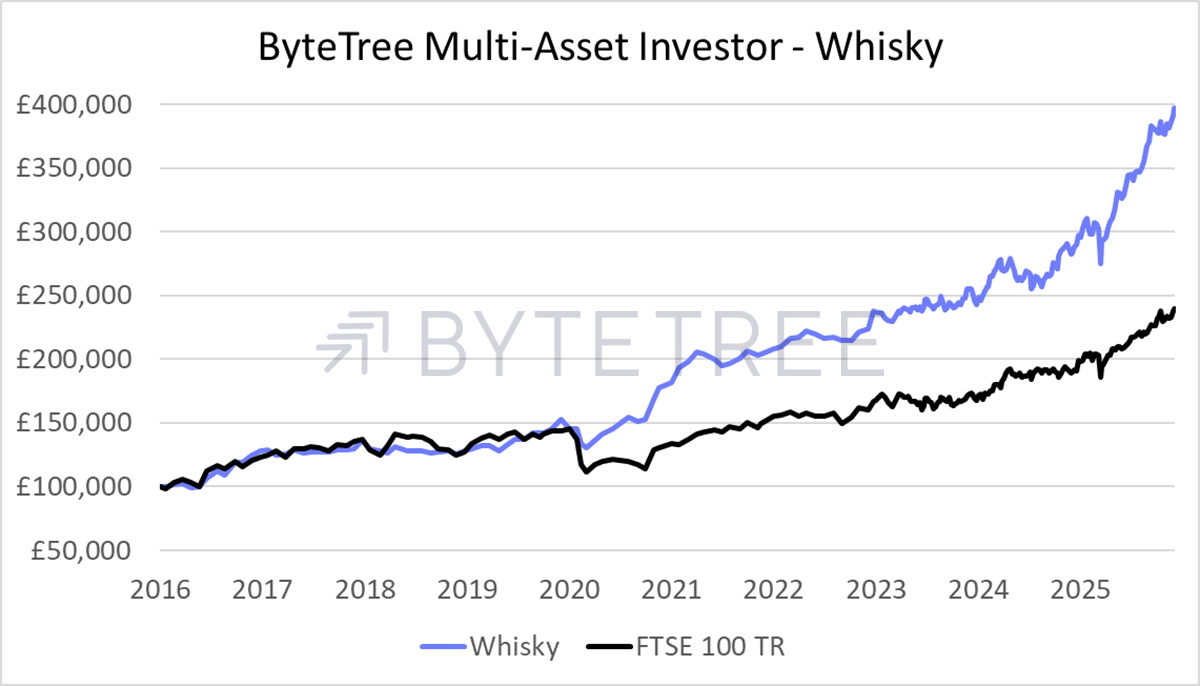

It has been a strong quarter for the Whisky Portfolio, which was up 39.0% in 2025, against the FTSE 100, which was up a respectable 25.8%. Notably, the FTSE 100 is now above 10,000 for the first time in its history. Since 2016, that has been the best nominal return for Whisky, but not the best outperformance, which was reserved for 2020, when Whisky delivered a good return against a weak market.

Whisky vs FTSE 100

Over the near decade-long track record (10 years on 29 January 2026), Whisky has returned 293% against 133.1% for the FTSE 100, including dividends; an outperformance of 159.9%. Whisky has been slightly more volatile than the index, but not materially so, delivering a Sharpe Ratio above one, which is a good sign. Whisky has annualised returns at a rate of 14.7% against the 8.8% for the FTSE 100.

Performance picked up after 2020 for two main reasons. The first is surely that I dedicated myself to this full-time after I left the city. The second is that I started to embrace more European and global stocks, despite the portfolio remaining predominantly in the UK. In 2025, you could add high exposure to precious metals and the mining stocks.

Whisky Portfolio Performance

The Whisky Portfolio held gold mining stocks and silver, a position which has grown since 2018. This was finally reduced from a peak of 38% in October 2025 to 20.6% today. Precious metals remain strong, but they are unquestionably moving into the crazy phase. That means higher volatility, meaning it is prudent to hold a lower position in the future. I remain bullish but am focused on broadening exposure to industrial metals and, at some point, other commodities, including energy and agriculture. Commodities tend to move as a group, and I doubt this cycle will prove different in the fullness of time. Whisky also made considerable gains in crypto-related equities.

Barry Callebaut, the Swiss chocolatier, was the most enjoyable note to write in Q4. It was an interesting situation, and a high-quality stock that had been shaken by the surge in cocoa futures. Cocoa prices are now down over 50% from their peak, as reports of better yields and improving disease rates increase. The company has taken steps to insulate itself from a recurrence and is recovering as the cocoa market normalises.

Malaysia was added too, a fast-growing country that has been overlooked by investors. The market was trading at a low valuation despite a strong currency over two decades, and with a cost of borrowing below that of the UK.

PHP, the healthcare REIT, was another good find. It has stable tenants in the healthcare sector, including hospitals, doctors, and dentists, has a strong balance sheet, and pays a 7% yield even after the gains since being added. Whisky judges value on its merit, and is happy to buy it in whatever form, wherever it comes from.

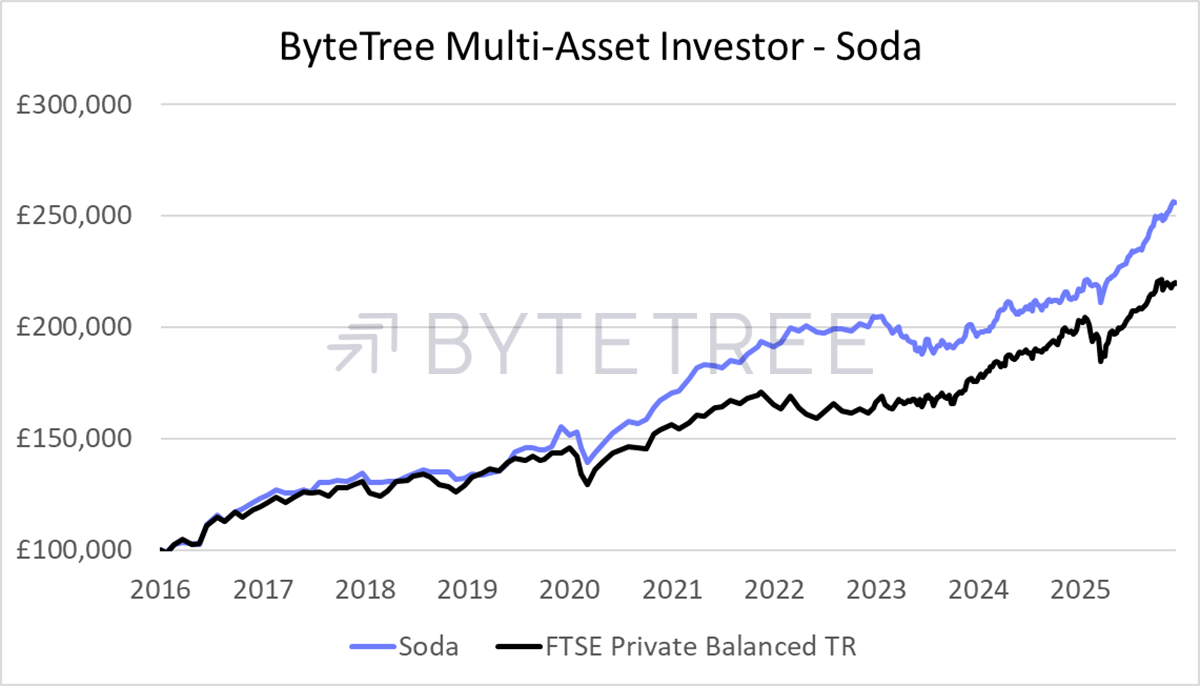

The Soda Portfolio

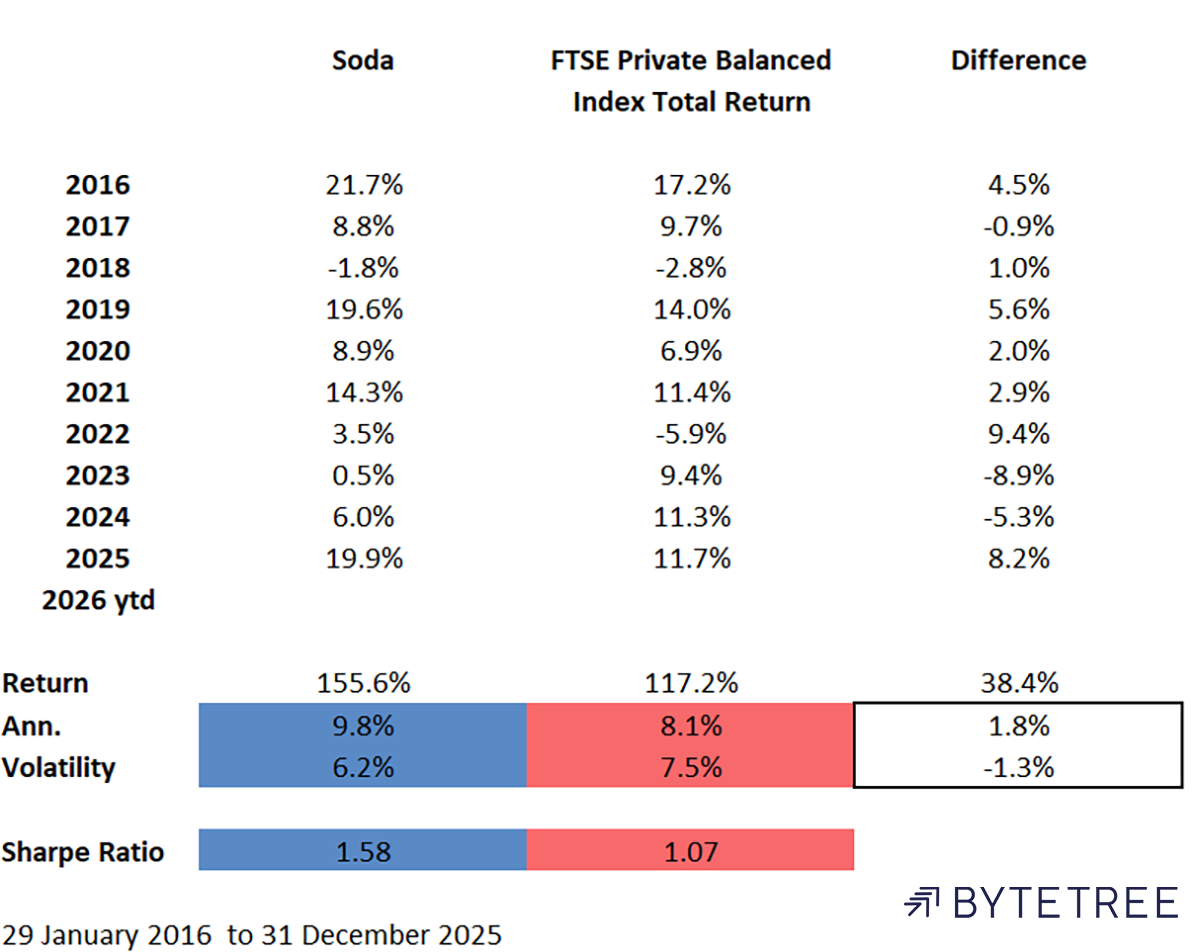

Soda is up 19.9% this year against the FTSE Private Balanced Index, which is up 11.7%, meaning 4.5% of outperformance. The previous two years were tough, mainly because market returns were driven by the large tech stocks, and I refused to buy them. More fool me, perhaps, but I stick to my investment process where I can find tangible value. I believe that big tech will grind to a halt in terms of delivering outsized returns, and that will hopefully provide a healthy tailwind of relative performance over the coming years.

Soda vs FTSE Private Balanced Index

2025 was a good year for Soda, and the long-term record remains healthy. A balanced portfolio that embraces bonds as diversifiers has been held back, as the bond market is yet to resume the strong performance seen pre-2021. Bonds may perform this year, as real yields are quite high, but so many things could go wrong, not least the addiction to government borrowing.

Soda has returned 155.5% since inception against 117.2% for the benchmark, which translates into a rate of return of 9.8% against 8.1% for the balanced index. Notably, Soda’s volatility remains materially lower than the index, which demonstrates effective diversification. The Sharpe Ratio remains much higher than the index, and I am pleased with that.

The long-term level of outperformance has been less impressive than in Soda, but ironically, this “balanced” index has a much higher exposure to technology stocks than the FTSE, which has none. I am confident that the gap, which shows relative performance, will continue to widen over the long term, especially should US equities lag the rest of the world.

Soda Portfolio Performance

Last year, Soda increased exposure to RIT Capital (RCP), which got a boost from its holding in SpaceX, which is expected to IPO this year with a trillion-dollar price tag. This is proof that balanced portfolios can still be interesting.

The portfolio took profits in European banks, which had been fabulous. The normalisation of the yield curve made banking highly profitable again, following years of zero rates. Perhaps that was too soon, but other new investments, such as Swiss equities and REITs, seemed compelling.

The BlackRock Mining Trust (BRWM) was a notable performer in 2026, returning 67%, as the mining stocks had their best run since 2016.

Japan remains a high-conviction overweight. The normalisation of the bond market, with a cheap currency, should lead to strong performance in the long term. Japanese equities have been the worst place to invest since 1990, and this should change.

I also highlight BH Macro (BHMG), which has done a good job over the years, delivering healthy returns when things go wrong. We bought in at a discount in 2024, and while not much has happened for them in 2025, it is worth remembering what that can add to a portfolio when it matters.

The Multi-Asset Investor, backed by Charlie’s experience and a nine-year track record, is open to new subscribers.

The ByteTree Quality Portfolio

The ByteTree Quality service was launched on 24 August 2025, and we started building the portfolio with our first stock, Diageo, on 3 September. Diageo’s multi-year downtrend continues for now, although it briefly jumped on the news that Dave Lewis, famous at Tesco for driving operational excellence, had been named the new CEO. He is just what the company needs. Meanwhile, late 2025 saw signs of a shift in the narrative about declining drinking habits, with full pubs for Christmas and falling Dry January commitment among younger consumers. Diageo is holding the portfolio back for now, but over any reasonable time frame, we remain confident in its outlook.

In December, we unlocked our second recommendation, Nestlé, which surged following the new CEO’s announcement of major layoffs and a “turnaround fire”. It has the brands to succeed long-term, and given the price paid, its prospects are excellent. Healthcare was also a dominant source of additions to the portfolio in the quarter, as the sector showed a balance of value and momentum that is rare in today’s highly valued markets.

We investigated and rejected a number of companies too, either on valuation or resilience grounds. Our focus is on the highest quality companies, with very high conviction in their future performance, which could reasonably be held for decades. Many great companies do not qualify, as uncertainty and the threat of disruption are too great. The discipline of what not to invest in is just as important as what we do invest in, especially given the current state of financial markets.

With 11 stocks recommended to date, and an additional spinoff, we aim to have around 24 stocks by the spring. Thereafter, the portfolio will continue to identify new opportunities when suitable companies are offered at low prices, with a positive outlook. The idea is that the turnover will be low but remain active. A robust group of stocks that should perform well over the long term, while proving resilient during times of stress. It is a different way of doing things that should appeal to long-term investors who take comfort in holding resilient businesses.

Other Matters

The Multi-Asset Investor quarterly webinar will take place tomorrow at 4 PM GMT. We hope to see you there – Register to Attend.

Over the Christmas period, as Silver soared, we released two videos. One responded to an aggregated list of FAQs about The Multi-Asset Investor service and portfolios, which you can find on our YouTube channel. We also released a helpful video on our Global Market Intelligence (GTI) research, which we publish on our sister site, Global Trends. Please subscribe to our YouTube channel as we will be posting more videos for you in 2026.

Finally, as always, we are very pleased to see the reviews we get from ByteTree clients, both privately and on Trustpilot. Thank you.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd