Bitcoin in BOLD Week

ByteFolio Issue 192;

Following yesterday’s launch of the 21Shares Bitcoin and Gold ETP (BOLD) on the London Stock Exchange, which tracks ByteTree’s Index, it’s a good time to remind ourselves that Bitcoin is not the poor cousin in this historically strong environment in the precious metals rally.

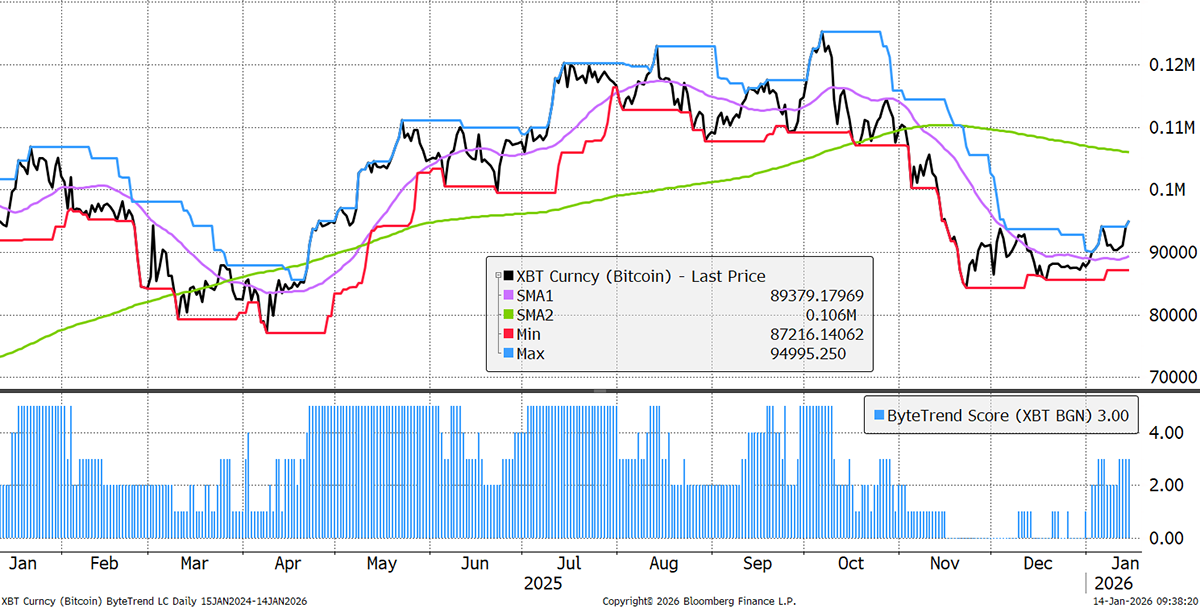

Bitcoin’s ByteTrend Score holds a 3. The short-term trend is up and looks promising, but the 200-day medium-term trend remains downward sloping. It will likely take time to restore the Bitcoin trends to rude health, but I’m optimistic.

Bitcoin

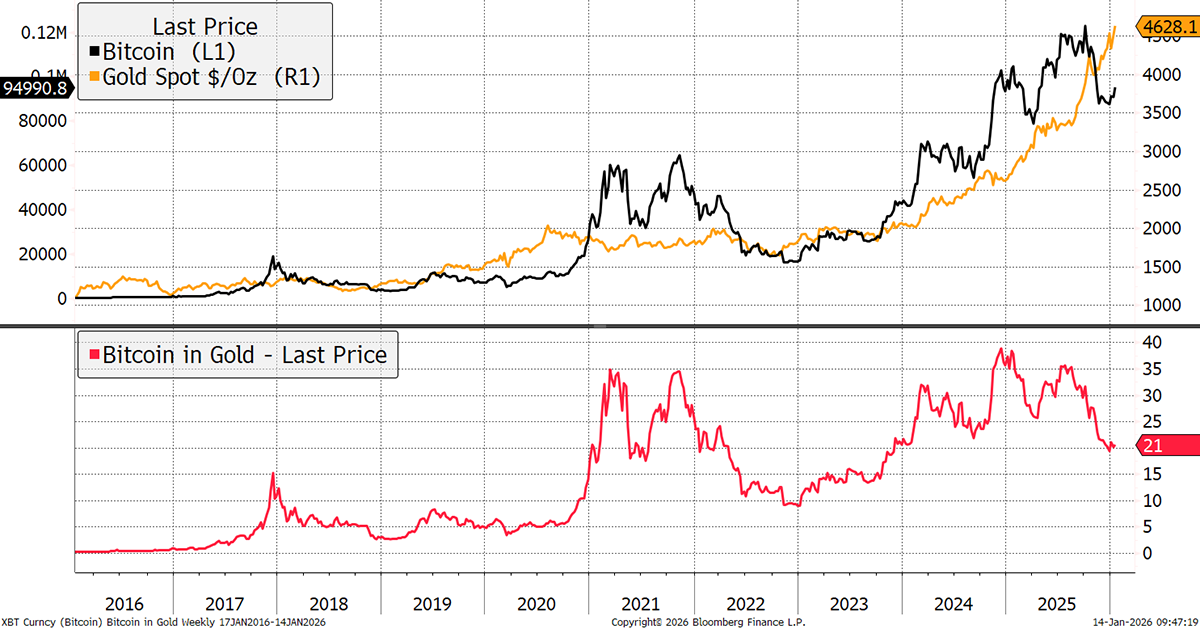

Gold has taken the limelight. I have long believed that Gold is the reserve asset for the real world, and Bitcoin is the reserve asset for the digital world. These are fundamental differences, despite similarities such as limited supply, global neutrality, and high liquidity.

It is the real world that has problems, and so demand for gold is high as the central banks increase their reserves. Bitcoin has always been highly correlated with internet stocks, and they have felt the pressure in recent months as the tech trade gasps for breath after a gargantuan two years. One Bitcoin is today worth 21 ounces of gold, a level not seen for five years. No doubt this will make a new high in the next cycle.

Bitcoin Versus Gold

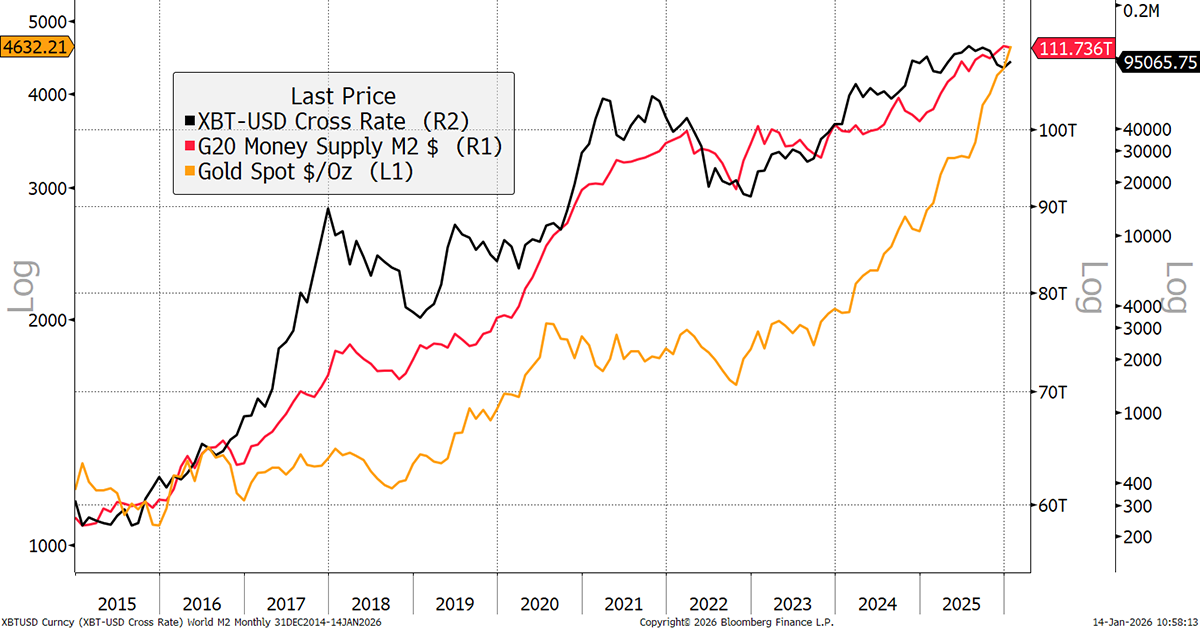

Both Bitcoin and Gold are said to be expressions of the money supply, a natural hedge against monetary inflation. Yet against the G20 M2 money supply, it’s an imperfect relationship. The trouble is that Bitcoin is risk-ON, and Gold risk-OFF.

Bitcoin and Gold Against the Money Supply

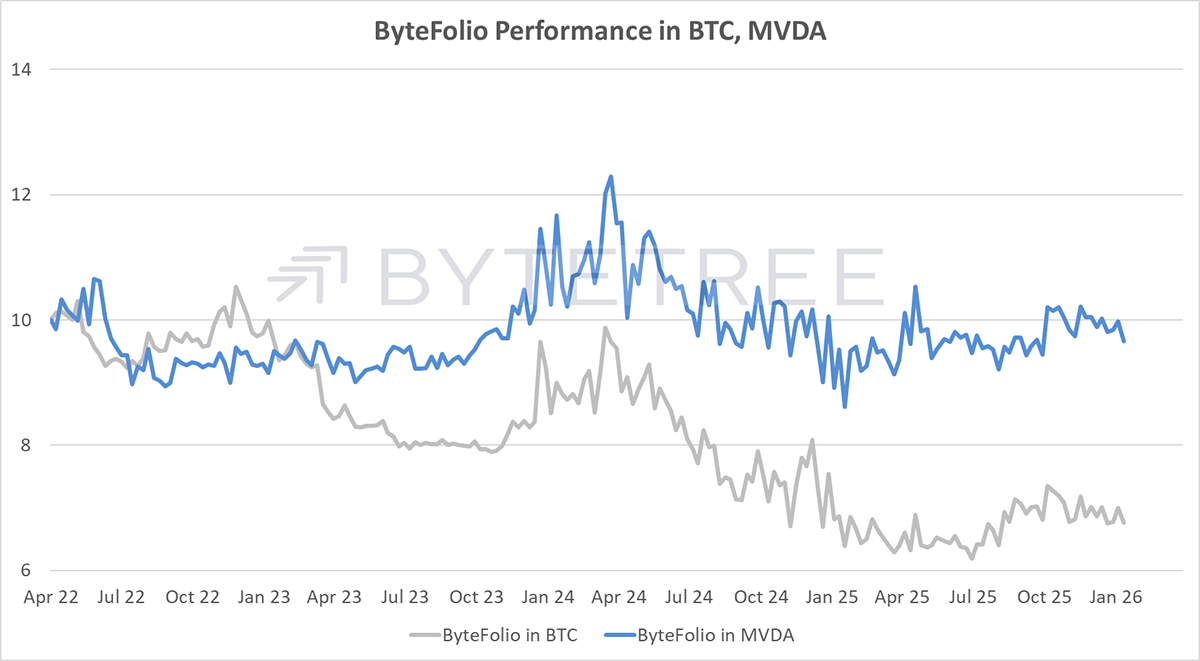

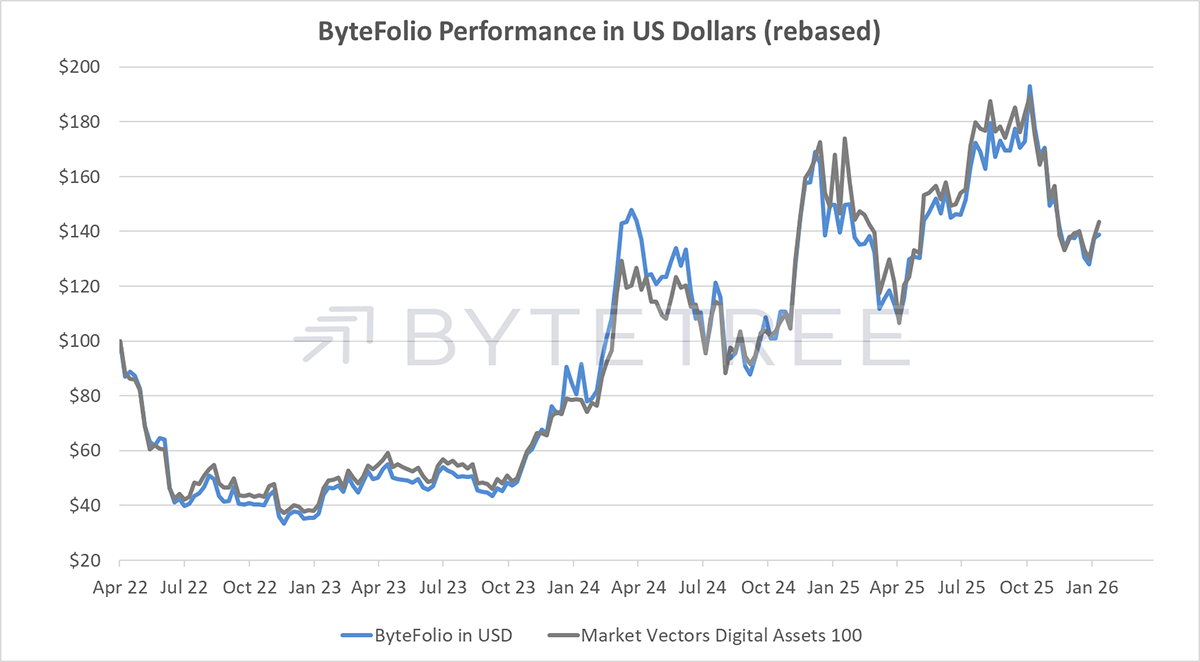

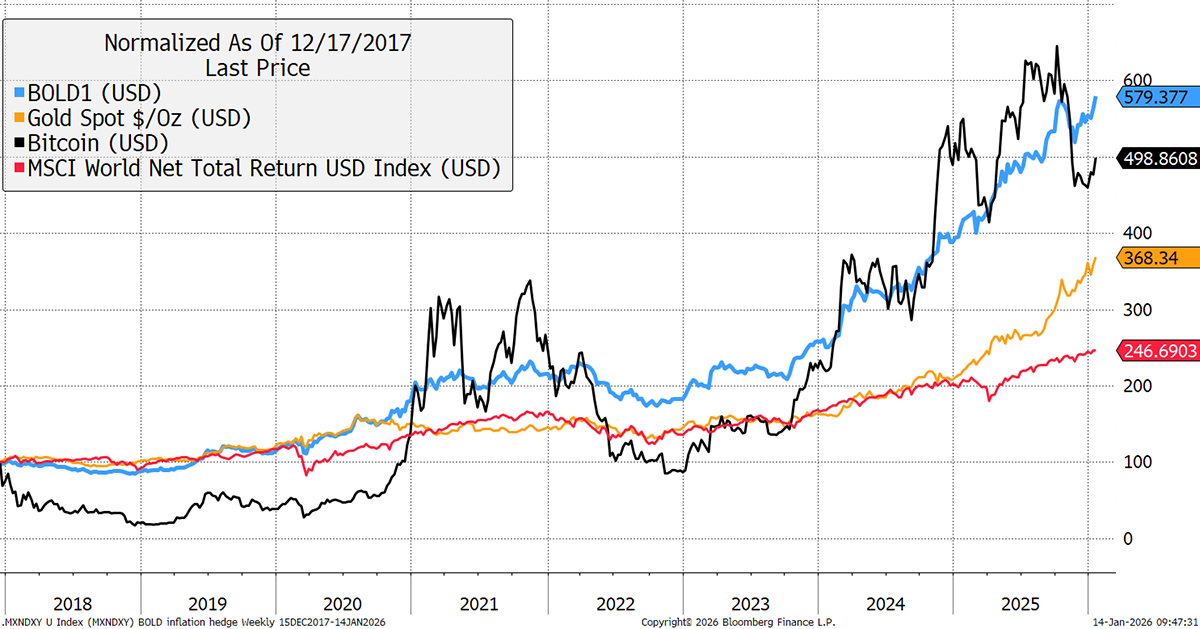

The BOLD Index solves this by risk-weighting each asset, which means adjusting for volatility. That improves the risk as the low correlation between the assets boosts diversification. Yet there are also higher returns, courtesy of the monthly rebalancing transactions. There’s a secret in finance which many seem to forget: buy low, sell high. That is what BOLD does each month when it rebalances to its target risk weight. The stronger asset is reduced, and the proceeds are added to the weaker asset. Repeat, repeat, repeat.

Bitcoin, Gold, BOLD, and Global Equities

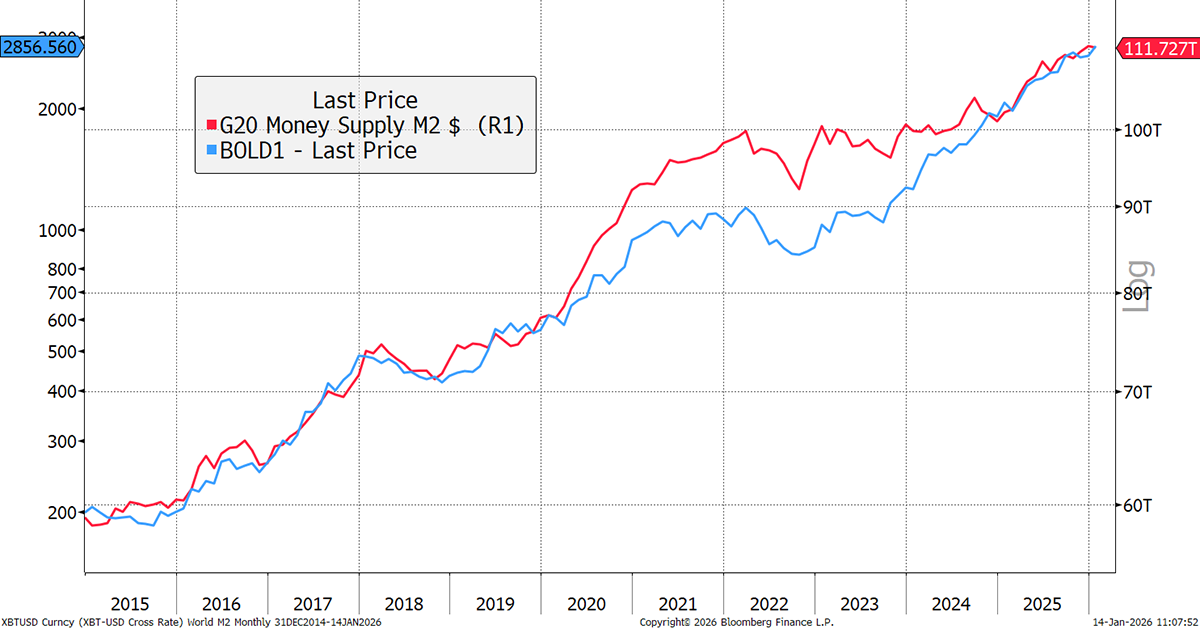

And it also has another benefit, which is to neatly match the global money supply with a roughly 5x natural gearing. Noting fits like BOLD.

BOLD and the Money Supply

Please join us this afternoon, 14 January at 4 PM GMT, for our webinar covering a deep dive into the BOLD ETF. ByteTree founder and creator of BOLD, Charlie Morris, will be joined by Adrian Fritz, the Chief Investment Strategist at 21Shares.

Adrian has been involved in the project since the beginning and is fluent in crypto matters. He will explain how the BOLD ETP works under the bonnet - creations, redemptions, dealing, rebalancing, and custody - and answer your questions.