Update on Caledonia Trust

Trade in Whisky;

This is probably my last trade of the year, but you never can be too sure of these things. We still have cash in The Whisky Portfolio following the profit taking in October, and as we put it back to work. We’re off to Germany again, and there’s no better time, as they do Christmas so well.

Before we get there, it has been a while since I updated you on the active funds we hold, and I felt it would be a good opportunity to go through some of them before Christmas. I don’t do this often, unless asked in the Postbox, mainly because if the funds are doing what they are supposed to do, I leave them to get on with the job. This is important because the Soda Portfolio is designed to have low turnover, and excessive intervention and switching would change that.

This week, I will touch on the Caledonia Investment Trust (CLDN). To recap, it is the publicly listed investment vehicle created to manage the wealth of the Cayzer family. The £3bn portfolio is split into three segments: public companies, private capital, and funds. Yet the market cap of CLDN is £2bn, and so by investing in CLDN, you get a share of £1bn for free.

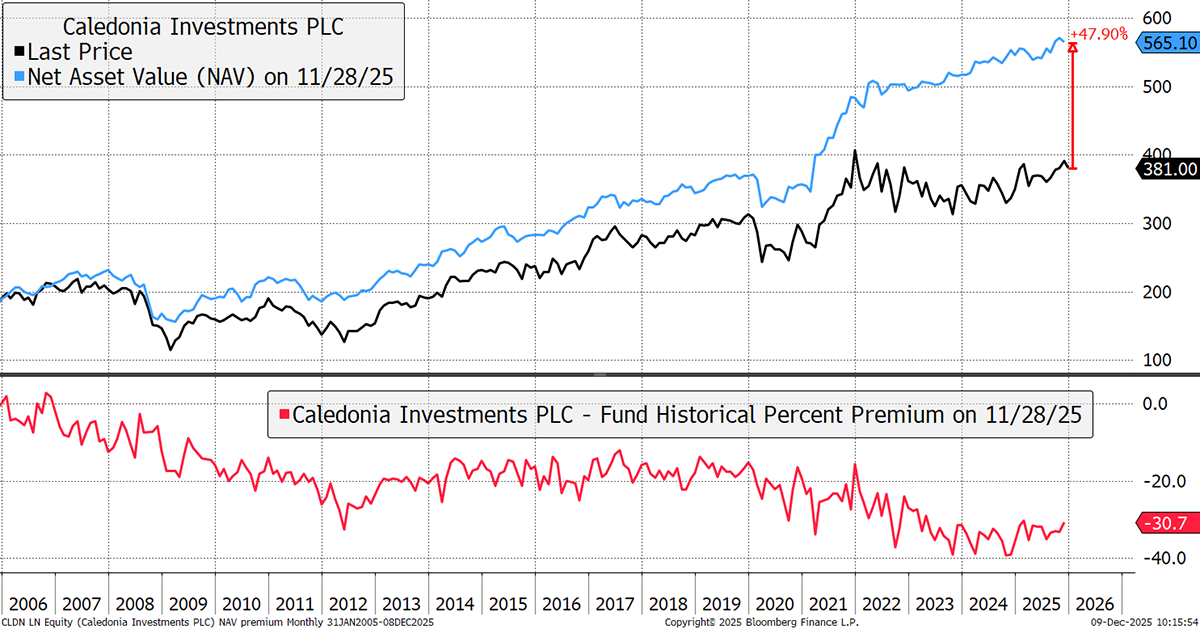

I show the net asset value (NAV) in blue against the share price in black. The current discount to NAV is over 30%, which means that if it ever closed, you’d make nearly 50% in addition to the investment returns and dividends. The discount is the primary reason we are invested.

Caledonia Investment Trust Price vs Net Asset Value

The shares are up 8.9% this year when their NAV is only up by 3.5%. That has been a shoddy result for the trust, but I would say that private equity valuations were overstated in 2022/3, as NAVs were not reduced in line with the market. However, it may be true that NAVs are now more realistic, although we can’t be too sure. But it doesn’t matter that much because the discount reflects this. If all were rosy, the discount would be much closer to zero, and the shares, therefore, much higher.

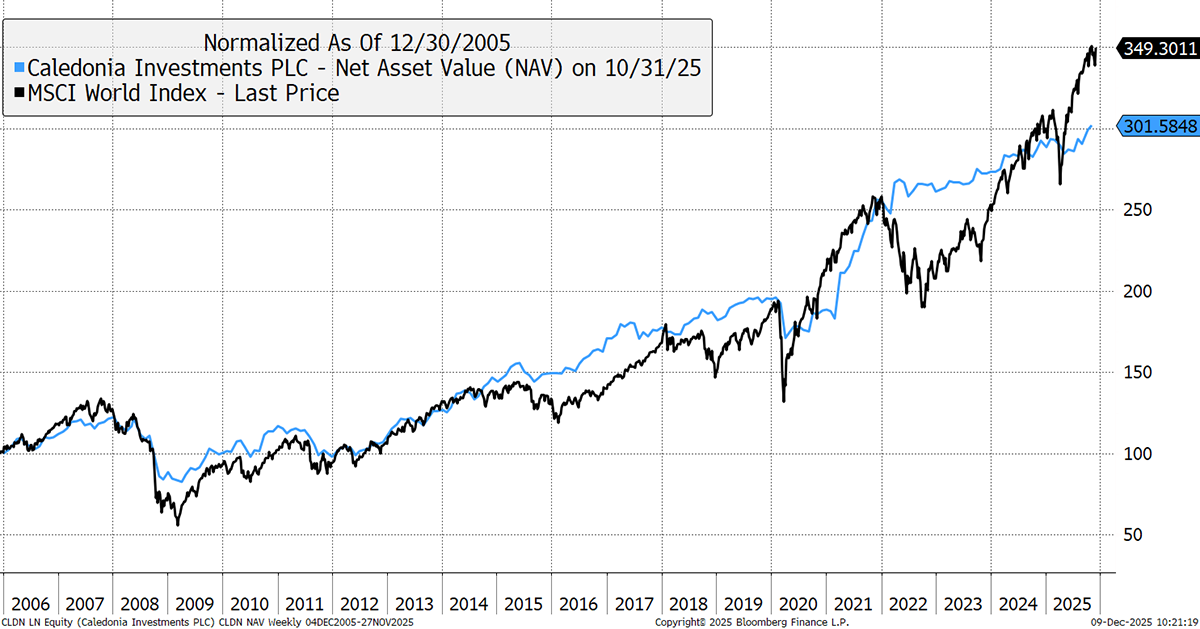

The average yield over the past three decades for global equities has been 2.2% compared to CLDN’s 2.5%. As they are similar, I compare them on a capital return basis, which is reasonable.

Caledonia Net Asset Value vs the World Index

Over the past 20 years, CLDN has nearly matched the World Index. While that has been hard to beat since the tech bubble took off a few years ago, it has not been a particularly high hurdle during normal times. From August 2003, when NAV data commenced, to 2016, CLDN had been ahead of global equities, but has since fallen behind. Overall, it has delivered returns to shareholders of 9.6% p.a., which is highly respectable for a diversified investment trust.

It is important to understand that CLDN makes long-term investment decisions and is not trying to beat the index in the short term. Their long-term returns are consistent, sustainable, and frankly, good.

The discount is mainly down to uncertainty over private equity valuations, but my sense is to trust them, as they have good governance. The other reason is that the family owns half the shares, so further buybacks make them the majority owner. Following last year’s AGM, they have the authority to continue buying back shares, which has helped narrow the discount.

Think of CLDN as a conglomerate. It has many different holdings across countries and sectors. It is well managed, mainly by chartered accountants, so the beans are fully accounted for. Their objectives are long-term, and no doubt they will prove resilient when the market turns sour because they follow sound investment principles. That’s the other thing; the family is also a long-term investor with no plans to sell. The dividend and its growth seem to be just fine.

What CLDN does is currently out of fashion, which is important. When investors return to their senses, I have little doubt that CLDN will become more popular. There is also the issue of the gargantuan UK wealth managers, created through mergers. They were once active in investment trusts, but have hit limits and backed off because they own too much of the sector.

Our current position in CLDN is small. If I saw a pickup in NAV growth and sensed a catalyst to reduce the discount, I would increase exposure. In the meantime, be patient. This is a great trust valued at a very low price.

Moving on to this week’s trade, this is a company I have been wanting to buy for some time.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd