Strategy Is Not a Systemic Risk to Bitcoin

ByteFolio Issue 187;

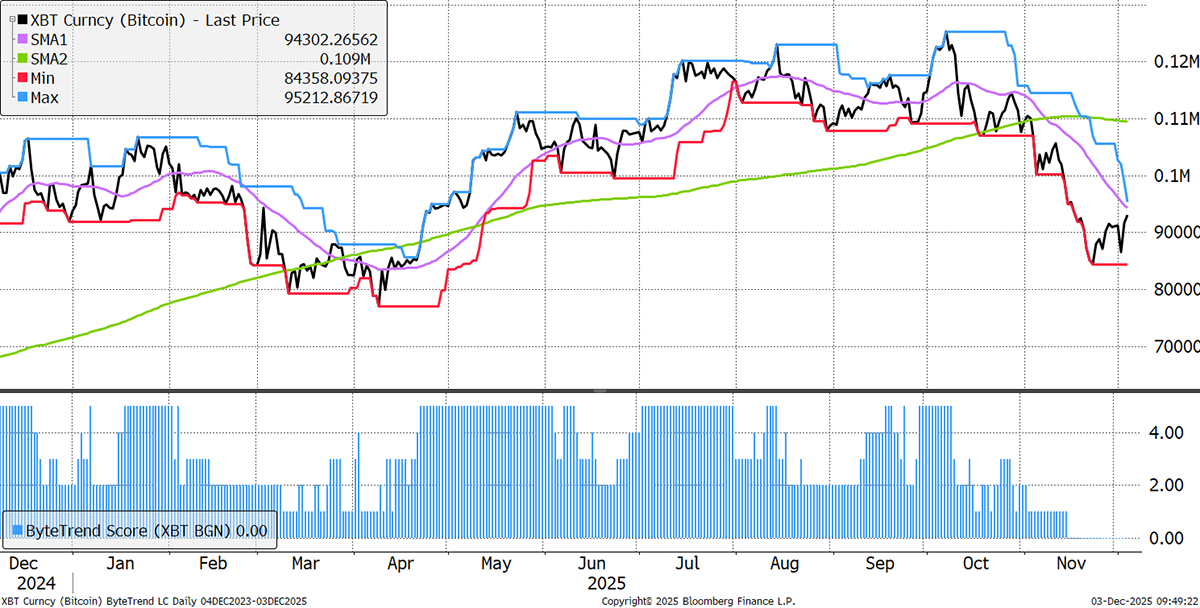

Bitcoin’s ByteTrend Score remains at a bearish score of 0 using a 200-day moving average (MA), although it is still a 1 on ByteTrend.io, which uses a 280-day MA to adjust for weekend trading. The positives are that the recent low is above the April low and that Bitcoin has made a higher low and a higher high over the past two weeks.

Bitcoin Remains Bearish

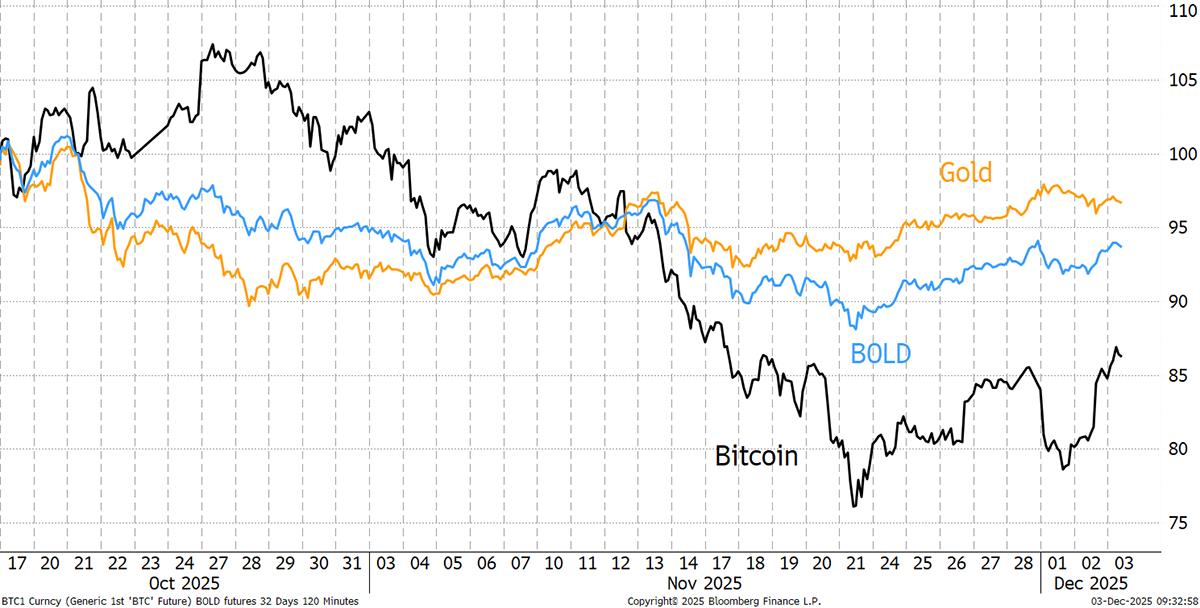

Looking more closely at the recent Bitcoin rally, it is encouraging to see the two-week high. It is also notable that this week’s rally displaced gold, if only slightly. It reaffirms our core view that these assets are highly complementary, as BOLD, our Bitcoin and Gold index, demonstrates.

Bitcoin, Gold, and BOLD

Last week, we covered the bear points, including tech stocks under pressure, ETF outflows, and treasury companies, focusing on MSTR. It should be noted that MSTR’s risk relates to the premium or mNAV, and not the credit risk. The latter would only kick in if the price of Bitcoin truly collapsed from here. Now that the premium has largely closed, the price will start to resemble Bitcoin. The credit risk is reflected in the yield of the perpetual bonds, which remain stable. MSTR can easily service its bonds with a high Bitcoin price.

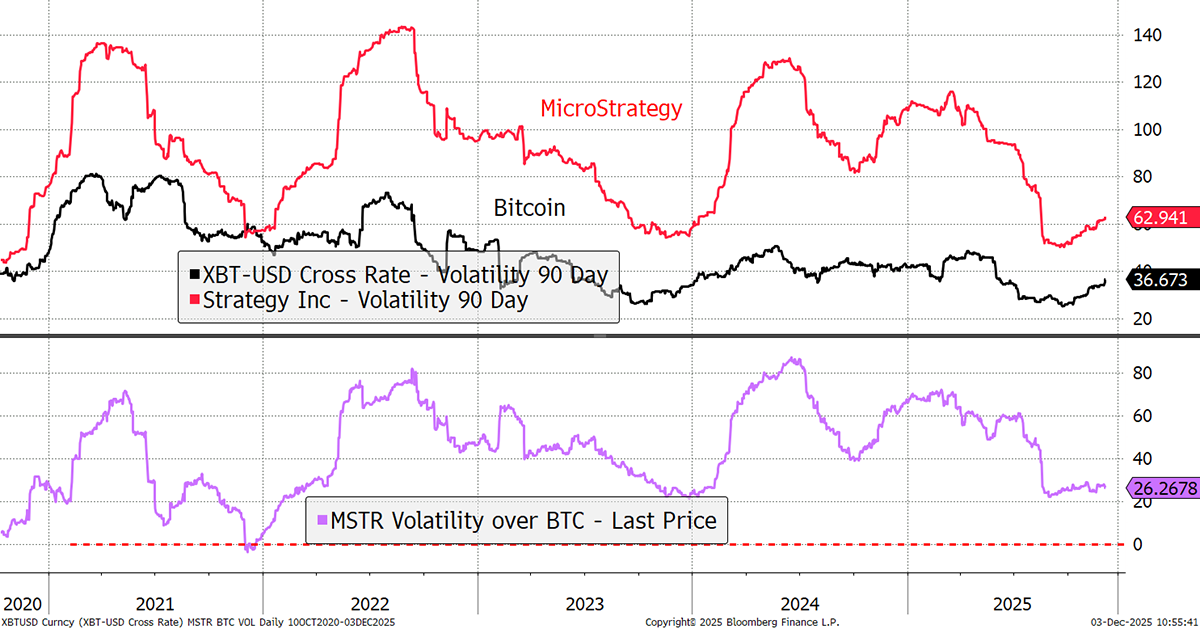

The other development is volatility. MSTR’s high volatility was used to sell convertible bonds with low coupons, as the “option value” was high. Saylor used the high volatility as an asset. That has now fallen and is slowly converging with Bitcoin itself, meaning that the game is up.

Strategy (MSTR) and Bitcoin Volatility

With their cash reserve to meet dividend payments, MSTR is neither a credit risk nor a forced seller. This would change at low Bitcoin prices, but that isn’t currently on the agenda. The mNAV may continue to slide, due to apathy, but it is not a risk to Bitcoin. The Strategy share price correction is largely done and poses no systemic risk to Bitcoin. The risk lies with shareholders, who may realise they would be better off in an ETF.

The Quantum risk is real, but solvable. The best work on this comes from Nic Carter’s posts on Substack:

- Bitcoin and the Quantum Problem – Part I: Discrete Logs are Hard

- Bitcoin and the Quantum Problem – Part II: The Quantum Supremacy

Carter frames quantum computing as the most significant existential threat to Bitcoin's security model—more pressing than regulatory or scalability issues. His analysis is grounded in cryptography basics, current vulnerabilities, accelerating quantum progress, and pragmatic mitigation strategies. In essence, whatever doesn’t kill Bitcoin makes it stronger.

Ali will also review the decline in the number of core developers, which he does not believe is an issue, and the impact of Core vs. Knots. Thank you to the client who wrote in.