Listing of the 21Shares Bitcoin and Gold ETP (‘BOLD’) on London Stock Exchange

First product to be listed combining Bitcoin and Gold

“Delivering Bitcoin-like returns with the lesser volatility of Gold”

BOLD combines the world’s two most liquid alternative assets - Bitcoin and Gold - in an innovative product, with its track-record to date demonstrating that it reduces volatility while delivering high returns.

BOLD is designed to provide investors with exposure to the performance of Bitcoin but in a derisked, highly efficient, and smooth way by blending it with Gold. The monthly portfolio rebalancing seeks to maintain the optimal level of risk exposure in each asset.

BOLD Key Facts:

- First product of its kind to be listed on the London Stock Exchange (tickers: BOLD in GBP, BOLU in USD)

- Proven performance and track-record since launch on 27th April 2022 in Switzerland

- BOLD has returned 122.5% since launch (in GBP to end 2025 including fees) compared to 111.3% for Bitcoin and 113.0% for Gold

- Physically backed by Bitcoin and Gold, with institutional-grade custody

- Weighting of Bitcoin and Gold rebalanced monthly using 360-day inverse volatility to maintain an equal level of risk exposure in each asset

- Efficient and low-cost trading product, trading intraday with a TER (total expense ratio) of 0.65%

- Already listed on several European Stock Exchanges: Zurich, Frankfurt, Paris, Amsterdam, and Stockholm

- Trading begins on Tuesday 13 January 2026 on the London Stock Exchange

About BOLD:

BOLD was created in 2022 and is the first listed product of its kind to be listed on the LSE, with a demonstrated performance and track-record. It is an efficient and low-cost trading product, underpinned by physical Gold and Bitcoin with institutional-grade custody. BOLD has been designed to provide an innovative, highly efficient, and stable way to own both Bitcoin and Gold.

Bitcoin and Gold are considered highly complementary assets, with limited supply, and should form part of a diversified and balanced portfolio. Their demonstrated low correlation makes them ‘perfect partners’ in a product, designed to work together to provide high but smoother returns with naturally efficient diversification and reduced risk.

“Why not just own Bitcoin and Gold separately?

- BOLD allows all investors to have exposure to the ‘alpha’ but in a risk-adjusted way that reduces the overall volatility to levels close to that of just Gold alone

- BOLD increases the returns profile, and delivers, on average, an additional 5-7% in excess returns per annum through the monthly rebalancing process, whereby the strongest asset is reduced, and the weaker asset is increased

- BOLD provides a smoother performance trajectory and is a pure-play on growth in the global money supply, with approximately 5x impact

“BOLD’s long-term performance should deliver returns in line with Bitcoin, but with the lesser volatility of Gold”

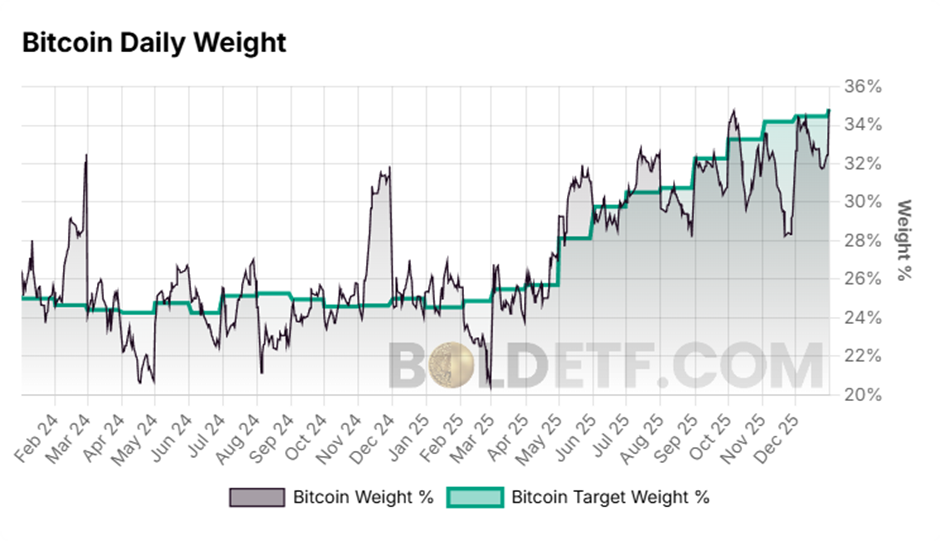

Rebalancing Strategy:

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in BOLD at the end of the monthly rebalancing. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”.

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, as it did in February 2025, it would be boosted back up to the target weight during the next rebalancing at the month’s end. This ensures the strategy maintains the optimised weights for Bitcoin and Gold.

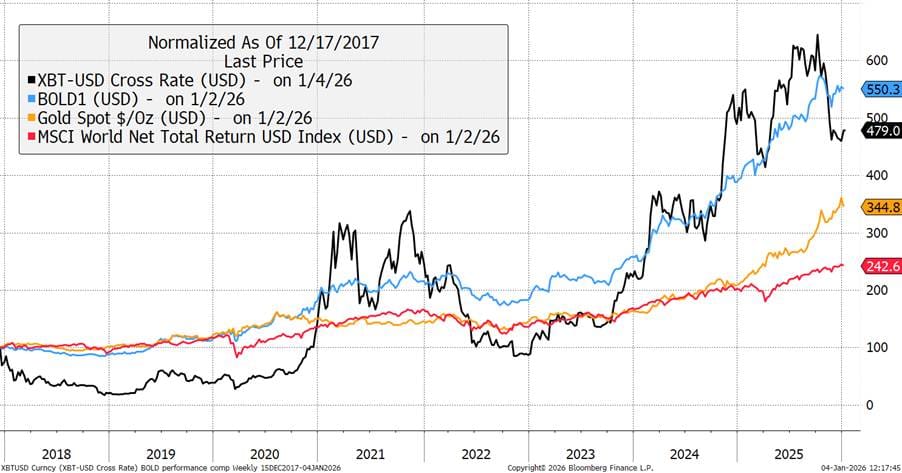

Performance Data:

The BOLD Index illustrates how the strategy has worked over time. Since the Bitcoin high in late 2017, BOLD has returned 450.3% which is above the returns of both Bitcoin and Gold. A 50/50 strategy over 8 years would have returned 311.9%, while BOLD delivered 139% above this. BOLD delivered an annualised excess return of 11.5% per annum above that average.

Bitcoin, Gold, BOLD, and Global Equities Performance Comparison

For more information on the BOLD Index, please visit BOLDETF.com.

Product Details:

- BOLD LSE Listing: 13 January 2025

- Assets Under Management: $40.5 million

- Ticker: BOLD

- Fee: 0.65% p.a

- Custodians: Gold - JP Morgan; Bitcoin - Anchorage Digital Bank N.A., Copper Technologies (Switzerland) AG

- Other Listed Venues: Zurich, Frankfurt, Paris, Amsterdam, Stockholm

- Issuer: 21Shares AG, Switzerland: https://www.21shares.com/en-eu/product/bold

Charlie Morris, Founder of ByteTree and Creator of BOLD, commented:

“This listing on the London Stock Exchange is another significant milestone for BOLD having already been listed on several European Stock Exchanges. This follows the FCA’s lifting of the ban on Bitcoin ETPs in October 2025, and for the first time allows investors to have exposure to an innovative way to invest in Bitcoin and Gold, the world’s two most liquid alternative assets.

BOLD is a unique product with no credible comparators, being backed by physical Gold and Bitcoin, institutional-grade custody, and having a demonstrated track-record since 27 April 2022.

I conceived the idea for BOLD to make Bitcoin ownership less stressful, and its track-record has fully proven this out. Since its launch in 2022, BOLD has delivered Bitcoin-like returns with the stability of Gold. It is an ideal way for all investors to have exposure to a continuously expanding global money supply, as highly indebted governments seek to maintain economic stability.”

How to Buy BOLD:

BOLD should be available on all major investment platforms in the UK.

Contact Details:

For more information,

- ByteTree: BOLD@ByteTree.com

- 21Shares: alex.pollak@21Shares.com

About the Creator:

Charlie Morris is the founder of ByteTree Group Ltd, a UK-based investment research firm, which created the BOLD Index. He has 28 years’ experience in fund management, and a reputation for actively managed, multi-asset, absolute return portfolios.

Prior to ByteTree, Charlie was the Head of Absolute Return at HSBC Global Asset Management, where he managed $3bn of assets. He was also formerly the Editor of The Fleet Street Letter.

Charlie manages the Soda and Whisky Portfolios at ByteTree, which are published through The Multi-Asset Investor https://www.bytetree.com/.

About 21Shares

21shares provides the world’s most comprehensive suite of crypto exchange-traded products (ETPs). In 2018, they launched the world’s first 100% physically-backed crypto ETP and have been simplifying crypto investing ever since. With headquarters in Zurich and offices in New York and London, our team brings together deep expertise in finance, engineering, and blockchain. We’re bridging traditional finance and the realm of decentralized finance (DeFi) to build the future of investing. 21Shares has assets under management of $8.3bn with 57 ETPs.

Notes to Editors:

“ByteTree is an investment advisory service for private investors. We don’t manage your money, but we help you manage yours. Our mission is to help you with clear, actionable investment research. We deliver high-quality financial guidance at an accessible price.”

https://uk.trustpilot.com/review/bytetree.com

The BOLD Index is issued by ByteTree Asset Management Ltd, an Appointed Representative of Strata Global Ltd (FRN 563834), which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest - never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees, and other charges can reduce returns from investments.

© 2026 ByteTree Group Ltd

-Ends-